Michael Burry bets $1.1B against AI leaders, targeting Nvidia and Palantir.

Investor claims tech firms understate depreciation, potentially masking ~$176B between 2026–2028 period.

Scion purchased puts: 1M Nvidia contracts ($187M) and 5M Palantir ($912M)

‘The Big Short’ Michael Burry: Man who Predicted 2008 Crisis is Now Calling Out AI Bubble

‘The Big Short’ investor Michael Burry has placed a $1.1 billion short bet against AI leaders Nvidia and Palantir, alleging tech giants are overstating profits by inflating asset lifespans. He compares today’s AI frenzy to past financial bubbles

Michael Burry, famously known as ‘The Big Short’ is going all against AI at a time when major AI companies are pumping billions of dollars into the technology, pushing their valuations to record highs.

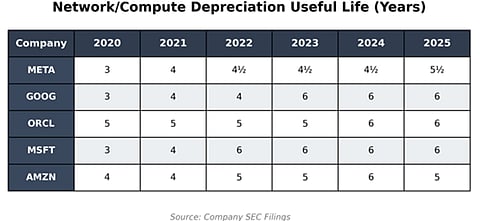

Burry notes that these tech giants are artificially inflating their earnings by extending the useful life of assets, thereby understating depreciation expenses. However, Outlook Business could not independently verify these claims. He even described the practice as “one of the more common frauds of the modern era.”

He argued in a post on X that massively increasing capital expenditure through the purchase of Nvidia chips and servers with a two- to three-year product cycle should not justify extending the useful life of computing equipment. According to his estimates, hyperscalers such as Meta, Google, Microsoft, and Amazon could collectively understate depreciation by as much as $176 billion between 2026 and 2028.

AI Bubble

An “AI bubble” is the combination of investor euphoria, outsized capital commitments and sky-high valuations that outrun the real, recurring revenue those technologies can reliably generate.

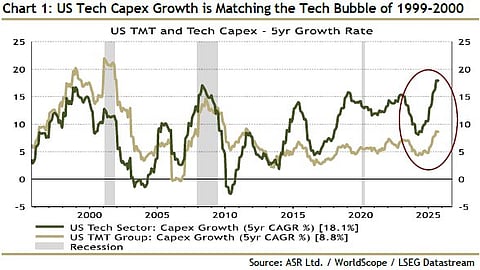

In past bubbles, such as the dotcom and housing crises, the pattern was strikingly similar, a compelling new narrative attracted waves of capital, which then flowed into projects with weak fundamentals. The resulting buildup of debt and excess capacity ultimately triggered a sharp market correction.

Today, the debate around a potential AI bubble centers on whether the industry has reached that same inflection point, with data centers, chips, and platform deals taking the place of websites and mortgages.

Burry’s Bet Against AI

Burry’s contrarian opinion is not just all talk. He has skin in the game.

The investor has reportedly placed a $1.1 billion short bet against AI leaders Nvidia and Palantir, signaling his conviction that the AI bubble is set to burst. His hedge fund, Scion Asset Management, purchased put options on 1 million Nvidia shares valued at $187 million and 5 million Palantir shares worth $912 million during the third quarter.

As a result, Palantir’s shares fell 8.32% on Tuesday amid concerns that its third-quarter earnings indicated it may struggle to sustain the rally that has driven its stock up 400% over the past year. Nvidia, which recently became the world’s first publicly traded company to surpass a $5 trillion valuation, also saw its share price drop by 3.45%.

Besides Burry, many other investors have cautioned against the risks of rapid AI expansion. But why does his opinion carry such weight?

Who is Michael Burry?

Michael J Burry is an American investor and hedge fund manager best known for being among the first to recognise and profit from the US housing and subprime mortgage collapse that triggered the 2007–2009 financial crisis. His story is dramatised in Michael Lewis’s book ‘The Big Short’ and its 2015 film adaptation.

Burry became widely popular after the film depicted how, between roughly 2003 and 2006, he analysed individual mortgage loans and the mortgage-backed securities built from them. He concluded that many subprime loans, particularly adjustable-rate “teaser” loans, were structurally designed to fail once interest rates reset.

He convinced major financial institutions to sell him credit-default swaps (CDS) linked to these vulnerable mortgage tranches, effectively shorting the housing market. When the bubble burst, those CDS positions paid off massively, yielding enormous profits for him and his investors. The trade, along with his public commentary on the crisis, made Burry a high-profile and often-quoted figure in financial circles.

Burry is now, in a way, predicting that the AI bubble will burst, and much like before, he appears confident that his bet will once again prove to be right.

Housing Bubble

The housing bubble of 2008 was a major financial crisis caused by a rapid rise and sudden collapse in US housing prices.

In the early 2000s, low interest rates, easy credit and risky lending practices encouraged millions of Americans to buy homes, even those who couldn’t really afford them. Banks issued large numbers of subprime mortgages (home loans to borrowers with poor credit) and then bundled these risky loans into complex financial products called mortgage-backed securities (MBS), which were sold to investors worldwide.

As demand for housing rose, prices skyrocketed, creating the “bubble.” But by 2006–2007, many homeowners began defaulting on their loans when interest rates increased and they couldn’t make payments. Housing prices fell sharply, wiping out the value of homes and the mortgage securities tied to them.

The bubble burst in 2008, leading to massive financial losses for banks and investors, triggering a global financial crisis, widespread foreclosures, and the worst economic downturn since the Great Depression.

Unlike many others who relied on broad credit ratings, Burry conducted a bottom-up analysis of loan-level data, examining underwriting standards, borrower credit profiles, and the prevalence of adjustable-rate and interest-only mortgages.

His research led him to project rising default rates, prompting him to buy protection on the collateralized debt obligations (CDOs) and mortgage bonds most at risk. Despite intense pressure from investors and mounting margin calls, he held his position until the market collapse proved him right.