A few days back, a frustrated tax payer wrote on Twitter that she would purposely file incorrect income tax returns in order to seek an extension on the last date set by the Income Tax Department. This, she said, was her desperate bid to avoid paying up an enormous sum as fine for the late payment, as the government categorically refused to extend the last date of filing for individual taxpayers in the non-audited category. She echoed the sentiments of not just millions of taxpayers but also an equivalent number of hapless tax professionals. The e-filing platform for ITRs has been marred by technical glitches since its inception. In order to expedite and cut down the period for processing refunds to 63 days, the government signed a contract with the IT giant Infosys for developing a new web portal. And, since then, the experience of tax professionals has been a downhill journey.

Hassled Companies, Upset CAs

Every year, accounting professionals and e-filing portals for income tax play a cat-and-mouse game at the time of filing returns

Tech Troubles

Things came to such a pass that finance minister Nirmala Sitharaman pulled up Infosys publicly on Twitter in June last year. She tagged Infosys and Nandan Nilekani, the company’s co-founder, requesting that the filing portal should live up to the expectations of tax payers. She urged them to fix the glitches at the earliest to ease compliance for taxpayers. In August, she summoned the company’s chief executive officer and managing director Salil Parekh to discuss the issue.

The Twitter timeline of the Union finance minister does not seem to have changed much till today. Moreover, this is not the first glitch of an e-governance portal developed and managed by Infosys. The GST Network portal for filing of goods and services tax (GST) payment and returns has been developed by Infosys. The company had faced similar criticism in 2017 after the launch of the GST. The MCA21 portal of the Ministry of Corporate Affairs (MCA) was also developed by it in 2013. Users complain, till date, about several issues on the platform.

“Any company secretary will tell you that after so many years, the [MCA21] portal still does not work properly. It is a headache for us as well as our clients,” a company secretary, who did not wish to be named, says.

The ministry has chosen to create OTP-based portals for filing direct and indirect taxes. The accounting industry is not happy with the way the MCA’s portals make a mountain out of a molehill with the integration of such a small feature. The company secretary adds, “In the name of ease of doing business, there are multiple changes happening. Everything is OTP based these days. On most occasions, OTP does not go to the client.”

Overworked Accountants

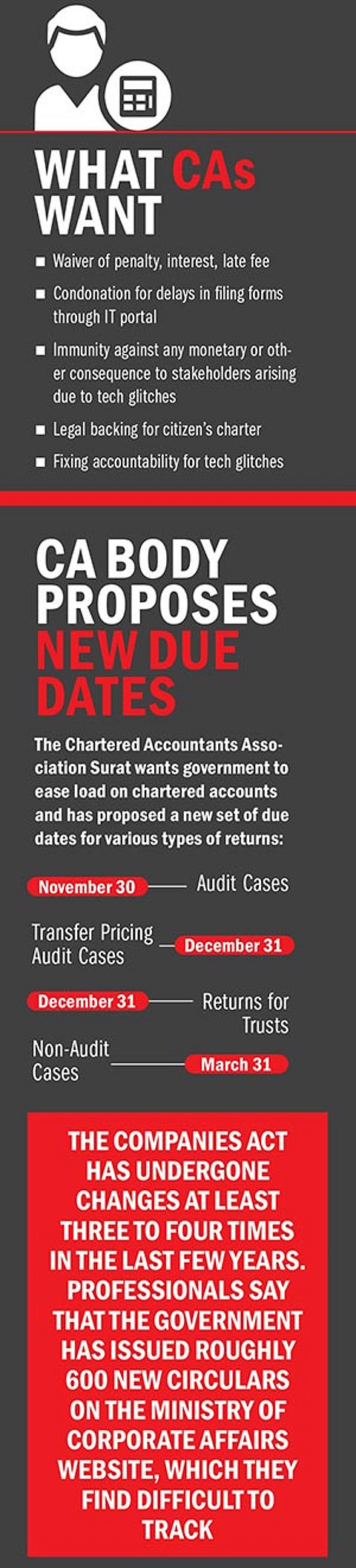

Chartered accountants, too, have a similar story to tell. Fed up of the glitches hampering the filing process, a chartered accountants’ body moved court for directions against the penalty for late filings of tax returns. The Chartered Accountants Association Surat (CAAS) petitioned the Gujarat high court for a stay on the revenue department’s practice, especially as the Central Board of Direct Taxes (CBDT) itself has extended deadlines several times in the past due to technical errors on the e-filing platform of the Income Tax Department.

The Central government said that till December 31, 2021, almost 5.89 crore income tax returns were filed on the new portal. “More than 46.11 lakh ITRs were filed on 31.12.2021. In order to assist taxpayers with a smooth experience on the portal, 16,850 taxpayer calls and 1,467 chats were responded to by the help desk,” the ministry had said in a statement.

While revenue secretary Tarun Bajaj had categorically refused any extension of the last date of filing, the professional bodies believe that there are valid grounds for an extension, as the problems were on the web portal and not due to other process-related reasons.

“Before Infosys, the portal was maintained by TCS [Tata Consultancy Services], and it ran fine. You do not need to replace something that is already working with a new system. And, if you do, the time taken for a new system to become operational is not the fault of taxpayers or tax professionals,” Rasesh Shah, president of CAAS, says.

In a presentation made to the finance ministry, the body had explained the nature of problems being faced by tax filers during the filing process. They included not receiving any OTP, user-interface-related issues, like missing dropdown menus, missing buttons and notifications, loss of stakeholder data from the database and digital signature mapping among others.

Professionals say that each financial year is a new challenge with the e-filing portal. Once the previous set of challenges gets resolved, a new set of problems crops up. The utility software that the government developed has not been provided with the basic infrastructure necessary to run it smoothly. Former revenue secretary Hasmukh Adhia had promised that the utility software would be provided every year on April 1. After his term ended, the incumbent did not fulfill the promise, says Hardik Kakadiya, vice-president of CAAS.

“In previous years, it was a problem with the GST portal. Then, last year, the time period granted for filing audits was less compared to the amount of work that needed to be done. It requires time to prepare documents,” Kakadiya added.

Chartered accountants had flagged to the ministry that according to the statutory guidelines, the time period provided for audits was not adequate. They had asked for changes in the law in order to provide time in keeping with the workload. “Once the filing became paperless, processing at the government end has become faster. We asked that that benefit should be passed on to tax professionals too,” Kakadiya says.

Chartered accountants claim that in the past when the forms were simple, the Income Tax Department allowed returns to be filed till October 31. But, with complicated forms, changes in the technology and the government’s insistence on faster processing, chartered accountants feel they need more time for each category and expect the government to introduce amendments in the Income Tax Act.

Face-Off

The government-CA face-off is not new. On the foundation day of the Institute of Chartered Accountants of India (ICAI) in 2017, Prime Minister Narendra Modi had criticized the body’s record in taking disciplinary action against rogue CAs. Commerce and industries minister Piyush Goyal had said in November last year that CAs needed to introspect in order to revive credibility of the profession.

“There is tremendous pressure on these bodies from the government. Last year, there was a backlash from the professionals on Twitter, where they spoke up against the government. This forced the ICAI and the ICSI [Institute of Company Secretaries of India] to come up with an advisory to its members to not speak out publicly. The ICAI has surprisingly not given any representation regarding the extension of due dates,” the company secretary quoted earlier in the story said.

Facing the backlash, the government extended the deadline for corporates to file income tax returns for the financial year 2020-2021, or assessment year 2021-2022, till March 15. The deadline to file tax audit report and transfer pricing audit report for FY21 too has been extended till February 15.

Unstable System

Corporate heads find it tough to handle the constantly changing guidelines of compliance. The Companies Act has undergone changes at least three to four times in the last few years. Company professionals say that in the last three to four years, there have been roughly more than 600 circulars on the website of the Ministry of Corporate Affairs.

Most of these changes are carried out through Parliamentary processes and not through dedicated executive orders, which entail officers to come up with circulars of the notifications. For professionals, these kinds of frequent changes, they say, cause uncertainty while working. “You never know which rule comes into force when,” they claim.