GoBoult is positioning smartwatches as lifestyle accessories, with the Mustang partnership boosting brand appeal and average selling prices.

The company is nearing ₹1,000 crore in revenue, targets ₹3,000 crore by 2030, and plans to go public in 2027.

With over 99% made in India, strong R&D focus and digital-led distribution, it is scaling through selective premiumisation and retail expansion.

Doubling Down on R&D, Quick Commerce, Nationalism: Inside GoBoult's Gameplan to Hit ₹3,000 Cr in Revenue

With an average team age of just 25, GoBoult believes building young leaders from within helps it stay closely aligned with its core Gen Z.

GoBoult is sharpening its positioning as a design-led, aspirational yet accessible wearable brand, with global partnerships. Despite a 25–30% decline in the smartwatch category over the past two years, the company grew 20% year-on-year while the broader industry contracted.

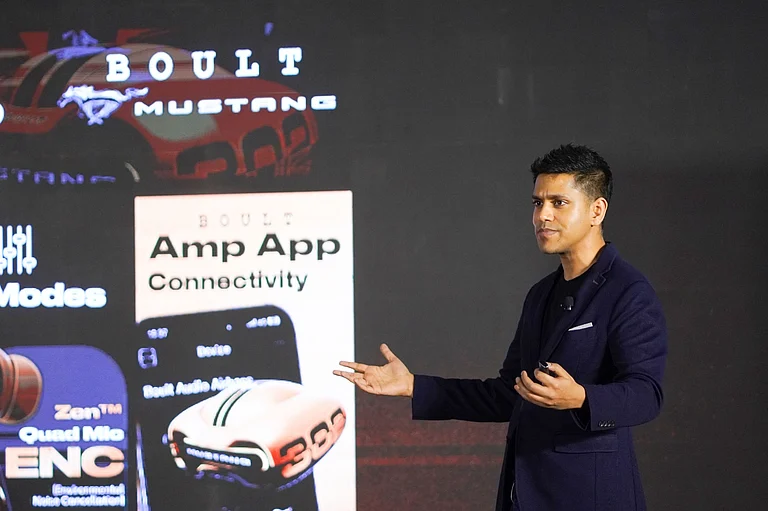

Its collaboration with Ford’s Mustang, at the Mustang 3.0 launch, reflects a focused approach to go deep with one strong global brand rather than multiple shallow tie-ups. The partnership lifted average selling prices by about 10% and strengthened appeal among millennials, while Gen Z continues to anchor its core portfolio. Alongside lifestyle partnerships, GoBoult has invested ₹21 crore in R&D over the past year to drive innovation and differentiation in a competitive market dominated by brands like BoAt and Noise.

Financially, the company has scaled from ₹3.5 crore in revenue initially to ₹762 crore last year and is nearing ₹1,000 crore this year, with a target of ₹3,000 crore by 2030, Co-Founder Varun Gupta tells Outlook Business.

Rebranding from Boult to GoBoult, and moving towards premiumisation, the company plans to go public in summer 2027. Over 99% of its products are made in India, with a digital-first distribution model complemented by expanding offline retail and quick commerce. Post-IPO, the focus remains on disciplined, profitable growth while building aspiration within accessible price bands.

Edited Excerpts:

Why are you betting on the smartwatch market? How are you positioning yourself differently?

Smartwatches really took off in India around 2019. Between 2019 and 2023, we saw triple-digit and strong double-digit growth. But over the last two years, the category has declined by about 25–30%. One key reason is charging fatigue. People buy them for fitness but eventually use them more as lifestyle products, and if the watch isn’t charged, there’s no incentive to wear it over a regular watch.

That’s why we see an opportunity to blend traditional analogue appeal with smart functionality. We’re building smartwatches that are lifestyle-led and design-first, not just tech products. Our partnership with Mustang reflects combining strong design, brand aspiration and quality at an accessible price. As we say, it’s not just a smartwatch, it’s a Mustang on your wrist.

Most smartwatches copy the same rectangular, Apple-style look. We launched round-dial watches that feel more like accessories. Even if the watch is powered off, it still looks good on your wrist almost like jewellery. They’re unisex, come in bold colours and are built to feel fashionable, not just functional.

And the launch prices range from ₹2,000 to ₹4,000, with regular prices about ₹500–1,000 higher.

How does the Mustang collaboration help appeal to your target customers?

We wanted a global aspirational brand that Indians connect with. Mustang had huge recall through movies and pop culture but wasn’t officially present in India. That created intrigue and aspiration. It took us about a year to convince them. There’s a revenue-share arrangement which I can’t share. They work closely with us on design. The technology is ours, but product design is collaborative.

For our core products, Gen Z is the largest segment because of sheer numbers. But for the Mustang line, Millennials are a bigger audience. They’ve grown up with the brand and also have higher purchasing power.

Typically, the 18–25 age group contributes about 38–40% of the customers while the 25–34 age group around 30%, and 34–45 about 15%, and beyond that it drops sharply.

How do you view competition, partnerships and positioning in such a crowded market?

We’re proud that Indian brands together hold over 70% of the market. It’s competitive, and sometimes there are tactics like predatory pricing or frivolous litigation. But we don’t react to price wars. We focus on building good products and staying profitable. We’re bootstrapped and profitable, and that discipline is important to us.

We prefer going deep rather than wide. We’ve partnered with Mustang for lifestyle and Dolby for tech. Instead of multiple shallow tie-ups, we invest 6–12 months into building meaningful, long-term partnerships.

We want to build aspiration while staying accessible. A ₹4,000–₹5,000 product may seem affordable to some, but for many consumers it’s a significant purchase. So we balance quality, design and value. Pricing too high would restrict us to the top 1%, and we want to serve the top 20–30%.

We are very open to partnerships. If it is in lifestyle, it has to be a more aspirational luxury brand. And if it is in tech, the other party should be able to offer incremental tech.

What is your product mix and growth trajectory?

Audio contributes about 75% of revenue and smartwatches about 25%. Within audio, true wireless earphones form the majority, around 55–60%, followed by headphones, speakers and neckbands. We’re underpenetrated in speakers and home theatres, so that’s an area of focus.

We started eight and a half years ago at ₹3.5 crore revenue. Last year we did ₹762 crore, and this year we’re nearing ₹1,000 crore. By 2030, we aim to reach ₹3,000 crore. The focus is steady, organic growth while remaining profitable, we’ve been profitable every year.

What are your plans around manufacturing, R&D, marketing and distribution?

Over 99% of our products are made in India. About 25% is manufactured in our own facility in Delhi, and the rest through partners in Noida and Greater Noida. Our focus remains on R&D, design and marketing rather than expanding heavy manufacturing.

We have spent more than ₹20 crore currently on R&D, which is about 2% of revenue. We see that rising to around 3–3.5% while maintaining profitability.

We’re digital-first heavy on marketplaces, social media, influencers and performance marketing. We focus on targeted, relatable content rather than big celebrity endorsements.

We’re present at about 3,000 retail counters and plan to scale to 15,000–20,000. Offline currently contributes 5%, with online at 95%.

How important are international markets, quick commerce and premiumisation?

We’ve entered the UK and Nepal. Exports are under 1.5% now and we want to take that to 5% this year, growing gradually while still focusing strongly on India.

There’s growing national pride and preference for Indian brands. Consumers increasingly trust Indian companies to deliver quality tech.

Quick commerce has grown from almost zero to about 11% of our business in 18 months. As it expands to tier-2 and tier-3 cities, we expect that share to rise further.

We’ve increased average selling prices by about 10–15% and plan gradual increases. But we want to stay accessible. Products above ₹40,000 aren’t part of our strategy. We’re focused on value-for-money premium.

What’s the long-term vision post IPO in 2027?

Post-IPO, the idea isn’t to change strategy dramatically, just scale what we’re already doing, invest more in R&D and marketing, and expand internationally, while staying disciplined and profitable.

The average age of our team members is 25 years. Our team reflects our customers, which helps us stay relevant. We prefer hiring young and building leaders internally rather than bringing in people who may be less connected to the market.