Despite a cumulative 125 bps repo rate cut in 2025, banks are struggling to pass on lower lending rates as deposit growth lags amid strong competition from equity and market-linked instruments.

With inflation expected to firm up and banks facing margin pressures, economists say the RBI is more likely to rely on liquidity tools rather than further repo rate cuts.

While surplus liquidity can ease funding costs and support credit, sustained liquidity risks fuelling inflation and financial market excesses, making calibration crucial in 2026.

Equity Boom Blocks Rate Cut Transmission as Savers Shun Bank Deposits

As market-linked investments lure savers away from bank deposits, the RBI's aggressive rate-cutting cycle risks running into a transmission dead-end

The increasing preference among savers for market-linked instruments such as mutual funds, coupled with inflationary threats, is likely to constrain the Reserve Bank of India’s ability to cut interest rates in this new year and force it to use other liquidity management tools such as open market interventions going forward, according to experts.

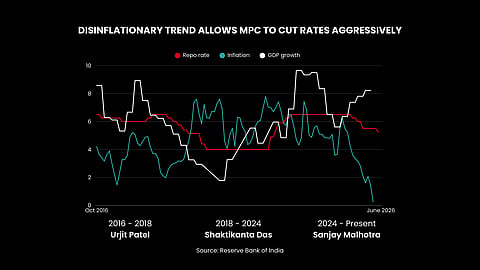

In 2025, the MPC cut the benchmark repo rate by a cumulative 125 basis points to 5.25%, marking its sharpest easing cycle since the pandemic. The front-loaded easing was enabled by a faster-than-expected moderation in inflation, alongside resilient economic growth through the first half of FY26. This combination gave the rate-setting panel room to ease policy aggressively after holding rates unchanged for nearly two years.

However, the space for further easing is narrowing due to dual constraints. First, inflation—currently at 0.71% (headline inflation as of November) —is expected to firm up in the coming quarters. RBI projections show headline inflation gradually inching back towards the 4% target, limiting the MPC’s ability to extend rate cuts without risking price stability.

Second, banks are yet to fully transmit last year’s lending rate cuts to borrowers as doing so would require them to cut interest rates on deposits in an environment when bank deposits already face tough competition from higher-return alternatives such as equity-linked instruments. Banks cannot cut lending rates without also cutting deposit rates, as doing so will squeeze their margins.

“A need for another rate cut is very minimal, unless there are real risks to economic growth,” said Gaura Sengupta, chief economist at IDFC First Bank. “The MPC has already provided maximum support through monetary policy over the past year. With limited space for further cuts, the RBI is likely to continue with liquidity infusion. We expect another ₹1 trillion liquidity support measure in the February policy, alongside a pause on the repo rate.”

Market Competition

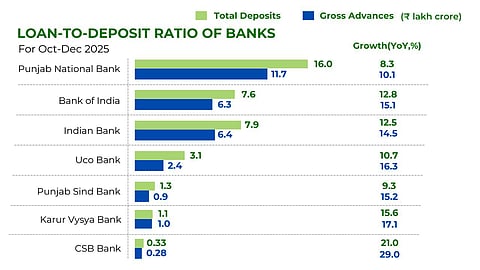

Credit growth has been outpacing deposit growth due to strong demand from micro, small and medium enterprises (MSMEs) and retail borrowers, aided by a revival in rural and urban demand. As of December 2025, the credit deposit (CD) ratio stood at 81.2%, with total bank credit at ₹195.3 lakh crore, or 11.5%, according to the latest monthly data available. Meanwhile, bank deposits grew at a slower pace of 10.2% for the same period.

The slowdown is attributed to a shift among savers towards higher-yielding alternatives such as mutual funds and other equity instruments. Competition from these market-linked instruments has kept deposit rates sticky, exposing the futility of cutting interest rates in a risk-on, high-return environment.

A senior executive at a state-owned bank said liquidity infusion by the RBI can help ease funding costs without forcing aggressive deposit repricing, supporting credit flow while preserving profitability and financial stability. At the post-policy press conference in December, RBI Governor Sanjay Malhotra indicated that the regulator would follow this course. “Monetary transmission is happening, and we will provide sufficient liquidity to support it,” the Governor said.

In line with this stance, the RBI has continued to actively conduct open market operations and foreign exchange swaps. Net liquidity in the banking system stood at a surplus of ₹23,865 crore as of January 1, according to RBI data.

However, economists caution that liquidity could tighten intermittently due to forex market interventions aimed at smoothing rupee volatility. The system, which had remained in surplus since March 2025, slipped into a deficit from mid-December due to GST payments and advance tax outflows. “If the RBI is able to sustain surplus liquidity over time, deposit growth should improve,” Sengupta said.

Economists caution, however, that liquidity-led easing is not without trade-offs. Sustained surplus liquidity risks fuelling inflationary pressures, complicating rupee management and encouraging excess risk-taking in financial markets, particularly as inflation is expected to firm up in the coming quarters. As a result, the effectiveness of liquidity support will depend not only on its presence, but on its quantum, pace and reversibility — requiring careful calibration to support growth without undermining price stability or financial stability.

Meanwhile, not everyone is writing off further interest rate cuts. Indranil Pan, chief economist at Yes Bank, said the MPC would require sustained undershooting of inflation projections—rather than isolated soft prints—to justify deeper rate cuts aimed at meaningfully lowering real interest rates.

Taken together, economists argue the current phase of monetary policy reflects a shift in emphasis rather than intent. The MPC is next scheduled to meet on February 4–6, with market participants divided on the policy outcome.