Investor fancy about internet stocks and the hopes of a recovery in the job market have led to a huge run-up in the stock price of Info Edge, which owns Naukri.com, a web portal providing recruitment solutions. Zomato, in which the company owns a 50% stake, has also made about six acquisitions in the past six months, boosting investor sentiment. The company’s stock is currently trading at 72X its FY15 estimated earnings and 7X its book value.

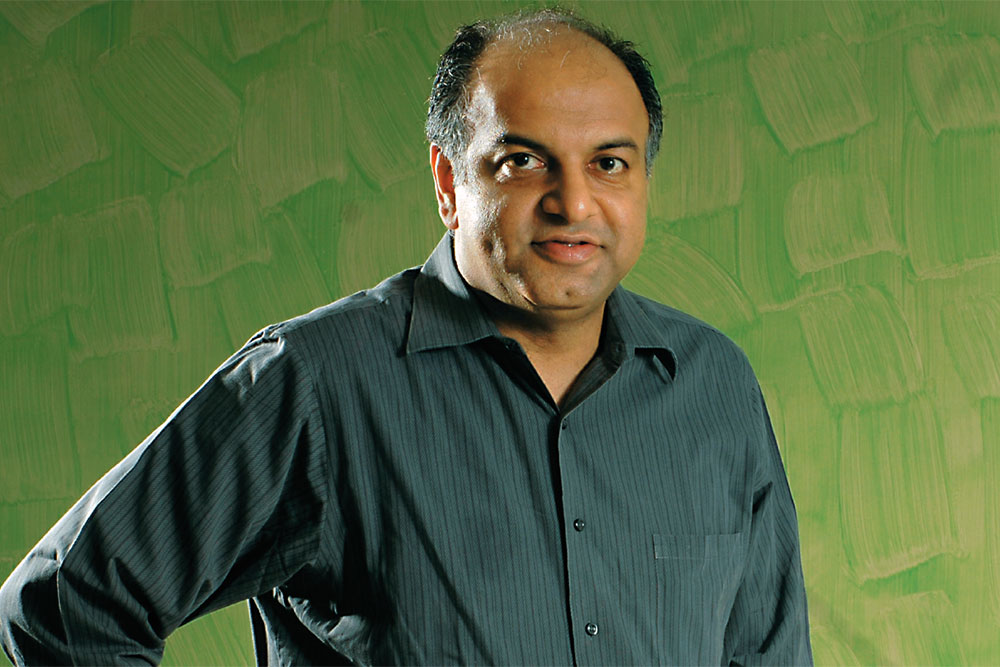

At a time when sentiment is high and valuation is at a peak, executive vice-chairman Sanjeev Bikhchandani has — in two different transactions — sold 535,000 shares in the company at an average price of ₹804 per share, taking his stake down to 29.6% from 30%. Of late, Info Edge has been focusing on its other verticals and ramping up investments in 99 Acres and Jeevansathi. As a result of these investments, the company reported an operating loss of about ₹6 crore in Q3FY15. Despite these continuing investments, its dependence on the recruitment business is still high. In Q3FY15, its other verticals — including 99 Acres and Jeevansathi — reported a ₹18.4-crore loss on a revenue of ₹37.3 crore. The company has tripped so far in its attempts to recruit growth.

Just one email a week

Just one email a week