Kishore Biyani, or KB, had taken a “pilgrimage” in 2000. It was actually a visit to Saravana Stores, on a thickly crowded Chennai street. Families spend hours in that five-storey shop, jostling each other, to buy everything from utensils and clothing to jewellery and gadgets. KB wanted that. That urgency of customers, that push-and-shove of demand and that clamour for everything; they thrilled him, he told Outlook Business, for the Secret Diary edition in 2018. It is a rush he has continued to chase, only to bring himself to the brink of losing control of his business time and again.

The first phase of his growth story seemed like a wild goose chase, as expansion failed to bring in the required profit, pushing the company deep into debt. In 2012, Kishore Biyani bailed himself out by selling the proverbial family silver — Pantaloon Retail — to Kumar Mangalam Birla for Rs.16 billion.

The next innings has not turned out any different. The pioneer of India’s modern retail is neck deep in debt once again. Biyani’s lenders have been growing nervous. This March, ICRA downgraded the credit worthiness of Future Corporate Resources, one of the four holding companies of the group, to BB+. Its report said the downgrading was driven by an increase in the total debt of the operating companies to Rs.127.78 billion on September 30, 2019, from Rs.109.51 billion on March 31, 2019.

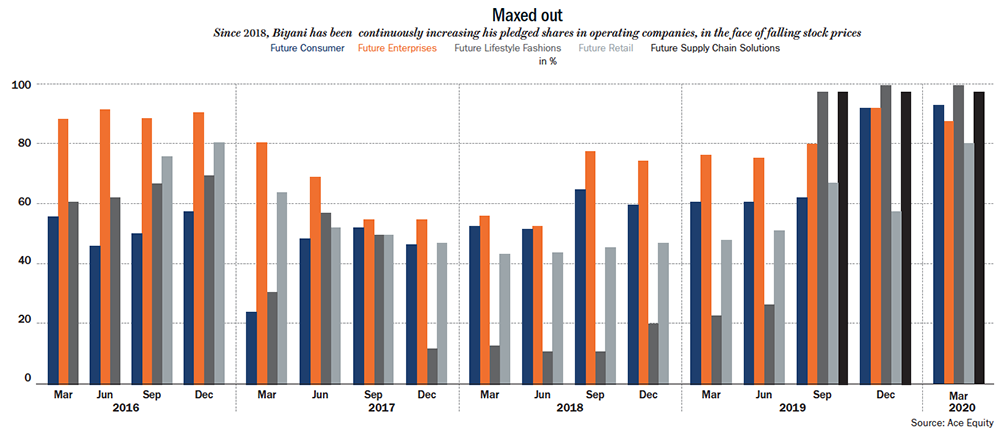

Sensing the stress, shares of Future Group companies tanked between 40% and 60%, prompting lenders to attempt to sell the pledged holding, with Biyani unable to meet margin calls right before the lockdown. Almost all the promoter holding is pledged in the group’s four main listed entities — 92.9% in Future Consumer, 87.6% in Future Enterprise, 80.3% in Future Retail and 99.8% in Future Lifestyle Fashion (See: Maxed out). There is hardly any headroom to raise further debt. At its lowest point, the value of the promoter holding free-of-pledge had plummeted to Rs.9 billion. Yet, Biyani managed to prevent the lenders from invoking the pledge in Future Retail — which would have reduced Biyani’s shareholding in the company where his biggest business Big Bazaar is housed — by taking the matter to Bombay High Court citing the extraordinary circumstances because of the lockdown.

Sensing the stress, shares of Future Group companies tanked between 40% and 60%, prompting lenders to attempt to sell the pledged holding, with Biyani unable to meet margin calls right before the lockdown. Almost all the promoter holding is pledged in the group’s four main listed entities — 92.9% in Future Consumer, 87.6% in Future Enterprise, 80.3% in Future Retail and 99.8% in Future Lifestyle Fashion (See: Maxed out). There is hardly any headroom to raise further debt. At its lowest point, the value of the promoter holding free-of-pledge had plummeted to Rs.9 billion. Yet, Biyani managed to prevent the lenders from invoking the pledge in Future Retail — which would have reduced Biyani’s shareholding in the company where his biggest business Big Bazaar is housed — by taking the matter to Bombay High Court citing the extraordinary circumstances because of the lockdown.

While the sale was stalled, business continues to be bad and shows no sign of revival anytime soon, especially after the pandemic. Now, faced with the imminent danger of losing control over businesses he built from scratch, the only way out for Biyani is to sell whatever he can, to keep whatever remains, and do so as quickly as possible. A detailed questionnaire sent to Future Group did not elicit a response. The spokesperson when contacted said the group will not be able to comment.

As it turns out, Biyani is in advanced stage of negotiation with Reliance Industries for a potential stake sale. Sources suggest Reliance would buy controlling stake in three key companies — Future Retail, Future Lifestyle and Future Supply Chain — which will ease Biyani of his substantial debt burden, while he retains the consumer brands business Future Consumer. The insurance business Future Generali that has been on the block for some time now may continue to look for options.

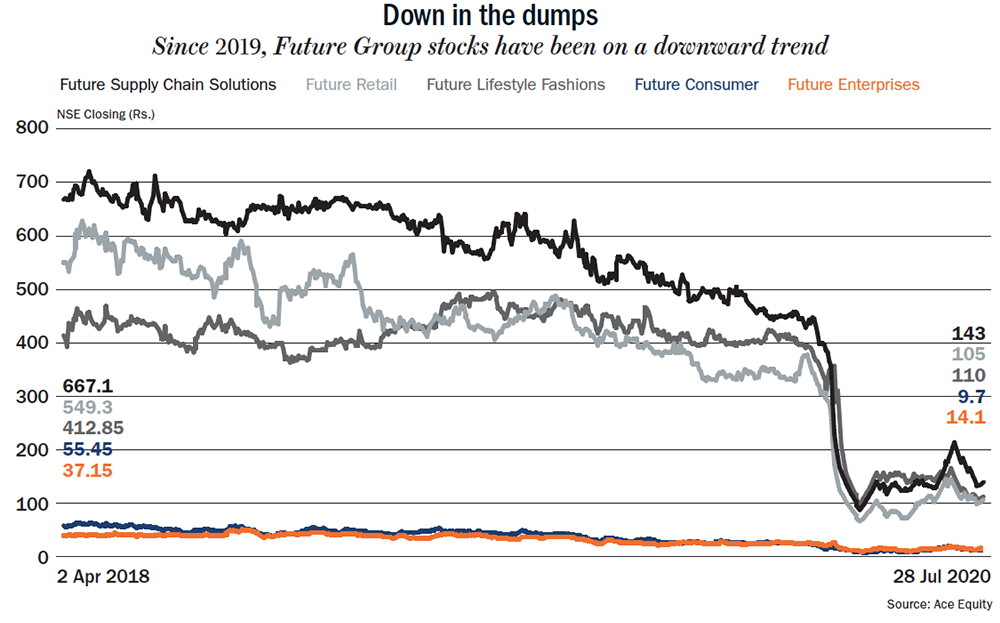

Future Group shares pulled back from the brink of an abyss after rumours about the stake sale gained ground. The combined market cap of the three companies that are likely to be acquired now stand at Rs.87 billion, from a peak of Rs.441 billion in FY19. What really went wrong with Biyani’s grand design that caused the massive loss in market cap in all his companies?

Retail fatigue

Biyani’s second innings started in 2012, right after he sold off the apparel retail business to Kumar Mangalam Birla.

Biyani’s ambition was always clear — he has always wanted to be the retail czar of India, across key categories — food, apparel and home; and across different formats — from hypermarkets to next-door neighbourhood stores. This time, after 2012, he had an additional goal — to create consumer brands. As he saw it, if the group owned the supply chain, distribution, retail network and consumer data, selling consumer brands should be easy.

Accordingly, Biyani steered a restructuring of the group, carving out separate companies that housed different businesses — Future Retail, which housed retail businesses including Big Bazaar, FBB and other small format stores; Future Enterprises, which invested and held all the store assets such as furniture and fixtures for which the retail company paid a rental; Future Lifestyle, which housed Central and Brand Factory; and Future Consumer, which held all the Future group’s private brands. Each of these was also held through separate holding companies.

By 2015, the group was streamlined and Biyani was expanding his retail footprint, buying into diverse retail formats. First came, Bharti Retail and its Easyday stores. It was part of his plan to dominate the neighbourhood-store format, which included earlier buyouts of Nilgiris, Heritage Foods’ retail business and Big Apple. Biyani had repeatedly spoken of 10,000 member-only stores, which he termed “Dubeyji ki dukaan.”

Two years later, Biyani acquired HyperCity from K Raheja Corp. These were large-format stores, 19 of them and mostly in metros. The size of the cash-stock HyperCity deal was Rs.6.55 billion and the asset had been on the block for a while. It was not hugely attractive — on revenue of Rs.11.91 billion, it was loss-making at the operating level. But, the buy was meant to increase the footprint, number of stores and, eventually, the valuation of Future Retail.

Biyani seemed unstoppable with his grand ambition in 2017. That year, unveiling Retail 3.0, a 30-year roadmap, KB said that by 2047 the plan was to become Asia’s largest integrated consumer business. In an interview with Outlook Business in October 2017, he talked about his group as a consumer-goods conglomerate with 27 brands across 64 product categories such as home furnishing, apparels, fashion and food.

In hindsight, it seems like irrational exuberance. Although topline growth was brisk, thanks to both organic and inorganic growth, cash flows were hardly enough to fund growth. Future Lifestyle was the only business that turned in free cash flows in FY17. Still, Biyani continued to power his ambition with high level of borrowing.

Jack of all trades

In fact, scaling up an operation has never been an issue for KB; the struggle has been with respect to building profitable formats. He faltered especially when it came to small-store format. Dippankar Halder, founder, Jalongi, who was earlier CEO of Wadhawan Retail and business head (small formats) at Easyday says, “70% of Easyday stores were profitable at unit level. Instead of pursuing the same track, Biyani introduced the Easyday club, offering a 10% discount, which flopped miserably.”

Privately, company insiders say Biyani cannot rid himself of the discount mindset since that was the very bedrock on which Big Bazaar was built. It’s not a bad idea, but a discount store is a hard win to score in a small-store format. One, the margins on food and groceries which account for the bulk of store sales tend to be fairly low, which limits the scope for discounting. Two, departmental stores create a good value proposition for customers by selling high gross-margin products such as apparels and consumer utilities, which ensure that they make better blended margins overall. In small-store retail, since such merchandising is not possible, it’s hard to achieve profitability.

That’s why a player like DMart, the most successful offline retail model by far in India, has abstained from venturing into this format. Neville Noronha, managing director of Avenue Supermarts, which runs DMart, had earlier explained to Outlook Business his reservations. “The kirana model is nimble and focused on convenience. We do not have the core competency to run a small format store to compete with the kirana model; our model focuses more on value. It is challenging to deliver value in the small format business,” he had said.

Biyani tried hard to make the cost structure work but it made things worse. Halder says that KB brought in cheaply hired senior staff to rein in overall costs, but that ended up affecting store management without saving substantially on expenses. At the same time, inventory management, which is essential when competing with the kiranas, was hugely compromised, too.

Poor store management has always been one of Future Retail’s weak spots. An executive at an FMCG major recalls going to one of Heritage Foods’ outlets, which Biyani bought in November 2016. Narrating the experience, he says the store was a lot more organised before the acquisition. “Now, products were placed randomly. Shelves were empty, and the floor was littered with plastic covers. It was the most unpleasant shopping experience,” he says. When the executive met Biyani in Mumbai and shared his feedback, he got a terse response: “You don’t understand. The Indian shopper likes that chaos inside the store.” The executive says Biyani did not seem to care much about execution. “To make things work on the ground, you need a specialised team and a sharp focus. Biyani didn’t manage that part well,” adds Halder.

It was exactly for the same reason his several shots at e-commerce failed.

It was July 2013. On a wet day, around twenty people were summoned into the Future Group office in Mumbai. Two days prior, each of those present had received an email without a subject. Like a bolt from the blue, in that meeting, they were introduced to the idea of Big Bazaar Direct. Dressed in a white shirt, as he most often is, KB explained the franchisee-model retail format. Now, his large customer base could order online and get the products delivered at home. In typical Biyani fashion, the numbers were large. He was targeting 50,000 franchisees by the end of the year. Uneasy glances were quickly exchanged across the room as the quantum of work that lay ahead dawned on the team. The boss was speaking impromptu and suggested equipping shop-owners with tablets. A deadline to begin operations in September was set and in that 45-minute meeting, job allocations were made with respect to product assortment, advertising and operations, among other things.

The tough deadline was met but in a few months it was obvious that Big Bazaar Direct was struggling. Customers had to wait four to seven days for their order to be delivered and that was testing their patience. The group is estimated to have spent around Rs.4 billion on the venture. By August 2016, it had officially shut down. Biyani had then said this was his fourth shot at e-commerce. He had debuted with Future Bazaar and also tried it with E-Zone and FabFurnish. “He was never serious about e-commerce. There was no attempt to have a team with an e-commerce background. People were just moved from within the group leading to no fresh thinking,” says a former official, who cites the case of E-Zone, where outdated mobile handsets were sold. “The approach was to have an offline store online, which just does not work,” he says.

Through Biyani’s journey as an entrepreneur, there are many such examples of flamboyant ideas failing to deliver the desired payoff.

Biyani’s strategy to grow his portfolio of brands through Future Consumer is another classic case. Topline was growing but operating margin was meagre; Future Consumer’s operating margin stood at 3.4% in FY19. Its private labels account only for 30% of the FMCG company’s Rs.38.8 billion revenue, with the rest still coming from staples such as rice and dal. Its flagship brand, Tasty Treat, which operates in segments such as biscuits, sauces and ready-to-eat snacks, is approximately a Rs.2-billion business.

Another setback in his strategy to grow a branded portfolio was Biyani’s JV with New Zealand’s Fonterra, to form Fonterra Future Dairy. First, the venture ran into trouble with the manufacturing facility, which was the Nilgiris factory, for producing flavoured milk. “Fonterra was extremely disappointed with the quality of the manufacturing facility in the south and changed their mind about having a full-fledged supply chain,” says the former official. Left with no option, a contract manufacturing deal was entered into with the Baramati-based Schreiber Dynamix Dairies, which also supplies dairy products to a host of other companies including Britannia and Nestle. Still, the troubles were not over. Most modern trade outlets refused to stock the brand when it hit the market. “For the local Indian retail chains, there was no question of stocking brands owned by the Future Group since it was a direct competitor,” says a source. In desperation, Fonterra had to fly in its officials from Southeast Asia to meet up with the likes of SPAR, Metro and Walmart — retailers with whom they worked in other parts of the world — and incentivise them to stock their Dreamery brand. But, even now, 80% of Dreamery sales come from Future Retail.

It is estimated that the entire Dreamery portfolio — flavoured milk, curd and UHT toned milk — clocks a monthly revenue of no more than Rs.20 million across all outlets owned by Future Retail; compare this to a monthly revenue of Rs.600 million from the total dairy business that Future Retail does, not counting for pouched milk. “The private label approach works in segments such as rice and dal where there is limited number of brands; and hence offers high margins. But in categories such as dairy, where consumers are used to established brands, it is hard for private labels to make a mark,” points outs Halder.

The consumer portfolio was giving Biyani a tough time, not only because it wasn’t scaling up profitably as anticipated but also because it was annoying big multinational vendors. It’s well known for some years that Biyani has had a slugfest with consumer giants, questioning why companies stocking their brands with Future Retail should call the shots. “They need us as much as we need them,” he had said to his top team. That soured relationships, although even that was only the lesser of the group’s woes.

The consumer portfolio was giving Biyani a tough time, not only because it wasn’t scaling up profitably as anticipated but also because it was annoying big multinational vendors. It’s well known for some years that Biyani has had a slugfest with consumer giants, questioning why companies stocking their brands with Future Retail should call the shots. “They need us as much as we need them,” he had said to his top team. That soured relationships, although even that was only the lesser of the group’s woes.

Woes get deeper

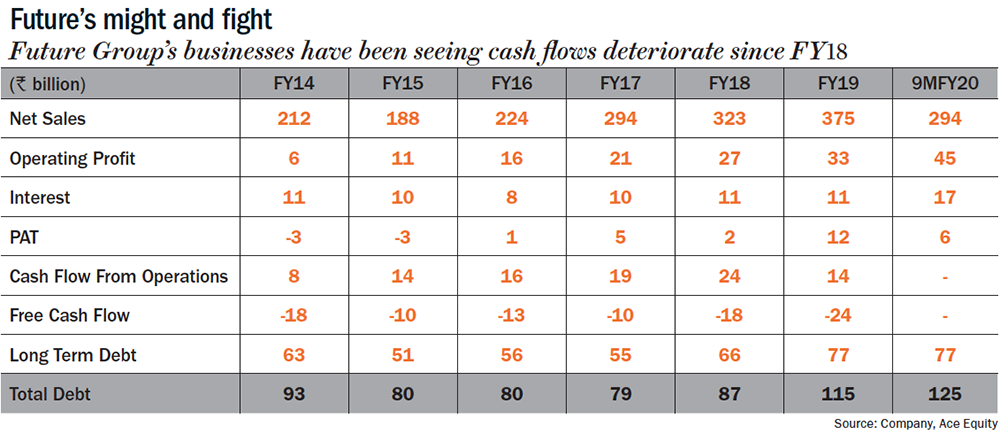

Coming back to the real issue — the poor economics of an ambitious expansion — things started to deteriorate badly after FY18. Since FY14 to FY19, though the consolidated sales of the six listed companies grew briskly at 12%, cash flows started to slow down a year prior (See: Future’s might and fight). Operating cash flow for the listed companies fell from Rs.23.54 billion in FY18 to Rs.13.81 billion in FY19. For flagship Future Retail, for the first time since FY15, operating cash flow had slipped into negative territory — compared with positive operating cash flow of Rs.6.32 billion in FY18, it was down to negative Rs.3.4 billion in FY19. Total interest expenses for the listed companies which has eased off between FY14 and FY16, compounded at 10% till FY19 but saw a steep 52% rise in FY20, chiefly because of higher working capital loans to support declining cash flows.

Still, Biyani was talking big, until last year.

In early 2019, the top brass at Future Retail made detailed presentations to the large consumer companies about their plan despite the business model not working out. Biyani’s team confidently spoke of how they would get to 3,000 small-format stores by 2021 from around 1,100. The head of a FMCG major recalls a line from the presentation about “having an Easyday store every two kilometres”. Just around that time, the announcement about signing a franchise agreement with 7-Eleven to open convenience stores was made — the foreign partner had over 67,000 stores in 11 countries. “The plan was to have at least 1,500 stores in that format as well,” he recalls. There has not been much progress since then. The total number of stores across formats was 1,000 before the lockdown, less than the 1,100 in early 2019 as the company shut down outlets.

Through last fiscal, business was getting tougher and the group’s ability to raise money, weaker. Apart from the listed companies, Biyani had already overextended investing in real estate and dozens of smaller ventures made through his group holdings companies, leveraging holding companies as well. The four main promoter holdings companies namely Future Corporate Resources, Ryka Commercial Venture, Central Departmental Store and Future Capital Investments had combined net debt of Rs.107 billion as of FY19.

Since March 2019, Biyani was hustling for capital, pledging higher stakes in all listed companies in order to both raise finances and make good margins calls in the wake of declining stock prices — pledged stake in Future Consumer went up from 61% (March 2019) to 92.9% (March 2020); in Future Enterprises, from 76% to 87.6%; in Future Lifestyle Fashions, from 23% to 99%; in Future Retail, from 48% to 80%; and in Future Supply Chain, from nothing to 98%.

In the stock market, investors started bailing out and since March 2019, Future Group stocks have fallen drastically (See: Down in the dumps). The market cap of its main listed company Future Retail crashed from a peak of more than Rs.270 billion in early 2019 to Rs.33 billion, just prior to the lockdown. It has since recovered to Rs.57 billion on talks of Reliance buying-out.

But the debt pile for the group stands at Rs.235 billion, including the FY19 debt for the four key holding companies and December 2019 figures for listed entities (See: Holding that debt).

Risking all

Biyani is no stranger to risking it all. bs Nagesh, founder of Trrain and chairman of Shoppers Stop, who has known Biyani for almost three decades, describes him as a high risk-taker who always wanted to grow aggressively. There is an oft-repeated story in the group about how Biyani in the late 1990s set a target of Rs.10 billion in revenue in 2005, when it was only a Rs.400-million entity. This was announced at the strategic meeting and the employees were stunned, with Biyani’s family vehemently opposing this idea, since they feared he would use unbridled expansion to get there, says a key member of his core team then. A year later, he had grown to around Rs.600 million. He unveiled Big Bazaar and soon opened Central and, in 2004, he had revenue of Rs.6.5 billion. That year, he told his top management he wanted to grow to Rs.25 billion by 2008. And every single time, he reached his target topline before time. “He sets a target and then figures out a way to get there,” says a former employee, who wryly remarks profitability was never discussed.

KB chased the topline like the devil. In 2003, he brought Professor Jagdish Sheth of Emory University, an authority on consumer psychology and marketing, to speak to his A team. Over that two-day session, the concept of cradle to grave was unveiled. Simply put, it was Biyani’s desire to be present at every step of the life cycle — later, it made way for what he would call “share of the customer’s wallet.”

Running with that idea, Biyani jumped into insurance in 2007 forming a joint venture with Italy’s Generali. A group insider says, “The insurance business is one characterised by long-gestation periods and calls for oodles of patience. It is a direct contradiction of what KB looks for in a venture.” Predictably, it’s hardly made its mark and has been on the block for six years now. In life insurance, the joint venture has a market share of less than 5%. Of the nearly two dozen players in this industry, Future Generali is not even among the top 15.

But that’s Biyani. His misadventures have never stopped him from taking on new ventures. Perhaps Biyani’s most intrepid adventure was in the movie business. Arjun Sablok recalls meeting KB sometime in 2001 as an ad film maker. He had been called by Pantaloon to make a 30-minute audio-visual as a way to motivate his team. When the script was narrated to Biyani, the Bollywood buff got all excited and announced he would produce it as a full-length movie! Thus came Na Tum Jaano Na Hum in 2002. In spite of having Hrithik Roshan, the star of the day, the film flopped. Internally, Biyani told his team the film venture (he produced another one, Chura Liyaa Hai Tumne in 2003 which also flopped) was not his cup of tea but “ek baar toh karna tha mujhe” (I had to try it once).

What now?

Unfortunately, the world of business is unforgiving. His drive, which once got him formidable success in expanding his empire, has proven to be a double-edged sword. “Resources are always limited and allocating them rationally is never easy. Kishore spread himself too thin,” feels Nagesh.

According to media reports, the group has already shown the door to 400 employees (insiders say it is at least twice that number). Insiders say KB used to be annoyed by any presentation with an Excel sheet; he preferred ideas plastered on a PowerPoint slide, but not anymore. After all, how those numbers actually stack up will make a difference when he is on the negotiating table.

For Reliance Retail, whose next quest is to dominate the category, buying into the company may make tremendous sense. It is hard for any company to leverage the offline store network optimally for the next few months but it still makes a lot of sense for any retailer to buy into a well-established offline asset from a long-term perspective. “The holy grail in retail is to be able to offer customers the choice to shop online and pick up offline, or browse offline and get it delivered at your doorstep,” says serial entrepreneur K Ganesh, founder, Growth Story. “The Future Group will surely be a valuable asset to own for strategic factors — the store network, the supply chain, the brands and the customers,” he adds. Biyani’s distribution of 1,388 stores, including 290 Big Bazaars is formidable indeed. It’s 80-year license agreement with convenience chain 7-Eleven for India may be a selling point but Reliance may not necessarily see value in that considering they may have their own plan for the traditional kirana stores.

Currently, Future Retail is the bigger piece of the business but the most profitable part is the fashion business housed under Future Lifestyle. Blackstone picked up a 6% stake through the open market in the company and has also subscribed to debentures in its holding company. Worryingly, that debt comes at an interest of 26.5%. There is a good chance that it will be converted to equity, but then it is a business that Reliance will also want for the same reason.

But the price will depend entirely on Reliance. “It’s a buyer’s market. You cannot attribute a value to the company based on fundamentals. The desperation of the seller and the number of players it can bring to the table for competitive bidding will determine the price,” says Ganesh. That means Biyani won’t have much room to negotiate.

The rumour mill has it that Mukesh Ambani is in talks with the lenders for a 30% haircut on the outstanding loans. If that is indeed the case, there is no question of any value left on the table for the equity shareholders. In any case, with the interest clock ticking and expenses mounting with negligible sales, the stress will only intensify if a sale is not closed. “Sometimes, it could help to wait it out, but certainly not in this case,” says Ganesh.

To Outlook Business, KB had said that the failure of his first movie was not easy to take. He sat up through the night, after the movie’s fate was sealed, and towards dawn wrote on a piece of paper, “One should not get attached to what one creates.” His aggression in business has taught him lessons and earned him a not-so-charitable nickname: his initials are often expanded to khareedo becho (buy and sell).

If his businesses, to which his identity is tethered, are sold, his spiritual lesson and the quintessential KB attitude should see him through.

He may be down for now, but don’t count him out.