Ever heard of complexity bias? In simple terms, it’s the love for complication. Take the case of Vedanta, the company that is owned by Vedanta Resources (VRL), which was listed on the London Stock Exchange until 2018. Its management seems to be a prime example of someone with a complexity bias. “We don’t like, we don’t own, and we don’t track the company. Commodity is anyway a complicated business. That coupled with Vedanta’s complex structure led us to avoid the stock for almost eight years now,” says the CIO of a prominent mutual fund. Ironically, the management has been hard at company “simplification” for years now.

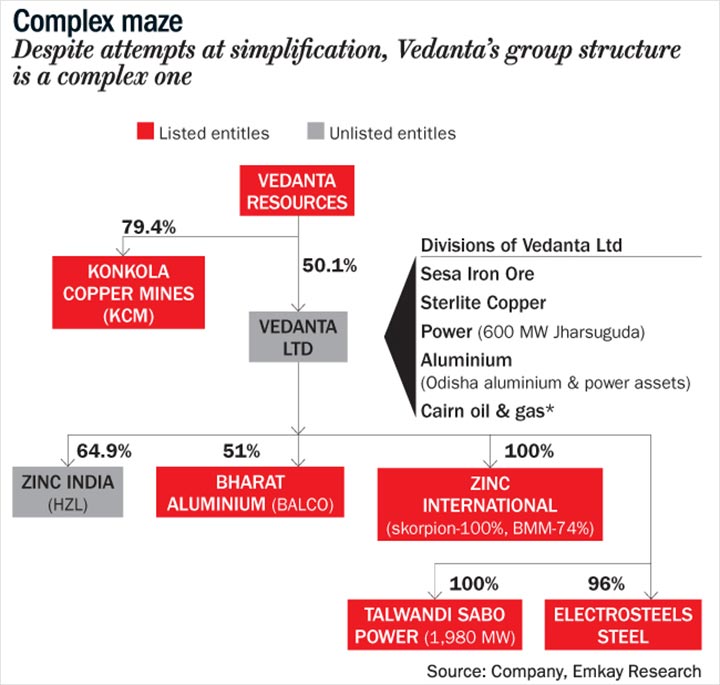

In 2012, Sterlite and Sesa were merged to form Sesa Sterlite, which was later renamed as Vedanta. That was followed by a merger with Cairn India in 2016. Thus, the listed Indian entity (Vedanta Ltd), turned into a hybrid structure comprising listed and unlisted subsidiaries and divisions, that produced everything from oil and gas, zinc, lead, silver aluminum, iron ore and power. Here’s how the Vedanta Group stands today — Volcan is a family trust with Anil Agarwal, scrap-dealer turned metals tycoon, at the helm. This promoter entity owns Vedanta Resources (VRL) and its subsidiaries) through Volcan Investments (65.73%) and Volcan Investments Cyprus (34.27%). Then, VRL controls 50.10% in the Indian arm and 79% in Zambia’s Konkola Copper Mines.

In 2018, the management claimed that the liquidity in Indian markets meant there was no longer any need for a separate London listing and took VRL private. Now in 2020, the management claims delisting the Indian arm will provide shareholders “an opportunity to realise immediate and certain value for their shares at a time of elevated market volatility.” Though the group, of late, has been on a media blitzkrieg to showcase its corporate social responsibility and added a few Peacock awards to its crown, it hasn’t helped dissipate the distrust around the group.

In his pursuit of becoming a behemoth in the commodities space, Agarwal, through Volcan Investments, since March 2017, started building a stake in the $29-billion Anglo American, using a complex structure that involved the issuance of mandatory convertible bonds to hedge funds. Volcan now holds 21% stake in the rival miner. The £3.5 billion convertible bonds carry a coupon of 3.875-4.15% that needs to be serviced half-yearly. In the December 2018 quarter, Cairn India Holdings (Vedanta subsidiary) bought a part of that 21% stake through a structured deal for $561 million. That was when Moody’s revised its outlook for Vedanta to ‘negative’. Kaustubh Chaubal, the lead analyst tracking Vedanta at the rating agency alluded that the move was a diversion tactic. “We view the related-party investment as credit negative for Vedanta and a means to fund the risk appetite of its shareholder, a clear indication of the company’s willingness to deploy cash at Vedanta to support Volcan’s interests,” said Chaubal. The move also made brokerages back home take notice, and several downgraded Vedanta to ‘sell’ in early 2019. CLSA had slashed its target price from Rs.250 to Rs.170, raising similar concerns. What’s worse is that, due to a provision in the Companies Act, Agarwal did not have to seek shareholders’ nod since the investment was routed through Vedanta’s overseas subsidiary, Cairn Mauritius.

So, while the promoter company pocketed a capital gain of around $500 million, Vedanta’s stock plunged 20% on Feb 1, 2019 when the deal was made public. Though in July 2019, Vedanta said the structure was unwound, fetching Cairn $100 million in gain, it hasn’t helped in easing investor unease around the stock. Similarly, in 2018, Twin Star Overseas, the promoter entity, pledged its entire 52.01% holding in Sterlite Technologies with Citicorp International as collateral for a loan taken by Volcan to fund the delisting of VRL. The pledge was later revoked in June 2019.

Then, in Q2FY20, Vedanta took an Rs.5 billion write-off in AvanStrate, a Japanese glass substrates manufacturer, which the company had acquired in 2017 with the intent of backward integration of its proposed LCD screen plant in India. After Cairn India Holding invested Rs.10.1 billion to buy out Carlyle Group’s 51% stake in AvanStrate, it put in an additional Rs.15 billion to repair a furnace. In the same quarter, Vedanta disclosed advances of Rs.12 billion to another promoter entity, Konkola Copper Mines, for future purchases of copper cathodes and anodes, even though the entity has been seized by the Zambian government since May 2019! Though VRL has sought international arbitration in the matter, it looks like a long haul as the Zambian government is seeking to sell Vedanta’s majority stake to other bidders.

Even as Vedanta’s stock fell out of favour over the course of 2019, the outbreak of COVID-19 at the start of 2020 prompted Moody’s to place VRL’s corporate family rating under review for a possible downgrade. "The review for downgrade reflects our expectation that low oil and base metal prices will significantly strain Vedanta's financial metrics, at least through the fiscal year ending March 2021,” Chaubal said in the March 24 report. Three days after that report, VRL CEO Srinivasan Venkatakrishnan resigned, making it a very short stint at the global miner since he had taken charge in October 2018. That was after Tom Albanese (former CEO of Rio Tinto) stepped down due to “personal reasons”.

That brings us to the present, when the family has taken center-stage with Agarwal as the non-executive chairman and his brother Navin Agarwal as the executive vice chairman. For the year ended September 2019, VRL managed revenue of $13.7 billion and Ebitda of $3.3 billion, even as debt piled up to $6 billion. More importantly, the bonds issued to Anglo American investors are due this year. On maturity, the bonds are exchangeable for underlying shares, unless Volcan repays the bondholders in cash. In other words, the billionaire needs some quick financing and greater control over the Indian subsidiary seemed like a lifeline. And on May 12, he just did that by making an offer to delist the Indian arm.

The only hope

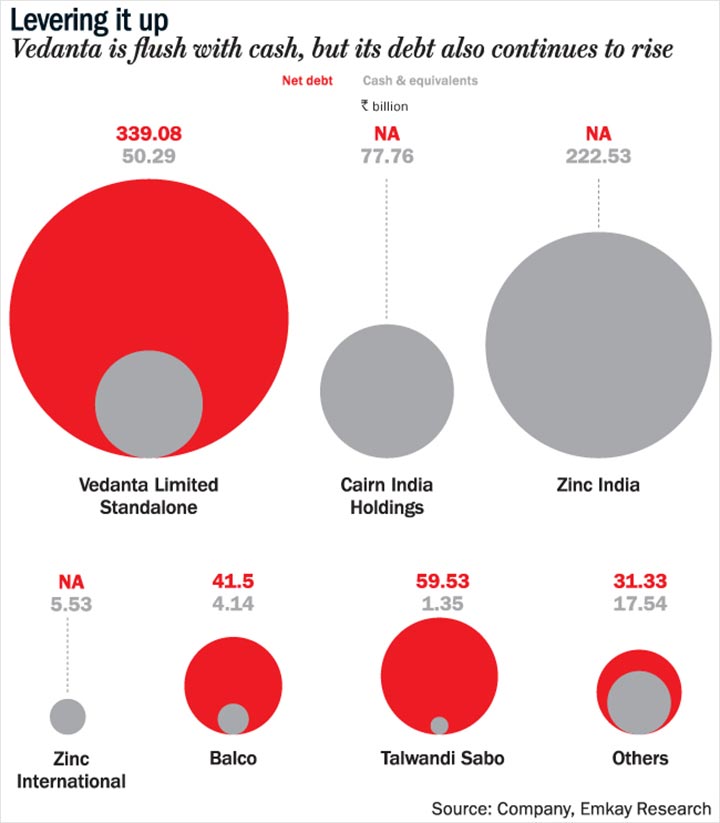

Though the Agarwal family is ensconced offshore, the heart of the empire lies in India. VRL and the promoter entity are dependent on the Indian entity for dividend income, to service their own interest obligations. As of September 2019, Volcan had a debt of $0.8 billion, while VRL had debt of $6.6 billion. Meanwhile, Vedanta (as of March 2020) accrued a debt of $5.9 billion including $2.8 billion term debt maturing through FY22. In effect, Agarwal is now running a conglomerate with $13 billion in debt (See: Levering it up).

Unlike Volcan and VRL, Vedanta is able to service its debt. In FY20, it generated free cash flow of Rs.116.29 billion and Ebitda of Rs.206.87 billion, enabling it to pay interest cost of Rs.49.77 billion. Moreover, it also owns controlling stake in Hindustan Zinc or HZL (64.92% with remaining owned by the government) and Cairn India. Of the total Rs.379.14 billion, Vedanta has Rs.50.29 billion in cash and Cairn India Rs.77.76 billion. Its crown jewel is HZL, which has cash of Rs.222.53 billion. The company has emerged as the world’s second-largest zinc-lead miner after Glencore and ranks among the top 10 silver producers globally. One would imagine HZL could solve a lot of the holding company’s problems. Unfortunately for the promoter, VRL cannot access all of Vedanta’s earnings since it owns just 50.14% and the rest is held by public and institutional investors (See: Complex maze).

That’s why the management has been trying to buy out the government’s residual stake in HZL. After the Supreme Court had stayed the sale in 2016, Vedanta moved the SC to reconsider its order in early 2020. HZL’s dividend payout has been healthy with Vedanta accruing Rs.54.86 billion and the government getting Rs.24.96 billion in FY19. Especially now that the dividend distribution tax has been abolished effective FY21, this figure is going to look more attractive. So, it shouldn’t come as a surprise that Agarwal wants to take Vedanta private since he would no longer need to share dividend with minority shareholders.

Melting point

After announcing on May 12 that VRL wants to acquire the entire public holding of 49.86%, the Vedanta board approved the delisting on May 18, with a due diligence report by SBI Capital Markets. The floor price was set at Rs.87.25/share on a day that it was trading around Rs.92. And VRL’s letter was accompanied by a certificate from Price Waterhouse, once again dated May 18. After an 85-minute deliberation, the board concluded that the delisting was in the interest of minority investors and only shareholders’ approval through postal ballot and e-voting remains, which is on till June 24. “This is not the first time Vedanta promoters have tried to buy back shares from the public. I vividly remember the cheque for Rs. 150/per share received like dividend warrants in 2000, which were encashed by gullible shareholders only to realise that they have unknowingly sold their holding to the promoters. Since then Sebi has tightened the open offer norms,” points out Ambareesh Baliga, independent market expert.

In response to Outlook Business’ questionnaire, the company in an emailed response stated: “The delisting exercise is being carried out to address the twin objectives of simplification of corporate structure and attaining enhanced financial flexibility, which is necessary to not just meet the debt obligations but ensure enough and more funds to expand the group’s footprint in various natural resources. The delisting will also support meaningful deleveraging and streamline cash flows.”

In fact, for such an important decision there is no minutes of the meeting that has been attached that would give investors a sense on what factors were considered and debated by the board, which includes former Sebi chairman UK Sinha! “In the present case, shareholders have the right to know the justification behind the approval. It is not a business decision, where commercial secret or competition issues are involved, it is a question of separation,” says Jitendra Gupta, former executive director at Sebi and founder of SES, the Mumbai-based corporate governance research and advisory firm.

Interestingly, in an interaction with analysts post Q3FY20, the management had given a healthy picture across all its businesses, especially HZL and Zinc International where operational efficiencies were kicking in with the company recording its highest production on the back of lower costs. “All the time, investors tagged along and when it is time to enjoy the fruits of patience comes an delisting offer at a price, which at best can be called an attempt to test the wisdom of investors. Or is it that the promoters themselves are valuing the business this cheap?” fumes Gupta, asking if the promoter is ready to sell his 51% stake at the same price?

In its report, SES has stated that the intrinsic value of the share is much higher compared to the floor price stated by the promoters. Since May 18, the stock has gained 13% to trade at Rs.105 on June 19, indicating the disappointment among investors. “On what basis did the board determine that the delisting is in the interest of minority shareholders? It appears that the board considered and took into account the interest of acquiring shareholders rather than public shareholders,” questions Gupta. According to SES, HZL’s value per share alone works out to be around Rs.132. “Unless the promoters have valued the remaining business of Vedanta at negative Rs.44, we are of the opinion that the offer price does not reflect the seriousness of the promoters,” he adds. Baliga concurs that the promoter will end up making a killing. “In fact, 25% of the buyback value is equivalent to the dividend Vedanta will receive from HZL. Also, the current market value of Vedanta is at Rs.26 discount to the value of HZL investment alone. In other words, the market is discounting all the other businesses and investments of Vedanta,” opines Baliga.

However, Vishal Chandak, research analyst at Emkay Global, says the company is playing by the book with respect to pricing. “Besides, commodities are in a downturn and, hence, valuations are depressed,” he adds. What’s pertinent to note though is the Vedanta management’s decision to substantially write-down Rs.173 billion in oil and gas assets in Q4FY20. Analysts believe the move reduces future estimates of book value as well. Rakesh Arora, who tracked commodities at Macquarie Capital Securities and now runs Go India Advisors, says, “While it isn’t unusual for companies to make diminution in the value of assets, the timing of the move when the stock is being delisted works in favour of the company.” Baliga agrees, “The company has aggressively written down the value of oil & gas assets when prices had crashed. Now with oil back to above $40, will they revalue the assets upwards?” The management has possibly brought out all the skeletons and more in an attempt to crash valuation and prove the promoter's offer of Rs.87 is extremely generous. This is an apt case for investigative audit by Sebi,” feels Baliga.

Meanwhile, rating agencies are turning cautious. Fitch believes that the debt required to finance the delisting would pressure the group's consolidated credit metrics in the near term. But, it would lead to cash savings for VRL from lower minority dividend leakage, which could facilitate deleveraging over the long term. However, the deleveraging potential depends on the transaction price and financing structure. In an interview with a business daily, Agarwal seemed unfazed. “We have enough funds, and we will take a bridge loan from the bank, for which, JPMorgan has come forward,” he said and added that it will provide funding for 49.5% of public shareholding, and with merged companies, “we will have enough to pay off”. With this move, VRL’s debt will increase by $2.5 billion, but Agarwal added, “We will have sufficient dividend (income) to service that. At the same time, deleveraging will happen for $1 billion debt”. Interestingly, the company did not declare the final dividend for FY20 and has said that in order to conserve cash, the board decided not to distribute dividend received from HZL.

Number crunching

At the floor price of Rs.87.25 a share, the consideration would be Rs.163.5 billion ($2.18 billion) to purchase the 49.86% stake, whereas at Rs.105, as on June 19, on a current market cap of Rs.391 billion, Vedanta would need Rs.195.71 billion ($2.6 billion). Vedanta’s consolidated Ebitda in FY20 was $2.79 billion, which helped it service interest cost of $0.67 billion on debt of $5.9 billion. Besides, it paid interim dividend of $1.95 billion. Assuming the June 19 price for delisting, VRL’s debt will increase by $2.6 billion to $9.2 billion, and the merger of Vedanta will further take the consolidated entity’s debt to $15 billion. But the question is whether the Ebitda of Vedanta will able to service the 2.54x jump in debt, especially at a time when analysts estimate the FY21 Ebitda to fall to $2.12 billion? Chandak believes, unless there is a second wave of COVID-19 in China, or bilateral tensions between the US and China, the outlook should improve. “When the Chinese economy revives, which appears so, we should see an uptick in commodities prices. Vedanta, like any other commodity stock, shall benefit out of the same.”

Gupta feels the minimum price offered to minority investors should be above book value. “In this case, it is above Rs.220/share as per consolidated assets minus liabilities. Based on PE & P/BV multiple of Nifty Metal Index over the past two years, the average price works out to be around Rs.310, more than 3x the floor price.” For Vedanta, any price beyond the current level will only make it unviable because even if VRL aims at 39% stake to achieve the 90% mark for delisting, at the book value of Rs.220, it will need $4.14 billion and at Rs.310, it would need $5.79 billion. That’s an awful lot of leverage to service. Shriram Subramanian, founder of InGovern Research, believes the substantial public shareholding (49%) is not easy to mop up. “For delisting, the promoters need at least 39% of that to be offered.”

For now, the probability of the company getting delisted, given the widespread holding of 49% stake, seems low. Foreign portfolio investors hold 15.18%, public shareholders 15.51%, mutual funds 10.91%, while LIC holds 6.37% stake. Among mutual funds, HDFC AMC holds 2.47% in its HDFC Infra Fund, the other two funds, ICICI Pru and SBI MF, hold 5.03% and 1.12% in their arbitrage funds. While LIC did not respond to Outlook Business queries on its stance, one private fund manager on condition of anonymity said, “Frankly, there is nothing to be discussed. It is a process and wherever the cutoff is, everyone will tender their shares. But a lot will depend on LIC’s stance.” While the state-owned insurance behemoth has made much money on its historical holding, much of its current buying has been around Rs.170. Vedanta has stated to Outlook Business that neither the indicated offer price of Rs.87.5/share nor the floor price is the final exit offer price for the delisting offer. “The final exit price shall be determined as the price at which equity shares accepted through eligible bids takes the shareholding of the promoter (along with the persons acting in concert) to at least 90% of the paid-up equity share capital of the company,” said the company.

Further, the promoter has the discretion either to accept or reject the final exit offer price discovered pursuant to the reverse book building process. Gupta of SES believes the current regulations give promoters the right to refuse a discovered price without assigning any reason. As there is no risk in offering a price which is far below intrinsic or fair price, there will always be offers which short-change investors. “The law can mandate that an acquirer while giving a call price must also give a put price, meaning that while indicating a floor price, there must be a requirement that acquirer must also declare at what price he would be a seller; Or, the law must make a provision that after acquirer declares a floor price, any other person or entity can declare the willingness to buy promoters shares at 10% above the declared floor price and offer the same to public shareholders. This way law can ensure that only fair price will be offered,” explains Gupta.

Subramanian of InGovern feels the promoters have only indicated their willingness to buy out minority shareholders, but it is for the latter to determine the price. “InGovern is recommending that investors offer their shares at not lower than book value,” he says. Gupta, too, believes that investors should hold out. “Given that the management has conveyed that Vedanta has a bright future, shareholders must continue and if they exit, they must offer the shares at the right price.” A clear picture on who will win the battle is yet to emerge.