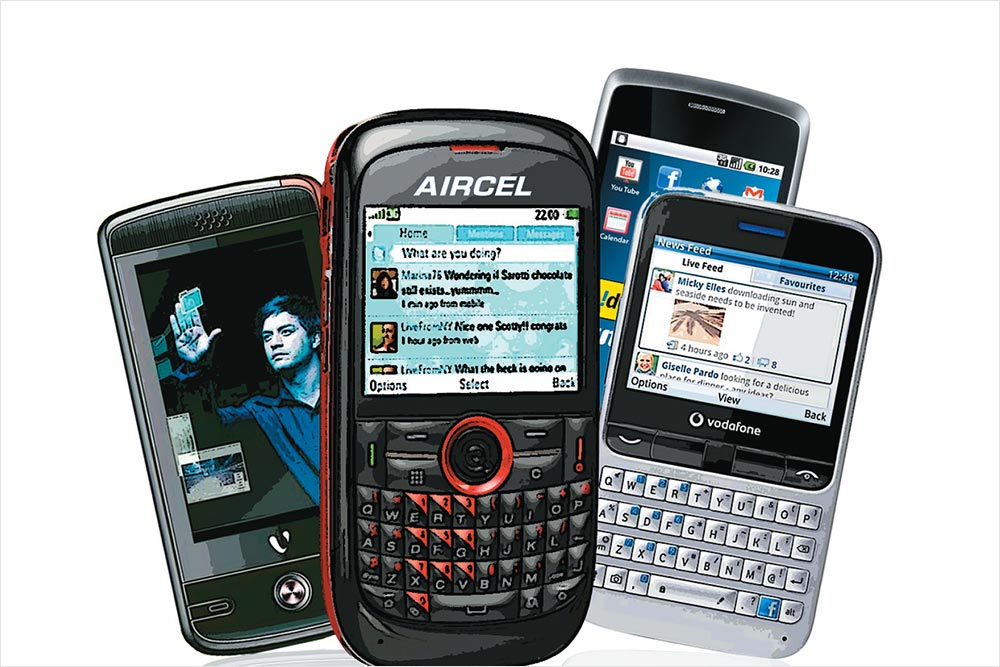

Virgin Mobile was the first in the market to start the trend. And while things aren’t going too great for the British telecom brand’s Indian foray, its strategy of introducing own-brand handsets is finding many takers here. Spice, Idea, Vodafone and MTS all have their self-labelled mobile phones and now, it’s the turn of Aircel Cellular, which is the Indian arm of Malaysia’s Maxis Communications.

Not just any old handsets, though. Aircel, which has been bundling Apple’s iPhone and a host of other models from vendors like INQ, HTC and Research In Motion (RIM, maker of BlackBerry), is gearing up to introduce affordable data handsets. Beginning next year, it will launch a range of 3G-enabled mobiles. Aircel will source the devices from handset-makers and partially subsidise them, which means they will be sold at lower-than-market rates. Buyers, however, will be locked into the carrier for at least a year or two, which will give the company the chance to recover its investment through data and voice usage by the consumer.

The idea is simple: price-sensitive consumers want to experience internet-on-the-go but don’t want to spend big money on a fancy 3G handset. And operators, who are already bleeding thanks to the insanely expensive 3G licences, are willing to do just about anything to get subscribers to use their phones more for pricier data services.

But how popular are these handsets? The cheapest data-enabled phone in the market costs around Rs.3,000, while operator-branded 3G handsets cost upward of Rs.3,000-5,000. Aircel’s devices are likely to be in the Rs.5,000 price range, which means if consumers are really driven only by the value-for-money proposition, they’re not likely to head to a carrier phone. “Aircel’s strategy may support its plans of acquiring and expanding 3G subscriber base by offering some lucrative deals. But I don’t see huge volumes for carrier devices in India, which is not a mature market yet,” says Anshul Gupta, principal research analyst at Gartner India. Idea Cellular launched its first branded handset in December 2011 and isn’t doing all that well: it’s sold only 120,000 devices till date, despite a barrage of freebies.

Aircel hasn’t had much luck with its data business so far. While it has spectrum for 3G in 13 circles and for broadband wireless access in eight, its 3G user base is just around 1 million, compared with over 9 million for Airtel and 3 million for Idea. In 2009, it was the first to popularise internet on mobile phones but, given the dearth of cheap data-enabled handsets at the time, failed to cash in on the idea. Will the 3G handsets ring in much-needed change?