When Virat Maan plunged headlong into the family’s liquor retail business, he hadn’t crossed the legal drinking age. He was 16. But he doesn’t care to talk about himself. The 25-year-old would rather keep the spotlight on his brand Royal Green, which comes in a distinctive bottle. Launched in 2014, this whisky brand hit the one million case mark in three years and today, it does over two million — one case is 12 bottles of 750 ml each or nine litres in all.

The Royal Green brand is owned by ADS Spirits, a company started by Maan’s father and his two siblings. Housed in Haryana’s Bahadurgarh, their journey in the liquor industry started off over three decades ago as retailers. Today, that network spreads to at least 100 stores apart from being one of the largest wholesalers in the state. Teetotaller Maan, who now doubles up as ADS’ business head, went to London for his MBA and even worked with the likes of Diageo and Pernod Ricard.

By his own admission, nothing has been more satisfying than building the family’s liquor business, more specifically creating brands across whisky, rum, vodka and gin. That said, the success of Royal Green stands out. Though Haryana and Delhi are core markets, the brand has slowly moved to selling in 17 other states — it has manufacturing plants in Haryana, Rajasthan and Uttar Pradesh, apart from contract bottling units in Goa, Madhya Pradesh and Chhattisgarh.

In the past five years, Royal Green has joined the likes of at least three more — Sterling Reserve B7 (from Allied Blenders and Distillers), All Seasons (Oasis Group) and White & Blue (Alcobrew Distilleries) — that have quietly made their mark in the whisky side of the spirits industry. These are million-case brands, which have earned the title after hitting the magical number in sales. Created from scratch, they have gained significantly from the decision of United Spirits (USL) to focus on the top end of the market — priced at over Rs.750 for a 750 ml bottle. London-headquartered Diageo, which gained control of USL in 2014, wanted to run a more profitable ship, and profit margin in the premium end is 5x more than the 7% the regular segment generates.

Santosh Kanekar, founder, BeLive Corp and ex-marketing director at Diageo India, says USL vacated a strategic area, which is the entry point for first-time drinkers in the middle and lower segment apart from those upgrading from country liquor. While the biggest gainer from USL’s decision was its direct competitor Pernod Ricard, the resultant market churn gave newbies a way in. They saw the opportunity opening up in the lower range, priced between Rs.500 and Rs.700, and grabbed it with both hands.

Whisky lovers

As much as 63% of the volume in the Indian spirits industry comes from whisky (See: Hard drinkers). Most of that is consumed in the North with some help from Andhra Pradesh, Karnataka and Telangana. When Diageo took charge of USL, their brands in the Rs.500-700 price band contributed volume of 30 million-case in a 190 million-case market. USL dominated this segment with its Bagpiper, Director’s Special and Old Tavern brands.

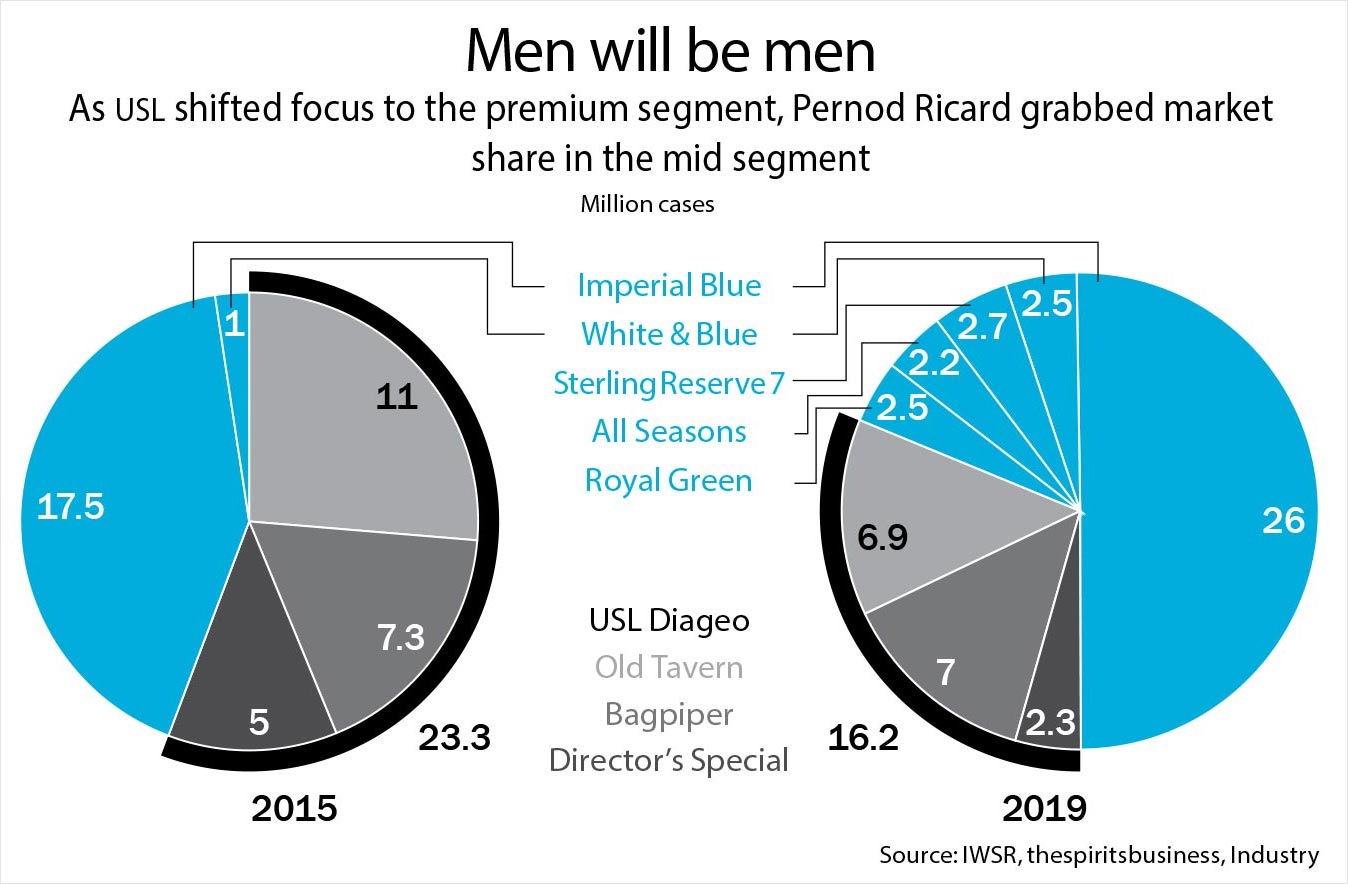

Cut to the present where the market has grown to 55 million-case but USL’s mid-brands have lost ground. Over 2015-18, Old Tavern’s sales fell 44% and Bagpiper’s 23%. The biggest gainer in this churn has been Pernod Ricard’s Imperial Blue (See: Men will be men). Over the same period, its volume increased from 17.5 million-case to 26 million-case, an increase of 49%. New players grew too — at 12% each year, compared to the overall spirits industry’s 3-4% — and their volume went up from barely a million-case to almost 10 million-case.

The newbies did more than grab the opportunity. Nimble-footedness and controlling costs have been critical to their success. Vijay Rekhi, ex-MD, United Spirits and now executive chairman, Vizanar Alcobev, says, “They have lower overhead costs, usually 60-70% of what a multinational spends. Typically, there are no elaborate offices nor will they have expensive manpower,” he explains.

Another advantage for some of the new entrants is that they control the entire value chain — bottling to retailing. The Oasis Group, which started with manufacturing country liquor and running 500 retail outlets in Punjab, has slowly moved up the value chain. Today, it owns five distilleries across MP, Punjab and Haryana in addition to an equal number of bottling units. Then, there are those such as Maan’s ADS Spirits who started out as retailers. “That was a huge advantage since we already possessed a deep understanding of the business apart from having strong relationships,” says Maan. The decision to opt for backward integration stemmed from a casual conversation his father was having with a friend. The friend was full of praise for Royal Stag, a Pernod Ricard brand. “My father decided to take it as a challenge to build a new brand,” he says, of the origins of Royal Green.

Premium play

If the newbies are challenging the icons in the volume game, why not go below Rs.500? There are inherent difficulties in that band. For instance, the one at the entry point (less than Rs.300) is dominated by state-level players, while the Rs.300-500 band has contracted since 2015 in favour of a consumer who is willing to spend a little more. In the Rs.300-500 band, volume has dropped from 70 million cases to 45 million cases, whereas the Rs.500-700 band has grown from 40 million-case to 55 million.

This is what caught the attention of Bikram Basu, COO, Allied Blenders and Distillers (ABD). Historically, the company is known for Officer’s Choice whisky (priced below Rs.300) the largest by volume globally at 32 million-case, with 30 million of that sold in India. “We realised there was up-trading taking place quite rapidly,” says Basu, who has had stints at USL-Diageo, Pernod Ricard and now ABD. Over 14-15 months, the company studied the market and launched a small pilot in limited markets with a brand called Officer’s Choice Black. It didn’t work. There was a limit to which Officer’s Choice could be extended. They knew then that they needed a whole new brand with distinct packaging. The new brand’s name was chosen going by the alphanumeric trend in high-end products, such as iPhone and BMW. So ABD decided on Sterling Reserve B7 (at Rs.700) and 10 (at Rs.1,000). It also meant that they could straddle two price points.

Launched nationally in May 2018, Sterling Reserve B7 has been a prominent success, with volume hitting 2.7 million-case. Along with ABD, packaging has been effectively used by ADS Spirits’ Maan, too. First, their whisky comes in green bottles — in this segment, green is associated with ‘premium’. Second, Maan says, they ensured that the brand was “always doing something”, to avoid user fatigue. The initial packaging had been kept unchanged from the launch in 2014 to 2019. But around the time of IPL and cricket World Cup last year, a special packaging was launched on the theme. “These things will not cost you much and helps in promoting the brand in the absence of advertising,” he says. The advertising-to-sales ratio for a new entrant is well over 20%.

Just as ABD, quality was the watchword for ADS Spirits, too. To ensure quality, the malt spirit was imported from Scotland. They knew that Royal Stag was a benchmark in the minds of people graduating to more expensive whisky. “We need to tell them our offering is not inferior and is less expensive as well,” says Maan. That pleasant surprise was what Gautam Malhotra, director of Oasis Group, was aiming for, too. The group launched All Seasons (Rs.710 for 750 ml) in 2017. ”We knew the segment we were playing in, it was users who were upgrading. They wouldn’t have tasted a high-quality drink often and that was our chance to surprise them,” he says.

ADS Spirits had kept Royal Stag as a benchmark and, similarly, Oasis Group had USL’s Signature as a standard while launching All Seasons. Sticking close to Signature’s blend and packaging won them loyal customers. Malhotra is now eyeing higher margins by enhancing the product portfolio.

Stick to your patch

If you colour the geographies where the new brands have come up, you will see more are concentrated in the North, particularly NCR, Punjab and Haryana. Distribution is key in this business, says Alcobrew Distilleries’ COO, Anant Iyer. “A smart company will identify pockets of strength in its core markets and put in all its effort there,” he says. The company, promoted by Romesh Pandita, who worked in the spirits industry, sells White & Blue Whisky (priced at Rs.700 approximately). Launched in 2013, it hit the million mark in 2015. With a manufacturing unit in Punjab, around 70% of its 2.5 million-case volume comes from North India; and the rest from markets that include Tripura, Orissa and Chhattisgarh. Inside the North market, ADS and Oasis Group focused on the big whisky-consuming markets such as NCR and Punjab.

Basu’s ABD went to West Bengal also, besides the North market. “86% of the North consumes whisky and West Bengal is open to trying new brands,” he explains. They built on Officer’s Choice goodwill too, and the trade gave them an opening and they sold 300,000-case just on their distribution strength. Usually, new entrants keep the trade happy by offering discounts, schemes and overseas trips at regular intervals; the established brands don’t have to usually woo distributors and retailers this aggressively. “Competition, especially the big boys, will block you in the trade. In FMCG, you can go to the next store, but not in a regulated industry,” says Basu.

Despite the obvious advantage enjoyed by established players, new brands have clocked impressive volume thanks to quick thinking in product development, cost efficiency and distribution. They stuck to geographies they knew and played to their strengths. It helps to keep your wits about you, even when you sell stuff that blunts them.