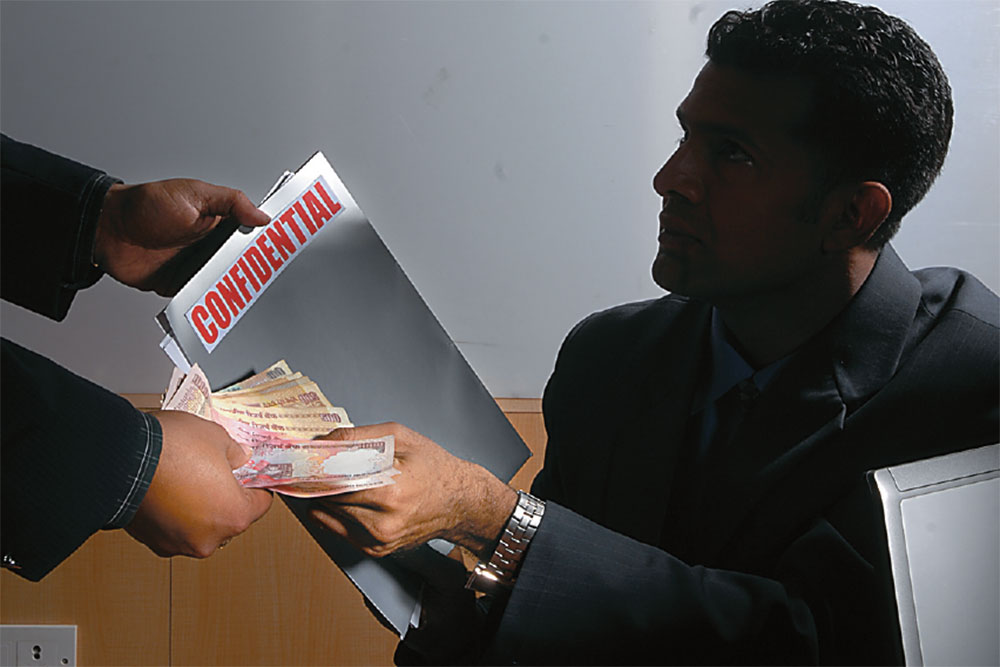

Over the years, venture capitalists (VCs) have played an important role in providing early-stage financial support to high-risk, high-potential startups. But when VCs exit, it usually happens in any of the three ways — an initial public offering (IPO), followed by the sale of VC’s share in the market; a trade sale; or liquidation of the company. An IPO is more or less acceptable to the entrepreneurial team — founder, executive team and shareholders — but resistance is quite likely in case of trade sale especially where the sale price is relatively lower than the company’s market value. Using data from firms in Silicon Valley, a study by Brian J Broughman and Jesse M Fried investigate how VCs overcome such resistance. The duo find out that in 45% cases, VCs give bribes (about 9% of the deal value) to the entrepreneurial team.

Title: Carrots & Sticks: How VCs Induce Entrepreneurial Teams to Sell Startups

Source: Social Science Research Network