India’s exports accounted for over 22% of the gross domestic product (GDP) in FY23, according to the Ministry of Finance estimates. The overall exports sector is estimated to witness a 13.84% growth in FY23 over the previous year.

A superficial glance at these figures might stoke collective optimism, but the larger picture calls for concern and caution. The country’s exports peaked in 2013, when they touched 25.4% of the GDP, according to the World Bank data since 1960. Since then, despite efforts from successive governments, the export sector has struggled to come close to attaining this ratio.

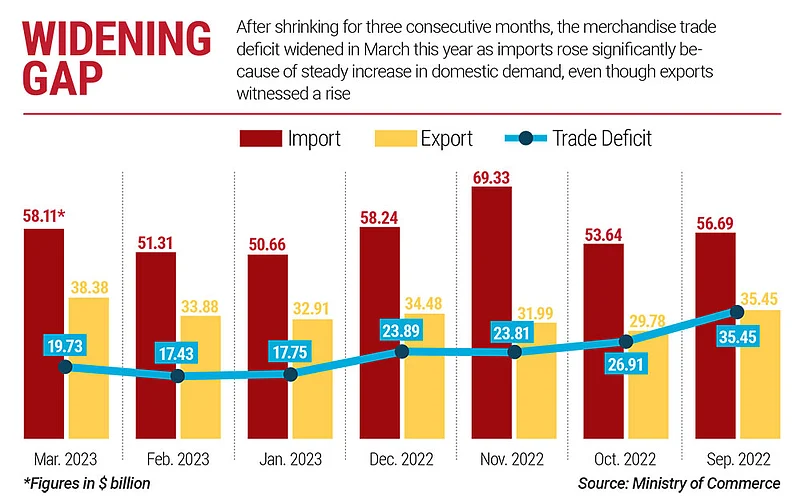

The growth in overall exports is led largely by the services sector, which is expected to witness a growth of 26.79% during FY23 over FY22. On the other hand, the merchandise exports contracted multiple times during the year. In March this year, merchandise exports contracted by 13.88% compared to the same month last year from $44.57 billion to $38.38 billion. This is the fourth contraction in the preceding six months. In February, they stood at $33.9 billion against $37.15 billion a year ago, which is a contraction of 8.8%. Prior to that, there was a contraction of 11.6% in October 2022 and 3% in December 2022 from their respective year-ago periods.

Meanwhile, merchandise imports in March fell 7.9% to $58.11 billion from $63.09 billion for the same month last year. However, after narrowing to a 13-month low of $17.43 billion in February this year, the merchandise trade deficit widened to $19.73 billion in March, as imports, while lower than in the month last year, were higher than in February. While exports are estimated to have increased by less than 14%, imports are up by over 17% against the previous year, thanks to steady domestic demand.

“There is no doubt that India’s merchandise exports are contracting. We had exports worth $406 billion last year but expect it to be $440 billion in FY23. While the services exports are booming, the situation for merchandise exports looks tough,” says Ajay Sahai, chairman of the Federation of Indian Export Organisation (FIEO).

Services in a Fast Lane

The merchandise exports are in a tight spot amid some tough challenges to the global economy, but services exports are showing good prospects, thanks to the post-pandemic rearrangement of the economy. India exports services in travel and transportation, insurance, software, like IT business process management, business, financial and communication sectors.

Commerce and trade secretary Sunil Barthwal was bullish about the potential of the services exports to help achieve the overall exports target of $750 billion set for the FY23 when he spoke on the subject in March this year. The new export orders index, from S&P Global Purchasing Managers Index, for the services sector rose to 50.7 in February from 49.6 in January, indicating expansion for the sector—a reading higher than 50 indicates expansion.

Services exports for the period from April to December 2022 climbed to $239.76 billion from $184.65 billion during the same period in the previous fiscal—which is a year-on-year growth of 29.85%—as per the Department of Commerce data.

“India’s services exports are recording a healthy growth rate. Going by this trend, the industry will cross $350 billion in 2022–23, and tapping global opportunities will help achieve $1 trillion target by 2030,” says Sunil Talati, chairman of the Services Export Promotion Council, as he credits the performance of sectors including IT, ITeS, tourism and healthcare for helping the exports register significant growth rates.

“As the world is rebuilding its economy post-pandemic, the services sector is finding itself at the centre of our economy with unprecedented growth. A lot of factors have contributed to this, including technological advancements, the revolution of information technology and growth in demand for manufacturing industries after the economic start,” Talati explains.

According to experts, the services sector provides various facilities on which even the manufacturing sectors are dependent. Transportation, legal websites, banking, logistics, IT services, healthcare, communication, etc. directly affect the development of an industry in any country. Understanding and leveraging this value in the domestic market and globally has helped the services sector witness massive growth in India.

Goods That Sell

Saket Dalmia, president of the PHD Chamber of Commerce and Industry (PHDCCI), notes that though merchandise and services exports have been impacted in the recent months due to geopolitical headwinds, the former is expected to grow reasonably well, somewhere between $435 billion and $445 billion. “The rest will be covered through service exports, somewhere between $305 billion and $315 billion. The overall exports are expected at $750 billion in 2022–23,” he says.

While the overall export market is showing signs of a slowdown, India’s petroleum export to the European Union has increased as the latter has largely stopped buying petroleum products from Russia. The value of European imports from Russia was over €158 billion in 2021, out of which €99 billion was for oil and gas.

According to data from the Minstry of Petroleum and Natural Gas, petroleum products exports went from $21.4 billion in FY21 to $44.4 billion in FY22. Experts believe that India has a good chance at getting a significant share of the export pie, including in non-oil sectors like food and cereals, iron and steel, metal, etc. in the European market as the Ukraine war shows no sign of abating. They are among the 17 key sectors that witnessed growth in FY23. According to a trader who did not wish to be named, orders are coming in from Russia as well for the supply of a range of products hitherto supplied by European countries.

The PLI Thrust

The government prefers to see the export-centric activity in manufacturing as a success of its much-celebrated production-linked incentive (PLI) scheme, which was introduced in 2020 to incentivise production with the aim of compressing imports and promoting exports. The government showcases the rise of electronics sector as an exemplary PLI story. Recent exports data shows an annual growth of over 50% in electronics in 2022–23, which crossed $25 billion mark. The mobile phone segment alone contributed over $10 billion to this figure.

According to government data, foreign direct investment (FDI) in India in FY23 was expected to cross $100 billion, riding on the Make in India, Ease of Doing Business and other government initiatives. However, unlike what the government believes, observers say that the combination of the increase in FDI and the government’s push for the PLI scheme may take more time to show results in the exports sector. “Substantial chunk of this [FDI] investment will go in the PLI segments. PLI sectors in the initial years will focus more on the Indian market, which is robust and growing. Over a period, after attaining scalability, they may focus on global market in a significant way. Hopefully, global trade, by then, will show much improved signs,” Sahai from the FIEO says.

Despite the challenges, Sahai believes that India can be a net gainer from the evolving situations across the world. “We are better placed to leverage free trade agreements (FTAs) that have been signed, including with the UAE and Australia. It has been three years since the PLI scheme was launched for the mobile [phone] segment and two years for a few other operations in the electronics sector. A significant portion of that [production] will find its way to the global market as well, which will be a positive for the exports,” Sahai explains.

Global Headwinds Hit Indian MSMEs

The slowing economy is a major culprit dragging India’s merchandise exports down—the slowdown in the growth of developed economies has had a cascading effect on Indian exports due to a dampening demand. “The recovery process of many of the economies has been impacted by post-pandemic geopolitical conflict between Russia and Ukraine, skyrocketing commodity prices, high inflation trajectory and synchronised move by the central banks in increasing the interest rates. World economic growth had recovered sharply in 2021 at 5.9% from a significant deceleration of 3.2% in 2020. However, it again decelerated to 2.9% in 2022 and is projected to decelerate further to 1.7% in 2023,” says Dalmia of the PHDCCI.

According to the World Bank, global growth has slowed to the extent that the “global economy is perilously close to falling into recession”, making it only the third weakest pace of growth in nearly three decades, “overshadowed only by the global recessions caused by the pandemic and the global financial crisis”.

Vivek Kumar, economist at economics research firm QuantEco, says that the situation will not change soon and impact Indian exports. He says, “Exports are subdued, and there will be more contraction. You will see persistence of negative numbers as we move ahead. It is widely expected as the global economy is slowing down.”

India’s merchandise exports contraction is a cause for concern for the micro, small and medium enterprises (MSMEs) sector. Jitender Singh, owner of Impact Engineering in Ludhiana, which exports surface grinding machines to Saudi Arabia, Egypt, Dubai and other places, is worried about the declining exports. “In a normal situation, we would have pending orders of three months, but now they are confined to just one month, indicating that the business has declined almost by half,” he says. A month ago, he had gone to “one of the biggest” exhibitions in the US, but the response from potential customers was lukewarm due to the economic slowdown in the North American markets, he adds.

Naresh D. Chandani of Disposafe, a medical disposable manufacturing company in Faridabad in Haryana, is equally concerned about the export situation. The company exports to over 100 countries. “We are not getting new clients owing to the slowdown. We are just serving our old clients, so our order book is stagnant,” he says.

Arun Shukla of Vishwakarma Engineering in Solan in Himachal Pradesh adds, “Indian exports are doing better than how other countries are performing, but, in the last two to three months, we could achieve just 80% to 85% of the exports target.” His company exports to Middle Eastern and African countries.

According to the PHDCCI, the average economic growth of top 25 global export destinations has been decelerating. It came down from 5% in 2021 to 3.1% in 2022 and 2.3% in 2023. Global economic prospects have shown a significant deceleration for 2023, as 94 economies are likely to grow below the pre-pandemic level of 2019, it adds. The deceleration will have some impact on demand of the destination countries and affect India’s growth of exports in 2023–24.

Engineering exports showed contraction in February 2023. According to Engineering Export Promotion Council, India’s engineering goods exports to nearly 17 key markets declined—including to the US by 9.1% and to China by 33.3%—year-on-year. Outbound shipments from the sector fell for the seventh straight month in February. The exports declined by 9.68% in February this year to $8.58 billion from $9.50 billion in the same month last year.

India Amidst Challengers

Indian exports have done remarkably well in last two years, jumping from approximately $500 billion in value in 2020–21 to over $750 billion in 2022–23. Speaking at an annual event of the industry group Assocham on March 28, three days before the close of the financial year, Union commerce minister Piyush Goyal said, “The naysayers have been proven wrong. I am happy to share today that India has crossed USD 750 Billion of exports. There has been growth in both goods and services exports.”

Despite this impressive growth and the minister’s confidence in the sector, the merchandise exports of the last few months tell a different tale. In a changing geopolitical scenario, where the US-led Western bloc seems inclined to reduce its dependence on China, India should have obtained a larger share of the global trade by now. The advantage, however, has gone to Southeast Asian countries, especially Indonesia and Vietnam.

These economies have been able to stay strong in global trade despite a decelerating world due to the China factor. Sahai explains the situation: “Vietnam is doing well in exports, as investment from China is moving to the country, particularly after the US-China tariff war started. South Korean companies have also shifted their manufacturing to Vietnam. It has effective FTAs as well. Indonesia is essentially a commodity exporter, and its exports are growing since commodities and energy prices have gained a lot in the last two years.” However, he adds, India is conscious of the challenges posed by these two countries and is also attracting global investment, particularly in the manufacturing sector.

Madan Sabnavis, chief economist at Bank of Baroda, agrees with Sahai on the advantage these counties carry. He says, “Southeast Asian economies, like Vietnam and Indonesia, have an edge on account of their lower cost of production because of better facilities and incentives provided by their respective governments. Also, there is a role of FTAs, which complement their exports and provide access to some big markets.”

Waiting for Growth

In the face of economic downturn inching up interest rates, the growth potential of exports looks marginal. “India’s overall merchandise exports are likely to see a moderate 2% to 4% year-on-year growth in fiscal 2024 to reach around $460 billion after witnessing an estimated growth of 5% to 7% this fiscal. Exports to the US and EU27, which account for nearly one-third of the total merchandise exports, are expected to see a contraction due to anticipated slowdown in their GDP as well as inflationary scenario,” says Aniket Dani, director of research at market research firm CRISIL.

Furthermore, observers say, a rapid rise in interest rates globally will affect consumption for key sectors, which is likely to affect exports in the near term.

Sabnavis also feels that Indian exports will have a tough time going forward. “Indian exports will be trending downwards or will witness marginal growth. As the global demand condition is not good and there is slowdown in two major destinations—the European Union and the US—there is a likelihood of the exports going down. I will not be shocked to see them stagnating or having a negative growth,” he says.

According to Sahai of FIEO, the next three years could be challenging for Indian exports. “It may get worse in 2023 and then may improve in 2024 and 2025,” he says. Dalmia of the PHDCCI expects that a significant recovery of exports is possible only with the recovery in economic growth of top 25 destinations and India’s improved connectivity with the global supply chains, going forward in 2024–25.

The commerce minister’s optimism apart, most observers believe that the Indian export sector is in for tough times. As services and manufacturing exports reduce their gap, it could bring cheers for one type of industrialists while bringing despondency for another.

If the reduction in this gap is caused by a contraction in merchandise exports rather than a spectacular performance of the services sector, India would have lost a once-in-a-lifetime opportunity brought by the changing geopolitics in its neighbourhood.