Despite Paytm's efforts to reduce its Chinese shareholding over the past few years, the fintech major still remains the listed new-age unicorn with the highest stake held by the neighboring country’s investors at the end of FY25, according to BSE data.

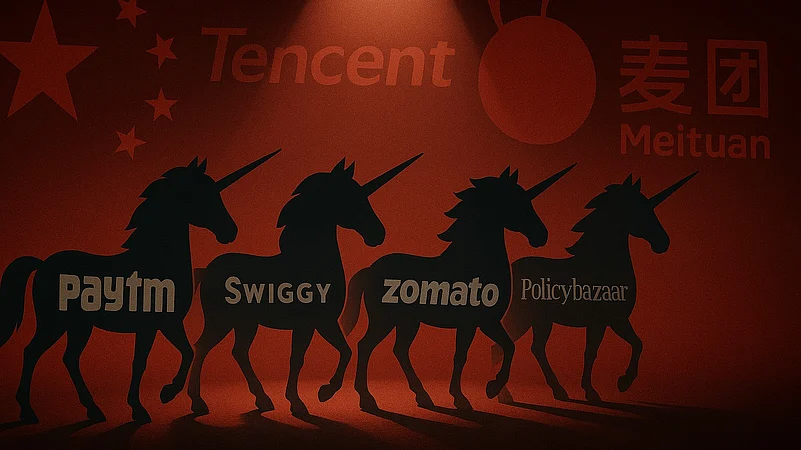

While Chinese investors owned 9.85% of Paytm at the end of FY25, they own 4.4% of Swiggy, 2.12% of Policybazaar, and 1.95% of Zomato.

Chinese Stakes in Listed Start-Ups

After Paytm, the food delivery start-up Swiggy holds the second-highest Chinese stake among listed new-age unicorns, with a total of 4.4%.

It is also the only listed start-up with two distinct Chinese stakeholders: Inspired Elite Investments Limited and Tencent Cloud Europe BV.

Incorporated in the British Virgin Islands (BVI), Inspired Elite Investments Limited is a wholly-owned subsidiary of Meituan, a major Chinese technology company headquartered in Beijing. Similarly, Tencent Cloud Europe BV is fully consolidated under Tencent Holdings Ltd, a Chinese multinational headquartered in Shenzhen, China.

BSE data from the end of FY25 indicates that Meituan holds a 1.13% stake in Swiggy through Inspired Elite Investments, while Tencent holds 3.27%.

Tencent Cloud Europe BV also owns a 2.12% stake in PB Fintech, the parent company of Policybazaar, making it the third start-up with the highest Chinese shareholding.

Likewise, Antfin Singapore, another subsidiary of Ant Group, holds a 1.95% stake in Zomato’s parent company, Eternal, placing it fourth on the list.

Notably, Meituan, Ant Group, and Tencent are the three Chinese entities holding the majority of stakes in new-age listed Indian start-ups.

Other listed new-age start-ups, including Ola Electric, Brainbees Solutions (FirstCry), Nykaa (FSN E-Commerce Ventures), Delhivery, IdeaForge, Mamaearth (Honasa Consumer), Yatra Online, MobiKwik, and Ather, have no Chinese shareholding, according to BSE’s shareholding pattern data.

Curb on Chinese Investments

China was once one of the biggest investors in India’s tech start-ups, investing billions between 2014 and 2020.

As per a report titled “Chinese Investments in India” by Gateway House, direct Chinese FDI in India peaked at around $859 million in a single year, and start‑ups alone attracted an estimated $5 billion from Chinese backers through indirect routes

However, after a tense military standoff at Doklam in 2017 and when India-China border tensions escalated again in 2020, the Indian government mandated that any foreign investment from neighboring countries requires prior approval.

Although the Doklam standoff lasted only a couple of months, it raised concerns among policymakers in New Delhi about potential security risks posed by Chinese companies in critical sectors like power grids and telecommunications.

Consequently, in August 2017, India quietly tightened its rules on Chinese telecom and power-equipment manufacturers, introducing stringent checks for malware and other threats.

By April 2020, when the government formally mandated prior approval for all investments from neighboring nations, many start-ups had already begun excluding Chinese investors from new funding rounds or facilitating the sale of their shares to avoid delays and additional scrutiny. This shift allowed companies to continue raising funds quickly without bureaucratic hurdles.

To reduce Chinese holdings to below 6%, MakeMyTrip worked to unwind stakes held by Alibaba and Tencent, Dream11’s parent, Sporta Technologies also sold Tencent’s holding to Tiga Investment and Zomato reduced Alibaba’s share from 16.5% at its IPO to below 10% by mid-2023.

Paytm’s Efforts to Offload Chinese Stake

At the end of the March quarter of FY25, Antfin (Netherlands) Holding BV, a subsidiary of Ant Group, held 9.85% of Paytm’s parent company, One 97 Communications. Ant Group, formerly known as Ant Financial, is an affiliate of the Chinese conglomerate Alibaba Group.

It is worth noting that Antfin (Netherlands) recently reduced its stake in Paytm through an open market transaction.

At its peak, Paytm’s largest Chinese investor, Antfin (Netherlands), owned approximately 23.79% of One 97 Communications.

Facing stricter RBI regulations on foreign ownership in payment firms and rising geopolitical tensions between India and China, founder and CEO Vijay Shekhar Sharma, in August 2023, orchestrated an off-market transfer of 10.3% of Antfin’s holding to his wholly-owned vehicle, Resilient Asset Management B, using optionally convertible debentures to shift economic benefits while gaining voting control, thereby reducing Antfin’s direct stake to approximately 13.5%.

According to a regulatory filing, the fintech investor sold 25.5 million shares on May 14, equivalent to 4% of the total equity share capital of the company.

Following this transaction, Paytm’s Chinese shareholding decreased from 9.85% to 5.85%. However, even after this reduction, Paytm remains the listed new-age start-up with the highest Chinese shareholding, according to BSE data.