As competition intensifies in quick commerce sector majorly led by Blinkit, Instamart, and Zepto, Tata-owned BigBasket witnessed a decline in its annual turnover for the fiscal year 2025. The report shows a decline in revenue across BigBasket’s core units.

The company’s B2C arm ‘Innovative Retail Concepts’ reported a 3% drop in turnover to ₹7,673 crore, while its B2B entity ‘Supermarket Grocery Supplies’ saw a 7% decline to ₹2,227 crore, according to Tata Sons’ FY25 annual report.

It also revealed that losses for Innovative Retail Concepts also widened significantly, rising to ₹1,851 crore from ₹1,267 crore the previous year.

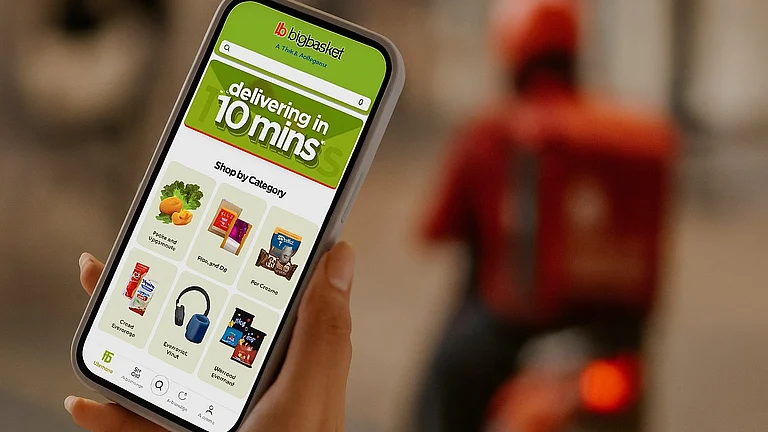

BigBasket was started as a slotted grocery delivery player, but it now transitioned into the 10-minute delivery game with ‘BB Now’ after consumers’ preferences changed in India.

BigBasket's Quick Commerce Strategy

The platform has come up with a “multi-category quick commerce (MC/QC)” model that could become the backbone for Tata’s digital push to beat the rivals like Blinkit, Zepto, and Instamart.

Under this, the company will use its existing dark stores, warehouses, and last-mile fleet to allow fast deliveries of Tata-owned brands like Croma, Titan, 1mg, Qmin, and others. All products will be available under one platform.

In addition, Croma and 1mg outlets are repurposed to function as dark stores for BigBasket. This strategy will allow the company to tap into hyperlocal presence and logistical muscle of its Tata Group partners as they have deep understanding of micro-markets across multiple product categories, the report said.

Unlike its competitors operating multiple apps, BigBasket will follow a “unified” app approach. This means every product – be its electronics, medicines, or clothing – will be available on BigBasket’s primary platform.

Additionally, the company will also not hold inventory for every category, rather the brands manage their own stocks and compliance. BigBasket will only focus on last-mile logistics and delivery.

BigBasket Plans to Go Public

Big Basket is eyeing to come out with an initial public offering in 2025 after turning profitable. "We will probably have it in 2025. But we are leaving it to the Tatas, there cannot be anybody better to guide us and advise us on that," its co-founder and chief executive Hari Menon told reporters earlier.

The company is targeting sales of up to ₹150 crore from the line christened "Precia" by 2026, and will be focusing on marketing the products, which also include items like momos and desserts, he added.

Founded in 2011 by Parekh, VS Sudhakar, Hari Menon, VS Ramesh, and Abhinay Choudhari, BigBasket was started as an online grocery platform but it fully transitioned into quick commerce model with delivering orders within 15-30 minutes last year.