What’s in a name? asked the Bard, but then it is not very often that successful companies change their name, especially in the midst of a once-in-a-generation pandemic that has flattened growth across economies and geographies. But, that’s exactly what the Noida-based software services company, NIIT Technologies, did this August by changing its name to Coforge, for “working together”. The name change comes more than a year later when the erstwhile promoters, NIIT, handed over the reins of the company to Baring Private Equity in April 2019. This is Baring’s second acquisition in the IT space, as it already owns 62.7% in Hexaware Technologies.

NIIT Tech wasn’t exactly an exciting mid-tier IT company but that changed nearly three years back when Sudhir Singh, a Genpact veteran, took charge in 2017. He sharpened the focus on insurance, BFS, travel and healthcare, revamped the leadership and operating structure and, more importantly, implemented an incentive structure that ensured that rainmakers got paid at a faster pace. “We looked for leaders who were comfortable with scale, knew how to build scale and were hungry for growth,” says Singh. More importantly, instead of CEOs sitting out of India, NIIT Tech moved closer to its clients.

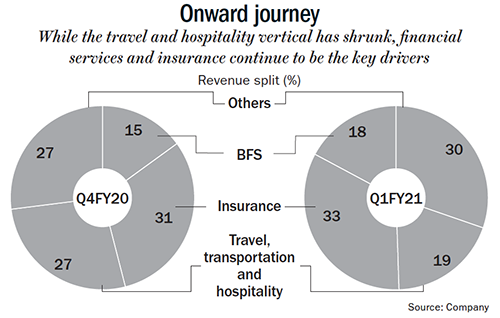

The change has worked wonders with revenue (Rs.29.91 billion to Rs.41.83 billion) and profit (Rs.2.80 billion to Rs.4.44 billion) growing at a healthy pace over FY18-20. Manik Taneja, analyst at Emkay Global Financial Services, says, “The senior leadership deserves credit for the superior growth metrics in recent years that changed the company from a growth laggard to a leader on growth.” However, following the pandemic, NIIT Tech given its significant exposure to the travel and transportation vertical, 19% in Q1FY21 and 27% in Q4FY20, saw revenue decline sharply. Within the travel vertical, airline revenue contracted 62% quarter-on-quarter in dollar terms and accounted for 5.5% of the mix versus 13% in Q4FY20. The management has not counted on recovery in airlines in its FY21 guidance.

Besides travel, transportation and hospitality, all other verticals (BFS/insurance/others) grew 8%, 1.4% and 5.9%, in dollar terms, sequentially in Q1. Despite the pandemic-led downturn, the management expects strong sequential recovery in Q2FY21 and has guided for mid-single-digit growth for the entire fiscal. “Despite the slight miss in the June-quarter, Coforge’s strong outlook for FY21 drives us to increase our revenue growth and margin assumptions,” says Taneja, who has also increased earnings estimates for FY21-23 by 4-7%.

As the company expects growth to keep ticking, it has added a new vertical in healthcare and has also set its sights on hitting a billion dollar in revenue. Though Singh did not reveal the timeline for hitting the number, he wants to build on the momentum that saw the company touch $600 million from $400 million in three years. While BFS and insurance remain the primary driver of growth, Singh expects travel to eventually make a comeback and its healthcare vertical to grow into a sizeable business. The prime mover at Coforge shares more:

Can you briefly tell us about the revamping exercise, which has been underway for the past three year?

We grew from being a $400-million firm to a $600-million one and this has been driven by multiple factors. One is the change in the operating culture of the firm. The incentive structure and compensation philosophy saw an associated change. The large deals commission has gone up nearly 4x and annual increments have also seen a similar expansion. Anyone who was pivotal in the firm securing or starting a material relationship for a large deal were given a payout that was 3.8x of what they were rewarded earlier. More importantly, the payout was not spread over multiple years, it was to be given out faster. Our attrition levels are the lowest in the industry.

Second is the revamping of the leadership team. 11 out of the 12 CEOs have been hired over the last 30 months. 60% of their directs have also been hired over the same period. Also, 70% of the executive team is sitting in the client markets. Third is a shift in strategy — we call our approach “transform at the intersect”, that is, we do not look at constructing solutions through a tech lens alone. So, for relevant solutions, we also need to understand the industry processes. Four is by delivering digital and not just talking digital. While our digital plus IP portfolio revenue is likely to hit 45% of our total revenue in the short term, we apply a very rigorous lens on what revenue can be classified as digital.

What is the proportion of revenue from your non-core verticals?

Outside of the three verticals, the revenue from others — which includes retail and manufacturing — is around 30% (See: Onward journey). In addition to insurance, BFS and travel, we have started a new vertical, healthcare, which is now part of the 30% revenue. Over time, we will keep assessing the ‘others’ revenue build-up because a lot of that comes from horizontal technology offerings that we have, and when it becomes feasible, start carving out these into independent verticals. My belief is that with just four verticals and existing number of clients we can traverse the journey to a billion dollars without adding more verticals beyond healthcare.

Outside of the three verticals, the revenue from others — which includes retail and manufacturing — is around 30% (See: Onward journey). In addition to insurance, BFS and travel, we have started a new vertical, healthcare, which is now part of the 30% revenue. Over time, we will keep assessing the ‘others’ revenue build-up because a lot of that comes from horizontal technology offerings that we have, and when it becomes feasible, start carving out these into independent verticals. My belief is that with just four verticals and existing number of clients we can traverse the journey to a billion dollars without adding more verticals beyond healthcare.

Given that the impact of COVID-19 has been most severe on the travel sector, how are you dealing with the disruption?

The impact on travel was significant and it has now been playing out for two quarters. In this quarter, in our travel portfolio, we expect to grow at least 7% over the previous quarter in constant currency terms. But, insurance and financial services, and healthcare sector will continue to grow in mid-single digits in constant currency terms, even this year. Today, almost 50% of our revenue is coming from financial-services sector (BFS and insurance). The insuretech platform AdvantageGo currently clocks revenue of approximately $40 million out of our approximately $300 million BFSI portfolio. It is both a differentiator and a door opener for us.

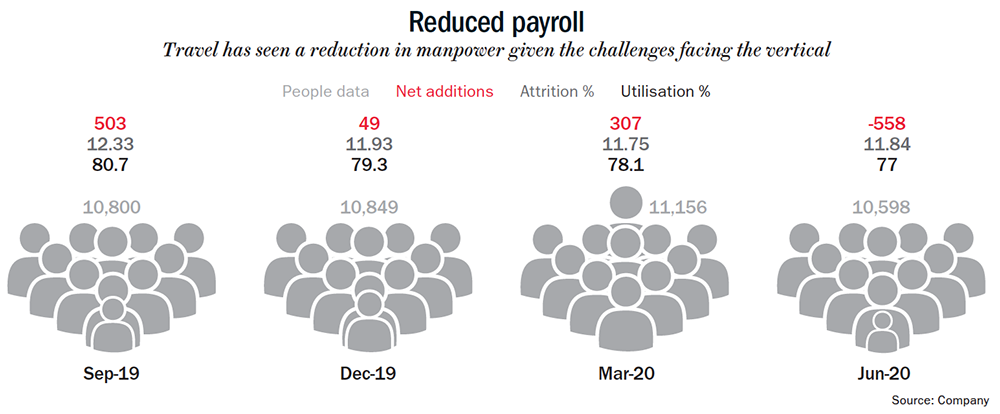

Headcount has come down in the travel vertical (See: Reduced payroll). Is the blip temporary?

Today, we derive close to 19% of our revenue from the travel industry. The impact of the disruption in the travel industry had resulted in drawdowns in the travel portfolio over the past seven months. But, in the coming quarters, we expect our business in the travel vertical to grow from where it is, because it has contracted significantly. I expect travel, in percentage terms, to continue to be where it is but growing in the context of the larger organisation, which also should be growing in mid-single digits.

Today, we derive close to 19% of our revenue from the travel industry. The impact of the disruption in the travel industry had resulted in drawdowns in the travel portfolio over the past seven months. But, in the coming quarters, we expect our business in the travel vertical to grow from where it is, because it has contracted significantly. I expect travel, in percentage terms, to continue to be where it is but growing in the context of the larger organisation, which also should be growing in mid-single digits.

In terms of resources, are your fixed cost and people fungible across sectors?

Yes, they are fungible and all those changes have been made in the past six months because the impact on the travel sector started showing in February. I think we have seen the travel story, the ramp-down and the impact, all play out and all factored in.

Post COVID-19, is there any change in sentiment? What is the scene in terms of pricing and billing?

As we have been able to maintain growth despite COVID-19, our operating margin too will be the same as last year. So, the impact has played out. We have fully absorbed that into our cost structure, after implementing a lot of cost-efficiency measures at the peak of the pandemic. Interestingly, our operating margin at about 18% is the best among peers and we are maintaining it.

In the healthcare space, how will you compete with or differentiate from the other bigger players such as Cognizant and the TCS?

We signed a very material deal and the intent is to follow the same playbook that we have followed earlier. We will select only one sub-segment within the sector and build capability in that. It is not going to be a broad-brush approach. Just like in our other verticals, we will hire consultants who come in with CXO kind of background in healthcare. But, the focus will only be on the provider space within healthcare.

The company won deals worth $186 million in the June’20 quarter, including three large deals with over $20 million total contract value. How is client spending panning out?

Our deal momentum has continued to be robust despite the pandemic. Client spending outside travel continues to be stable. The insurance industry spends have always pivoted upwards after major disruptions and, because of the pandemic, the spends continue to be largely unaffected at this stage. The ‘buy side’ of the capital markets, which we focus on, is also expected to largely sustain and even slightly grow spend volume with increased spends on personalisation and automation. Brexit will likely create an uptick around compliance spends with system de-linkages and systems creation.

As a mid-tier IT services firm, we focus on wallet-share expansion and not on industry-spend growth alone. We are working to expand our wallet share even from clients who have reduced their overall spends.

The organisation is aiming to get 45% of its revenue from digital and IP portfolio in the short term. What is the roadmap to achieving that?

We plan to meet this through organic growth alone. We have built a significant, 1,500 engineer-strong, architect-and-tool-heavy automation service line that straddles robotic process automation, business process management and cognitive tech. We will continue to scale it up speedily. Our product engineering expertise is borne out by insuretech platform AdvantageGo, which we own and operate. We are open and always looking out for inorganic opportunities and acquisitions, provided they fit into the mix.

Since both Hexaware and Coforge have Baring PE as a common promoter, have synergies been explored between the two companies?

There is no association at all in any shape or form, operationally or otherwise. We do not expect any association in the future as well. Both are independent entities. Even when the last stakeholder transition was done, that is what the stakeholders had clearly spelt out and that continues to be the stated position.