It is a fairly hot summer day in Jaipur. Inside one of the offices, in Pink City’s Ashok Nagar, Harendra Singh is having a busy day with three back-to-back meetings lined up. Project teams from different parts of the country are travelling to the headquarters of HG Infra Engineering to report progress to the boss.

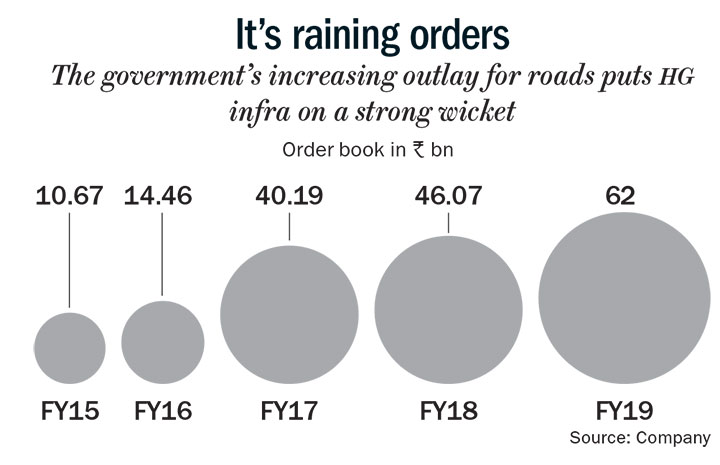

The infra company, which primarily develops roads and highways, is seeing the best year so far. Its kitty is full of orders, worth Rs.62 billion or 4.4x its FY18 sales. The road sector itself is booming with government’s thrust on building highways.

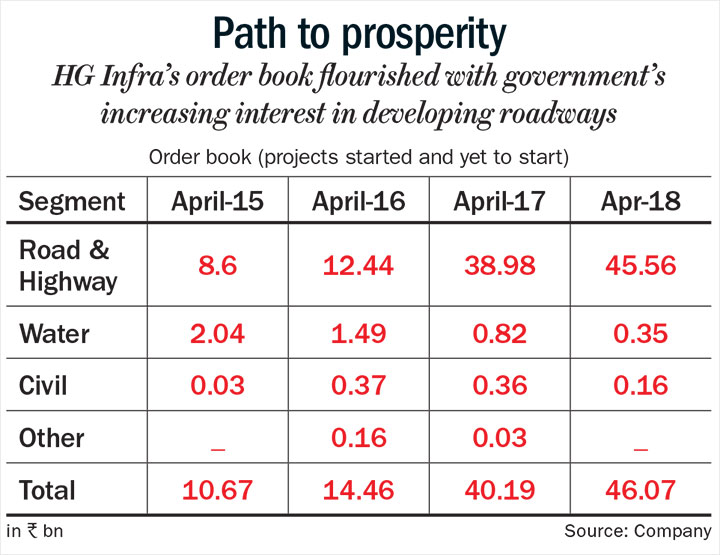

Singh’s company has gained dramatically in size over the last decade and a half. From a barely Rs.100 million topline company in 2003 to becoming a Rs.1.23-billion company in 2010, it is now racing towards an impressive Rs.20 billion to close FY19 on the back of road projects (see: Path to prosperity). All of this was made possible by right investments in assets and a smart bidding strategy.

Singh’s father started HG Infra back in 1970s in Jodhpur as a firm that executed small-time construction contracts. Singh’s two other brothers joined the company soon after finishing their graduation, but he had other ideas for a while. Having graduating in engineering from Jodhpur, Singh worked at Hindustan Petroleum Corporation for four years. In 1994, he joined HG Infra.

When it was incorporated as a private limited company in 2003, HG Infra was present only in and around Jodhpur. “From 1970s through 1990s, for three decades, the company was engaged in small public works department (PWD) expansion contracts around the city,” says Singh, now the managing director.

In 2007, there came an opportunity for it to enter the big league. “It was a project from JP Associates for a part of Yamuna Express Highway,” says Singh. It was a subcontract for a six-lane highway, and the work marked several firsts for the company. “It was for the first time we went out of our home state (Rajasthan), and it was also the first big project for us,” he says. It was a Rs.770-million job. When they finished in 2010, it had grown to a Rs.1.3-billion project. “Wherever the adjoining work was poorly done, or not done, they assigned that to us too,” says Singh.

But despite implementing this subcontract, HG Infra didn’t have any financial prequalification to bid for big contracts, such as the ones awarded by the National Highways Authority of India (NHAI). So, the company diligently pursued subcontracts, which helped it scale up operations and demonstrate its capabilities.

In 2010, Isolux Corsán, a Spanish company which was developing the Ajmer Bypass, subcontracted a part of it, a Rs.600-million job, to them. The same year, IRB Infrastructure subcontracted a Rs.2.57-billion Jaipur-Tonk-Deoli project to HG Infra. By the time they finished it in 2013-14, the subcontract value went upto Rs.3.64 billion. Again, after another subcontractor had failed, the additional job had been awarded to HG Infra. Building on the trust generated with IRB, they finished another subcontract of Rs.4.4 billion in Haryana between 2014 and 2017. “Between 2010 and 2013, we did a lot of subcontracting project for quite a few players such as GVK, Gammon, Isolux and L&T,” informs Singh. These projects, mostly between Rs.1 billion and Rs.2.5 billion, helped the company gain financial prequalification to bid for some of the NHAI projects.

In 2014, HG Infra finally achieved the distinction of a ‘prime contractor’ (a company that is directly awarded a contract by an authority). The prime contractor for EPC and HAM projects is decided by the valuation and size of the work done earlier, and its net worth. These jobs offer better margins — 4% to 5% more. “The subcontracting was gradually reduced and we started taking prime contracts only. We got our first three in 2014, two in 2015, one in 2016, and eight in 2017,” says Singh. Today, 70% of their work is from prime contracts.

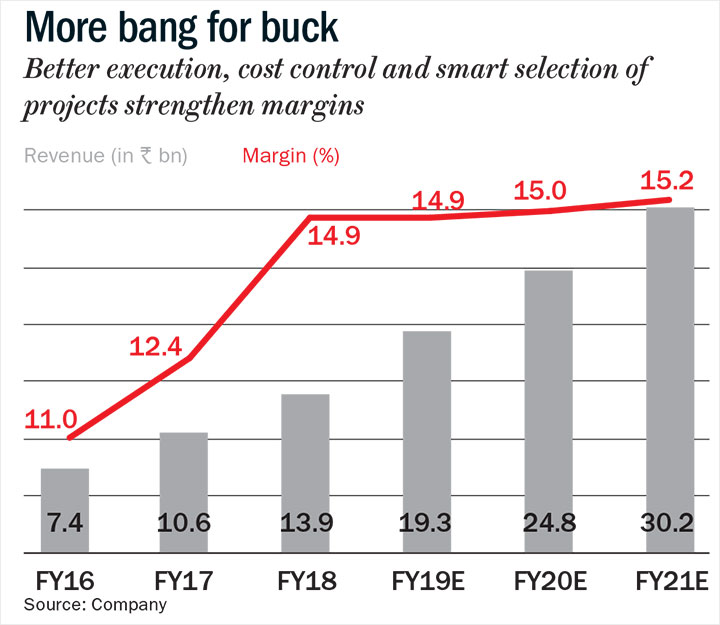

Parikshit Kandpal, senior analyst, HDFC Securities tries to identify things that may have worked for the company. “They are largely into Engineering, Procurement and Construction (EPC) projects, have focused on northern and western states, where more projects are coming up, and wisely chose clients such as Tata and IRB whose balance sheets were strong even during their subcontracting days,” he says. HG Infra’s margins have improved from an 11% to 15% in the past three to four years (see: More bang for buck).

All-In-One

One of the other reasons they saw was a rapid improvement in the margins was their relentless pursuit of self-sufficiency, through investment in machinery and equipment. This helped the company manage costs better, and control the quality and timing of operations.

“Between 2008 and 2013, we were either hiring the equipment or offloading some of our work,” says Singh. For example, production of the aggregate (the raw material used for road construction made from sand, gravel, crushed stone and so on) was completely outsourced. Aggregate is, typically, 10-15% of the overall cost of a project. “By developing in-house capabilities, we have been able to save anywhere between 0.6% and 1% of bottomline with this,” he says.

As a strategy, the company started investing in equipment aggressively. The key equipment included production plants (such as hot-mixing plants, concrete-batching plants and crushers) and road-laying machines such as graders and pavers. Rajeev Mishra, CFO, HG Infra, says, “The company has invested Rs.3.5 billion in plant and machinery over the past two years. New equipment will need to be procured for approximately Rs.1 billion to Rs.1.5 billion. This will be sourced partly through internal funds and partly through financing from banks or financial institutions.” It raised Rs.3 billion through an IPO in 2017, in which the shares were oversubscribed 5x. Part of the proceeds — Rs.900 million — was allocated for purchasing capital equipment. The remaining was used kept aside for servicing debt (Rs.1.15 billion) and general corporate expenses (Rs.950 million).

The company has fixed assets of Rs.6.05 billion tentatively (gross block) which includes the block of plant and machinery of Rs.5.1 billion (approx.) as on FY19. “As per thumb rule, gross block can handle 5x the turnover, that is, Rs.30 billion.” The current debt of the company stands at Rs.2.9 billion. Its RoE is 23.5% and RoCE is 23.95%.

They followed the golden of the road-construction industry, says Vijay Agrawal, advisor, Equirus Capital, who deals with the infra sector. “What differentiates a company in this sector is how much do they do in-house? How you are creating and managing the assets? Typically a 10-11% Ebitda margin company does a lot of outsourcing, and a 14-15% Ebitda company has superior in-house execution capabilities,” says Agrawal. The company can then get the latest in machinery for better efficiency and lower running and maintenance costs.

Nalin Gupta, MD of Rs.25-billion J Kumar Infra, which executes Metro-related projects, flyovers and roads among other things, too stresses on self-sufficiency. “Our differentiator is that we do everything in-house. We have own machinery, we do casting, crushing and aggregates ourselves,” says Gupta.

Over the past five years, after HG Infra’s order book has grown more than 12x, from around Rs.5 billion. With better efficiency, they are inching closer to its listed peers who have 17% margins. Mishra says their bargaining power with suppliers have improved too. “Even for diesel — we are doing annual contracts with IOC and HPCL. Similarly, the loans which were at 12% have been brought down to 10% in the past two years,” he says.

But isn’t there a downside to asset heaviness? Singh says it is aligned with Indian government’s long-term commitment to this sector. “Post 2014, the new government came with very clear vision to build infrastructure in a big way. We understood that they were looking 10-15 years down the line,” he says. Gupta of J Kumar Infra, a company with an order book of Rs.110 billion, echoes this sentiment. “Right now the whole country is flooded with orders. I don’t see why any company wouldn’t make margins,” he says.

Agrawal of Equirus Capital says that Nitin Gadkari has cleaned the sector and orders worth Rs.1.5 trillion have already been awarded over the past four years, to be completed in the next two to three years. “Everybody has a robust order book. The sector is doing well. Post election, there are more orders expected for Bharatmala project,” he says. Under Bharatmala, 50 new road corridors are to be developed in this ambitious project to build a 34,800-km road network for Rs.5.35 trillion.

Kandpal of HDFC Securities says, “If Modi government comes back, more work will come. Their manifesto has that promise. Then equipment lease and rentals will go up.”

Bidding Strategy

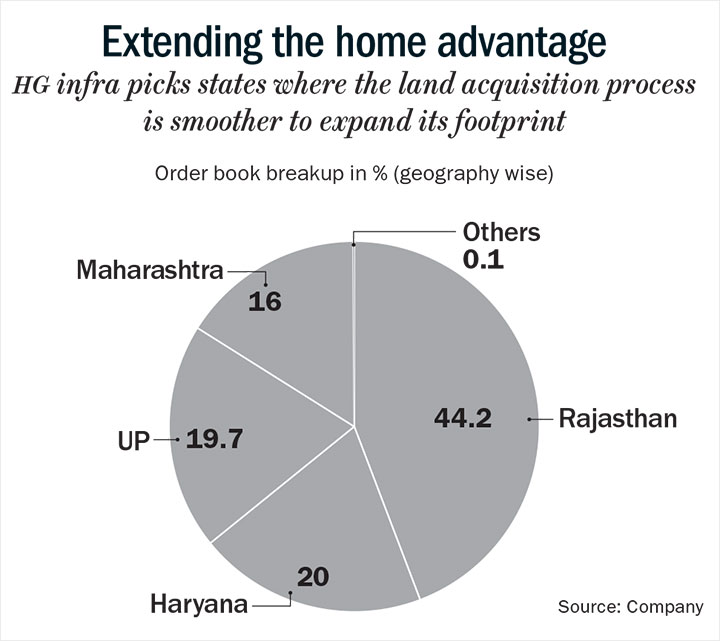

Opportunities seem to be on the rise, but Singh says it’s very important to have a selection strategy in place. Till now, the company has remained focused in the northwestern part of the country. “Initially, law and order was an issue in several other areas such as Kashmir or Northeast or some central states. Secondly, you get to work most part of the year in the Northwest. There is no disruption due to a snowfall or rains. You can’t work for five months in the Northeast.” Idling machinery is expensive.

Gupta agrees with Singh. “The selection can make all the difference. It is always better to build in your home territory where you have established relations.” J Kumar Infra has over Rs.25 billion worth of flyover and Metro orders in its home territory of Mumbai. “New areas… you go with caution, because you lack synergies,” says Agrawal of Equirus. Singh adds that working in an unfamiliar region can lengthen the process. “If we have to do a project in Bihar and Odisha, it will take at least four to five months to simply understand the psyche of the local bodies,” he says.

HG Infra also picks projects in areas that are not “very urbanised”. “Therefore, there are fewer displacement related issues,” says Singh. Manoharpur-Dausa and Uncha-Nagla are some of the highway projects in less urbanised areas and for which client (NHAI) had handed over more than 80% land at the beginning of work. Land acquisition is smoother in northwestern states such as Rajasthan, Haryana and now even in UP, says Singh (see: Extending the home advantage). “These states are more peaceful in terms of political scenario and have a more efficient bureaucracy. Land acquisition starts much before the award of contract,” says Mishra.

Next plank of Singh’s strategy is to focus on NHAI projects, more than anyone else’s, and it forms 50% of HG Infra’s order book. “It has foremost vision of developing highways, so all officials from top to bottom imbibe that vision,” he says. Agrawal agrees. “If you were doing a project for a state department, there would be way more payment risk,” he says.

Now that they are on a growth path, the company has become more ambitious. “Now we are looking to diversify into airport development as well. We have recently taken one small size project in Goa Airport. If not major shift, we want 10-15% shift into other areas,” says Singh. They are also now willing to try new formats of infra development.

So far, they have been following the EPC framework. In this, the contractor merely completes the project. In the alternative, HAM or hybrid annuity model, developers and governments invest, and the developer is also paid an annuity for maintenance. These projects offer 150 to 200 bps better margins than EPC projects. Last year, HG Infra signed on its first HAM project worth Rs.6.06 billion, for six-laning and strengthening of new NH 248A in Gurugram. For this, they got Rs.1.45 billion from Tata Cleantech Capital and Rs.1.42 billion from PTC Financial Service, besides the Rs.728 million in equity capital and Rs.2.42 billion as NHAI grant.

Singh says chasing HAM models depends on a company’s risk appetite. “We feel 20-25% can be HAM projects under our model in the future,” he says. They are not aggressively pursuing this strategy, and believe that the current projects can be borne by their balance sheet (see: It’s raining orders).

Speed Bump

There is one aspect of HG Infra that analysts are concerned about. They point to the company’s dependence on fixed-price contracts. Typically, these offer less flexibility to a developer to maneuver, particularly if the costs move up. But Singh challenges this notion. If the delay is from the awarding authority’s end or due to unforeseeable factors, the agreement has a clause that permits escalation of costs, he says.

Singh adds that they also work with designers to estimate requirements (raw material, manpower) before and after bidding. “We design projects in such a way that we end up saving one to two per cent on quantities (of materials),” he says. Added to that, they try to complete projects before time, in which case they can win a bonus.

Also, what if the government changes after elections? Kandpal says that, then, the flow of orders can slow down. “New governments might spend on social sector more than infrastructure,” he cautions. But Singh says the change won’t be immediately felt, that any new government takes six months to a year to settle down and then things come back on track. “The Golden Quadrilateral was started in 2003 by Vajpayee government, but later governments persisted with the project,” he says.

For now, prevailing sentiment at HG Infra is optimism. “We will become a Rs.50-billion company in two to three years,” says CFO Mishra. On the revenue visibility, Kandpal of HDFC Securities says, “They will do Rs.27 billion to Rs.28 billion next year (from Rs.22 billion this year), a 25-30% growth. Since they still have some subcontracted projects, the margins are expected to remain at 15-16%.” This is close to the numbers Singh quotes .

He says, “The idea is to maintain a growth rate of not less than 30-35% each year, and not chase many projects but those that offer good margins.” Slow, steady and meticulous is how they have got this far, and there is a reason enough to stick to that path.