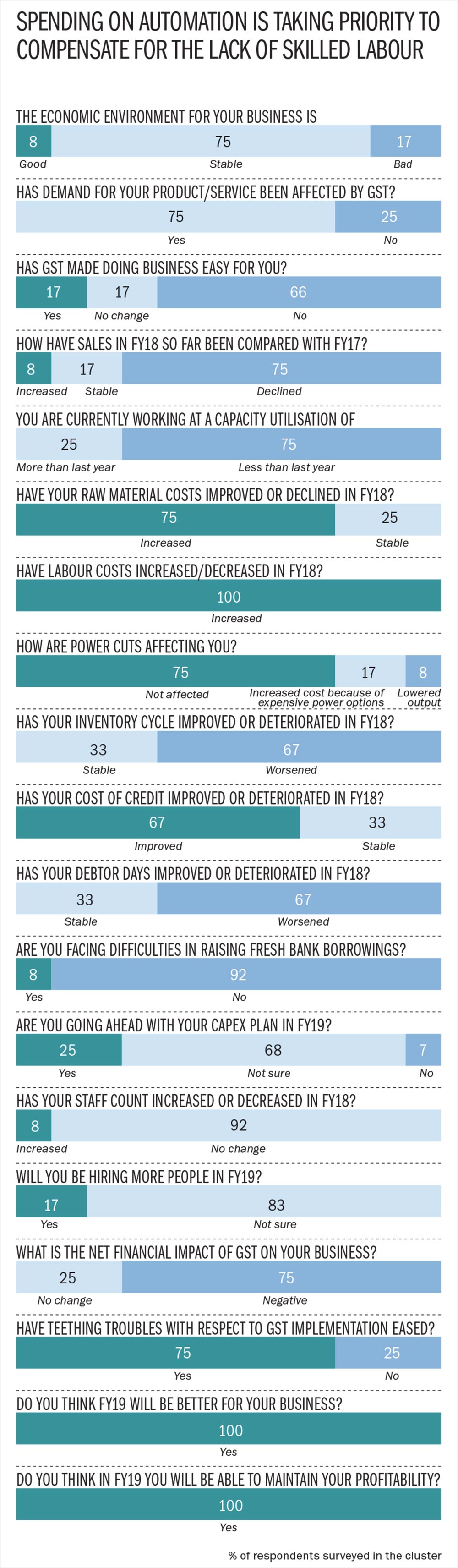

It’s a long trudge, really. The 180-km stretch from Aurangabad to Nashik — both key industrial pockets in Maharashtra — mirror the state’s apathy towards the two cities. In both the cities — home to a substantial number of manufacturing units catering to automobile and pharmaceutical sectors — access to skilled labour is a much-voiced concern. The higher proportion of SMEs — 75% in Aurangabad and as much as 90% in Nashik — only compounds problems. While enterprises are emerging out of the long shadow of the Goods and Service Tax (GST) and demonetisation, the road ahead continues to be fraught with uncertainties.

No skills, all labour

Milind Kank, managing director, Yeshshree Press Comps based in Waluj, close to Aurangabad, manufactures auto parts for clients such as Bajaj Auto and Piaggio. Yeshshree logged 15% growth in sales and its largest business is manufacturing sheet metal. It is expecting to clock revenue of Rs.400 crore in FY18.

With the younger generation moving towards the services sector, the shortage of skilled labour has Kank fretting. “The rising cost of raw materials and labour is not as much a worry as getting skilled labour is. Dearth of talent has worsened over the past three to five years. Opportunities in the service industry, such as hospitality and e-commerce seem more remunerative for today’s generation,” explains Kank, who has a 1,200-strong labour force.

Even by the most conservative estimates, manufacturing units such as Yeshshree have attrition rates, of well over 15%. “We have to make compromises while recruiting because of the lack of options,” says Kank. Companies need to spend time and money on imparting necessary skills. “The Industrial Training Institute’s graduates are simply not skilled enough. The industry is being used like a training ground by most people who join,” says Prasad Kokil, president, Chamber of Marathwada Industries and Agriculture. The prevailing situation is forcing companies such as Yeshshree to invest more in technology.

Over the past couple of years, the company has shifted to machine tool manufacturing, engineering and track solutions for defence tanks. Although today it contributes only 10% to revenue, Kank, a first-generation entrepreneur, is sure it will build up over time. “Next year, our capex outlay will be Rs.25 crore, of which 90% alone will be on technology,” he says.

Like Aurangabad, the quality of labour in Nashik is also a sore point. Someshwar Metal, a manufacturer of zinc and zinc alloys in Sinnar, spends 25% of its indirect cost only on labour. “If I were to match this to what the services industry pays, I will have to increase wages by 50%. That will make my business unviable,” says Abhimanyu Asija, CEO, Someshwar Metal. He believes the opening up of the job market in Saudi Arabia is also one of the reasons for the paucity of labour. In fact, the situation has been further compounded by the heavy-handedness of worker unions.

Sachin Ambardekar, joint managing director, Innova Rubbers explains, “Unionisation of labour is a huge concern in Nashik,” he explains. There are close to six worker unions in the industrial town. Innova Rubbers, which clocks a turnover of Rs.175 crore selling suspension parts to automakers, has seen its monthly wages rise from Rs.11,000 four years ago to Rs.14,000. “Dealing with unions, which are all politically affiliated, takes away most of our time,” rues Ambardekar.

It is not surprising to find companies willing to invest in technology and semi-automation. Over the next two to three years, Asija of Someshwar Metal plans to invest over Rs.6 crore in technology.

Passive state

Two years back, travelling from central Nashik to Sinnar, was enough to rattle an otherwise calm Asija. On a bad day, the 30-km stretch, from home to his plant would take an hour and a half. But the four lanes now ensure that he reaches within an hour.

While the road trouble has been resolved, infrastructure continues to remain a lingering concern for the cluster. For instance, in Ambad — another industrial area in Nashik that is home to 1,500 units — the promise of a common effluent plant is still a pipe dream. “We have been hearing about it for years but are yet to see any progress,” says an angry Ambardekar. Land prices, which have doubled in the last three to four years owing to a demand-supply mismatch, are not helping matters either — an acre in Sinnar costs about Rs.1.5 crore, and Rs.6 crore in Nashik city. Lalit Boob, executive member, Ambad Industries and Manufacturers’ Association, says this issue alone has ensured that the IT industry has stayed off limits. “Nashik needs to attract new industries, but that will be difficult if the infrastructure does not keep pace,” says Boob. Asija concurs, as he feels industrial real estate in Nashik is still a seller’s market. “There is no indication of that changing in the immediate future,” says Asija.

On the other hand, Aurangabad’s hassles with land are slightly different. Kokil explains that the industry was promised a simple process wherein acquisition of agricultural land was also allowed. The whole procedure was to take 45 days, post which it would become a deemed order, making the buyer eligible for tax benefit with 75% of the capex being returned, besides stamp duty exemption. “But government officials say a deemed order is insufficient and do not process our papers. We have instances where nothing has moved for three years,” he says, adding that at least 15 large businesses are suffering as “hundreds of acres” are at stake.

The indifference of the authorities is also evident when it comes to the Maharashtra Industrial Development Corporation’s reluctance in removing non-hazardous waste from industrial areas. “We pay a service charge for this because rules say it has to be done by the gram panchayat. But we have to get this done at our own cost,” says Kokil, also the founder of Sanjay Group, a tier-II manufacturer of auto components to companies such as Varroc Group and Endurance Technologies. “Business has been good in Aurangabad and would be better if the government could fulfill some of its promises. It hurts when something as complex as GST is implemented, while we are forced to deal with smaller issues that should have been addressed much earlier,” says Kokil.

Way forward

Unlike labour and infra issues that seem to be chronic, businesses are, thankfully no longer cribbing about the impact of demonetisation and GST. While demand took a knock for a couple of months when GST implementation was underway, the general belief now is that the disruption was just an aberration, though the exercise could have been held more deftly. Suyog Machhar is not worried about the drop in revenue. Machhar Packaging, based in Chitegaon, on the outskirts of Aurangabad, makes co-extruded tubes for the personal care industry, primarily for toothpastes and gels. Some of the company’s clients include Patanjali, Marico, Himalaya and VLCC. In fact, Patanjali alone accounts for 80% of Machhar’s business. He laughs when asked if the period after GST was tougher than 2008. “That year was a honeymoon compared with GST. This hit us right in the middle of the consumption season, leading to a loss of business,” explains Machhar. By the time the new tax structure had settled down, it was the beginning of the lean season that coincides with the onset of monsoon. “It was much worse than what we had expected it to be,” he adds, expecting to end the current fiscal at Rs.75 crore-Rs.80 crore compared with Rs.90 crore last year. Yet, Machhar is looking to invest Rs.10 crore in a new paper coating business.

For Kank, the impact was limited. In fact, Yeshshree’s volume has been on an upward trajectory ever since it began three-wheeler exports to markets such as Bangladesh and Nigeria. “There were issues such as a currency crisis in the past, but things have improved significantly. Even the cost of credit has dropped by over 100 bps from 10% to 9% over the past one year. From a business point of view, there is really nothing to complain about,” says Kank, who sells most of his finished products to Bajaj Auto’s Aurangabad plant.

The business community in Nashik is fairly upbeat now. If you were to compare this to five years ago, the mood was largely despondent, accompanied by the incessant rant of no power and poor access to Sinnar. “Things are a lot better and most companies like us are in investment mode today,” says Asija, who expects turnover to rise at least 50% this fiscal from Rs.30 crore last year.

Life does seem to have switched back to normal, but it is the resilience of the entrepreneurs that has saved the blushes for these two cities. Ease of doing business, infrastructure and labour issues have been masked by the general buoyancy in business. If private enterprise alone can drive development, would be the subject of conjecture, the lack of state support can render Aurangabad and Nashik extremely vulnerable if the sentiment changes.