It was sometime around the middle of 2013, we were analysing a company, Fresenius Kabi Oncology (FKL), in wake of Sebi’s mandate for companies to comply with the minimum 25% public shareholding norm. The promoter (Fresenius Kabi Singapore) was holding 81% stake at that time and had decided to offload the excess holding in the market. When we were analysing FKL in detail, we came across a name, Shilpa Medicare, in its list of oncology API suppliers.

In fact, we were a bit surprised to know that SML was a listed entity engaged in the supply of oncology API to not just players in India but in Europe as well. Later, we approached the management to understand the company’s business model. Initially, the promoter Omprakash Inani was very reluctant to meet. After much persuasion, we met him for 15 minutes in Mumbai. We discussed briefly about the company and expressed our desire to deep-study the company. Inani’s first reaction was that since the company was in the process of building the business, it would be better if we could meet him after the management had done some more work. In response to this request, our instinctive question was after how many days should we approach the company, assuming that the company must be in the final stage of some announcement and, hence, was unwilling to talk at that point in time. But the promoter said that the work they were doing would turn into blockbuster numbers only around 2017-18, a good four years from our meeting date! We were shocked to hear that but the answer made one thing very clear that here was a promoter who is a visionary and not at all impatient to grow the business. He wants to give his best without haste to fulfill his dreams.

After that meeting we waited for a few months, deep-dived into more details about the molecules SML was working on, taking cues from the USFDA and related websites. After some requests, we finally met the management at SML’s Raichur facility in Karnataka.

The meeting was even more interesting. The management had a clear timetable of what they were planning to do over the next four years, the amount of funding the company would require and, similarly, how it would sustain itself during the intervening period.

The important thing that the promoter made it very clear was that given the four-year time-frame, we should not ask him about financial ratios or near-term guidance. He was, however, willing to dwell at length on the products and molecules that the company was planning to file, timeline on approvals, competitive scenario in those products and what were SML’s strengths and weakness. After a few more months of work, we recommended SML as a buy for first time on March 24, 2014 at Rs.174 (adjusted for 1:1 split, the recommended price was Rs.348).

Strong niche

For readers who do not know much about SML, the company operates in three major business segments — oncology API, non-oncology API and custom synthesis (CS). Oncology-API will be the key driver for earnings going forward. Till now, SML was supplying its products majorly to European countries. However, its API facility has now received approval from the USFDA, which would mean SML will be able to sell onco APIs in the US, thereby adding a new stream of revenue.

Custom synthesis segment formed 50% of total sales in FY16. SML has delivered 25-30% y-o-y growth in this segment on the back of higher volumes. The only product in this segment is intermediate for Ursodiol which is supplied to Italy-based Industria Chimica Emiliana (ICE). On its part, ICE has 75-80% market share of API for ultimate formulation suppliers. A testimony to SML’s strong relationship with the customer can be gauged from the fact that now ICE has formed a JV with SML for supplying this same product. Both partners will share 50-50 in investment as well as profitability in this joint venture (JV) under a separate entity named as Raichem Medicare.

SML will gradually shift entire production of this product to this JV over the next two years, beginning 2017. The JV will double the capacity of Urosodiol over the next two years with more than 600 tonne annual capacity. Hence, from FY19 onwards, the topline of the listed entity may witness a dip (in accordance with new IndAs accounting norms) but the bottomline will not be impacted as the JV’s profit will be directly added to it. Despite 50% share in the JV, the net impact on SML’s net profit will be negated owing to doubling of capacity. We expect the customer synthesis segment to maintain a growth rate in range of 15-20% y-o-y on sustained basis, driven by increased demand for its products.

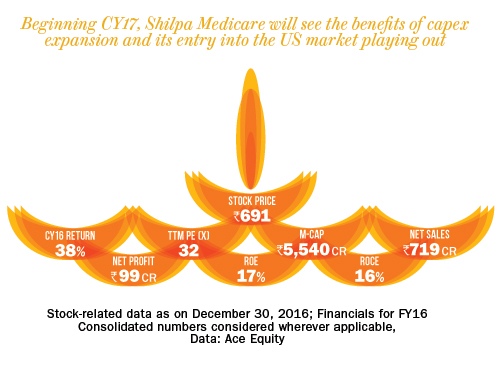

In non-oncology API, a key molecule is Ambroxol, which is supplied to European as well as domestic markets. Recently, SML increased its capacity of non-oncology API by four times. We expect business from Ambroxol and other non-onco APIs to grow at a stable rate of 8-10% every year. In fact, we believe the time has come for the company to reap the fruits of all the hard work done by the management over the past few years. We expect numbers to start trickling in from the first quarter of CY17 and expect the company to remain in a high-growth trajectory over the next three to four years.

Primed for growth

In 2016, SML got approval from the USFDA for it Raichur API facility and managed to file about 25 DMFs for the US market from this plant. The DMF filed are of cytotoxic drugs which have relatively better operating margins compared with other APIs, given the complexity involved in manufacturing. We expect SML to take about 12 to 18 months to fully ramp up the onco-API business from the US. Since the first quarter of FY17, SML started selling small quantities into the US, but we expect quantum jump in sales in the US over the next two years.

The company has also received US regulatory approval for its formulation site at Jadcherla, implying that it can now start supplies from the plant, subject to approvals coming for product filed from here. SML has already filed 22 ANDAs from the site (eight of its own and 14 for clients).

Despite the success of its own filings, SML’s strategy of filing products for clients, that is, opting for contract manufacturing business model, is a deliberate attempt to mitigate risk and take the advantage of the client’s experience in adverse conditions related to regulatory or others. Formulation sales are high margin and high value, thus revenue from this facility can jump significantly. We expect significant revenue to accrue from formulations for the company from FY18 onwards.

The management’s extreme confidence and vision is reflected in the expansion of its formulation facility without even starting any supplies from the existing plant, which has received only one approval.

After the Jadcherla formulation site approval in September 2016, till now, SML has received two approvals: one for Imatinib from EMA and Azactedine from the USFDA. The management expects to start shipping Imatinib from December 2016. We expect Azactedine to be launched in the US from the fourth quarter of FY17. Additionally, SML has settled Imatinib Mesylate litigation with Novartis (Innovator) in USA, and the launch may be happen in 2018, subject to approval.

US and beyond

Apart from the US, Japan is the other lucrative market for generic players. Owing to strict regulatory compliance and stiff quality controls, Japan is very hard market to crack for Indian pharmaceutical companies. With its strong R&D capability and an impeccable track record on regulatory compliance, SML has been able to get a small hold in the market.

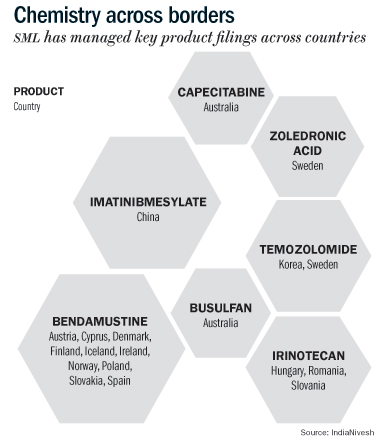

Additionally, the company has filed for its key products in many other markets including China, Austria, Australia, and South Korea. In our view, contribution from these markets is likely to help SML sustain a healthy growth in the long term.

SML has subsidiaries in Austria, the UK, and Germany, catering to specific geographies or specific therapies. The management is very excited about the future of biosimilars and anticipates this segment to be the largest contributor, five years down the line. In order to address this opportunity, SML has recently acquired a small company called Navya Biologicals. Recently, some of the company’s subsidiaries have turned around. Despite SML itself being in an expansion and capex mode, investing for future technologies/growth areas shows the management’s long-term vision and commitment to the business.

Long term bet

The company’s R&D efforts in the past are now fetching good dividends; SML developed 11 oncology and four non-oncology products during the year. Another 18 are in the pipeline.

The company has embarked upon a Rs.450 crore capex plan for the next two years. This capex will go into expansion of formulation and API facilities, expansion of R&D facility at Vizag, investments in biosimilars and nano-technology through subsidiaries. For all its ambitious plans, the management is quite conservative and prefers the equity route to fund its expansion by diluting equity. The company has marquee list of PE funds which have been with the company for a very long time.

The company had a gross debt of Rs.93 crore as of September 2016. Over FY11-16, the company’s sales and adjusted PAT clocked a CAGR of 16% and 20%, respectively. Despite being an API company, SML has been enjoying operating margin in the range of 19-25% for the past five years. We expect sales to grow at CAGR of 35% over FY16-18 to Rs.1,300 crore, led by increased business from the US market. This will have a rub-off effect on the bottomline with the adjusted PAT expected show a CAGR of 55% to Rs.250 crore over the same period. The company’s previous expansion happened between 2007 and 2009, when it started supplying anti-cancer and other drugs to European markets. At peak capacity utilisation (in 2010 and 2011), the company’s RoE was in the range of 22% in FY11. With increased capacity utilisation coupled with higher realisation and subsequent profitability, the return ratio will further increase from 17% in FY16 to 27% by FY18.

Against such a backdrop, Shilpa Medicare has all the makings of a multi-bagger in the years to come.

The author has no personal holding in the stock. IndiaNivesh directors, promoters, clients and associates may have a position in the stock.