Over past three years, the global agrochemical market has come under some rough weather with sales declining by around around 8% to 9%. There have been many reasons: unfavourable weather conditions, delaying planting patterns in key markets such as Latin America, severe drought situations in Mexico and Australia, and dry weather in Southern Europe. Inventory had piled up and prices were stagnant. But with inventory levels coming down and demand starting to pick up, things are definitely starting to look up for the global agrochemical industry and in particular for Indian companies with a significant exposure to exports.

In fact an improving global scenario is going to more than make up for the not-so-rosy picture on the domestic front. The implementation of Goods and Services Tax (GST) and demonetisation were one-off but they have slowed down the movement of goods from the warehouses.

In September 2018, there was good news. Food production in the kharif (July to October) season was predicted to hit a record high and monsoon arrived on time; but the investors were still not excited about agrochemical stocks. With record production, agro commodities were commanding only low prices, which led to poor sale of agrochemicals, and rains were erratic.

In the rabi season (October-March), the agrarian distress continued to persist. Sowing as of December 14, 2018, which accounts for 81% of the total sowing in rabi season, was down 5.25% year-on-year to 47.6 million hectare compared with 50.25 million hectare in the previous rabi season. “This is of concern, because the rabi crop accounts for 40% of India’s agricultural produce... in both volume and value terms,” stated a CRISIL note. While there is distress in the rural economy, Indian agrochemical companies will find relief in overseas markets and some of the export-oriented companies are poised for recovery in sales and profit.

Global Focus

The global tailwinds include an improvement expected in demand from Brazil and Europe, depreciation in rupee, vendor consolidation and production curbs in China. India’s export-oriented agrochemical companies such as UPL, Dhanuka Agritech and PI Industries are ready to surf this wave. With exports contributing between 60% and 80% of their revenue, these firms are expected to clock good numbers going forward.

According to analysts, Indian companies hold several advantages over their global counterparts. Rusmik Oza, head of fundamental research, Kotak Securities, states that India continues to remain among the low-cost manufacturing destinations, making it attractive for global agrochemicals innovators. “Agrochemical players leverage India’s inexpensive but high-skill labour resource for their R&D requirement. Cost competitiveness remains with favourable currency movement and government’s Make in India initiatives. Low switching-over cost for R&D on crops, due to varied climatic conditions, is an added advantage,” says Oza. Other global agrochemical companies are struggling with exorbitant costs to discover and commercialise new molecules and tightening regulations across the world, which have disrupted their innovation rate.

Oza adds that India’s largest competitor, China, is facing trouble in raw material supply, rising energy and labour costs, and incremental effluent treatment and compliance charges. So, a prolonged slowdown in the Chinese chemical industry has offered India a chance to step in and build strong relationships with global agrochemical players.

Ritesh Gupta, an analyst at Ambit Capital, says that global agrochemical giants prefer Indian companies such as PI, Aarti and SRF because they adhere to safety and environmental norms. And, even if the capacities in China bounce back, the cost of adhering to environmental norms will take away the cost advantage it had earlier. “Also, since China aims to become a consumption-driven economy, it may not provide stimulus to environment-polluting sectors in future. In the case of the agrochemical sector, if more capacities come up in the raw material space it will be advantageous to Indian companies as they primarily source it from China,” says Oza.

Some of the agrochemical companies such as Sharda Cropchem, which has been facing pressure on margins due to rising cost of raw material sourced from China and deteriorating working capital (WC), are likely to benefit from the higher availability of raw material. The company’s agrochemical segment had reported 170 bps decline in EBIT margins to 3.7%, its lowest Q3 margins in the past four years, due to a mixture of higher revenue growth but from less-profitable geographies and its inability to pass on the higher production cost. Its average consolidated EBIT margin has been 13.7% over the past two years, on a quarterly basis.

Sharda Cropchem isn’t the only one reeling under the pressure of rising raw material cost. There are other companies such as Dhanuka Agritech, Rallis India and PI Industries. All faced margin contraction in the December quarter.

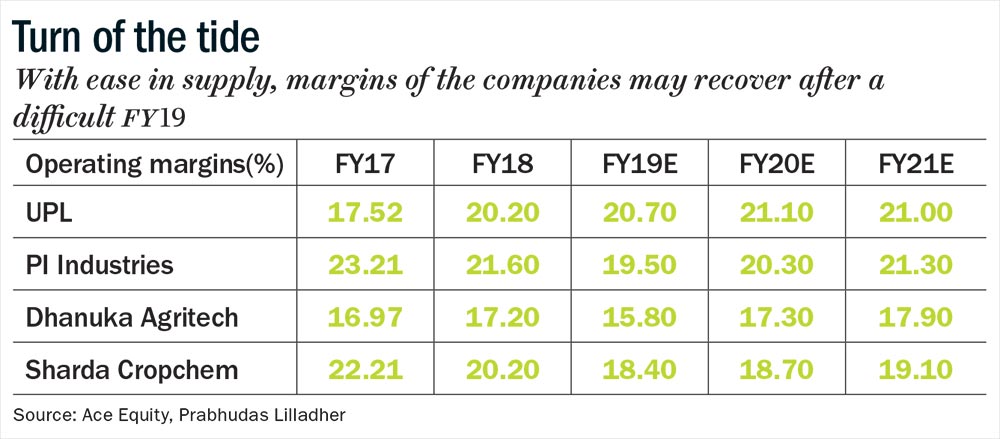

But the cost pressure could soon ease with better availability of raw material in China, according to the management of Sharda Cropchem. Even the analysts concur with their assessment (see: Turn of the tide). “The availability of raw material is increasing as Chinese companies have started producing more and the government has also eased pollution control measures for smaller firms. The shifting of factories is also taking place from industrial areas to near Mongolian region. The shifting process will be underway for one or two years, and the supplies may continue to improve incrementally,” says Prashant Biyani, research analyst (agri inputs) at Prabhudas Lilladher.

Turn Of Cycle

Good news is also coming in from the demand side. Global agrochemical cycle is turning around, with indications aplenty. Growth is expected to pick up meaningfully in H2FY19, and Q3FY19 numbers already reflect the momentum. PI Industries’ custom synthesis and manufacturing (CSM) segment, which accounts for 61% of the revenue, clocked a robust 40% plus growth in the December quarter. Even in Q2FY19, the CSM business had received strong traction, growing 32% (YoY).

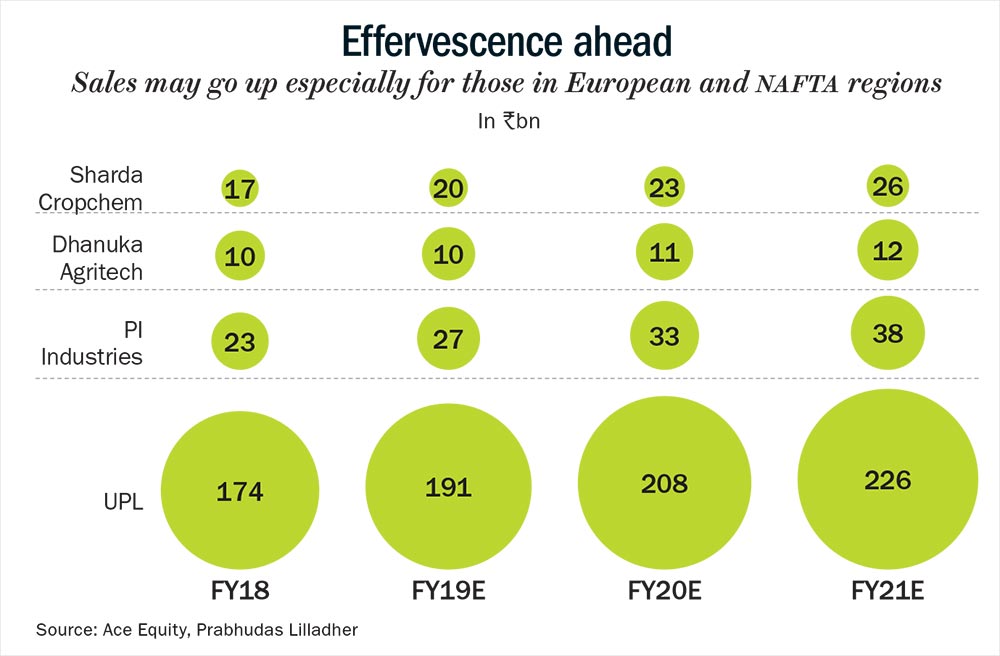

UPL also benefited from strong performance in Europe, region covered under the North American Free Trade Agreement (NAFTA) and Latin America. Sharda Cropchem reported similar growth trend across geographies of Europe and NAFTA (see: Effervescence ahead).

Analysts claim that exports, which contribute 50% of the Indian agrochemical market revenue, are expected to grow at 8-10% CAGR over the next seven to eight years. This will be driven by opportunities in contract research and manufacturing services (CRAMS) with $3 billion worth of molecules going off-patent by 2020 and scarcity of supplies from China.

Large enterprises are looking for partners who can provide high-end CRAMS, according to analysts. “With rising R&D costs for most of the global companies, the consolidation will help them focus more on the core competency, cost-cutting and improving synergies. Commercialisation and manufacturing of molecules would be another area of growth for the established CRAMS companies,” says Biyani.

There has also been a shift to generic-crop-protection chemicals and products, which is expected to help Indian companies tap into new growth avenues. The share of generic molecules in the global agrochemical market is set to increase (currently at 66%) with molecules worth billions of dollars likely to go off-patent. Products worth $3.7 billion have already gone off-patent between CY15 and CY17.

Dicey Domestic

While the decline has been arrested on the global front, the performance at home has remained muted. Along with erratic weather and slowdown in demand, a large inventory has contributed to single-digit growth (4%) here. PI Industries reported 9% YoY sales growth and Rallis India reported a stable 7% growth in standalone operations. However, major disappointment came from UPL, which reported a 21% decline in sales impacted by inventory. Even Dhanuka Agritech saw a 2% YoY decline in sales, which could also be from the deficient southwest monsoon.

It has been a bad year on domestic front but things are set to improve, according to the analysts. The growth drivers include the scope of increasing yield, reduction in crop losses and government’s rural thrust ahead of all crucial general elections. The rise in minimum support prices, benefits of farm loan waiver and money transfer under the PM Kisan Yojana are seen as key. “Most of the state governments and Central government have credited money into bank accounts of farmers. Even if a farmer invests part of this money in agrochemicals, it should give some fillip to the sector,” says Biyani.

Analysts forecast that, even if none of the macroeconomic factors support the agrochemical industry, there could be 5% growth in FY20 due to the confluence of factors. “There is a shift taking place from generic to speciality,” says Biyani. This could be because farmers now prefer branded products over local ones, according to another analyst.

Still Valued

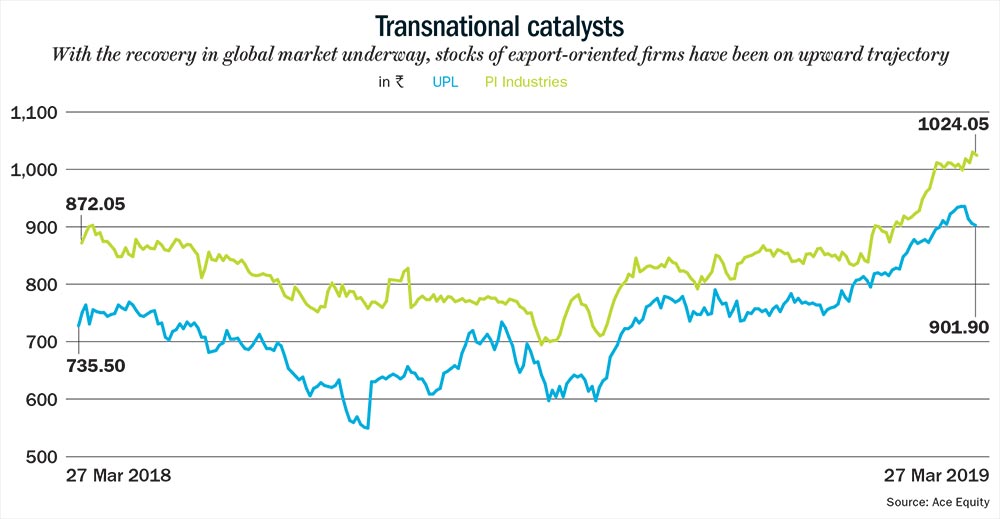

Investors have already started flocking towards agrochemical stocks because they see an upswing coming on the global front. Stocks of agrochemical companies such as UPL, PI Industries, and Coromandel International hit 52-week highs, while peers such as Insecticides (India) and SRF are close to yearly highs on improving revenue outlook (see: Transnational catalysts).

Despite the stock prices running up, analysts believe there is further potential for upside. “The agrochemical stocks are trading at their fair valuation. We don’t see any undervaluation in them at this point. Earnings growth which was suppressed in FY19 should pick up in FY20E. For 17-18% average RoE the sector trades fairly at 17x forward PE,” says Oza of Kotak Securities.

Ambit’s Gupta is betting on PI Industries, stating that the revival of the global agrochemical cycle will help the company grow CSM sales at 22% CAGR over the next three years. “PI is adding two plants next year after commissioning a multi-purpose plant during the quarter, providing visibility on growth; note that PI didn’t add any plant in CY16/CY17 when growth visibility was poor. The recent quarter’s growth seems to have been driven by continued strength in a large herbicide molecule and launch of another novel insecticide,” says Gupta. The stock is also trading at a reasonable price-to-earnings (PE) ratio of 21x FY20E EPS, with industry leading RoCE of 26% over the past five years.

Biyani also believes that PI Industries is all set to make a comeback (revenue CAGR of 18.6% between FY18-21E) driven by both domestic (which contributes 39% of revenue) and CSM business (61% of revenue). He is also banking on UPL due to its sizeable presence across major geographies. “UPL is well placed to capture a significant share of $3.7 billion off-patent products between CY15-CY17, given its cost-competitive manufacturing capabilities,” says Biyani. And further making UPL an attractive bet, the stock trades at 14.5x on a one-year forward basis.

Though the picture on the agrochemical companies’ domestic prospects is still unclear, the global uptick in demand offers enough for investors to jump onto the bandwagon. Easing cost pressure, better earnings outlook and diversified presence across geographic will make export-oriented companies clock robust growth.