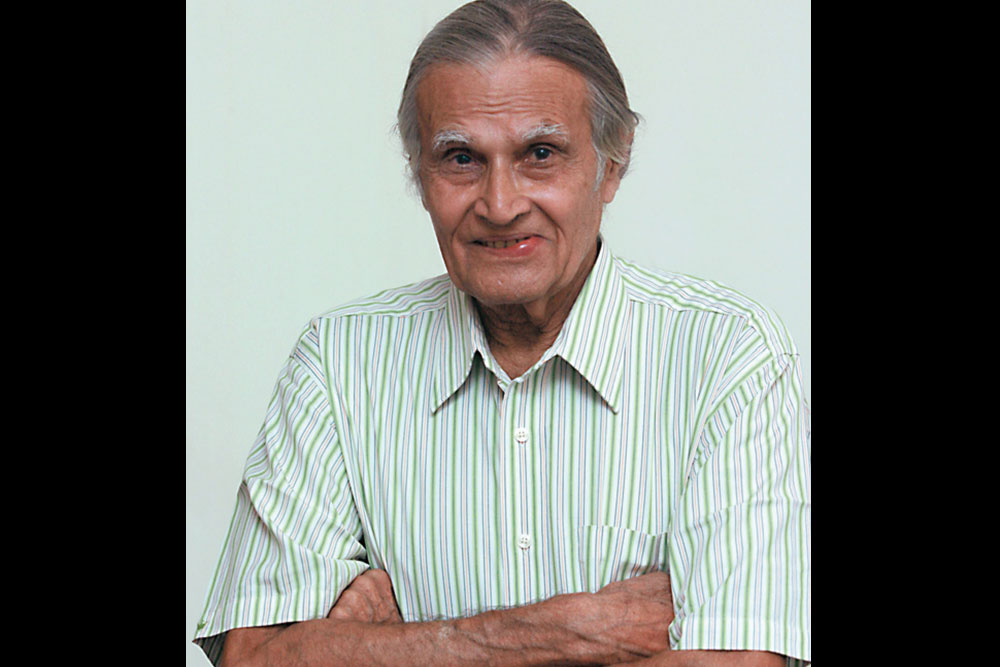

Chandrakantbhai focused on values — in investing, in society, in institutions, in ecology and, most importantly, in the conduct of one’s life. He lived and practiced the first and the last with dedication, discipline, devotion and detachment. His was a life that was duty-bound till death. Integrity, simplicity, transparency and humility were central to Chandrakantbhai’s value system.

He defined integrity as complete congruity between thought, speech and action — they formed the bedrock of his personal ethics. They were also the bedrock of his systems-driven, multi-disciplinary worldview that placed inter-dependence and interconnection as vital to rational decision-making. He drew inspiration from the Bhagavad Gita and the Jain scriptures and would relate their teachings to what was missing in today’s capital markets.

Whilst Chandrakantbhai decried the perils of unrestrained technology, he also looked for innovation capabilities in companies that he chose to invest in. What he sought was — like Edmund Burke and Peter Drucker — a balance between continuity and change. He found that balance missing when confronted with a world full of gaudy excesses that was not living within limits — excessive consumption, excessive debts, excessive government, excessive money-printing, excessive inequalities and an excessive focus on the short-term. He often spoke and wrote about Schumpeterian “creative destruction”, about the Druckerian necessity of viewing profits as “the cost of staying in business” and about the Austrian School’s views of thrift, savings, entrepreneurship, capital formation and focus on the future.

I used to frequently meet Chandrakantbhai at his residence and his daughter Nitiben’s office. There were discussions that were philosophical in nature but practical in import. The sheer breadth of subjects that Chandrakantbhai was familiar with never ceased to amaze me. But whichever lens he looked through — and he had mental models from sociology, biology, ecology, history, psychology, literature and physics — his conclusions for the past few years have always been the same.

An unsustainable credit-driven global asset bubble has been formed, which will end with disastrous consequences for economies and societies. He may have got the timing wrong but, in all probability, will be proven right in the next few years. Fitting, given that he always wished that he wouldn’t be around to see his predictions come true.

Conventional yardsticks can rarely be used to measure the legacy of an unconventional man. There, however, can be no doubt that his memes have shaped the lives and thought processes of some of India’s leading practitioners of value investing and inspired many more to follow that discipline. Leo Tolstoy wrote of a “supremacy” expressed altogether in “moral power and in the greatness of character”. Chandrakantbhai, as I will always remember him, was the embodiment of this supremacy.