IndusInd Bank has been in the thick of things since the year began. The bank raised $500 million as a three-year term loan from overseas investors. Later, in March, it gobbled up microfinance major Bharat Financial Inclusion. Continuing with its M&A spree, the bank bought out IL&FS Securities. Following this move, the bank’s stock hit a 52-week high of Rs.1,995 on 27th June. In fact, since January while the Nifty Bank Index has gained 4.36%, the stock has surged 21%.

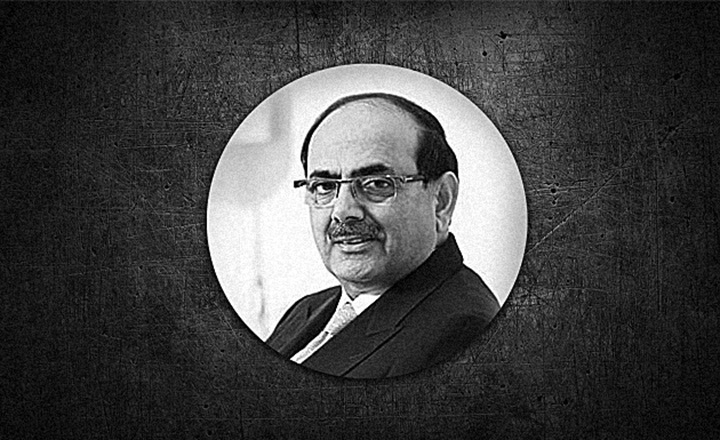

Making the most of the purple patch, CEO Romesh Sobti sold 40,000 shares worth around Rs.78 million in two instalments on June 22 and June 25. Post the transaction, Sobti still holds 360,000 shares worth Rs.720 million. This is the first time since the past two years that the CEO has disposed shares in the open market. He last disposed 30,604 shares worth Rs.37.3 million on September 22, 2016.

The bank has been doing well operationally. In Q4FY18, net interest income hit a five-quarter high at Rs.20.07 billion and interest earned grew 21% YoY to Rs.46.50 billion from Rs.38.30 billion. The bank’s loan book grew 28% YoY, led by 30% growth in corporate loans and total net income jumped 27% YoY to Rs.9.53 billion.

Loan book growth was driven by market share gained from PSU banks. Analysts continue to have a ‘buy’ rating. According to Morgan Stanley, earnings were helped by strong loan growth, lower credit cost, and good cost control. Brokerage Jefferies expects earnings to grow at 25% CAGR over FY17-20 and investors believe high profitability will help the bank contain its gross NPAs to 0.97% by FY20.