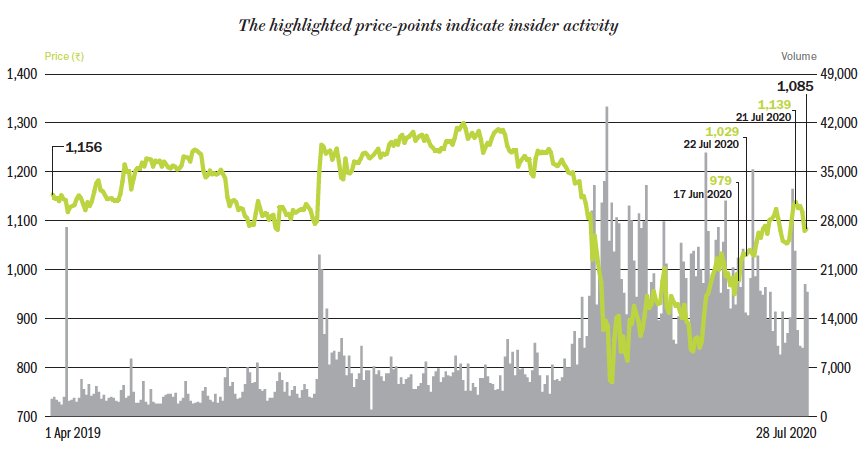

India’s longest serving private bank CEO Aditya Puri is all set to hang up his boots this October. Serving as the top boss of HDFC Bank, Puri has led the private lender since its inception in 1994. But, despite the long association, Puri has sold almost his entire holding. Between July 21 and 23, he sold 7.42 million shares worth ₹8.43 billion. His holding now stands at 376,218 shares. Earlier, in February, Puri had sold 1.25 million shares for ₹1.56 billion.

An investor darling and Index bellwether, HDFC Bank, has bounced back remarkably from the March low of ₹738 on the back of overall market recovery. In Q1FY21, the bank’s revenue rose 8% year-on-year to ₹197.4 billion and net profit came in at ₹66.6 billion compared to ₹55.7 billion posted in Q1FY20. Asset quality deteriorated marginally as gross NPA stood at 1.36% in Q1FY21 against 1.26% in Q4FY20.

An investor darling and Index bellwether, HDFC Bank, has bounced back remarkably from the March low of ₹738 on the back of overall market recovery. In Q1FY21, the bank’s revenue rose 8% year-on-year to ₹197.4 billion and net profit came in at ₹66.6 billion compared to ₹55.7 billion posted in Q1FY20. Asset quality deteriorated marginally as gross NPA stood at 1.36% in Q1FY21 against 1.26% in Q4FY20.

Given its pedigree and track record, analysts remain bullish on the stock. Commending its performance amidst COVID-19 uncertainty and maintaining a ‘buy’ with target price of ₹1,239, analysts at Axis Securities feel, “HDFC Bank remains one of the resilient stocks in the sector.” Analysts at Motilal Oswal Securities, too, have a ‘buy’ rating with a target price of ₹1,280. However, they caution that “CEO succession remains an important event in the near term and a key monitorable.”

Reportedly, the names of company insiders Sashidhar Jagdishan and Kaizad Bharucha, and Citibank’s Sunil Garg have been recommended to the RBI. In the virtual AGM held on July 18, Puri told the shareholders, “He (the successor) has been with us for 25 years… My successor was always in place, at least in my mind.” However, Puri’s selling now raises question about who the eventual successor will be.

Mutual funds are playing it safe, having cut their stake from 15.01% in March 2020 to 14.04% in June 2020. While SBI MF has reduced its stake from 3.14% to 2.98%, ICICI Prudential MF has brought down its holding from 1.18% to 1.14%. However, foreign investors have increased their holding from 36.68% to 37.04%.

*RBI cleared the appointment of Sashidhar Jagdishan on August 5, 2020