Feel good has been in very short supply everywhere of late, more so in the markets. Retail investors, therefore, continue to flock to investment round tables where they think they might get some. No wonder the 4th annual forecast event of the Indian Association of Investment Professionals, a member society of the CFA Institute, saw a huge turnout. This is a yearly discussion featuring the outlook of investment experts on various asset classes. This time the panelists comprised Sunil Singhania, head of equities, Reliance Mutual Fund; S Naganath, chief investment officer, DSP BlackRock Mutual Fund; Prabhat Awasthi, head of equities, Nomura Securities; Rajiv Anand, chief executive officer, Axis Mutual Fund; and Shubhada Rao, chief economist, Yes Bank.

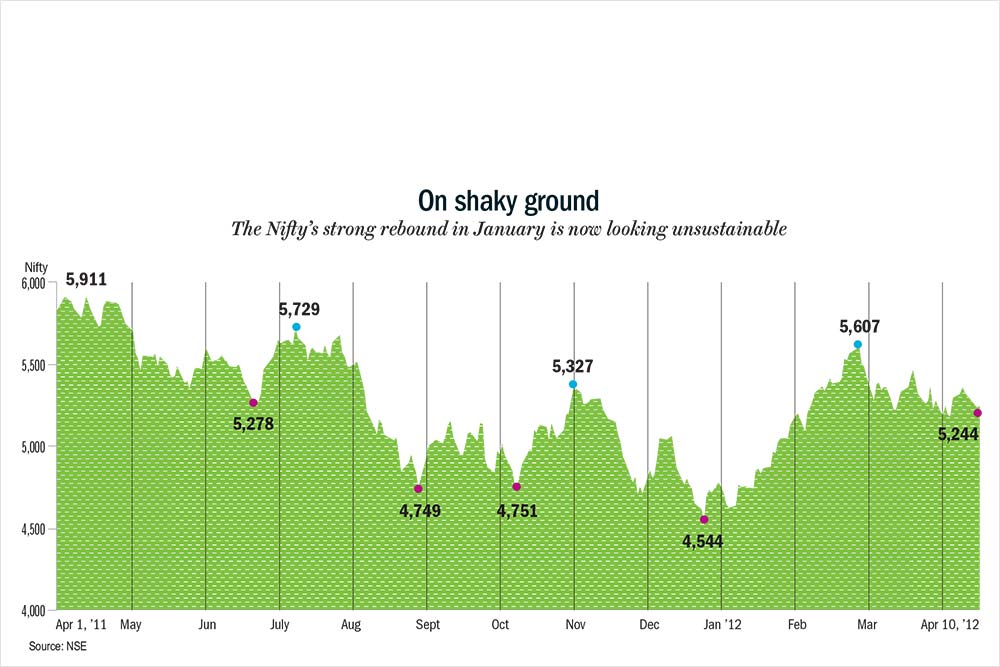

Right now, most analysts’ bullishness is hostage to a number of factors. Prime among them are local policy gridlock and a high crude price. The Budget has been a big letdown to say the least, foreign institutional investors (FIIs) are living in fear of getting GAARed and policymakers continue to throw curveballs by the day. So, can the going get any more dismal for equities? The current mood is quite a change compared to the one prevailing at the end of January. On the back of FII inflows, the benchmark rallied by over 15% and some individual stocks much more so.

At that time everybody was gung-ho that we could end up making a new high on the back of QE3 liquidity. In fact, the expectation of what QE3 could do to emerging markets still gets a lot of talking heads animated. Naganath is one of them. He said, “Globally, the opportunity cost of money is zero. For all of us it is 10%. So, even if the local investor is averse to buying equities, the global investor is quite happy to buy Indian equities even at these valuations.”

Pump it up

It seems then, more than fundamentals, investment experts are banking on liquidity to perk up the market. Well, one cannot ignore that possibility at all and since the greatness of gold has been hard sold over the past few years, the audience was eager to know whether gold’s good run will last. If you recollect, in the market last year, everybody’s favourite whipping boy was the “Eurozone debt crisis”. Well, it is to counter this crisis that the European Central Bank backed by the Fed, opened its liquidity spigot. That led to a second round of reflation for all commodities, including crude, and spilled over to gold as well.

As the underlying driver of gold is now global liquidity, its safe haven status is increasingly becoming a farce. How does one explain the recent correction in gold price on reports that QE3 will be delayed? All this while the media at large and gold ETF managers were tom-tomming its safe haven status. But never mind, gold still continues to be an asset class that is being peddled for FY13 and beyond. Anand said, “Asset allocation is not going to change materially over the next three-five years. So, investors will continue to buy into gold and real estate.”

In fact, over the past couple of years, sceptics have used the relative outperformance of real estate, gold and even fixed deposits to damn equities. Singhania, however, thought that this is a case of misplaced metrics. He defended equities saying, “If we move a little bit back, in absolute terms, from 1994 to 2004, real estate in Mumbai gave a negative 30% return. I think we are getting swayed by what we have seen over the last five to six years in terms of real estate prices.”

Maintaining his optimism for equities in FY13, Singhania added, “When our first panel discussion was held in 2009, the market was down and out. Everyone was negative, but the markets jumped up 50%. In the third year not everyone was as negative but the markets slipped. So the law of averages could work in our favour.”

Unlike Singhania, Nomura’s Awasthi is a little conservative. His fears stemmed from the precarious position of the rupee against the dollar. He said, “There will be pressure on the currency. It will be interesting to see how the RBI responds to that. At this point of time, any sort of external risk can take the market down.” He is banking on improved conditions closer to the end of the financial year driven by easing domestic liquidity. It goes without saying that the central bank’s options are very limited in the current circumstances of sticky inflation, high fiscal and current account deficit. A falling crude will, of course, help improve the deteriorating current account, but that is not a given.

Sitting on the fence as all economists do was Rao, who professed to be “cautiously optimistic”. Like others, she too is banking on monetary easing. “Timing of the cut is one thing, but the quantum will depend on how the crude oil scenario plays out,” she added. Her best case scenario is a rate cut of 75 basis points through the year.

Cheap money

Historically, while the benefit of a rate cut has percolated throughout the economy, some sectors do end up with outsized gains. Besides the banking sector, are there any other sectors that one should buy into and should it come at the cost of exiting the defensive stocks in one’s portfolio? Singhania’s stock picking acumen had ensured that his fund had much earlier loaded up on pharmaceutical stocks. Even now, despite their run-up, he continues to prefer select pharma stocks over the more high profile fast moving consumer names. He opined, “If a stock is quoting at a price-earnings multiple of 40, it cannot qualify as a defensive, even if everyone is buying and perceives it to be high quality. We believe that pharma is better than FMCG as it has higher growth and lower risk.”

Capital goods is also a sector that seems to be coming back to favour, partly because of the expectation of lower rates and largely because the sector has been beaten down due to policy paralysis and execution delays. Naganath said, “Investor interest could be back as driven by rate cuts, the subdued investment cycle of the last three to four years could reverse.”

Meanwhile, Awasthi continued his cautious stance as he feels it is too early to assume that the policy delays around infrastructure will be resolved. In fact, he is rooting for a much deeper change in the way the government has been handling its affairs. He said, “There is an urgent need to rebalance the economy. Consumers have too much of a free ride now and the government needs to cut down on petrol and agriculture subsidies.”

But whether self-serving politicians will oblige is anybody’s guess. Since the audience was keen to know where Awasthi was directing his institutional clients’ money, he answered, “We favour certain financial stocks and are avoiding capital goods as well as overvalued consumer discretionary stocks.”

For investors sitting in the audience who believed that all the bull talk is, well… bull, there is no alternative but to stick to the safety of inflation-stricken fixed deposits. Needless to say there, too, the government’s action or inaction will influence returns. The government’s spendthrift ways will ensure tight liquidity and that, in turn, means that despite the RBI rate cut, banks will have to stick to high deposit rates to pull in more savings.

For those with bulging pockets, Awasthi recommends that they stick more to short-term government bonds than long-dated paper until the time is right. His rationale for avoiding the 10-year bond for the next six months, “Due to the high government borrowing the market will push the 10-year yield to a point where the RBI will intervene with a cut in cash reserve ratio or sell bonds from its own account. At that point, it makes sense to buy long bonds.”

Foggy screen

As the outlook for equities is hazy from a one-year perspective, Anand too favours the safety of fixed income. Optimist though he is, Singhania said from a six-month horizon there are headwinds and the effect is getting reflected in stock prices. “Return expectations clearly have been lowered. If there were no challenges, you would not be getting stocks at these prices.” While most panelists did not hazard a guess as to what the worst case scenario could be, Naganath was candid enough to admit that in the event of a triple whammy of high crude prices, shrinking bank loan books and rising inflation, the Nifty could find it difficult to hold the 5,000 level. He, too, prefers sticking to short-term debt for the first half.

A snide cynic once remarked, “When all else fails, change the goalpost.” That is why investment advisers advise you to think for the long term, but collect their fees in the short term. Here too at the end of the panel discussion there was unanimity that equities will outperform fixed deposits over a three-year period. Nevertheless, such confidence could be misplaced. In the months ahead, Naganath reiterated, the way crude oil price moves is critical, and geopolitical tension could only add more fuel to the fire.

If that happens everything will go out of kilter for the Indian government that has badly underprovided for crude subsidies in its latest Budget. Then there is China, which is reported to be slowing down. Oh, did we mention the now on-now off Eurozone crisis? Awasthi feels the biggest danger there is that the band-aid could rupture again as the basic problems are still to be addressed.

When you are despairing or depressed you need a distraction. One hope that investors seem to be hanging on to is a market powered by sheer liquidity. As for fundamentals, they don’t give a damn.