Most new listings in India fail to shine after going public but IndiaMart has been bucking the trend. After a stellar listing at Rs.1,177 against issue price of Rs.973 in June 2019, it has doubled to Rs.2,331. This is after dipping to Rs.1,750 during the market selloff in March. It didn't trade there for long, and got another boost after the strong Q4FY20 earnings. While its revenue grew 23% YoY due to rise in number of paying subscribers and higher realisation from existing ones, net profit increased almost 60% from the previous year. For the full year, its net profit saw a 7x jump from Rs.200 million in FY19 to Rs.1.47 billion. The management stated that they expect short-term decline in demand due to COVID-19 disruption, but added that their “value proposition will only become stronger as more businesses look for transforming themselves”. Analysts at Edelweiss Securities in their latest report post Q4 earnings, state that the “lockdown would accelerate digital adoption, implying higher growth potential over medium to long term”. They have a ‘buy’ rating on the stock, but have lowered their target from Rs.2,815 to Rs.2,535, valuing it at 27.5x its estimated FY22 earnings.

In order to deal with the coronavirus impact, IndiaMart is offering subscription discounts and validity extension to its customers. To cut costs, they have deferred appraisals and let go of variable pay. ICICI Securities analysts add that the company’s ability to “manage costs in a challenging economic environment would help it protect profitability”. Meanwhile, JM Financial Institutional Securities likes IndiaMart due to its “asset light, negative working capital cycle and strong network effects business model.”

Their optimism is shared by foreign portfolio investors, who have gradually increased their holding in the company from 5.77% in July 2019 to 12.24% in March 2020. Westbridge Crossover Fund and Amadeus IV DPF have kept their holdings stable since September at 5.34% and 3.05%, respectively; whereas, Steadview Capital raised its stake from 1.7% to 2.54%.

Mutual funds, as well, have increased their stake in CY20 from 1.9% to 2.44%, but their holding has fallen from July 2019 level of 4.71%. In the latest quarter, Invesco MF hiked its stake from 0.53% to 0.76% and UTI MF added the stock by buying 0.82%.

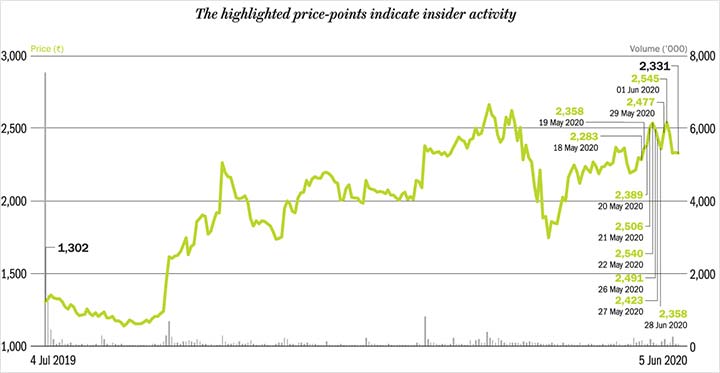

And as the stock rallied, employees and promoters have been selling IndiaMart shares. Since the last week of May, chief operating officer Dinesh Gulati has sold shares worth Rs.182.7 million, at an average share price of Rs.2,480. In fact, of the Rs.715 million worth shares offloaded since January 2020 by insiders, Gulati’s sale amounts to Rs.350 million. But he still holds 1.44% stake in the company, which is worth Rs.970 million. But it’s not just Gulati who is booking profit. Insiders including Madhup Agrawal, Vivek Agrawal, Rajesh Sawhney and others have also been selling the stock. The total value of shares offloaded in the month of May is Rs.313.4 million. Since IndiaMart’s listing last year, insiders have sold a total of Rs.1.47 billion. Meanwhile, promoter holding has remained stable since Q2FY19 at 52.34%.