Fuelled by discounts, Gulf Oil Lubricants has been chipping away at leader Castrol India’s market share. Over the last six months, Castrol India’s shares have dipped 18.5%, while Gulf Oil’s have gained 9%. The latter’s stock price also touched an all-time high of Rs.586 on April 18. On the same day, chairman Sanjay Hinduja’s holding company Gulf Oil International (Mauritius) bought 4.9 lakh shares for a consideration of Rs.27.61 crore. If the promoter’s market activity is anything to go by, this might just be the beginning of good days for the company. And analysts agree: they reckon Gulf Oil Lubricants is undervalued (24x FY17E) despite low leverage, superior return ratios (FY18E RoE at 40.5%), multi-year market share gains, healthy dividend payout (35%) and growth prospects. Gulf Oil also reported a 12% y-o-y jump in volumes in Q3FY16, with the top line rising 9% to Rs.259 crore and net profit improving 43% to Rs.26 crore. The company is now aiming to grow its volumes 2-3 times the industry growth rate, besides increasing capacity to 170,000 kilolitre from 90,000 kilolitre. It is also mulling tie-ups with OEMs and industrial consumers to boost volumes.

Bridging The Gulf

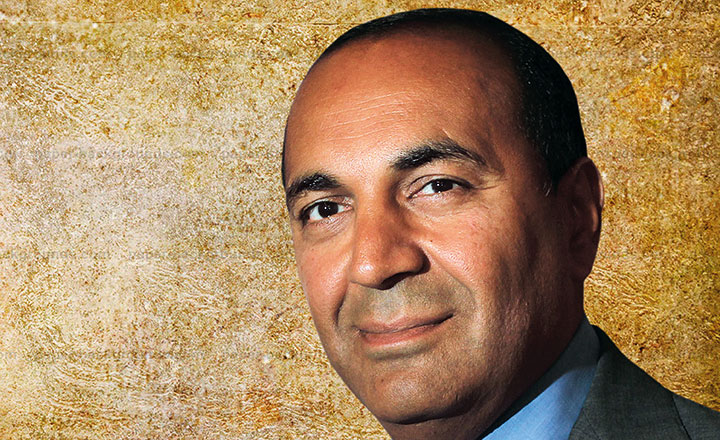

Promoter Sanjay Hinduja ups his holding in Gulf Oil Lubricants

Opening

Opening