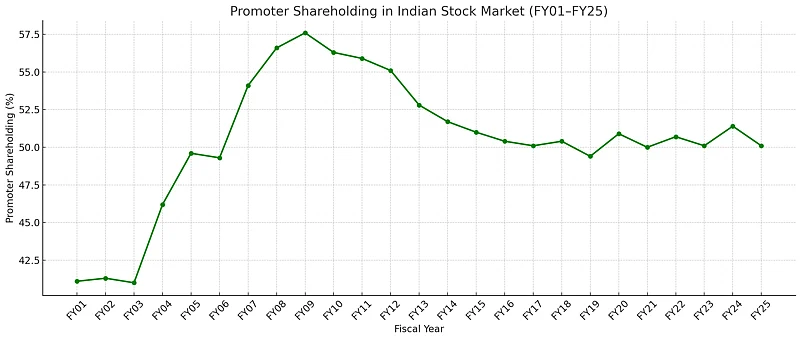

Promoters have once again trimmed their stakes in India Inc, marking the third consecutive quarter of selling. By the end of the January–March period, promoter ownership in NSE-listed companies had dipped 22 basis points sequentially to 50.1%, the lowest level in seven quarters and capping a cumulative fall of 1.3% in FY25 so far.

“The absolute amount held by promoters fell by 6.9% on quarter to ₹205 lakh crore, taking the total decline to 14.3% in the second half of FY25, after a strong 21.8% increase in the first half,” data from NSE’s latest Market Pulse report showed.

The slide was even more pronounced in the Nifty 50 universe, where promoter holding dropped 57 basis points to 40.6%, its lowest in over two decades. This decline was largely attributed to a reduction in government and foreign promoter stakes. On the other hand, the broader Nifty 500 saw relative stability, with promoter ownership holding steady at 49.5%, as a dip in government stake was nearly balanced out by a rise in private Indian promoter share.

This wave of selling has coincided with a rush of block deals and offer-for-sale (OFS) transactions, as promoters cashed in on lofty market valuations.

One such example played out today, when private equity firm Westridge Investments, also the promoter entity of Aptus Value Housing Finance, reportedly offloaded nearly 8% stake in the company in a deal worth around ₹1,131 crore.

This adds to a series of recent high-profile stake sales. British American Tobacco’s (BAT) notable exit from ITC, Rakesh Gangwal’s continued stake reduction in InterGlobe Aviation (IndiGo), and the Sajjan Jindal Family Trust’s partial divestment in JSW Infrastructure have all made headlines. Other major stake sales include Singapore Telecommunications (Singtel) trimming its stake in Bharti Airtel and promoters of Paras Defence, PG Electroplast, and TD Power Systems selling through block deals.

From a sectoral standpoint, promoter ownership remained strongest in real estate, which saw a 19-basis point rise to 62.8% in Q4. Utilities followed, climbing to a two-year high of 59.2% (up 48 bps), while information technology also rose to 52.8% (up 32 bps). Industrials held steady at 55.1%, while materials and energy slipped to 56.1% (down 58 bps) and 52.5% (down 9 bps), respectively.

Among the top gainers, consumer staples stood out with a 1.2% jump in promoter holding, while consumer discretionary followed with an 82-basis point increase.

However, the financials space bore the brunt of the selling, with promoter shareholding falling by 1.4% during the quarter to 40.7%, marking a 2.6% drop over the second half of FY25.