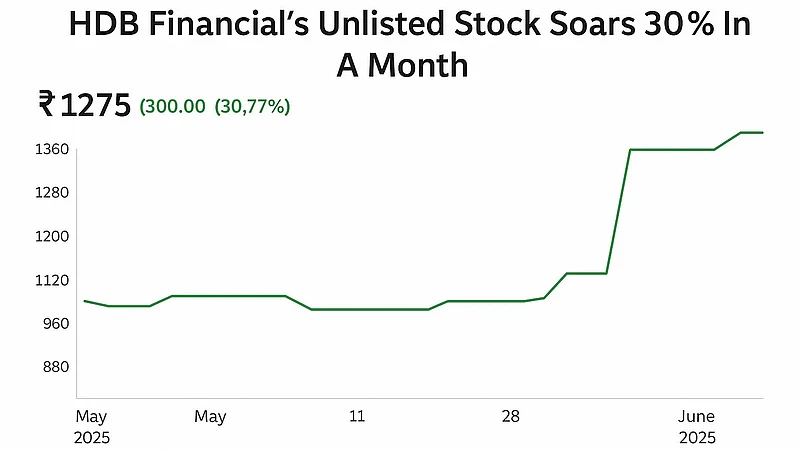

HDB Financial Services’ unlisted shares have been on a quiet rally. The non-banking finance arm of HDFC Bank saw its stock skyrocket nearly 31% in just the past month, riding a wave of investor optimism ahead of SEBI’s green signal for its IPO on June 3. The sharp jump in the grey market came after a relatively lukewarm six months, during which the stock barely moved 2%, according to data available on Unlistedzone. Over the past year, however, HDB shares have quietly clocked 17.5% gains, hinting at growing investor appetite ahead of its public debut.

The surge in the grey market coincided with regulatory clearance for HDB Financial’s much-anticipated public debut. The Securities and Exchange Board of India, on June 3, approved the firm’s proposal to raise Rs 12,500 crore through an initial public offering. Of this, Rs 10,000 crore will be raised via an offer-for-sale (OFS) by its parent, HDFC Bank, which currently holds 94.6% stake in the NBFC. This would mark the first public issue from the HDFC Bank group in six years.

The IPO structure includes a fresh issue of shares worth Rs 2,500 crore, in addition to the OFS, all comprising shares with a face value of Rs 10 each. The net proceeds from the fresh issue of shares will be utilised in augmentation of its Tier – I capital base to meet the NBFC’s future capital requirements including onward lending.

The move to take its NBFC arm public aligns with a directive from the RBI issued in October 2022, which mandates upper-layer NBFCs to list on the stock exchanges within three years.

The NBFC is classified as an upper layer NBFC, and has diversified and retail-focused approach. Its total gross loans stood at Rs 986.2bn as of September 2024, marking a 21% compound annual growth rate during March 2022-September 2024, the company had said in its draft red herring prospectus. Its assets under management were recorded at Rs 902.3bn as of March 2024, HDB Financial said.

In addition to HDB Financial, the market regulator has also approved IPO proposals from five other companies on Tuesday—Vikram Solar, A-One Steels India, Shanti Gold International, Dorf-Ketal Chemicals India, and Shreeji Shipping Global.

According to the data available in the draft papers, HDB Financial’s consolidated net profit was recorded at Rs 1,172.7 crore for the six months ended September 2024, slightly higher than the Rs 1,167.7 crore profit recorded in the year-ago period. Its total revenue for the period rose to Rs 7,890.6 crore from Rs 6,902.5 crore recorded in the year-ago period.