In Tamil Nadu, heroes live and dance among the lesser mortals during Pongal. The four-day harvest festival holiday is incomplete without blockbuster movies — a rushed visit to the theatre or binge-watching on the television as a family. It’s entertainment, entertainment and more entertainment, and the day closes with a favourite soap on Sun TV. In 2019 as well, the 26-year-old channel did not disappoint. It aired some of the biggest hits that year — from Vijay’s sports action film Bigil to Rajinikanth’s Petta and Ajith’s action drama Viswasam.

For nearly two decades, faithful following and strong political connections have given Sun TV a stronghold over the South. But over the past few years, Star Vijay and Zee Tamil have caught up. After all, Sun TV isn’t the only one with the wherewithal to premiere movie hits. Vijay TV aired Dhanush’s Asuran and Samantha’s Oh Baby, while Zee jammed in a variety of shows, comedy and sports to award shows, and then topped this off with Rajinikanth’s films. With quality programming in abundance, Sun’s market share is in danger.

Back then, advertisers had to concede to Sun’s terms even during a slowdown. Not anymore. “Both viewers and advertisers now have more options to chose from. Earlier advertisers used to check whether there is inventory available on Sun before they could launch a product. That is no longer the case,” says B Shankar, CEO, Fourth Dimension Media, a media outsourcing firm. Cracks in the broadcaster’s performance have also begun to hurt its stock. From a high of Rs.650 in April 2019, the stock declined nearly 50% to Rs.323 during the current market plunge.

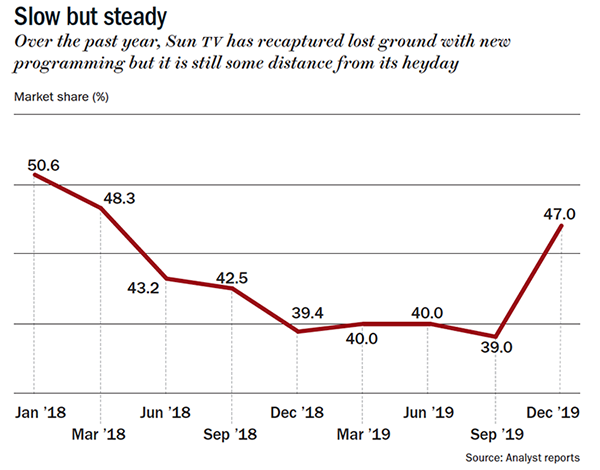

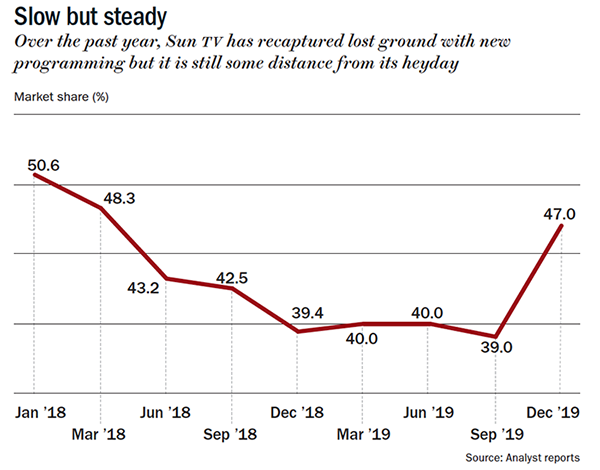

While Sun TV enjoyed an unprecedented run as market leader, increasing competition from Zee and Star TV saw the channel lose significant ground over the past couple of years. From a market share of 50.6% in January 2018, it slipped to a low of 39% in February 2019. To regain some of the lost market share, Sun launched new shows such as Roja (April 2018), Nayagi (Feb 2018) and others on its flagship channel to boost viewership. New shows and blockbuster releases have partly helped as its share increased to 47% during Q3FY20 (See: Slow but steady). The internal target is to surpass the 50-52% ratings share in Tamil Nadu and gain 5-6% in other regional markets. What is working in its favour though is good cash flow and high return on equity. With that available at a rather compelling valuation, is this an opportune time to buy into Sun TV?

Changing weather

The channel has a colourful history. It proliferated and thrived under the erstwhile DMK regime, since the founder Kalanithi Maran was the grand nephew of late DMK chief M Karunanidhi. It had complete control over distribution through Maran-owned Sumangali Cable Vision (SCV), which enjoyed a monopoly. But all that changed when AIADMK’s Jayalalithaa came to power in 2011. The new administration declared Arasu Cable as the official cable distributor, dropped prices and gained market share. What’s funny is that Arasu Cable was first started by the DMK government, but an internal family feud stymied its progress. Today, SCV has 1.9 million households as subscribers while Arasu has about 2.7 million. In the same year, the government imposed a heavy tax on DTH operators, which included Sun TV.

Those were the days when cables dangled over buildings and looped around poles, but now households have moved from analog to digital, to dish receivers that point skywards. Sun TV adapted well to this change, and over the past two to three years, its subscription revenue from digital TV has increased and now contributes 40% of its overall revenue. In fact, the management expects five to six million more households in the region to hop on todigitalin the next few years. Abneesh Roy, director, Edelweiss Research, says, “At Rs.4, the company’s analog revenue per month per subscriber is one-tenth DTH revenue (Rs.40), which provides huge upside potential over long term.” Also, Sun Direct (a promoter group company) has considerable presence in South India’s DTH distribution market.

Viewers are now migrating to over-the-top platforms, such as Netflix and Hotstar. And Sun TV has invested in an OTT platform too, called Sun NXT, launched in 2017. “But it still has a long way to go, when compared to competition,” says Roy. Late to the party, coming in a year after Netflix, Sun NXT is not looking to take on the biggies. It is still working hard to increase its subscriber base. Towards this end, the company has tied up with Jio Cinema, MX Player and Vodafone Idea and is also in talks with telcos to port its content to their platforms. The first will integrate Sun TV’s television content on the RIL-owned platform. These partnerships have helped Sun NXT snap up 15 million subscribers in FY19, and it is aiming for 20 million by the end of 2020.

Sun TV will also invest Rs.1.5 billion over the next 18 months to create original programming for Sun NXT. “The company’s success will depend on its ability to create engaging content, especially for a younger audience, and on a sustainable basis,” says Karan Taurani, Vice president, Elara Capital. With the partnerships and content creation, the OTT platform turned profitable during the December 2019 quarter. “The quality of content wins the game for broadcasters. As long as you are ahead of the changing preference of your viewers and alter and improve your programming, you win the race,” says Tony D’Silva, former CEO of Sun TV.

While the Sun NXT push is helping with incremental revenue, Sun TV’s IPL franchise and the movie business (entered in 2009) have raked in serious money for the company in the past. For instance, SunRisers Hyderabad’s 2018 win brought in Rs.4.4 billion and movies brought Rs.2.2 billion in FY19. That is nearly 17.5% of the total revenue. IPL and the movies also led to 28% growth of the company’s topline; if not for IPL and the movie distribution business, revenue growth would have been a modest 11% that fiscal. Due to the coronavirus crisis, it remains uncertain if IPL will be held in FY21 and analysts aren’t factoring any revenue from the tournament. Given that the entire cost of the IPL franchise is variable, it will impact the company’s profitability.

While the Sun NXT push is helping with incremental revenue, Sun TV’s IPL franchise and the movie business (entered in 2009) have raked in serious money for the company in the past. For instance, SunRisers Hyderabad’s 2018 win brought in Rs.4.4 billion and movies brought Rs.2.2 billion in FY19. That is nearly 17.5% of the total revenue. IPL and the movies also led to 28% growth of the company’s topline; if not for IPL and the movie distribution business, revenue growth would have been a modest 11% that fiscal. Due to the coronavirus crisis, it remains uncertain if IPL will be held in FY21 and analysts aren’t factoring any revenue from the tournament. Given that the entire cost of the IPL franchise is variable, it will impact the company’s profitability.

Taurani says producing movies is a good move because the IP stays with them for life. “Instead of spending Rs.500-600 million on a movie to get broadcasting rights for about five to 10 years, they can produce movies and recover some cost by selling to theatre distributors,” he says. In movie production, the broadcaster has also cleverly chosen to stick with superstars, such as Rajinikanth and Vijay. The success of Petta and Sarkar boosted movie distribution revenue in FY19, and the company is also producing the stars upcoming movie. Airing these films fetch 25-30% premium over weekend prime ad rates. Analysts expect the movie revenue to decline by 29% in FY21 before seeing 3x increase to Rs.1500 million in FY22.

In 2009, they got into film production to build on a library and supplement the core business with an additional revenue stream. That is coming in handy as the network started airing old content from April 7, at a time when the whole country is under lockdown. The network boasts of a large inventory of old serials and more than 11,500 movies across four languages. The inventory will help reduce content cost by 30-40% during the first quarter of FY21, which is expected to offset some pain from the declining advertising revenue.

Sun of the parts

Even before the pandemic struck, the industry was witnessing unexpected headwind — one being the well-meaning but erratic policymaking. In 2019, the TRAI passed a New Tariff Order. It was meant to move consumers from unorganised cable operators to organised DTH players, where they would get to choose channels instead of being forced to take a ‘bouquet’. The idea was to reduce the bill for subscribers, but it played out differently. In fact, the result was the exact opposite of what was intended, largely because of canny repackaging done by broadcasters. They started bundling channels — Rs.19 for a popular channel and lesser for others. This led to an increase in average revenue per user, and overall subscription revenue for all the players.

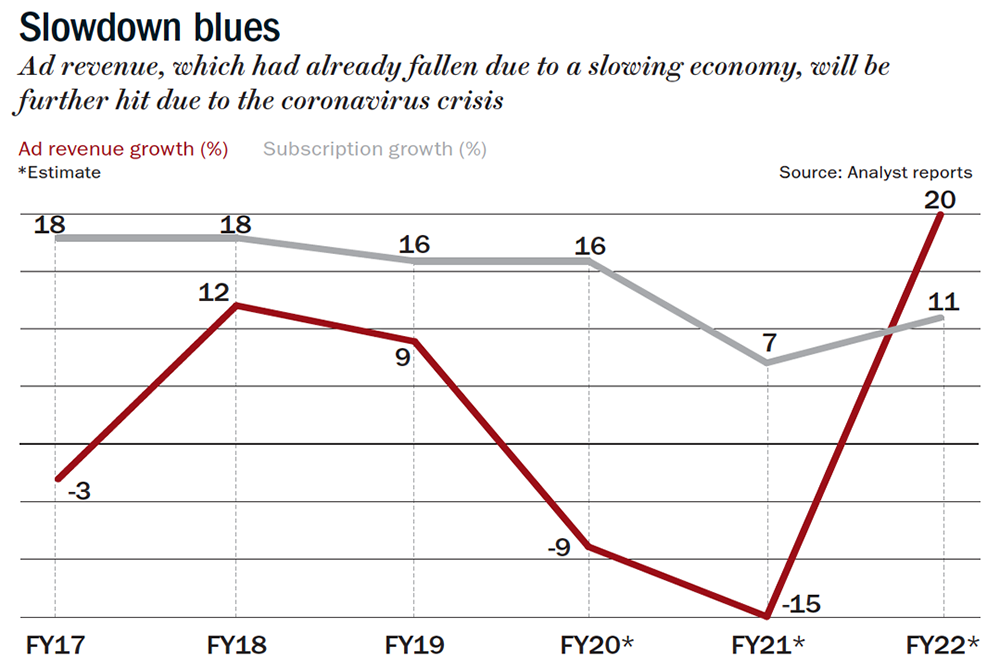

In 2020, TRAI amended the order. It capped the price of individual channels at Rs.12/month and restricted discounts on channel bouquets to 33%. Analysts believe this intervention will hurt broadcasters’ subscription growth. The amendment also brought down the network capacity fee, from Rs.160 for 100 free-to-air channels to Rs.130 for 200. The broadcasters have appealed against the order, and analysts could accordingly revise Sun TV’s subscription revenue growth estimate of 7% for FY21 and 11% in FY22 against estimated growth of 16% in FY20.

Another uncertainty looming over the broadcaster is the impact of COVID-19 on advertising revenue, which makes up 43% of Sun TV’s topline. In a recent investor call to discuss the impact of the pandemic on the business, the management admitted that the revenue outlook remains uncertain. But they do not see an alarming decline as FMCG accounts for nearly 56% of the ad revenue — the one sector that weathered the pandemic better than most others. Nevertheless, analysts expect this income to decline by 8-9% in FY20 (See: Slowdown blues) and further by 15% in FY21 before it bounces back to 20% growth in FY22.

Another uncertainty looming over the broadcaster is the impact of COVID-19 on advertising revenue, which makes up 43% of Sun TV’s topline. In a recent investor call to discuss the impact of the pandemic on the business, the management admitted that the revenue outlook remains uncertain. But they do not see an alarming decline as FMCG accounts for nearly 56% of the ad revenue — the one sector that weathered the pandemic better than most others. Nevertheless, analysts expect this income to decline by 8-9% in FY20 (See: Slowdown blues) and further by 15% in FY21 before it bounces back to 20% growth in FY22.

Besides a better macro environment, the company could also do with management depth. “Maran is definitely one of the sharpest minds in the business, but professional management will help the company scale up,” adds D’Silva. While old hands, ex-CEO and now ED, K Vijaykumar and Group CFO SL Narayanan have played their part, Maran is still hands-on with the business and has also inducted his daughter Kaviya on the board.

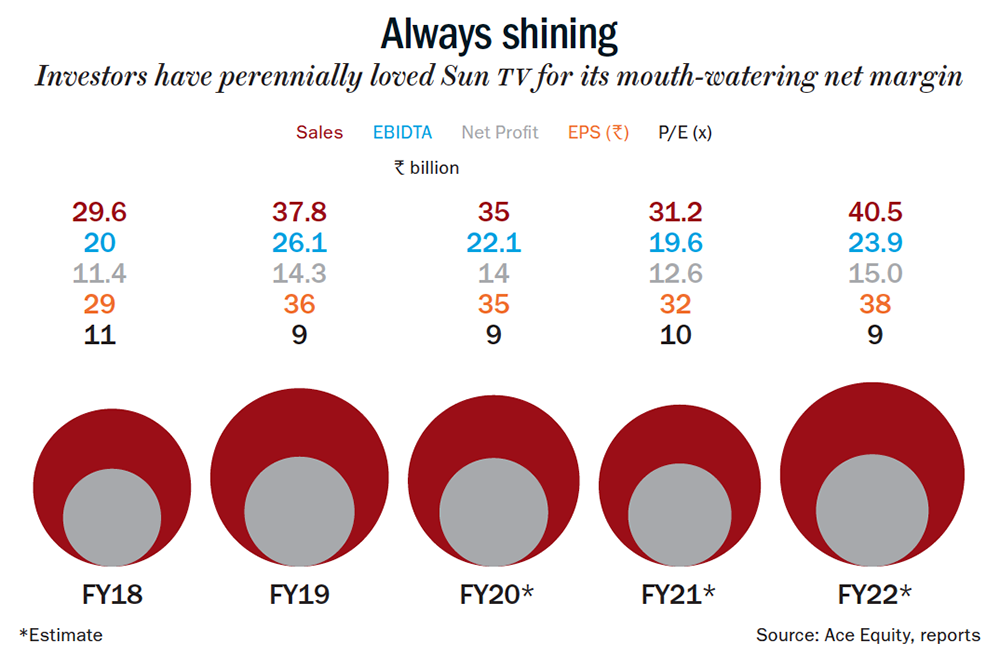

Analysts expect overall revenue to decline by 8% in FY20 and 11% in FY21 but forecast 30% recovery in FY22. They expect a smaller hit on earnings growth, which may fall 2.5% in FY20, 10% in FY21 and get back on track with 20% growth in FY22. The COVID-19 fallout aside, Sun TV’s fundamentals have remained solid with high return on equity at 28% in FY19 and cash balance of more than Rs.25 billion. The stock currently trades at 10x its FY21 estimated earnings. (See: Always shining). Given its market grip, Sun TV seems a better bet among the listed media plays despite the earlier mentioned challenges. After all, the network has Thalaivar, Thalapathy and Thala on its side.

Analysts expect overall revenue to decline by 8% in FY20 and 11% in FY21 but forecast 30% recovery in FY22. They expect a smaller hit on earnings growth, which may fall 2.5% in FY20, 10% in FY21 and get back on track with 20% growth in FY22. The COVID-19 fallout aside, Sun TV’s fundamentals have remained solid with high return on equity at 28% in FY19 and cash balance of more than Rs.25 billion. The stock currently trades at 10x its FY21 estimated earnings. (See: Always shining). Given its market grip, Sun TV seems a better bet among the listed media plays despite the earlier mentioned challenges. After all, the network has Thalaivar, Thalapathy and Thala on its side.