It’s nearing lunch hour but Rakesh Kumar Goswami is a tad too busy to notice the clock ticking by. For the manager of Indraprastha Gas’ pump station in New Delhi’s Moti Bagh has enough business on hand. Two years into manning the operations at the pump, he is seeing a noticeable difference. “We are getting well over a lakh four-wheelers for refuelling at our pump every month,” he says. That business is booming can be evinced by the fact that this single gas pump sells over 360,000 kg of compressed natural gas (CNG) in a month, compared with the national average of 125,000-130,000 kg a month for petrol or diesel pumps. “The demand for CNG has been on the rise of late,” points out Goswami. The spiralling prices of petrol and diesel in the recent past have created a whopping 86% differential between CNG and petrol (₹71.41 in Delhi) and an equally significant 50% differential between CNG and diesel (₹53 in Delhi), leading to wallet-conscious consumers switching over to fuel-efficient cars driven by CNG. In fact, last month, Maruti unveiled its latest CNG version of the Celerio, boasting of delivering best-in-class fuel efficiency of 31.79 km/kg. The launch follows Tata Motors’ attempt to woo customers with a CNG version of its small car, Nano, in late 2013. Though the overall automobile industry has been going through a slowdown, car-makers are churning out CNG variants to keep pulling in customers. More importantly, at ₹1.61/km, the running cost of a CNG vehicle is the lowest, compared with ₹4.45/km for petrol, and a little over a fifth cheaper than a diesel vehicle.

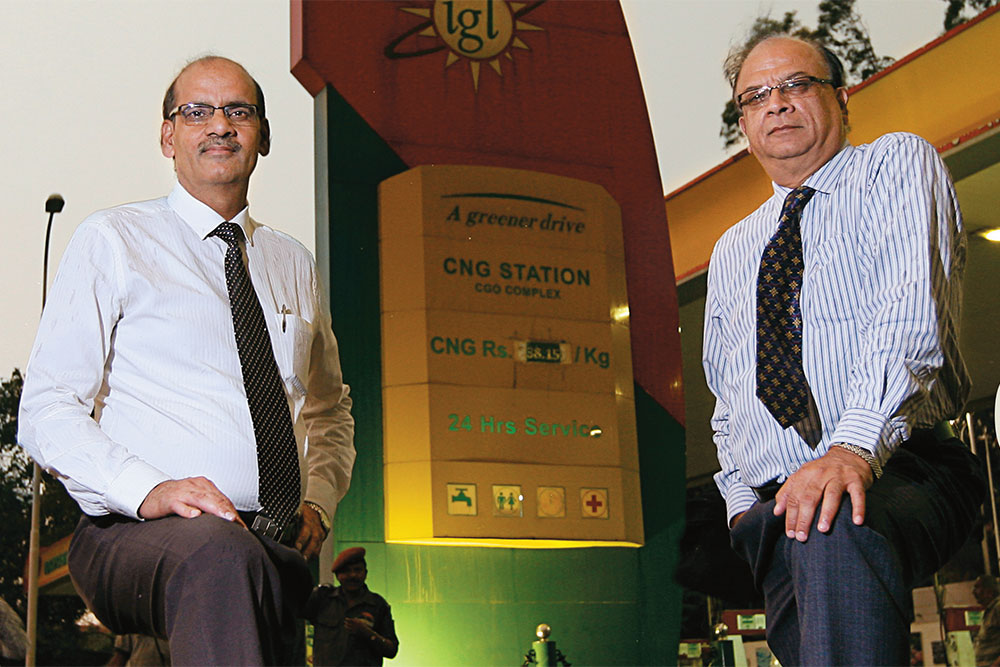

And that can only be good news for Indraprastha Gas (IGL), the natural gas provider that owes its existence to a Supreme Court directive in 1998 that ordered the Delhi government to set up a gas distribution network for consumers and industries in the National Capital Region (NCR). The state government then tied up with GAIL India, Bharat Petroleum Corporation and a few other institutional investors to create IGL. It started small with just nine CNG stations and 1,000 piped natural gas (PNG) consumers. Today, it provides CNG to Delhi and the adjoining satellite towns of Noida and Gurgaon through a network of 324 filling stations and PNG to more than 450,000 households and 1,382 industrial and commercial users. More importantly, given that about 5,000 new Delhi Transport Corporation (DTC) buses, along with 15,000 autorickshaws running on CNG will be inducted over the next two years, CNG volumes are expected to go up. Private vehicle owners too are keen on switching to CNG, what with diesel prices being deregulated and the gap between the two increasing. “Of 20 lakh diesel and petrol vehicles, so far only 4.75 lakh have converted to CNG. So the scope for conversion is huge,” points out Rajesh Chaturvedi, director, commercial, IGL. Not surprisingly, over the past five years, revenues and profits have shown 32% and 11% CAGR. How has IGL grown so well so soon? Can it keep up the momentum?

Pumped up

What has proved a shot in the arm for IGL over a five-year period has been the rapid expansion in its PNG business. While growth in CNG has been steady from 605 million metric standard cubic metre (mmscm) in FY09 to 1,006 mmscm in FY13 at a CAGR of 15%, it is the PNG segment that has seen spectacular growth, from 54 mmscm in FY09 to 333 mmscm in FY13 — a CAGR growth of 51%. Similarly, while the number of CNG stations has doubled from 181 in FY09 to 324 in FY13 due to an increase in vehicular demand by 25%, over the same period, the real growth has seen the near tripling of PNG users from 138,332 in FY09 to 388,078 in FY13 and a corresponding increase in the steel and medium-density polyethylene (MDPE) pipeline network by 42%.

Not surprising, then, that in the recent quarter, IGL added 75 new PNG commercial connections and 15,000 domestic ones. However, in terms of absolute sales volumes, at 75% of total sales turnover, CNG remains IGL’s bread and butter. For the longest time, IGL’s focus was only on the NCR, given its exclusive monopoly in the region. But that monopoly ended in December 2011 and the firm has since been eyeing new pastures elsewhere. With the objective of expanding its presence outside the NCR, the company recently acquired a 50% equity stake in Central UP Gas (CUGL), a Kanpur- and Bareilly-based gas company, for ₹69 crore, to be funded entirely through internal accruals. Financially, the move is a sound one as CUGL is a debt-free entity and can meet its capex funding requirements without any support from its new parent.

That isn’t the only step IGL has taken to grow beyond Delhi. Inorganic growth could be one avenue for expansion, with smaller private independent players such as Maharashtra Natural Gas, Avantika Gas and Bhagyanagar Gas seen as potential targets. “While we will continue to expand IGL’s infrastructure in Delhi and NCR, we are also looking forward to entering new geographies through the bidding route and through strategic acquisitions,” points out Narendra Kumar, MD. In fact, the PSU is other companies. “Hopefully, these [buyouts] should materialise by the end of this fiscal,” adds Chaturvedi. Organic growth, too, remains an option, with 14 cities — including Ernakulam, Bengaluru, Pune, Amritsar and Panipat — identified by the industry regulator Petroleum and Natural Gas Regulatory Board (P&NGRB) for expanding city gas reach. IGL is planning to bid for some cities and plans to fund the same through a combination of external borrowings as well as internal accruals. But while the company is on an expansion spree, it is also facing some headwinds.

Feeling the blues

The P&NGRB in 2012 had directed IGL to reduce its network and compression tariffs by 60%. Network tariffs are the charges levied by city gas companies to recover costs incurred for laying pipelines from the source of gas from state to state and within the city from one CNG station to another. Compression tariffs are charges levied by these companies for use of specialised machinery to compress natural gas into CNG. In addition, companies charge a marketing margin to recover their investment and bear the liquefied natural gas (LNG) spot price currency risk. IGL was continuously increasing all the three charges, which the regulator felt were excessive. In a non-commoditised business such as gas, compression and network tariffs make up the bulk of the margins so, not surprisingly, IGL appealed against this directive in the Delhi high court and won. Subsequently, P&NGRB appealed against this decision in the Supreme Court and the matter is sub judice.

The second litigation is a dispute between IGL and the Delhi Development Authority (DDA) on rent rates for leased land. In FY06 and FY08, IGL had acquired land from the DDA for setting up 60 CNG stations and signed a lease agreement with a 6% minimum escalation clause. However, in Q2FY14, the DDA hiked the rent for this land by a factor of 10 without prior notice, insisting on a retrospective hike in rent with effect from 2007. This matter is pending in the Delhi high court. The management is hopeful of a verdict in its favour since it is already paying the agreed upon escalation cost.

The other issue is the company’s increasing reliance on external supply of gas — in this case, higher-priced imported LNG — despite the government allocating higher domestic gas output to players such as IGL. Though city gas distribution companies in Gujarat such as Gujarat Gas, GSPC and Adani Gas cut rates by 30% in February 2014, IGL was forced to raise CNG rates to ₹38 per kg from the earlier ₹35 per kg as it received only 80% domestic gas allocation against the mandated 100%. To make up for the shortfall, it had to resort to importing costlier rarified LNG (see: Gas trouble). While imported LNG is priced at $18 mmbtu, domestic gas, under the administered pricing mechanism, is significantly cheaper at $4.2 mmbtu. As a result, margins have been trending down. (see: Feeling the pinch).

For the just-concluded fiscal, IGL posted a 2% growth in net profit, to ₹360 crore, while turnover increased 16% to ₹4,328 crore. The average daily gas sale during the year was up to 3.79 million metric standard cubic metre per day (mmscmd) from 3.67 mmscmd in the previous year. CNG realisation has improved significantly owing to three price hikes in June, September and December 2013. PNG volumes, on the other hand, have been muted, thanks to a slowdown in demand from industrial customers due to a price differential in Q4FY13 between LNG spot prices, which were at $20 mmbtu, and furnace oil, which was priced at $18 mmbtu. Furnace oil is an alternative replacement fuel derived from crude oil, often preferred by industrial users as the sales tax on it is only 4%, compared with 26% on PNG. “Industrial demand was affected by a switch to alternative fuels. Current LNG spot prices of $19/mmbtu make it further unviable,” points out Niraj Mansingka, analyst at Edelweiss Financial Services. Though the potential customer base for industrial PNG users in the Noida and Ghaziabad region is 2 million, IGL is serving just 0.5 million customers. It is lobbying hard with the UP government to bring furnace oil taxes at par with that of PNG. If that were to happen, then PNG volumes could see a significant uptick.

Though the marketing exclusivity for IGL in the NCR ended in 2011, till date, not a single player has expressed intent to enter the region. Besides, the regulator is yet to develop a policy framework for new entrants. Meanwhile, IGL has signed agreements with oil and marketing companies (OMCs) — which also pose a threat to its existence — for setting up CNG infrastructure in the 150 stations run by them. It also signed agreements with DTC for supplying CNG to it till 2020. All of these moves, the management feels, will help IGL safeguard its turf from rivals.

When the going gets tough

Going forward, volumes in the CNG segment are expected to improve owing to higher conversion of diesel and petrol consumers. With diesel prices being deregulated in a phased manner, the price of diesel may be hiked to ₹62 per litre, compared with ₹38 per kg of CNG in the NCR, making it an attractive switch. “If the government reduces sales tax and excise duty and sets up CNG infrastructure pan India, it will greatly enhance conversions of automobile users to CNG,” points out Dhananjay Sinha of Emkay Research. Currently, excise duty on diesel and petrol stands at a mere 6.5% and 13.1%, compared with 14.4% excise duty in case of CNG.

Volumes will also get a fillip from the addition of 5,000 CNG buses under the cluster, integrated multi-modal transport scheme and 15,000 new autorickshaws. “The use of CNG has already been mandated in all forms of public transport vehicles operating in the national capital. All additions in the public transport fleet by the government and autos would add to CNG volumes,” adds Kumar. As far as PNG volumes are concerned, the industrial segment could revive thanks to a sharp correction in spot LNG prices. Moreover, on the anvil is a proposed move to bring natural gas under the declared goods status that would lower sales tax on natural gas to 4% from the current 0-25% across various states. Sinha believes the rationalisation of duties and taxes will help in the future. “Eventually, the APM mechanism will be dismantled and the pricing will become market-driven,” he adds.

Ongoing legal battles aside, IGL has a few factors in its favour. The barriers to entry for a competitor looking to replicate its success are many. “It has an unbeatable first-mover advantage in the NCR, with maximum market share and an unmatched distribution network,” says Sinha. And while the marketing exclusivity has ended, IGL’s infrastructure exclusivity continues — what that means is that in order to recover the high cost of setting up the infrastructure, whose life is 30 years, IGL has exclusive usage of the same, which it would otherwise have had to share with new entrants. Then, having GAIL and BPCL as promoters means that it has access to low-priced gas, although it does import 45% of its gas requirements. Other players may not have access to gas at such competitive rates.

The stock, which managed to dish out just 7% return in 2013 and is up 23% since the year began, is currently trading at 10 times estimated FY15 earnings. Against such a backdrop, betting on an upside in IGL far outweighs the risk on the downside.