Soon after OnMobile Global went public in February 2008, its co-founder and CEO Arvind Rao gifted himself a yacht on his 50th birthday. Not just any old boat: he bought Jeanneau 54 DS, a 54-foot luxury yacht replete with real teak and leather. With a love for the seas discovered while doing his MS from the University of Wisconsin-Madison, Rao sails at least eight days in a month. The yacht is estimated to have cost Rs.2.5 crore, excluding 35% customs duty and octroi, and shipping experts estimate the vessel’s annual maintenance cost at upwards of Rs.15 lakh, including the salaries of captain, guards, cook and other crew.

Rao’s kingsize approach to fun spills over to work as well. Twelve years ago, he co-founded OnMobile Global, which quickly went on to become India’s largest player in the value-added services (VAS) space and the first VAS company to go public. He made international acquisitions and doubled, then tripled, revenue in a very short span. As it turns out, Rao’s fall from grace has been equally attention-grabbing — on July 9, he resigned as CEO of OnMobile after getting enmeshed in corporate governance issues.

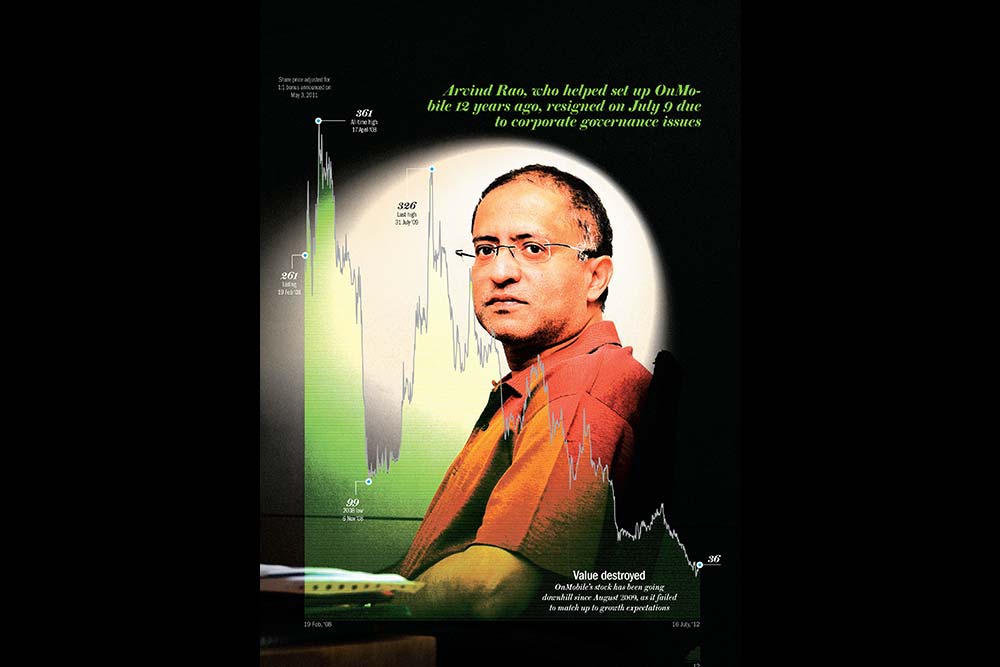

Several high-profile exits from the company since end-2011, compounded by allegations of financial irregularities, have hammered OnMobile’s stock — the stock touched its all-time low of Rs.28.75 on July 2 before closing at Rs.29.50. It’s down 41% in the past three months and has plunged over 91% since the February 2008 listing. How did Rao and OnMobile go so spectacularly off?

High tech dreams

“He dreamt big, and was passionate about tech businesses,” says a former colleague of Rao, an IIT Bombay alumnus. Rao went on to do his MBA from Wharton and landed a job in McKinsey and Co. With his background, he specialised in tech counselling at the consultancy and developed an affinity for advising on building tech businesses and expanding them through alliances and acquisitions.

He subsequently went on to the US-based Gilbert Global Equity Partners, where he met a team from Infy that was looking to develop products for the internet, such as sending alerts to websites. Rao, who was by then bored of advising others, grabbed the opportunity and ended up as the CEO and co-founder of OnScan, as OnMobile was then known. The other co-founder was Chandramouli Janakiraman, better known as Mouli Raman, an ex-Infoscion and CTO of OnMobile.

Rao, however, tweaked Mouli’s original business model to develop alerts for mobiles instead of the internet as he felt there was a bigger opportunity in that space. “He thought ahead of times. Rao saw the mobile boom coming and set up a business that could capture that growth,” says the CEO of a smaller, rival VAS company.

OnMobile received its first round of $15 million VC funding from Argo Capital Management, HNQ Asia Pacific and Satwik Venture Capital Partners in 2000. But it had almost exhausted the money by 2002 in developing products and travelling to get clients. Then, Rao convinced Asim Ghosh, then-MD of Hutchison Essar (now Vodafone Essar), to deploy OnMobile’s services — ringtones and cricket alerts.

Ghosh agreed on a shared revenue model: the operator didn’t make any upfront payment to OnMobile for activating its services on the network. About 30% of what subscribers paid for using the service went to the VAS provider, with the operator retaining the rest. The service turned out to be a hit in Mumbai and Hutch soon extended the services to other circles. Airtel and Idea followed suit.

Those were the heydays for telecom in India — subscriber base was zooming, revenues were rising and VAS players were strategising to cash in on the opportunity. OnMobile had already mastered the art of voice-based services. It was offering caller ringtones, ringback tones (RBT), news, jokes, astrology services, live commentary, scores and updates for cricket, football, tennis and Formula 1, besides having contests on mobiles. By FY07, the company had revenues of Rs.133 crore.

Less than a year later, in February 2008, it listed on BSE with a bang — at Rs.440, the stock was valued at 9.6 times its trailing 12-month revenues and 34 times earnings. The issue was oversubscribed 10.95 times and the shares in debut trading closed at Rs.521.90, giving the firm a market cap of Rs.3,037 crore. OnMobile seemed firmly set on a growth trajectory and the market continued to show its appreciation — the scrip touched an all-time high of Rs.744 in April 2008. In March 2011, the company gave a 1:1 bonus to its shareholders, doubling the number of equity shares, which halved the share price.

What’s gone wrong

The financial irregularities that led to Rao’s departure from OnMobile is only the latest hit the company’s taken in the past year or so. It hasn’t helped that there’s been heavy churn at the top level in the recent past. In December 2011, CFO Rajesh Moorti quit. Amit Rastogi, who took over, was also out by April 2012. The following month, Rajesh Kunnath was appointed as the new CFO. Early this year, M&A head Sandhya Gupta resigned. This was followed by the exit of Sandeep Ganguly, who was heading Latin America operations, and Pratapa Bernard, head of marketing and products.

But the root of the trouble lies in OnMobile’s over-reliance on voice services. “Formerly, we were more focused on voice and messaging products like our classic voice portals, messaging and RBT. But in the last year, we have also launched data services, in particular VAS, USSD [unstructured supplementary service data, which lets you check your balance on the phone, for instance] and richer alerts,” Rao said in a post-results conference call on May 8 this year.

Data services typically include video streaming, interactive games, m-commerce and other such services where data, and not voice, travels over networks. Despite a slew of international acquisitions in the mobile data space, OnMobile was slow in launching data products in India. From 2006 onward, the company looked outside India to expand product lines — it bought mobile software firm ITFinity that year, followed in 2007 by the buyout of French data products company Voxmobili; French speech recognition company Telisma was next in 2009 and Dilithium Networks, which develops mobile video technology, in 2010.

The increased focus on international operations, though, allowed competitors of OnMobile like IMImobile and One97 to fill the domestic space. Other players have diversified from VAS to newer areas, making their revenues more stable and less dependent on the fortunes of the telecom sector. For example, IMImobile also designs and builds mobile portals as well as mobile and tablet applications. It works not only with operators but also with other enterprises.

With operators, it has gone beyond VAS to offer services such as customer lifecycle management and analytics. The company aggregates large volumes of data about telecom users based on their usage patterns and consolidates it for use by operators such as making recommendations to consumers on best tariff plans, personalisation, campaigns, churn modelling etc. For this, it is paid a management fee and also has a share based on results achieved. Not only operators are making use of this service; other enterprises also use data collected from mobile neworks to get usage insight covering customer location, time and demographics.

IMI is also working with financial services companies, including four retail banks in the UK as well as credit card companies and insurers to engage customers via the mobile phone. It helps them communicate with the customer in various ways like getting alerts on phone regarding bank accounts, helping users tap into bank network and keeping them posted about their transactions. IMI is paid on a transaction basis for these services.

But OnMobile’s approach of putting all its eggs in one basket is now reflecting in the company’s financials. Net profit went down from Rs.89 crore in FY11 to Rs.83 crore in FY12, despite revenues growing from Rs.538 crore to Rs.638 crore during the period. A bigger worry for investors is the company’s poor financial ratios.

In FY11, for instance (the latest year for which audited numbers are available), OnMobile’s return on capital was just 8% while return on net worth (which is an indicator of a company’s ability to maximise shareholder return) was a paltry 8.3% (see: Rolling Down) It’s been coming down continuously, a poor show for a company in the services business, that, too, supposedly a lucrative one. To get a sense, companies in the software service space usually earn RoCE upwards of 30%. In the past 15 months, OnMobile has lost nearly two-thirds of its market value and its stock is still trending down.

“The slowdown in business is largely due to the slow transition from 2G to 3G in India,” says Abhishek Chauhan, senior consultant of the ICT practice at Frost & Sullivan. “And now corporate governance issues have arisen. That is an area of concern.” OnMobile’s official stance, however, is that it’s business as usual. In response to an e-mail questionnaire, a company spokesperson said, “The alleged irregularities had nothing to do with the MD & CEO misappropriating funds of the company. The internal control weaknesses, identified for a few transactions, have not required it to restate its financials besides there being no loss. There has been no impact on its cash and bank balances.”

But analysts are unanimous that the issues around alleged misappropriation of funds have harmed OnMobile’s reputation and prospects. Suresh Parmar, assistant vice-president and institutional head, equity, KJMC Capital Market Services, says the company should make a clear announcement regarding the state of affairs to bring back the confidence of institutional investors. “Outlook on the stock will be negative unless the management clears the air,” he says.

Already, investors have been selling the stock heavily. Some like Norwest Venture Partners, which pumped in $15 million in March 2009, exited within two years. The firm declined comment. Other investors who have been selling the stock over the past few days include Birla Sun Life Trustee, which sold over 800,000 shares and Smallcap World Fund, which sold almost two-thirds of its 6.25% holding in OnMobile.

Gaurang Shah, assistant vice-president at Geojit BNP Paribas Financial, believes the stock, last traded at Rs.36 (July 16), should be totally avoided as it has come down from triple digit to double digit levels. “It would be important to watch earnings and see if the company is able to sustain billings and retain clients. There are definitely much better bets in the market,” Shah says.

But OnMobile remains upbeat. “We are optimistic about our potential and we are making good progress on customer wins and consumer traction. We have an excellent set of competent and passionate leaders, who have made all this happen. Thus, we believe business will strongly continue with no or minimal interruption,” the spokesperson said.

While that may be the management’s view, OnMobile has clearly missed the data services bus. Besides, churn within the organisation has shackled its ability to fully exploit growth in the VAS segment. Governance issues haven’t helped matters either, with institutional investors voting with their feet. Hence, it will take some determined effort from OnMobile to win back the confidence of investors, who for now have hung up on the stock.