To understand India’s renewable energy (RE) push in 2025 is to witness a high-stakes Olympics race, where the runner is sprinting towards a 500GW finish line, but the track is littered with several hurdles.

The momentum has now come to a near grinding halt for the country’s green sector. The bottlenecks are aplenty—transmission gaps, land acquisition issues and poor health of state power discoms.

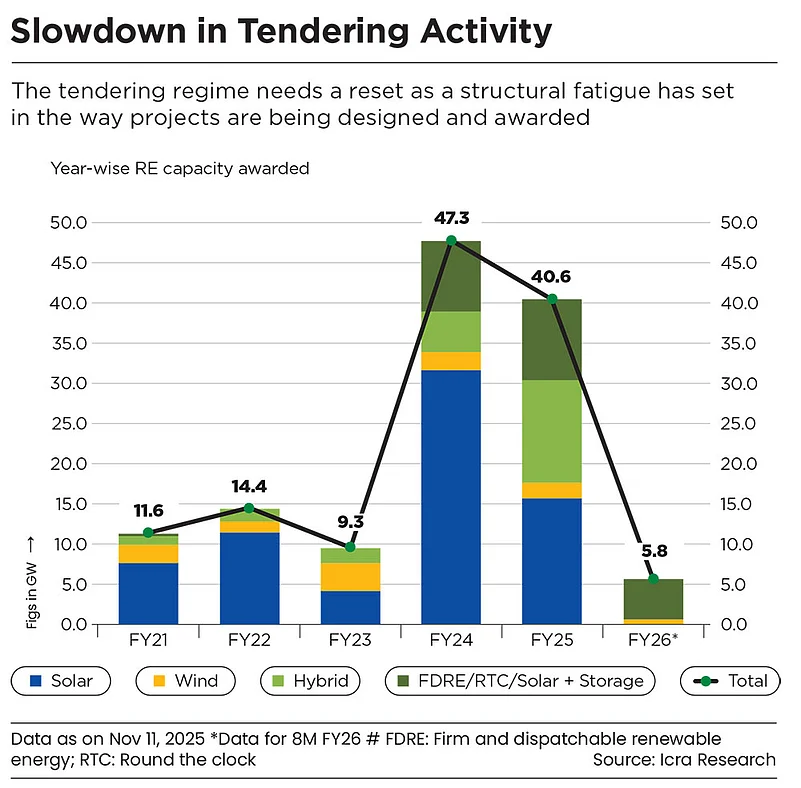

These structural and financial roadblocks have led to the pipeline collapsing to just 5.8GW of RE projects being awarded in the first eight months of 2025–26, according to a report by Icra, a credit-rating agency. This is a sharp fall from the record 47.3GW of clean energy capacity in 2023–24 and 40.6GW in 2024–25.

Not just awards, nearly 50GW of projects remain stuck without power purchase agreements (PPAs), raising concerns about whether India can maintain its ambitious 2030 target.

“The decline in new project bids and delays in signing PPAs for large RE capacity by central nodal agencies clearly reflect the concerns on the execution related to available transmission connectivity for the RE sector,” said Girishkumar Kadam, senior vice-president and group head, corporate ratings, Icra.

Tendered projects cumulatively worth billions of dollars awarded to companies like JSW, NTPC, Adani Green, ACME Solar, Renew and Sembcorp are stranded.

First and foremost, the tendering regime needs a reset as a structural fatigue has set in the way projects are being designed and awarded.

Structural Strain

The Solar Energy Commission of India (SECI) invites bids through a reverse auction, where developers compete by quoting the lowest tariff. And “in their rush to win projects, developers often bid aggressively, assuming the project will remain financially viable”, says Akkenaguntla Karthik, an energy-market analyst.

However, once the project is awarded, delays begin as discoms take months and sometimes over a year to sign PPAs. This creates a bigger beast—project cost escalations. The average cost of large-scale solar projects increased by 3% quarter on quarter and 1% year on year in the first quarter of 2025, according to Mercom, an energy consultancy.

With delays, land prices increase, compensation payouts rise and global supply chain disruptions such as spikes in Chinese module prices push up equipment costs. As a result, a tariff like ₹2.70/kWh, quoted during bidding, may no longer be feasible by the time execution starts.

Developers then approach Appellate Tribunal for Electricity seeking tariff revisions to keep the projects financially viable, but these petitions rarely get approved. “Many projects end up getting cancelled, forcing SECI to retender. This exposes a major weakness of reverse bidding—it doesn’t account for future uncertainties, and long delays erode the viability of aggressively bid projects,” says Karthik.

“This is why the process needs to be faster and more predictable. Delays not only squeeze developer margins but also weaken investor confidence,” he adds.

There is another critical bottleneck hindering the green dream—the fall in new power line additions.

Transmission Gaps

Delays in critical transmission infrastructure—especially in sun-drenched states such as Rajasthan and Gujarat—have forced many solar plants to miss commissioning deadlines, the Sustainable Projects Developers Association (SDPA) wrote in a letter to the government. The transmission capacity is not keeping pace with the new generation capacity, which has nearly tripled to 26.8GW so far this fiscal. Only 1,998 circuit kilometres (ckm) of new lines were added till August, 30% less than a year ago, against a full-year target of 15,382ckm, according to the Central Electricity Authority.

Similarly, substation capacity additions are lagging too. In April-January of 2024–25, a total of 51,500 megavolt-ampere (MVA) was added, which is 33% short of the planned target, despite being 14.7% higher than the previous year’s addition of 44,908MVA.

“Long-distance transmission depends heavily on HVDC [high voltage direct current] systems, and currently only two global suppliers—Hitachi and Siemens—dominate this space. This duopoly leaves us vulnerable,” says Santosh Kumar Sarangi, secretary, Ministry of New and Renewable Energy.

Power transmission is a vital component of the electricity value chain, and a robust and resilient network is essential for integrating the increasing RE capacity into the grid. However, the significantly shorter gestation periods of variable renewable energy installations have left the transmission network struggling to keep pace with RE deployment. “The result is a growing gap between clean power generation and the availability of energy evacuation infrastructure,” says Shreya Mishra, co-founder and CEO, SolarSquare, a solar firm.

To bridge the gap between increased planning and actual execution, it is essential to tackle persistent challenges like land acquisition and overseas equipment procurement. But what if the process cannot even begin as it needs signed PPAs.

PPA Logjam

State discoms are central to the survival of a project. Once RE projects are awarded, it falls on state discoms to sign PPAs and power sale agreements (PSAs). And this is where the system gets hammered by delays.

Cash-strapped discoms—sitting on a huge debt pile of ₹7.4 lakh crore as of March 2024, according to an Icra report—are reluctant to lock into long-term fixed tariffs. They expect prices to fall further, especially when cheaper short-term market power or existing thermal contracts are available. This has been a major point of pain for renewable developers.

Transmission constraints are also slowing down the entire pipeline with nodal agencies unwilling to sign PPAs until they are certain that adequate evacuation infrastructure will be in place for new projects. “We are reviewing PPAs on a case-by-case basis and conducting a complete assessment to determine how many of them will be signed,” says Sarangi.

Unsigned PPAs have seen developers suffer heavy financial losses, thereby creating business uncertainty and making projects less viable. “This backlog triggers cascading delays, pushing project timelines months beyond targets, inflating costs and eroding investor confidence. Longterm, this fosters a vicious cycle of cancellations, undermining India’s RE attractiveness,” says Karthik.

Land Troubles

Land acquisition has been an age-old problem for RE projects, particularly large solar parks and wind farms that require vast, contiguous land parcels. Developers are haunted by fragmented land ownership, unclear land titles and lengthy procedures for converting agricultural land for industrial use.

“Dealing with multiple departments—revenue, forest and local authorities—adds several layers of delay, making acquisition a slow and unpredictable process,” says Karthik.

Resistance from the local community further complicates the process. Many villages fear loss of agricultural livelihoods, restricted access to grazing land or undervaluation of their property. In several cases, mistrust grows due to inadequate consultation or unclear compensation structures. These can lead to protests and even litigation, putting projects on hold.

Environmental and wildlife clearances also add to the woes. Projects located near forested areas, wildlife corridors or ecologically sensitive zones often require additional approvals that can take months or years. Restrictions aimed at protecting species have led to rerouting of transmission lines and redesigning of project layouts, slowing timelines.

Total Reset

India’s renewable energy slowdown reflects a build-up of structural frictions across the value chain. “A structural reset is needed. Moving from purely utility-scale renewable projects to renewable-plus-battery and hybrid models makes sense,” says SolarSquare’s Mishra.

If discoms are forced to manage fluctuating supply without adequate tools, that cost is eventually passed to consumers; if not, the government ends up bailing them out.

“Structurally, it is better if tenders evolve into hybrid tenders,” adds Mishra. Such a shift would bring solar developers into battery deployment, improve grid reliability, ensure more dependable power for consumers and help the government avoid repeated bailouts.

So, forget the podium finish; to even reach the finish line, India needs to address the core weaknesses slowing its clean energy transition.