"It’s the economy, stupid,” the now famous catchphrase coined by Bill Clinton’s campaign strategist James Carville in 1992 set the stage for his victory with the message: the economy matters. That underlying fact was a topic of tense discussion in India in 2018 in the form of the RBI versus the government saga. In a two-year-long battle, two RBI governors stepped down to make way for a handpicked North Block veteran. The new appointee was handed over a battered sector that was at the peak of its worst crisis. “Not a day passed in the past several months when we didn’t discuss or review NBFCs,” said the current RBI Governor, Shaktikanta Das, in an interview to Bloomberg, seven months after his appointment. This crisis also reflected in the new Finance Minister’s maiden Union Budget where the government decided to get banks to lend to the shadow-banking sector. But, what led to the crisis in the first place?

Domino effect

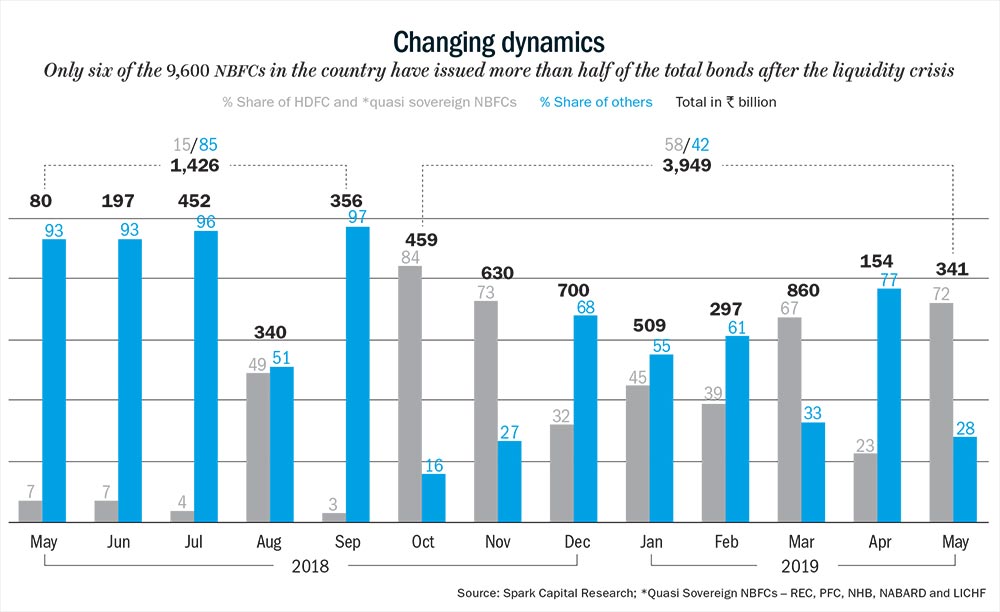

Once called a ‘systemically important’ institution by the central bank, the fall of IL&FS Group began with a series of missed payments, eventually leading to its default. That led to a confidence shaking realisation about the health of non-banking financial companies that were increasingly relying on debt funding. This event roiled the stock market and investor sentiment, triggering a credit crunch for NBFCs. The average cost of borrowing went up by 100 basis points in September 2018 compared to April 2018. And while the economy may be settling down to the storm as liquidity eases, there’s another side to the story. “There is no dearth of liquidity for larger players, whereas smaller and weaker players are facing a liquidity crunch,” says Abhinesh Vijayaraj, vice president-equity research, Spark Capital Advisors (See: Changing dynamics). Analysts claim that it’s taking around two to three months for an NBFC to borrow funds compared to 10-15 days a year ago. “There is a crisis of confidence today as large housing finance companies such as DHFL and Reliance Home Finance are defaulting on their repayment. Six months ago, lenders never thought that such a scenario would emerge,” adds Vijayaraj.

According to a Spark Capital report, HDFC and quasi-sovereign NBFCs such as REC, PFC, NABARD, NHB and LIC Housing Finance account for 58% of bond issuances between October 2018 and May 2019. That’s six companies issuing more than half of total bonds in a universe of about 9,600 NBFCs in India. “Large well-managed NBFCs with good governance, risk management and track record of prudent lending such as HDFC, LIC Housing and Bajaj Finance are backed by strong parent firms. So, they get funding at benign rates,” explains Rajiv Mehta, research analyst, Yes Securities. The RBI’s latest Financial Stability report also points to the polarisation in funding, “The top 10 NBFCs accounted for more than 50% of total bank exposure to the sector.”

While the market was riding high during the industry’s golden years, NBFCs have few sympathisers today. Experts believe that the liquidity crisis is of their own making, driven by risky lending in a bid to grow the loan book. “NBFCs with a poor track record of governance and higher degree of non-performing assets are finding it difficult to raise money,” says Sanjay Sakhuja, executive chairman, Ambit Finvest.

HDFC and Bajaj Finance have reported stable asset quality over the past year with gross NPA of 1.2% and 1.6%, respectively, even as gross NPA of the NBFC sector rose from 5.8% in FY18 to 6.6% in FY19. Meanwhile, LIC Housing’s NPA doubled to 1.53% due to rising bad loans in home lending and loan against property (LAP). The NBFC seems to have paid the price for relying on risky LAPs which drove its loan growth of 15% in FY19.

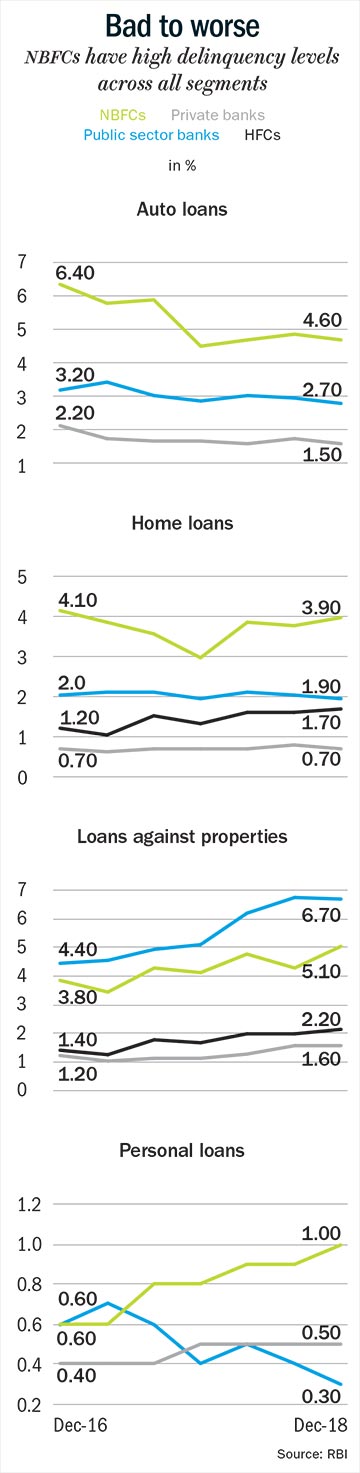

Highlighting the deterioration in the asset quality of NBFCs, the RBI report states that these companies have higher delinquency in most sub-segments of consumer credit including personal, auto and home (See: Bad to worse). NBFCs account for 4.6%, 3.9% and 1% of delinquency in auto, home and person loans respectively, much higher than public sector banks and private banks. Even in the LAP segment, NBFCs’ delinquency level including housing finance companies stands at 7.3%. This can spell further trouble for small and weaker NBFCs at a time when credit is drying out. “NBFCs don’t want to face a situation where they are not receiving cash flows from assets and funding support from lenders at the same time. They need capital to withstand the current scenario. Several smaller and mid-sized NBFCs and HFCs have been cornered,” says Mehta.

As small and mid-sized NBFCs battle a credit crunch, the larger and well-managed shadow bankers are set to grab higher market share. In the housing finance space, while DHFL is not in a position to give out loans, Indiabulls Housing Finance has adopted an extremely cautious approach. “DHFL is reducing its book, and Indiabulls Housing is lending very selectively. Several smaller NBFCs have been out of business for a while as they are not getting any funding,” says Mehta, asserting that this provides an opportunity for stronger players such as HDFC, LIC Housing and even Can Fin Homes to seize market share. Reduction of competition in an over-crowded NBFC market would also mean the profitability of the biggies will improve. Vijayaraj states that the interest rate for LAP loans fell from 12% to 9.5% before the credit crunch. “But post the crisis, the interest rate has gone back to 12% as competitive intensity has eased, since many small and marginal NBFC lenders are disappearing from the market. Hence, larger NBFCs are now pricing LAP appropriately, and margins will likely expand,” says Vijayaraj.

Mind the gap

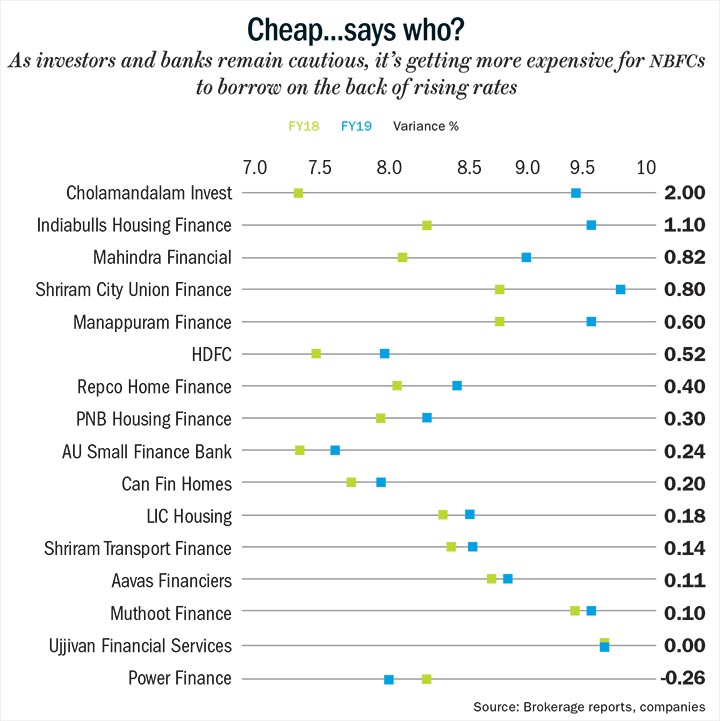

Now, the cost of borrowing has eased, but is still higher as compared to FY18. After jumping to 8.9% in October 2018, yields on AAA three-year borrowing have eased to 8.1% in May. Similarly, AA three-year borrowing has also cooled off by 80 basis points since October 2018 to 8.8%. For HDFC and LIC Housing Finance, the average cost of borrowing has gone up marginally by 52 basis points and 18 basis points over FY19, despite a strong balance sheet and stable asset quality.

The shift in the source of funds for NBFCs is clearly visible over the past two years, and it has played a key role in the rise of the cost of borrowing. The share of commercial paper (CP) and debentures has reduced, whereas that of banks has risen between FY17 and FY19. While the share of debenture and CPs went down to 41.5% and 7.6%, respectively from 50.2% and 9%, the bank’s share went up to 29.2% from 21.2%. Following demonetisation in November 2016, banks were flush with surplus cash, leading to a spurt in liquidity. Subsequently, deposit rates dropped, and money was diverted towards mutual funds, which started investing in commercial paper. With credit readily available, NBFCs floated short-term papers with low rates. “Post the IL&FS default, the rates on CP increased sharply, impacting the rollover of these instruments. NBFCs realised borrowings should be stable and long-term to withstand liquidity cycles. Hence, most NBFCs are moving to long-term paper,” says Vijayaraj. Also, institutional investors who were heavily investing in commercial paper in a flush credit environment, turned cautious.

“Since the panic in debt market started, institutional investors have shied away from investing in short-term papers, especially CPs issued by NBFCs/HFCs. Such issuers have faced difficult times given the unfavourable pricing and demand environment,” notes an Edelweiss Securities report. This risk-averse approach by mutual funds means NBFCs are forced to turn to banks for cash. Sensing the opportunity, banks are charging higher interest rates, hence resulting in higher cost of borrowing (See: Cheap...says who?). “The banking sector is looking at the NBFC space with reluctance. The demand for borrowing from NBFCs is still there, but the supply has dropped,” says Sakhuja. Besides the marginal cost of funds based lending rate (MCLR), banks are levying extra charges today. “Right now, banks are charging slightly higher rates because they have become the primary source of funding for NBFCs,” says Mehta. He adds that even if an NBFC is well rated, it still has to pay 10-20 basis points more as it has no alternate option.

Public sector banks who are battling their own NPA demons are now being seen as a buyer of last resort if one goes by Nirmala Sitharaman’s Budget promise. Public sector banks will buy pooled assets of highly rated NBFCs and the government will provide cushion by offering six months’ partial credit guarantee for first loss of up to 10%. “This should encourage public sector banks to take on securitisation,” says Sakhuja. This means that well-managed NBFCs, which are already getting a positive response from the debt market, will also get a fresh lifeline of liquidity from PSU banks. But, the keyword here ‘highly rated’ will only widen the gap between large and small NBFCs. Analysts believe this ‘crisis of confidence’ is here to stay, and it’s very difficult to predict when it will ebb. “Lenders believe there is a contagion risk of this liquidity issue impacting real estate. For now, the polarisation will continue,” concludes Vijayaraj.