Do you think the speed, aggression and technique shown by Fernando Alonso and Felipe Massa with Ferrari cars mirrors your style? Want to compare notes with the Formula One drivers? You can if you sport a Hublot on your wrist. The Swiss luxury watch maker has arranged for its patrons to meet the Ferrari team at the Indian Grand Prix. “Hublots are often the fifth or even the sixth watch after people have bought more popular brands,” explains Ashok Goel, the brand’s sales consultant in India.

“For such buyers, just owning the brand is not enough. The entire pre and post-owning experience counts.” Hublot’s efforts to ensure its Indian customers get what they want have borne rich dividends. In October 2011, as the official F1 watch maker, it launched a limited edition watch for the first Indian Grand Prix, which had the tricolour on the dial and strap and carried a price tag of $47,000 (Rs.23 lakh). All 200 pieces, including the 35 allotted to India, were snapped up, says Goel proudly.

Hublot isn’t the only watch maker that goes out of its way to pamper its customers. Swiss watch maker Parmigiani, for instance, takes special guests, including watch owners from India, for rides in its bright orange hot air balloon in Gstaad, Switzerland.

And Breitling is known for sending hand-made chocolates, monogrammed caps and similar little gifts even several weeks after the purchase. The Indian premium and luxury watch market is ticking furiously with activity. Some of the world’s best known brands are now available in the country — from Tissot, Dior and Omega to Patek Philippe, IWC, Raymond Weil and Rolex — and they’re all working overtime to attract customers and make their presence felt.

Whether it’s a brand like Rolex that established its India subsidiary in July 2008 after many years of retailing through appointed dealers; Raymond Weil and Omega opening stand-alone stores; Seiko and Rado expanding their distribution reach to smaller cities and towns; Hublot and Tag Heuer offering exclusive Indian editions; or brands like Longines and Ulysse-Nardin signing up local celebrities (Aishwarya Rai Bachchan and Yuvraj Singh, respectively), watch brands are willing to do whatever it takes to find a place on the wrists of well-heeled Indians.

It’s India time

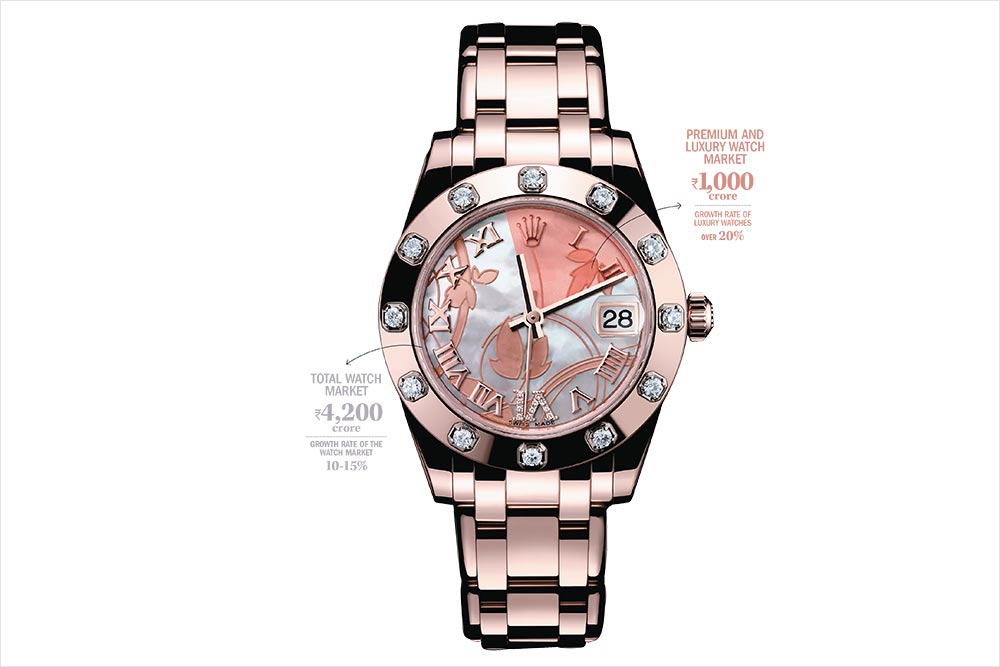

You don’t have to look far for the reasons. While China’s luxury watch market is the world’s largest, India isn’t doing badly either. “The watches and jewellery segments represent the largest and fastest growing segments within the luxury goods space,” says Technopak’s luxury report for 2011-12. Valued at approximately Rs.1,000 crore, the premium and luxury watch market makes up nearly a third of the Rs.2,750 crore luxury products market. And it’s growing at over 20% y-o-y, which is much faster than the 10-15% of the Rs.4,200-crore watch market and is also more than the 15% at which the overall luxury market is growing.

Some estimates suggest the Indian market for premium and luxury watches could double in just two or three years whereas, says Bain Capital, global average growth in the same period will be only around 18%. “Buying a Rs.25,000 watch was ment even five or seven years ago. Today, this is a price point where impulse purchase is quite common, especially at our airport stores and busy malls,” says Yashovardhan Saboo, owner of Ethos, a 38-store strong luxury watch retail chain. Saboo also manages the Omega boutique in Mumbai and a Rolex boutique in Bengaluru.

What’s driving the urge to splurge? The usual reasons: increasing incomes and aspirations, and awareness of international trends. And affluent Indians are spending not just on themselves; high-end timepieces are also popular as gifts. Whether it’s a present for the groom or a corporate gift, forking out Rs.1 lakh on a watch isn’t uncommon anymore.

Companies like Reliance Industries, Asian Paints and several financial institutions routinely buy premium watches, from Tissot to Omega, as gifts for associates as well as for senior executives. “We get about 30-35% of our sales volume and value via corporate gifts,” says Rajiv Popley, director of Popley Group, a well-known Mumbai store. And the segment, at least in metros, is only growing bigger.

Reaching out

With so many eager customers it’s not surprising that watch brands are trying to get closer to their buyers. The first step is opening more stores and appointing retailers to increase points of sales. LVMH Watch and Jewellery India general manager Franck Dardenne, for instance, plans to open seven new Tag Heuer stores in the next two years to add to its current near-100; his company already has 16 outlets for group brand Dior and seven for Zenith.

“India is a small market at present but it is showing growth,” he says. Dardenne’s competitor, Olivier Bernheim, president and CEO of the Raymond Weil watch brand, is also on a store opening spree. In July, he launched a stand-alone boutique in Kolkata and two in Mumbai (there’s one more coming up shortly) to add to the existing two in Chennai and Delhi.

Then, in February, Japanese watch brand Seiko launched its Ananta Collection, which retails for prices from Rs.1-5 lakh a piece. Speaking at the launch, Seiko Watch India president Susumu Kawanishi said he was impressed with the growth potential of the luxury watch segment in India.

“We have established a subsidiary in India to move ourselves closer to the Indian consumer.” Seiko’s plan is to expand its presence from the current 250 point-of-sales in 61 cities, to 300 over the next two years. It will also set up eight stand-alone stores (currently there’s one in Chennai).

Clearly, luxury watch brands have understood the importance of the tier 2 cities. “Indians are among the best-educated customers and even those in smaller towns want to buy luxury watches,” says Jean-claude Monachon, vice-president and head of product development for Omega. The Swiss brand has opened stores in places such as Ahmedabad and Visakhapatnam in the past couple of years, while Tag Heuer’s new stores will be in Ludhiana, Surat and other smaller cities.

Similarly, Rado has been opening stores in Ahmedabad and Pune and recently opened a second store in Hyderabad; the plan is to expand from the current 65 outlets to 80 in the next couple of years. “South India is a very important market for Rado,” emphasised Matthias Breschan, CEO, Rado, at the store opening. Recently, the brand introduced its latest collection of jewel-encrusted watches in Odisha through a local jewellery store, Khimji Jewellers, which also sells other brands like Omega, Tissot and Longines. Proprietor Mitesh Khimji is confident of finding buyers for the watches, prices for which range from Rs.1 lakh to Rs.45 lakh. “Over the past few years there has been an increasing trend of buyers for high-end branded watches in the state,” he says.

Time to grow

Of course, it’s not enough to merely open new stores. High-decibel launches, celebrity endorsements and events ensure that excitement and awareness levels of luxury watch brands remains constantly high. For instance, at the launch of its Sea Master Planet Ocean range, Omega brought in a team of Russian aqua dancers who performed for a star-studded audience that included brand ambassador Abhishek Bachchan. And a couple of months after Rado signed on Hrithik Roshan, it organised a screening of his latest movie Agneepath for a select audience comprising Delhi’s page 3 crowd.

That’s in the metros. In smaller towns, companies mostly rely on conventional advertising to create brand awareness, which is why many of them have signed on Indian celebrities as brand ambassadors. Brands such as Tag Heuer (Shah Rukh Khan, Priyanka Chopra, Karun Chandhok), Longines (Aishwarya Rai Bachchan), Tissot (Deepika Padukone), Omega (Abhishek Bachchan), Ulysse-Nardin (Yuvraj Singh), Hublot (Harbhajan Singh), Rado (Hrithik Roshan, Lisa Ray) and Audemars Piguet (Sachin Tendulkar) have all been endorsed by Indians at various times in the past few years.

“There are many in India who have the money but may not necessarily understand or be exposed to a luxury watch brand. These stars help bridge the gap and get brands the stamp of approval,” says Harminder Sahni, founder-MD of retail consultancy Wazir Advisors.

And English print can only work so far. Dardenne says LVMH realises its potential customers also come from smaller Indian towns and they may not always read English lifestyle publications. Consequently, “We have started to advertise in more broadbased news and regional publications as well,” he says. LVMH brand Tag Heuer now advertises in publications such as those from Gujarat-based Chitralekha Group and Kerala’s Malayala Manorama. Rado, on the other hand, has associated with a TV reality show Band, Baja, Bride aired onNDTV Good Times, as co-sponsor; in each episode, the bride is presented with a Rado watch.

It’s not just the communication that’s being tweaked for Indian customers. The product offerings and business models, too, are being rejigged. Consulting firm Technopak says international luxury watch brands have realised the need to customise their products to Indian traditions to boost sales. Customer preferences for materials and colours are being noted and followed: leather and metal bracelets more than rubber, ceramic or silicone; yellow and pink gold more than white gold and virtually no titanium or platinum.

Of course, Indians are notoriously price-sensitive and there’s no reason for them to change when it comes to luxury timepieces. So, watch makers go out of their way to make their offering more wallet-friendly in India. There’s a steep 30% duty on imported luxury watches in India, but most brands bear that cost rather than adding it to the sticker price — they are reworking retail margins, have exclusive offers and discounts to keep the price on par with Singapore and Dubai. “We do take a hit on profits, but if we want to grow in the Indian market this is what has to be done. Hopefully, the volumes will kick in future,” says Raymond Weil’s Bernheim. That’s where the distributors come in.

Lending a hand

Most watch brands recognise the fact that they can’t reach out all over India on their own. So they’re taking help from outside. Aiding them are watch retailers like Rose and Popeley in Mumbai who see value in diversifying from jewellery retail to luxury watches; specialised premium and luxury watch retail chains like Ethos and Prime that are expanding their networks to cover many Indian cities; as well as established watch distributors such as Johnson Watch Co and Kapoor Watches.

Many of these retailers also serve as authorised service centres for international luxury watch brands, helping them to offer a better product experience to the Indian buyer. But really, their role is much like what Kimaya or Kitch perform for the luxury apparel industry — creating a shopping destination for luxury timepieces. At Rose Watch Bar, for instance, the décor screams luxury. Watches like Bvlgari, Cartier, Hublot, Franck Muller, Girard Perragaux and Jaeger Le-Coultre are suitably offset by a glittering black chandelier, red-accented interiors and multiple mirrors. And the stone tables are set upon carpets so thick that soft literally acquires a new dimension — a sink-in-and-stay-there depth. The address, too, is suitably posh — Mumbai’s Breach Candy. Customers can look over the latest collections as they sip Colombian coffee and browse books on horology and the world’s best watches.

“Our idea is to sell not just a watch but an entire experience that creates aspiration and the pride of possession,” says Rose Group’s managing director Biren Vaidya, whose jewellery company opened this dedicated watch boutique in March 2011. He says it’s the first ever such concept store for watches anywhere in the world. And it is doing brisk business. “Despite the recent slowdown, we are selling more watches. There are new buyers in the market now — those who have made money trading in stocks, new business owners and professionals,” he adds.

Like the watch brands, retailers, too, are stepping out of the metros, replicating the shopping experience for wealthy customers in smaller cities. Ethos, for instance, is already present in cities like Aurangabad, Nagpur and Bhopal. The plan now is to add another eight or 10 stores every year. Similarly, Helios, the high-end watch store from Titan, retails over 50 watch brands in stores at Bhubaneshwar, Guwahati and Chandigarh, and will add 28 stores by end-FY13, taking the total to 65.

For luxury brands, there’s a two-fold advantage in associating with retailers: not only do they get access to small-town customers without investing in the infrastructure, these stores also advertise fairly heavily in the local media, helping increase brand awareness. Some stores go even further in helping sell expensive watches. At Popley’s, for instance, customers can buy luxury watches in 15 instalments at no additional interest cost. This not only encourages purchases, it usually also raises the budget. “Once people figure out they can pay in EMIs, they tend to increase the value of their purchases,” says Popley.

“They may have walked in to buy a Rs.25,000-30,000 watch, but often end up buying watches twice as costly.” Such buyers currently contribute 10-15% of Popley’s monthly sales. Ethos too has a similar scheme in place. Helping the retailers offer such deals are not only credit card companies but also financial services companies like Bajaj Finserve, which recently launched financing schemes for luxury watches. As Indian men and women indulge themselves, despite the current slowdown, it seems to be action time for luxury watch makers.