“Happy families are all alike; every unhappy family is unhappy in its own way…” so read the opening lines of Leo Tolstoy’s Anna Karenina explaining why unhappy families make for better plots than their happier counterparts

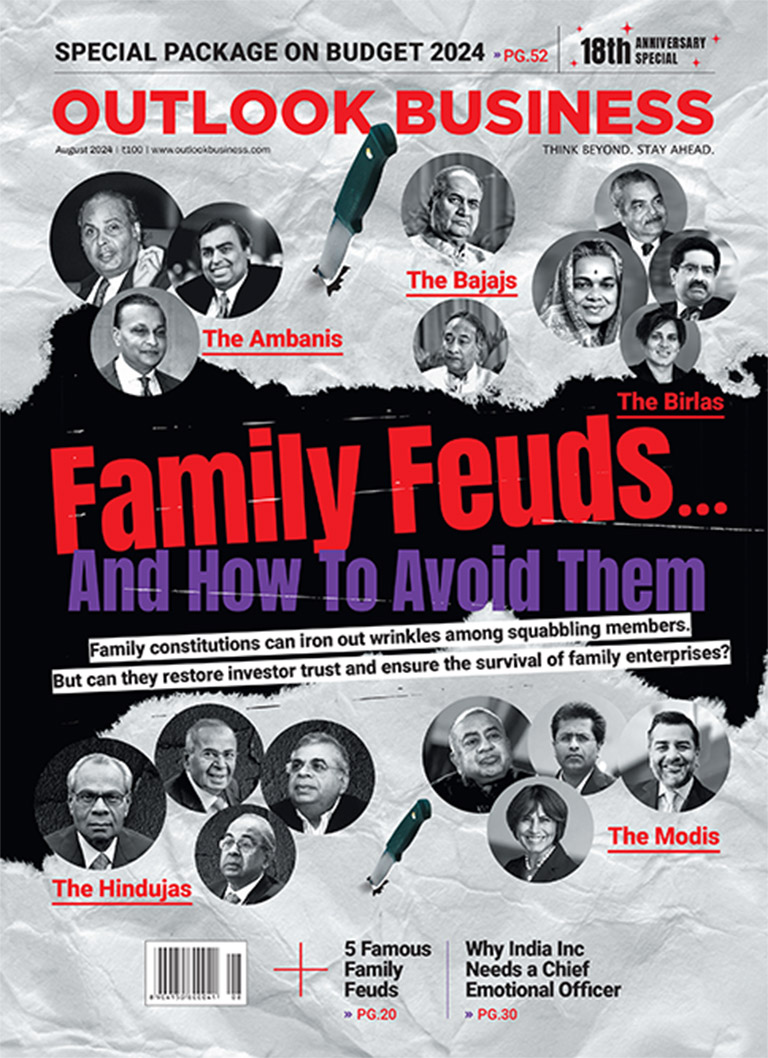

- COVER STORY

“Happy families are all alike; every unhappy family is unhappy in its own way…” so read the opening lines of Leo Tolstoy’s Anna Karenina explaining why unhappy families make for better plots than their happier counterparts

It is that time of the year. Major Indian companies released their quarterly earnings. RIL reported a 5.4% Y0Y decline in net profit to reach Rs 15,138 crore.

Relatives falling out is bad for business. Family constitutions, settlement agreements and family trusts can smoothen wrinkles. But will they be enough to gain investor trust and ensure the survival of family enterprises in the long run?

Dhirubhai Ambani’s death in 2002 left the Ambani family without a clear succession plan. This led to a battle between brothers Mukesh and Anil

At a family gathering in Pune in 2001, Shishir Bajaj told his elder brother Rahul he wanted the family business split. Rahul and his cousins did not want the company splitting. A years-long battle thus ensued

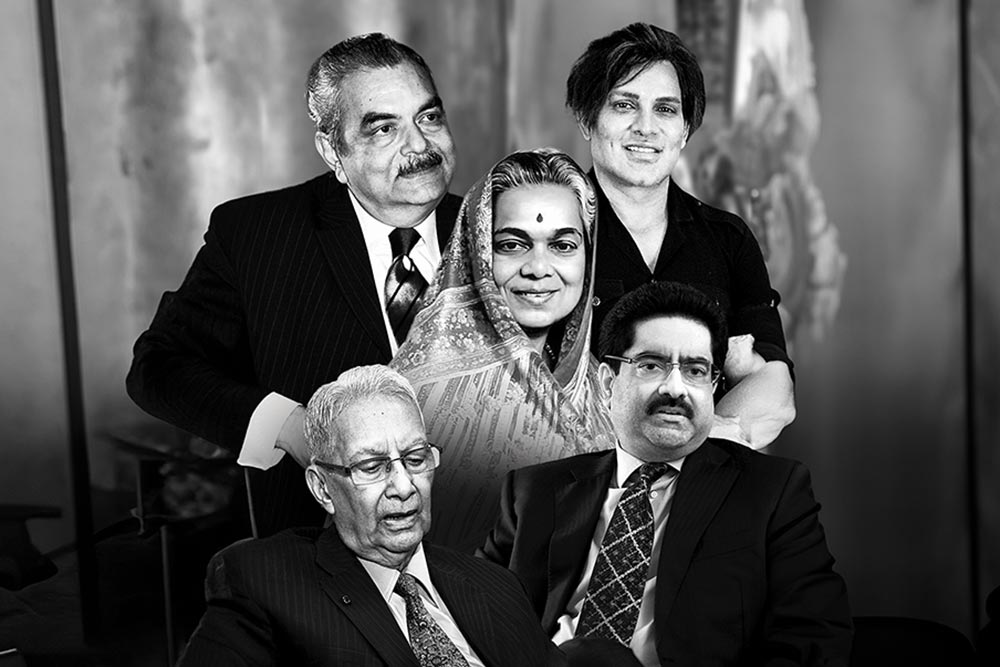

Priyamvada Birla, widow of Birla Corporation promoter Madhav Prasad Birla, died in 2004. A will from 1999 emerged bequeathing Rs 5,000 crore worth assets to chartered accountant Rajendra Singh Lodha. The Birla and the Lodha families have been at each other’s throats ever since

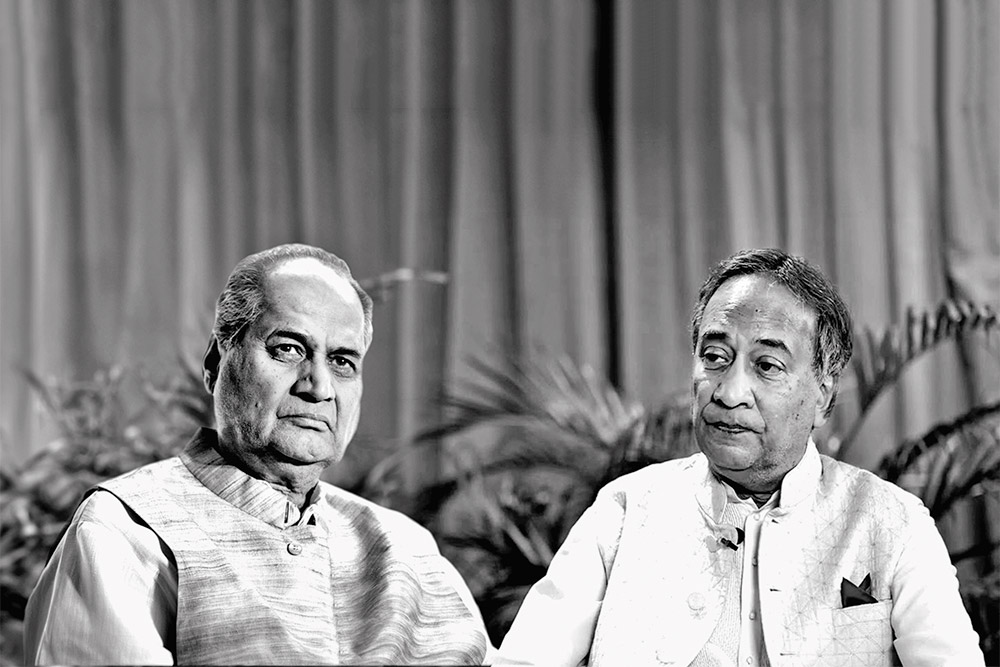

A brotherly agreement saying ‘Everything belongs to everyone; nothing belongs to anyone’ left one brother complaining that he was being cornered. Srichand took his brothers to court in 2019. A truce was made in 2022, but rumour has it that tensions persist

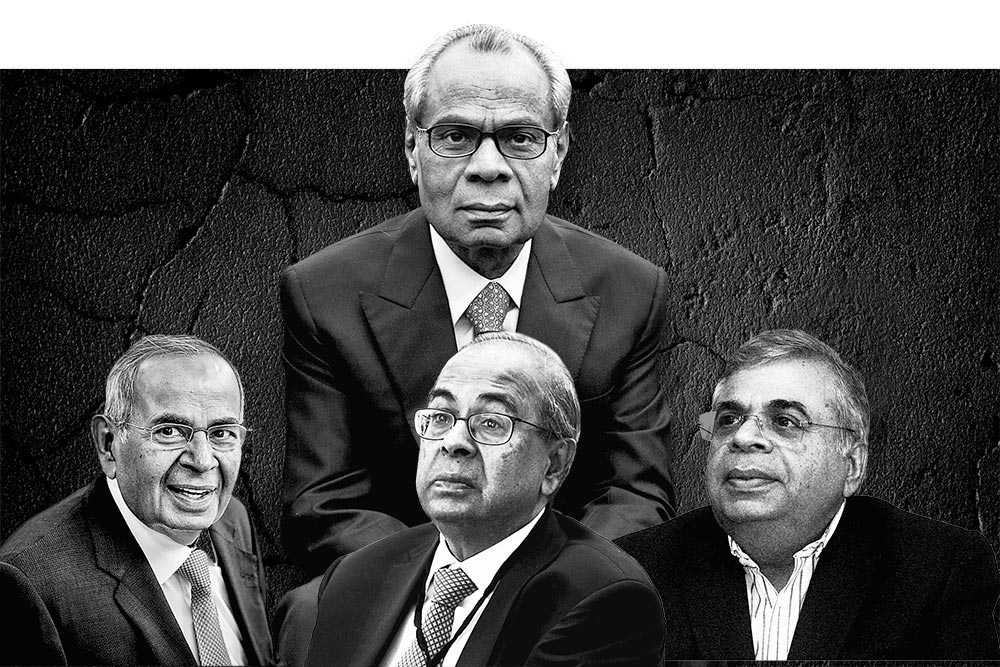

K.K. Modi put in place a trust deed in 2014 that said his wife Bina would take over as managing trustee after his death. He died five years later. Since then, his elder son Lalit has been fighting it out with his mother, brother Samir and sister Charu. Recently, Samir too has gone against his mother. The primary bone of contention: Tobacco company Godfrey Phillips India

Even within the constraints of patriarchy, women wield immense power. Once upon a time, women stopped conflicts between kingdoms. Now, they stop billionaire families from breaking apart in their role as chief emotional officers

Managing a family business is complex. In addition to managing the business, the family also needs to manage itself. Countries and jurisdictions impose well-established structures with well-defined rules and roles to manage a business—boards of directors, board committees, required audits, chief executives’ management teams and executive directors—with clear goals and incentives

India’s family businesses have long been the bedrock of our economy, built on the values of hard work, prudence and commitment to long-term success

The Bharat Ram family has seen two splits: In 1989 and then in 1999. During the second split, Ashish and Kartik Bharat Ram decided there would be no splits on their watch. In a conversation with Ayaan Kartik and Neeraj Thakur, the two brothers talk about how they have kept the family together

Farhad Forbes, former global chair of Family Business Network and co-chair of Forbes Marshall, talks about what family businesses must do to survive in an interview with Ayaan Kartik and Neeraj Thakur

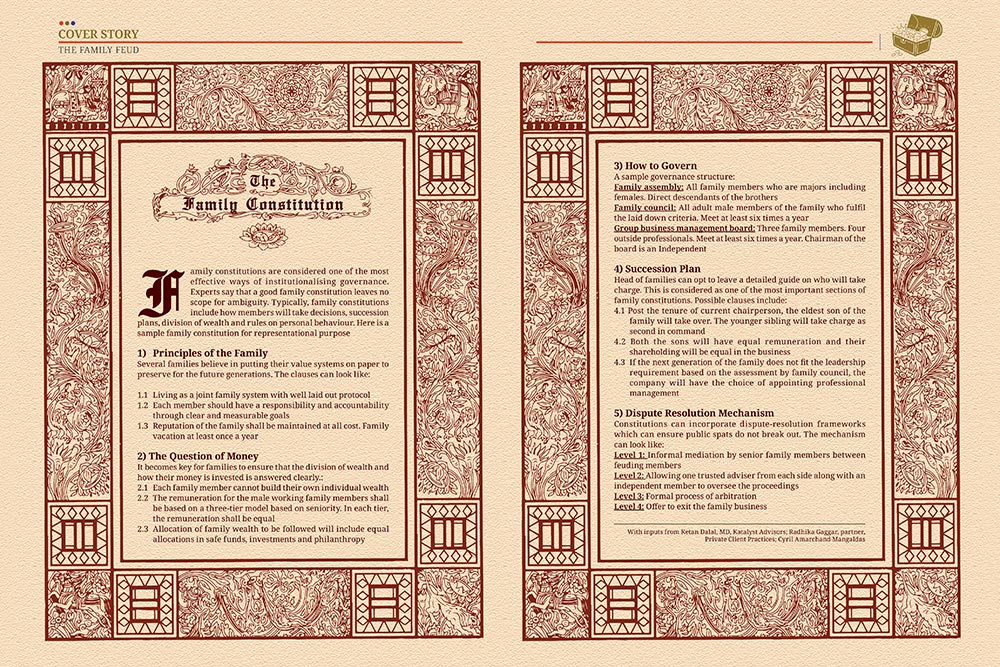

Family constitutions are regarded as one of the most effective ways of governing family businesses. Here is a sample

With job creation at the forefront, Union Finance Minister Nirmala Sitharaman's Budget aims to navigate BJP's electoral setback while keeping the growth momentum intact

It has become commonplace for business leaders in India to sing the praises of any economic policies of the Narendra Modi government—even when they are clearly wrong and misguided

The Union Budget provides the right ingredients for laying the foundation to help propel India to the next decade of growth aligning with the goal of Viksit Bharat.

Micro-, small- and medium-enterprises (MSMEs) are a critical part of the economic backbone of India. They account for approximately 30% of the gross value added (GVA) in the gross domestic product (GDP) and 36% of manufacturing output

The Finance Minister’s move to limit most benefits to the new tax regime have confirmed the writing on the wall: that the old regime is on its last legs. Deloitte India and Outlook Money compared the tax payable under both the tax regimes for various salary brackets to figure out when old tax regime is better

India should prioritise income growth rather than directly boosting consumption, says T.V. Somanathan, Union finance secretary. In an interview with Parth Singh, he says that the Union Budget emphasises job creation and addresses existing skills gaps. Edited excerpts

In a post-Budget interview, Ajay Seth, secretary, department of economic affairs, tells Parth Singh that net annual accretion to EPFO is approximately 13 million and not 8 million

Simplicity and higher returns in the new tax regime would compensate for the benefits in the older one, encouraging more people to migrate going forward, Sanjay Malhotra, revenue secretary, tells Parth Singh. Edited excerpts

With government funds drying up, public educational institutions are reaching out to the private sector to sponsor research. Companies are only too happy as they can outsource their R&D to competent academics

Rising household incomes are driving the demand for residential properties in India, says Ramesh Ranganathan, chief executive, K Raheja Corp Homes, a real estate company. He discusses the five factors transforming Indian luxury real estate in 2024

“Happy families are all alike; every unhappy family is unhappy in its own way…” so read the opening lines of Leo Tolstoy’s Anna Karenina explaining why unhappy families make for better plots than their happier counterparts

It is that time of the year. Major Indian companies released their quarterly earnings. RIL reported a 5.4% Y0Y decline in net profit to reach Rs 15,138 crore.

Relatives falling out is bad for business. Family constitutions, settlement agreements and family trusts can smoothen wrinkles. But will they be enough to gain investor trust and ensure the survival of family enterprises in the long run?

Dhirubhai Ambani’s death in 2002 left the Ambani family without a clear succession plan. This led to a battle between brothers Mukesh and Anil

At a family gathering in Pune in 2001, Shishir Bajaj told his elder brother Rahul he wanted the family business split. Rahul and his cousins did not want the company splitting. A years-long battle thus ensued

Priyamvada Birla, widow of Birla Corporation promoter Madhav Prasad Birla, died in 2004. A will from 1999 emerged bequeathing Rs 5,000 crore worth assets to chartered accountant Rajendra Singh Lodha. The Birla and the Lodha families have been at each other’s throats ever since

A brotherly agreement saying ‘Everything belongs to everyone; nothing belongs to anyone’ left one brother complaining that he was being cornered. Srichand took his brothers to court in 2019. A truce was made in 2022, but rumour has it that tensions persist

K.K. Modi put in place a trust deed in 2014 that said his wife Bina would take over as managing trustee after his death. He died five years later. Since then, his elder son Lalit has been fighting it out with his mother, brother Samir and sister Charu. Recently, Samir too has gone against his mother. The primary bone of contention: Tobacco company Godfrey Phillips India

Even within the constraints of patriarchy, women wield immense power. Once upon a time, women stopped conflicts between kingdoms. Now, they stop billionaire families from breaking apart in their role as chief emotional officers

Managing a family business is complex. In addition to managing the business, the family also needs to manage itself. Countries and jurisdictions impose well-established structures with well-defined rules and roles to manage a business—boards of directors, board committees, required audits, chief executives’ management teams and executive directors—with clear goals and incentives

India’s family businesses have long been the bedrock of our economy, built on the values of hard work, prudence and commitment to long-term success

The Bharat Ram family has seen two splits: In 1989 and then in 1999. During the second split, Ashish and Kartik Bharat Ram decided there would be no splits on their watch. In a conversation with Ayaan Kartik and Neeraj Thakur, the two brothers talk about how they have kept the family together

Farhad Forbes, former global chair of Family Business Network and co-chair of Forbes Marshall, talks about what family businesses must do to survive in an interview with Ayaan Kartik and Neeraj Thakur

Family constitutions are regarded as one of the most effective ways of governing family businesses. Here is a sample

With job creation at the forefront, Union Finance Minister Nirmala Sitharaman's Budget aims to navigate BJP's electoral setback while keeping the growth momentum intact

It has become commonplace for business leaders in India to sing the praises of any economic policies of the Narendra Modi government—even when they are clearly wrong and misguided

The Union Budget provides the right ingredients for laying the foundation to help propel India to the next decade of growth aligning with the goal of Viksit Bharat.

Micro-, small- and medium-enterprises (MSMEs) are a critical part of the economic backbone of India. They account for approximately 30% of the gross value added (GVA) in the gross domestic product (GDP) and 36% of manufacturing output

The Finance Minister’s move to limit most benefits to the new tax regime have confirmed the writing on the wall: that the old regime is on its last legs. Deloitte India and Outlook Money compared the tax payable under both the tax regimes for various salary brackets to figure out when old tax regime is better

India should prioritise income growth rather than directly boosting consumption, says T.V. Somanathan, Union finance secretary. In an interview with Parth Singh, he says that the Union Budget emphasises job creation and addresses existing skills gaps. Edited excerpts

In a post-Budget interview, Ajay Seth, secretary, department of economic affairs, tells Parth Singh that net annual accretion to EPFO is approximately 13 million and not 8 million

Simplicity and higher returns in the new tax regime would compensate for the benefits in the older one, encouraging more people to migrate going forward, Sanjay Malhotra, revenue secretary, tells Parth Singh. Edited excerpts

Employment Story In Numbers

With government funds drying up, public educational institutions are reaching out to the private sector to sponsor research. Companies are only too happy as they can outsource their R&D to competent academics

Rising household incomes are driving the demand for residential properties in India, says Ramesh Ranganathan, chief executive, K Raheja Corp Homes, a real estate company. He discusses the five factors transforming Indian luxury real estate in 2024

Eric Ou, Country Head, President & Director of Systems Group, ASUS India