In the 1990s, a newly liberalised India was undergoing sweeping economic change. Satellite TV dishes were sprouting on rooftops, and a wave of consumer brands flooded the urban shelves. But for millions across the country—particularly in small towns and villages—a visit to the doctor often ended in a quiet compromise.

Prescriptions were written but rarely followed in full. With household budgets already stretched thin, families would often buy just a day's worth of medicine, as the full three- or five-day course was simply out of reach.

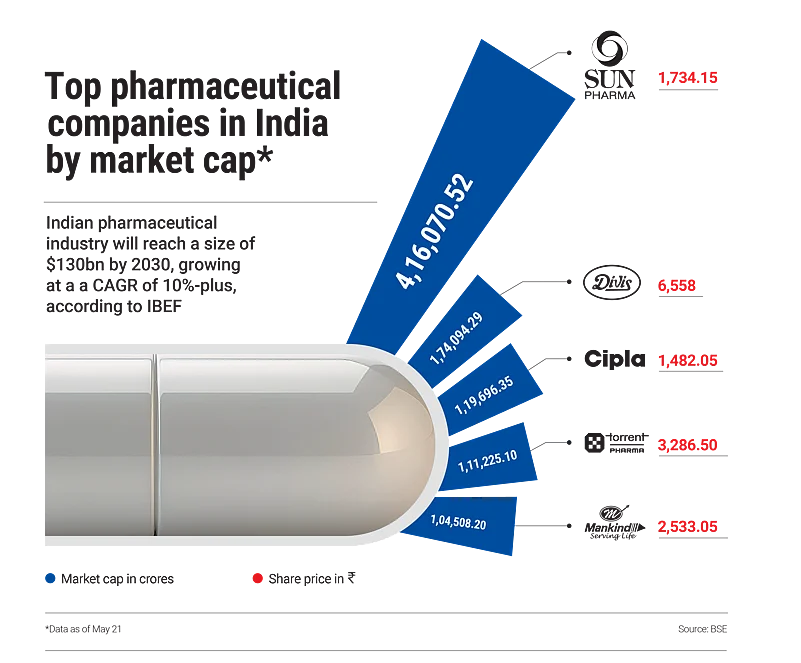

In that gap—between medical advice and affordability—a small family-run venture in Meerut saw an opportunity, marking the start of Mankind Pharma, which has since grown into a listed company with a market cap of over $10bn.

Going Shopping

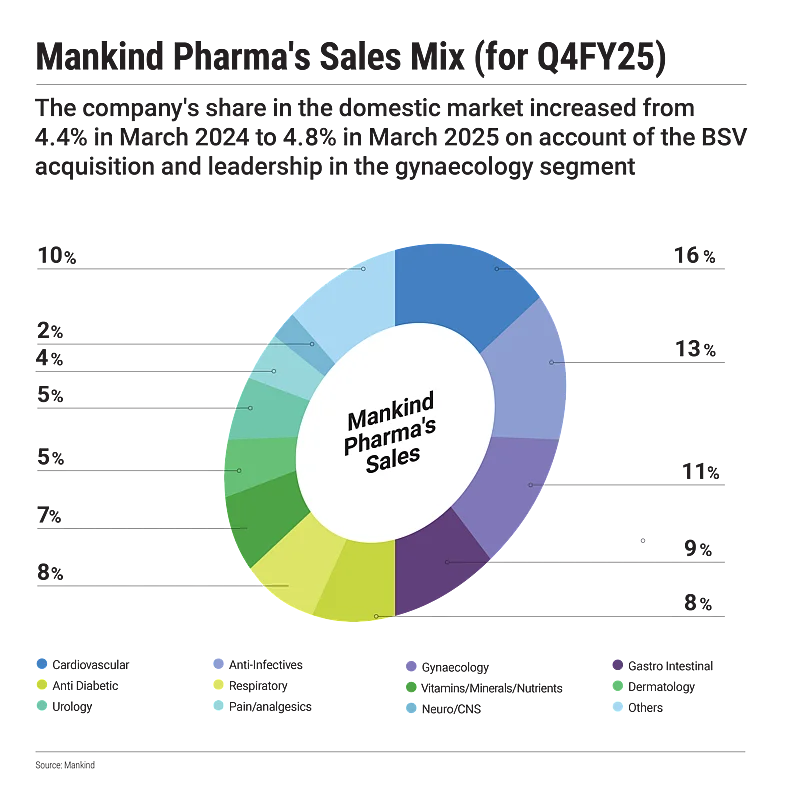

Cut to 2025. The company, till now mainly domestic-focused, has been eyeing the export market. To grab a bigger slice of the foreign-market pie Mankind Pharma has been on an acquisition drive. Last October the company made its largest-ever acquisition—the ₹13,768-crore purchase of Bharat Serums and Vaccines (BSV). Earlier in 2022, it acquired brands of Panacea Biotec Pharma enabling entry into transplant and oncology, followed by acquisition of Daffy and Combihale from Dr Reddy’s Laboratories.

Funded through internal accruals and debt, the acquisition of BSV gives Mankind Pharma access to high-entry-barrier therapies such as fertility and critical care, along with an international presence. The company plans to leverage BSV’s portfolio in countries like the UK, Germany, Spain, Russia, Australia, the UAE and Brazil to gradually increase its export share.

“India is our stronghold and it will remain so. We will consolidate in the domestic market. Expansion wise, with the acquisition of BSV...revenues from the international market will go up to 15% and domestic will be around 85%. The share of the international market will gradually increase,” says Sheetal Arora, chief executive and whole-time director, Mankind Pharma.

While still far behind Indian peers like Sun Pharma (69% revenue from exports), Cipla (58%), and Dr Reddy’s (83%), this is a step in the right direction.

Medicines Without Frontiers

“Mankind will likely continue its domestic-focused approach and expects to leverage BSV’s super-speciality offerings in women’s health and fertility segments…The company plans to leverage BSV’s complex and speciality portfolio in the critical care and fast-growing fertility segments in the international market due to limited competition and huge market potential of about $9.9bn by 2027,” says Sunny Agrawal, deputy vice-president and head of fundamental research at SBICAPS Securities.

Agrawal points out that Mankind’s export share stood at 8% and increased to 13% when adjusted for BSV exports on a pro forma basis. Most of its export revenues come from the US. In the US market, the company has launched 42 products as of the third quarter of 2024–25.

The company’s strategy for global markets is different from the India market and is not solely based on leveraging affordability. “Since day one, we have always said whenever we go outside India, we will go with niche brands that are not easy to manufacture, complex molecules where entry barriers are high and we will work on a profit,” says Arora.

He goes on to add, “With the acquisition of BSV we are ready to expand in a global market. But there is also huge potential in the Indian market too. The IVF [in vitro fertilisation] portfolio has a huge potential...and even critical care. For example, they [BSV] have snake venom antiserum.”

According to the Indian government’s National Action Plan for Prevention and Control of Snakebite Envenoming, roughly 50,000 fatalities occur from around 30–40 lakh bites, with actual numbers likely to be higher because of unreported cases. Arora says that infertility is also going to grow as more women are marrying late around 30–35 years of age.

International markets, primarily the US, are attractive for Indian companies due to the market potential it offers. The global pharmaceutical market was valued at about $1.6trn in 2023, with regulated markets accounting for 77% of the global market. The US, which is the largest consumer of pharmaceutical products, accounts for 43.4% of global pharma and 56.5% of the regulated market.

Regulated markets also generally have better margins compared to unregulated markets, and thus, Indian pharma companies focus on these markets.

Charting foreign markets is easier said than done and Arora has his job cut out. Mankind Pharma is entering markets dominated by companies with strong innovation pipelines and deep experience navigating complex global regulations. Establishing credibility in these geographies will require sustained R&D investment, stronger regulatory capabilities and a shift from cost-driven products to scientifically differentiated offerings.

Analysts have also highlighted pricing pressure from Chinese competitors and broader uncertainties in global trade as key risks to Mankind Pharma’s international expansion.

Healthy Portfolio

While analysts do expect Mankind Pharma’s core business to remain domestic in the near term, that doesn’t insulate it from challenges at home. The company underperformed in the acute segment—the drugs for short-term illnesses such as respiratory ailments, cough and cold, antibiotics and painkillers—due to regulatory headwinds affecting key products, amid continuing intense competition within the domestic market. Performing well in the acute segment is important as its product portfolio is currently concentrated there.

While details are sparse, such headwinds could involve pricing caps, approval delays or product-specific restrictions.

“Mankind is working to mitigate these issues and expects performance in the acute segment to stabilise in the coming quarters. Additionally, it undertook a sales-force rationalisation exercise during the year, which analysts say could improve operational efficiency but may take until 2025–26 to fully show results,” says SBICAPS Securities’ Agarwal.

Once the company reached ₹500 crore, it wanted to be known as more than just a company from a small town. That is when the company decided to launch its over-the-counter (OTC) business to build a strong consumer-facing brand portfolio alongside its prescription drug business.

Its OTC brands have become household names—Manforce condoms (30% market share), Prega News pregnancy test kits (85% market share) and Gas-O-Fast antacids.

Arora’s vision is to see Mankind Pharma as India’s No. 1 domestic pharma company in the coming few years. The growth, he said, will come largely from three-four areas. First being the BSV portfolio, followed by their consumer segment. Mankind is also expecting good growth from the in-licensing segment.

International markets are attractive for Indian companies due to the market potential...The global pharmaceutical market was valued at about $1.6trn in 2023

The company has, for example, in-licensed Neptaz from Novartis, Nobeglar from Biocon and Symbicort from Astra Zeneca. Additionally, in the next few years, he expects many products that will go off-patent to bring good growth.

The company recently launched Empagliflozin, a diabetes medicine, at “rock bottom prices, just a month after it went off-patent”. The company is also eyeing corporate hospitals, which have come up particularly in Tier-II and Tier-III cities following Covid, for growth.

More Lab Rats

For the Indian pharma industry and Mankind Pharma to grow, there is a need to move beyond generic and have an innovator mindset. “So that is missing. But most of the pharma companies know this and now are starting to spend significantly on R&D,” says Arora.

Over the years Mankind Pharma invested in its own manufacturing facilities and backed the quality of its products with third-party lab reports. Today, it operates around 30 manufacturing plants across the country.

Nearly a decade ago the company set up its own R&D centre. Its most notable scientific achievement—after nine years of R&D—was the development of dydrogesterone—a complex molecule used in women’s health care. This made Mankind Pharma the first Indian company, and only the second globally after Abbott, to develop it.

So far, the company invests about 2–2.5% of revenue on R&D—typical for a domestically focused firm but lower than export-heavy peers. Indian pharma companies catering to regulated markets like the US and Europe often spend 5–6% or more.

Stressing on the need to invest, Arora adds that if US tariffs were to hit, it could disrupt India’s pharma exports—since India supplies about 40% of the generic drugs used in the US. “But when it comes to complex or innovative molecules, where competition is low and entry barriers are high, governments have little choice but to ensure availability for patients. That’s why Indian pharma needs to move beyond basic generics and invest in high-value, differentiated drugs—and we’re working towards that,” he says.