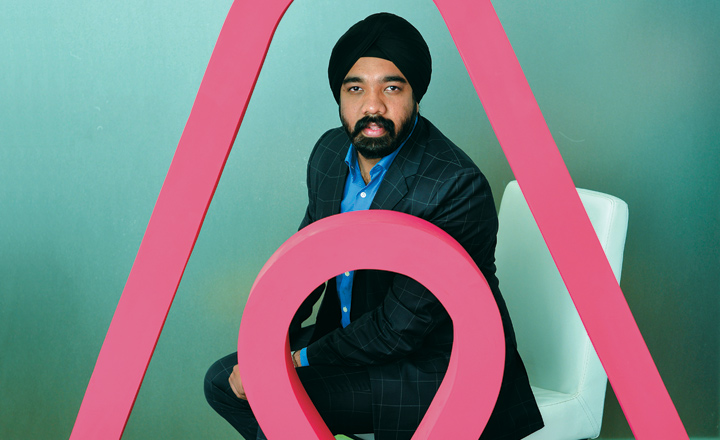

The tiny pop-up informs you of the long-awaited email — your leave application approval. Within seconds you’re scouting numerous travel portals to book that perfect holiday. Tempting hotel packages vie for your attention as multiple tabs open up on the screen. But this time around you want to try out something different. The comfort of a standardised hotel room doesn’t seem alluring enough, you want it to be more than just another holiday. San Francisco-based homestay portal Airbnb is proposing the same idea in its global ad campaign that it launched in India early this year. “Don’t go there. Live there. Belong Anywhere,” says the 60-second commercial. Started in 2008, it has identified the country as one of its top growth destinations. Amanpreet Bajaj, who has donned the hats of an entrepreneur and investor, was chosen to steer Airbnb India’s journey as its country manager in 2015. However, the official launch happened in May 2016 in the presence of co-founder Nathan Blecharczyk.

Building a global home

It all began in the year 2007, when two Rhode Island School of Design alumni faced a crisis. Brian Chesky and Joe Gebbia were unemployed and living in a rented apartment in San Francisco. They felt the squeeze even more when the landlord raised the rent. This prompted the two designers, who were aware of a design conference being held in San Francisco, to rent out their spare bedroom. That’s how Air Bed and Breakfast aka Airbnb was born. Interestingly, its first guest turned out to be an Indian design student. With the first booking turning out to be a success, the duo joined by CTO Blecharczyk, have expanded this personalised accommodation service across 190 countries and have managed to serve 100 million guests, as per the latest count in July 2016.

The portal, that began operations in India in 2011, is now going all the way to woo the Indian traveller. Bajaj asserts that the company is only responding to the impressive 115% listing growth on its India site in the last one year, taking the total count to 18,000 homestays across 100 cities — a figure that’s significantly higher when compared to other players in the market. He elaborates on the company’s aggressive push in India, “With incomes increasing, two things are happening — those who didn’t travel before are now exploring new places and those who did, are now increasing their number of trips. Earlier people did three to four domestic trips a year; now, that number has increased to six or seven. Also, with people exploring the concept of homestays on foreign trips, they have seen the economic benefits and want to bring the same experience to their own country.” The premise of Indians travelling more is corroborated by a study conducted by MakeMyTrip (MMT), based on bookings made between January to June 2016. The report states how the average domestic holiday trip has gone from 7-9 days to 12-14 days and that increasingly, Indians have begun taking impromptu foreign trips, with 65% of travellers making bookings just four weeks in advance compared to 59% for the same period last year.

Airbnb is counting on this surge for the growth of its homestay business in India. Bajaj explains, “Travellers are now interested in more authentic experiences. They want to experience life as a local when they travel someplace.” He underlines a few trends observed among Indian travellers. While Europe accounts for 50% of outbound trips among Indian guests, the Asia Pacific region, United States and South Asia account for the rest; Paris, New York and London are the most preferred destinations followed by Singapore, Bali, Bangkok and Toronto. When it comes to domestic holidays, Goa and Puducherry see the most bookings followed by Ooty, Coorg, Mumbai and Bengaluru.

Another interesting fact is that almost 39% of Indians travel as couples and about 34% travel in groups. This explains why Airbnb has something for every type of the Indian traveller. The vast database of unique homestays include listings that entertain couples, individuals, families with kids, with pets, a group, etc. Accommodation categories vary from state to state with the regular spare room, to a studio apartment, to an entire villa, a boathouse, a haveli, etc. Nevertheless, the homestay market is currently at a very nascent stage in the country. Having perfected the bed and breakfast model in other countries, Airbnb is bringing its expertise, deep pockets and global network as it forges ahead in India. “The good thing about Airbnb is that we have been a global platform from day one,” Bajaj proudly affirms of the company that raised $555 million in September from the likes of Google Capital and Technology Crossover Ventures.

However, Airbnb isn’t a lonely participant in the homestay segment in India. There is competition from start-ups and some of the bigger online travel agencies. Stayzilla, which started out as an online aggregator for alternate accommodations in 2010, discovered the potential of the homestay segment in 2014. The Bengaluru-based start-up has 8,000 such properties across India and receives 40% of its business from this segment. Nasdaq-listed MMT, which earns 56% of its revenue from hotels and packages, launched RightStay, its homestay offering in October 2016, post a soft launch in May. With 10,000 properties listed across 200 Indian cities, MMT is extending features like pay-at-checkout for this segment too. Yatra Online set up TG Stays, its homestay segment on the site in October last year. It currently has 3,000 such properties listed. Then, there are other start-ups who are jumping onto the homestay bandwagon like HeyBnb and alternate accommodation portal, WudStay and even budget hotel room aggregator,OYO.

Hosting a new market

Selling the concept of a bed and breakfast would be easier abroad where there is some familiarity with alternate accommodation. But for a model like this to be successful in India, the company needs to appease both parties involved — the guest and the host. Yatra Online’s president, Sharat Dhall, describes what the average Indian host and traveller looks for, “Homestays are targeted at two segments of customers — people looking for local experiences, and value-conscious travellers who find it economical to book a single villa instead of paying for multiple hotel rooms. As for a host, a lot of them don’t live in the homes they let out. They have a spare apartment and this is additional income.” This additional income could look like Rs.13,497 a week if you have a spare room in Mumbai. While the offer is attractive for both the guest and host, there are inherent trust issues that crop up in the process. On the guest’s mind is the constant worry of paying a fee for a property they haven’t visited, or staying with a host they don’t know much about. As for the host, there is the fear of opening up their home to a complete stranger.

This is depicted well in a 2015 article in Condé Nast Traveller India titled Confessions of an Indian Airbnb host that talks about guests who steal and create a mess, along with some pleasant experiences as well. Bajaj acknowledges this challenge as he goes on to explain how Airbnb brings some of its global practices to the Indian portal to address these concerns. “Yes, the resistance to homestays can be seen as a cultural challenge. But the Sanskrit adage Atithi devo bhava reflects our hospitable culture. Only 30-40% of the hosts on our platform use earnings from Airbnb as their primary income; for the rest, it is supplementary income. They are open to hosting travellers and the platform offers them the ease and convenience to do so,” he says. Airbnb India currently deploys a host of online tools as part of its verification process — hosts are encouraged to verify their email ids and phone numbers, link their social media profiles to the Airbnb page and also upload government documents for verification. In some cases, hosts/guests are allowed to refine their search based on such criteria.

Currently, Airbnb completely relies on the feedback received from a guest and a host about each other. Both parties are required to review the other across specific categories, which are then displayed on their respective profile pages for prospective clients. But, industry experts stress on the need for a company-sponsored audit check. Vikramjit Singh, chief revenue officer, Lemon Tree Hotels, points out, “They will have a make or break situation if they sign up anyone coming on to their website. If they do not have a company-sponsored way to verify, they will have problems even before they take off.” This view is also reiterated by Stayzilla’s co-founder, Yogendra Vasupal, who rents out a spare room himself at his home in Bengaluru. “Simply going on TV and asking people to open up their homes is not going to work. This we realised from the concerns raised by hosts during town hall meetings. Many people feel homestay as a category is not accredited and not verified. More than paying a lower tariff for a room, people are looking for peace of mind in the form of safety,” he says, explaining why Stayzilla has a team that verifies properties personally against a 45-item checklist comprising mobile phone network availability, public transport, landline availability, safety, etc. However, Bajaj defends the Airbnb verification process. “Reviews are linked to payment systems, so it is mandatory for a host and guest to review each other. We don’t accept reviews from anyone and everyone like other travel portals; these are from verified accounts. Also, we monitor these reviews very carefully. A low rating would prompt our team to educate the host and if it continues then we do not hesitate from de-listing such properties,” he explains. The portal doesn’t pass on the money paid to the platform by a guest to the host until 24 hours after check-in.

Being a pioneer in this space, Airbnb discovered the importance of educating the community to drive growth. The company is popular for organising host meet-ups across cities where existing hosts are invited and educated about best practices and are also encouraged to bring along others who are curious about the homestay concept. This is a practice it has picked up from the parent company and something adopted even by its peers in the industry like Stayzilla which discovered that the best way to get people to sign up was to hold town hall meetings. Airbnb also runs a reward initiative programme called the Super Host, where those particular listings are bumped up on search lists and have the notified badge. This is one way the company rewards hosts who have a high response rate, who complete 10% of trips on their listing in a year, earn five-star reviews from most of their guests and rarely cancel confirmed bookings.

When it comes to the host, Airbnb believes in complete independence. Hosts are allowed to determine the listing price and cancellation policy they wish to avail. Airbnb charges a 3% commission from its hosts, quite low in comparison to other players — Stayzilla charges 15%, Yatra earns 10% and OYO charges an average commission of 20% (See: Playing host). Hosts are also allowed to choose from three different cancellation options that differ in severity of the cancellation fee. “We give the host complete freedom on the terms and conditions they wish to set when they want to list their property. The cancellation policy chosen depends on the location and season. For instance, for an elderly couple in Andhra Pradesh who rent out a spare room just to be able to meet new people, the policy is flexible. But for someone renting out a villa in Goa during the holiday season, will end up losing money if a customer cancels; so they might opt for a more severe one. We have received positive feedback on the choices that we make available to our hosts,” says Bajaj.

While homestay portals are currently required to honour tax obligations like service tax and Swachh Bharat cess on behalf of their hosts, there are few other regulatory hurdles yet to overcome. Lemon Tree Hotels’ Singh points out, “Government regulation on this type of accommodation is unclear. There is complete ambiguity regarding legal bye-laws about running a commercial venture in a residential colony. A few state governments have taken some initiatives but largely there is ambiguity.” Both Bajaj and Vasupal recognise this as a work-in-progress for homestay portals. “The laws for short-term rentals vary in every building, city and state. The current laws in this regard date back to several years, when such a business model didn’t exist. There is a need for more fair and progressive laws,” adds Bajaj. Currently, homestays are required to secure a licence from the respective state government and must pay service tax and other levies at commercial rates. But an August 2016 report by the Tourism Ministry reflects a desire to reform laws to make states homestay-friendly. Airbnb is actively working with various state government boards to iron out the hurdles. It has partnered with the Gujarat state government to make affordable homestays available for domestic and foreign travellers in the state. As per the agreement, Airbnb will conduct sessions with existing hosts and prospective ones about hosting standards and promote tourism in less-explored destinations in the western state. In this regard, Airbnb’s competitor, Stayzilla, has covered more ground, it has signed MoUs with tourism boards in Madhya Pradesh, Uttarakhand, Punjab and Gujarat. Stayzilla’s Vasupal explains, “Building an ecosystem cannot happen with just one company. All the portals engaged in this business will have to continue talks with relevant state tourism ministry bodies.”

Best bet?

The proportion of domestic travellers making bookings online is a very small number. As per a Phocuswright report titled Indian Online Travel Overview, only 10.4% of domestic hotel bookings are done online. “You have to remember that the local travel agent is still a very strong force in the Indian travel market,” says Singh. Airbnb has identified this aspect of the Indian market and partnered with Thomas Cook in February to offer unique homestay offerings to outbound Indian travellers.

But with three-star and four-star hotels offering attractive discounts, will homestays still find a market to cater to? Lemon Tree Hotels, which runs the economy hotel chain, Red Fox, believes that the challenge of ensuring standard quality within homestays is eliminated in a hotel. “With hotels like Red Fox and Ibis, even though the economy traveller is paying less, he knows what to expect in terms of service. Homestays are absolutely no threat to economy hotels,” he affirms. Achin Khanna, MD, HVS Global, a hospitality consulting firm, stresses on the importance of consistency in service for homestay players. “There are two ways to go about this — either you just provide cheap accommodation or work on building a brand and impose some bare minimum requirements of amenities for hosts who enlist their properties,” he says. OYO, which has built its network of 70,000 rooms on the affordable and standardised service, also stresses the need for a well-defined offering. CEO Ritesh Agarwal explains, “We entered this segment to transform the way people stay away from home and to build a standardised marketplace. Unlike typical homestays, our properties are equipped with standardised amenities that provide visitors a predictable experience.”

Nevertheless, Airbnb’s Bajaj is confident that the model will work despite the presence of budget hotels. “Hospitality is a big market in India and we are not taking market share from somewhere else. The Indian traveller today, is moving away from the typical standardised experience.” With this premise in mind, Airbnb is also extending its global offering, the Business Traveller service in India. “We launched Airbnb as a pure leisure play. Then we realised that more and more people opted Airbnb when they went on work trips,” Bajaj explains. The feature was launched globally as well as in India last year and accounts for 10% of Airbnb’s business already. The platform lists certain amenities that a property must have to qualify for a business travel listing — hosts are required to provide a 24-hour check-in facility, keyless entry, Wi-fi, laptop-friendly workplace, basic personal amenities, etc. To encourage the growth in this listing category, the company even offers carbon monoxide and smoke detectors to such property owners. Airbnb provides a seamless interface for companies to keep track of employee work trips and expenses.

Here’s a segment that seems to have caught the fancy of Airbnb’s competitors too, and with good reason. The demand for lodging in India is primarily driven by business travel that accounts for 70% and another 25% by conferences; organised leisure travel is the rest. OYO’s Agarwal explains why he hived off OYO for Business as a separate entity, “Corporate business is a very important category for us. Early on, as a dependable and repeat source of business, it aided growth and today, it serves as a customer acquisition channel.”

Apart from the business travel segment, Airbnb might be looking at additional avenues for revenue. Kenny Blatt of HeyBnb, a start-up that hasn’t shied away from borrowing its name and business model from the pioneer, says, “There is a need to identify other verticals in the business. The best thing about this segment is the customer will direct us to our value-added services. For instance, if a lot of Indians pick say, Paris, for their holiday and prefer a particular ride-sharing app or airline, then we could partner with it to have the service ready on our site too.” News reports reveal that Airbnb might just be working on another vertical, a mobile app called Airbnb Trips which will help travellers organise their itineraries along with several value-added services. However, when quizzed about the app, Bajaj remains tight-lipped and says, “The apps and more will be announced soon.”

Right now, all Bajaj seems to be focused on is growing Airbnb’s user base in India. And the timing couldn’t be better with the government stressing on the importance of homestays to make up for the shortage of affordable stay options. Under-supply of hotel rooms coupled with rising costs proves to be a major impetus for growth in the homestay segment, claims Vasupal. “My thesis is completely different from the rest of the industry. I believe that there are not enough rooms to begin with,” he says of the high rates travellers end up paying for hotel rooms in tourist hotspots, over weekends. A view that is strongly contested by Singh who says, “Supply is growing annually by 17-18%. So, there is a scenario where supply is more than demand. The average occupancy of hotels in FY15 was 60%, so a lot of rooms were lying vacant. Thus, the ADRs (average daily rate) have not grown but remained flat in the past few years.”

With the homestay segment being at a nascent stage in India, there isn’t reliable data currently available on the demand and supply for this category of accommodation. HVS Global’s Khanna feels the segment is still largely unorganised in India. His take on the current leader: “Airbnb has not been able to penetrate the Indian market, the way it has achieved scale globally. It is safe to say that 95% of hotel operators in India don’t see it as their competitor.”

But, Airbnb is eagerly counting on the surge in the Indian travel market that is predicted to cross the $42.4 billion-mark in 2020 and the online travel market is set to reach $16.6 billion from $8.5 billion in 2015. Singh remains skeptical about the growth of the homestay segment, he believes that it might not grow beyond tourist hotspots while he underlines the uniqueness of the market Airbnb seeks to conquer, “Changing demographics will be a major challenge to Airbnb in India. In other mature markets, they are used to people, speaking the same language, having the same kind of food. The demographic here changes every few miles.” But none of this deters Bajaj. He believes that Airbnb’s tech-centered platform is powerful enough to understand the nuances of every country and develop offerings accordingly. India being a strategic market, will only be dealt with additional care.