On July 8, IDFC Bank and the Shriram group announced that they have entered into an exclusive arrangement for 90 days to explore the possibility of a merger. As per the proposed arrangement, Shriram City Union Finance (SCUF) will be merged with IDFC bank, while Shriram Transport Finance Company (STFC) will become a subsidiary of IDFC and will be subsequently delisted. The other businesses (life and general insurance, AMC, stock broking) will also become subsidiaries of IDFC.

The proposed deal got a thumbs-down from the market with STFC and SCUF declining 7.57% and 8.48% and IDFC Bank losing 4.87% (as on July 2017), since the deal was announced.

The merger will give IDFC Bank, which has been struggling to grow its retail business given its limited branch network, access to more than 10 million customers of both the Shriram group companies. If the merger goes through, the bank, which currently has 90 branches, will also have access to nearly 1,000 branches that SCUF has across the country, apart from ensuring that the bank meets its priority sector lending (PSL) requirement since more than half of SCUF’s loan portfolio is PSL-complaint. For Shriram group of companies, the merger will lead to lower cost of funds and the ability to cross-sell multiple banking and investment products. But the good news ends here.

The three-way merger is not only a complex one to execute, but it is also poised to run into hurdles at different stages. The deal has to get regulatory approvals from the RBI, Sebi, IRDA and CCI, besides finding synergies between three firms with distinctly different business models, divergent customer profiles and work culture.

“Given the fact that Shriram’s borrowers are from the informal economy, their lending requires decentralised decision making at the branch level. So, a centralised model followed by banks may not work with SCUF or STFC,” says Aadesh Mehta, research analyst at Ambit Capital.

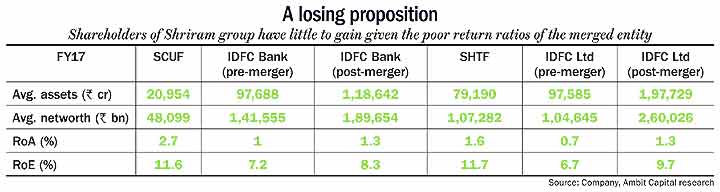

In this complex merger, it seems the investors of STFC have been dealt the worst hand. Not only is the company getting delisted, it will now attract a holding company discount as it merges with IDFC. Its RoE and RoA will also decline from 11.7% to 9.7% and 1.6% to 1.3%, respectively, post the merger. IDFC Bank has not been able to scale up its retail business as well as it would have liked over the past two years. Its CASA ratio is adverse compared with other private sector banks. and they have not been able to build a good retail/SME book. They are possibly trying to improve that through the SCUF merger. “The question is whether they will be creating shareholder value or whether they will be destroying it. On a short-to-medium term basis, it seems there will be destruction of shareholder value for the Shriram group shareholders,” sums up market expert Ambareesh Baliga.