Kotak Mahindra Bank on July 23 launched an invite-only Solitaire Credit Card for its high-value customers. The exclusive invite-only card offers high credit limits and comes with no annual fees for its affluent users. The development comes just five months after the Reserve Bank of India lifted its ban on the bank from onboarding new credit card customers.

“Solitaire is our response to affluent customers who feel underserved by traditional banking,” said Rohit Bhasin, President and Head of Affluent NRI and Business Banking at Kotak Mahindra Bank.

The move seems to align with the bank's broader strategy to increase the share of its unsecured loan portfolio from 10.5% in FY25 to 15%.

The Solitaire Programme: Key Features and Exclusive Benefits

The Solitaire Programme is an invite-only affluent credit card plan launched for individuals and families with a high-value, multi-dimensional relationship with the bank.

The bank will track Total Relationship Value (TRV) across deposits, credit cards, investments, loans, insurance and demat holdings offered by the lender, the Mint reported. TRV is a metric used by banks to assess the financial relationship a customer has with them based on combined balances across various accounts, investments, and loans linked to a customer’s ID. The crucial eligibility criteria for salaried customers is a TRV of ₹75 lakh, and ₹1 crore for self-employed customers.

While in the past few years, the bank reportedly collaborated with partners to offer early access for tickets to events like Ed Sheeran and Maroon 5 concerts for its card holders, under the Solitaire programme, the lender will offer more exclusive benefits, including early access, premium access, access to better seats, lounge partnerships and designated parking at events.

“A combination of premium events and premium dining experiences, to start off with, is what we want to really provide to this customer under the Solitaire umbrella,” Bhasin told the Mint. With this newly launched offering, the bank is eyeing increasing its market share in the affluent market, which is presently just 4%, he added.

Kotak Mahindra will now join the list of large lenders who also offer similar programmes. The bank’s Solitaire credit card plan will compete with Axis Bank’s Burgundy Banking and HDFC Bank’s Diners Club Black Credit Card for affluent customers.

Is It Kotak’s Revival Strategy After RBI Ban Lift?

In April 2024, the central bank had imposed a ban on Kotak Mahindra bank from onboarding new customers digitally and issuing new credit cards due to issues with the lender’s online data management and security. While RBI lifted the ban in February this year, its move impacted the lender's financial health in the fiscal year 2025.

“FY25 was a tough year for Kotak Mahindra Bank with the regulatory restrictions on digital on-boarding of customers through the 811 channel and issuing new credit cards, hampering credit growth and weighing on margins for most of the year,” a report by Axis Securities mentioned.

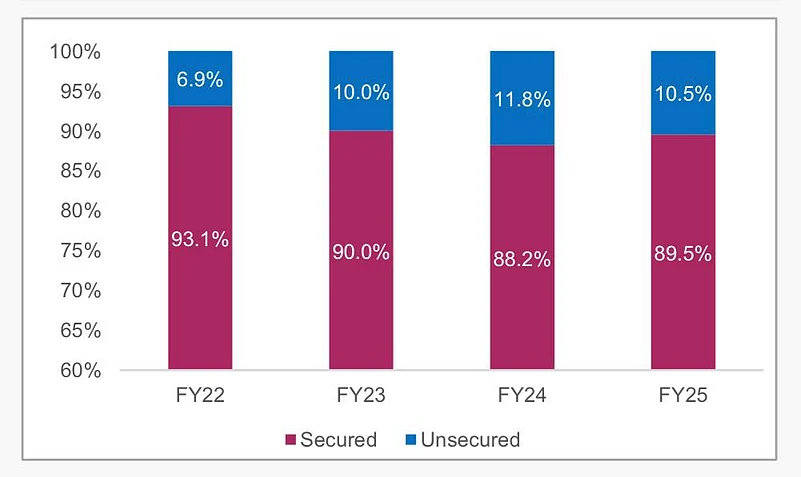

In FY25, Kotak's customer assets — which include retail lending and credit substitutes — grew by 13% year-on-year (YoY) to ₹4.78 lakh crore, driven by a similar 13% growth in the total loan portfolio to ₹4.44 lakh crore. Within this, unsecured retail advances (including microcredit) accounted for 10.5% of net advances as of March 31, 2025. This marks a decline from 11.8% in FY24, following a regulatory restriction on new credit cards and digital platform.

The unsecured lending portfolio — comprising personal loans and credit cards — had previously seen rapid expansion, increasing from around 7% in FY22 to over 12% in FY24 before being scaled back.

“Asset quality challenges seem to be waning away with fresh stress accretion trending downwards in the unsecured portfolios and secured asset quality holding up well,” the report added.

After the RBI lifted the ban, the lender has taken several corrective initiatives to revive the unsecured loans segment, including redefining its go-to-market strategy with two app like the new Kotak Mobile Banking App and the new 811 App that target affluent and core customers. The bank has projected to scale up the share of its unsecured loan portfolio from 10.5% in FY25 to 15%.