Tata Sons Chairman N Chandrasekaran says the 156-year-old conglomerate is "fit and ready for the future" after several years of massive investment, which he called "a transformational journey towards financial and strategic fitness." He told shareholders in Tata Group's latest annual report that in the last five years, Tata Sons has invested ₹1,00,000 crore in its group companies, and those companies themselves have undertaken capex and investments totalling over ₹4,50,000 crore — taking cumulative investments to ₹5.5 lakh crore.

With the help of these investments, Tata Group’s aggregate revenues rose 1.9x to ₹15.34 lakh crore in FY25 from ₹7.89 lakh crore in FY20. Net profit reached ₹1,13,011 crore, up 3.6x; the leverage ratio halved to 0.7x; and return on equity now stands at 17.5%, up from 8.7% in FY20.

Chandrasekaran also acknowledged that during these five years, some decisions that might have “appeared ideal when they were taken may have aged poorly with time and changing economic conditions.”

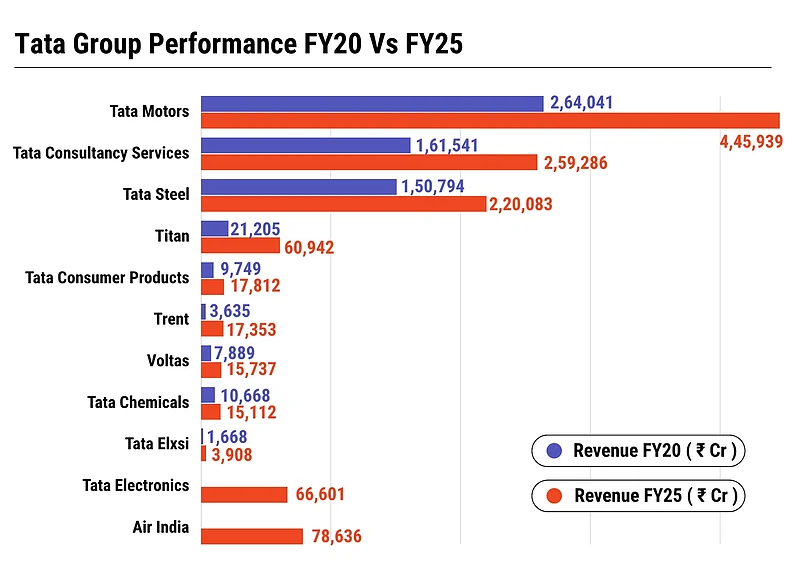

As of March 31, 2025, the company had 323 subsidiaries, and together with its subsidiaries, it had 39 associates and 32 joint ventures. TCS continued to be the group’s profit engine, accounting for 43% of group net profit in FY25. Among the other listed companies, in the last five years, Tata Steel grew from ₹1,50,794 crore to ₹2,20,083 crore, while Tata Motors saw a jump from ₹2,64,041 crore to ₹4,45,939 crore. Another IT unit, Tata Elxsi’s revenue more than doubled from ₹1,668 crore to ₹3,908 crore. In the consumer space, Tata Consumer Products rose from ₹9,749 crore to ₹17,812 crore, Titan from ₹21,205 crore to ₹60,942 crore, and Trent from ₹3,635 crore to ₹17,353 crore. Voltas grew from ₹7,889 crore to ₹15,737 crore, and Tata Chemicals increased from ₹10,668 crore to ₹15,112 crore. Tata Power’s revenue more than doubled from ₹29,699 crore to ₹66,992 crore. Indian Hotels posted growth from ₹4,596 crore to ₹8,565 crore, while Tata Communications moved up from ₹17,138 crore to ₹23,239 crore.

Among the new businesses within the Tata Group, iPhone supplier and semiconductor firm Tata Electronics reported revenue of ₹66,601 crore in FY25, while Air India posted ₹78,636 crore for the same period. Tata Digital, the omnichannel retailer, grew from just ₹7 crore in FY20 to ₹32,188 crore in FY25.

Point to Note: Tata Sons’ standalone financial performance for FY25 showed a mixed trend. The holding company's revenue declined by 11.5% to ₹38,834.6 crore from ₹43,893 crore in the previous year, which had included a one-time gain of ₹9,375.7 crore from the sale of investments. Total expenses dropped significantly by 29.9% to ₹1,945.6 crore from ₹2,776.5 crore. Profit after tax (PAT) fell 24.3% to ₹26,231.7 crore compared to ₹34,654 crore a year earlier.

However, the company’s net cash position strengthened considerably, rising 165.5% to ₹7,117.4 crore from ₹2,679.2 crore. Return on equity (RoE) declined to 19.11% from 32.2%, marking a drop of 13.09 percentage points. The carrying cost of investments also rose by 17.4%, reaching ₹1,69,826.6 crore from ₹1,44,711.2 crore.

Tata to Focus on Manufacturing

On the road ahead, Chandrasekaran said, "we want to pursue manufacturing excellence at scale."

"At Tata Electronics, we are building a vertically integrated ecosystem for technology hardware and semiconductor manufacturing. It is hard, but that is why it matters so deeply to us. I am proud to share with you that Tata Electronics is well on the road – it already employs over 65,000 workforce (of which approximately 70% are women) and has an annual revenue of ₹66,000 crore. In the capital-intensive world of technology hardware, I am told this is a good start," he noted.

The group chairman added that for now, they have chosen to start their chip unit at the 28nm node but aim to "move steadily towards where the cutting edge of chip manufacturing is today."

"That, I must tell you, will take several years of serious work," he acknowledged.

Tata Electronics, set up in 2020 as a wholly owned subsidiary of Tata Sons, took over Wistron’s iPhone plant in Karnataka in 2023, making it the first Indian company to manufacture iPhones domestically. Last year, they also acquired the plants of Pegatron Technology.

Tata Group is entering the semiconductor space with a ₹91,000 crore chip fab in Dholera, Gujarat, in partnership with Taiwan’s PSMC, to produce 28nm chips. The unit is expected to start production by 2026. It is also setting up chip assembly and testing units in Assam, including a ₹27,000 crore OSAT facility in Morigaon and another plant in Jagiroad.

Chandrasekaran also highlighted the group's battery arm, Agratas, which is establishing 60GWh battery capacity in India and the UK, with R&D centres in Bengaluru and Oxford.

"By way of context, the global fleet of electric vehicles added in 2024 accounted for about 864GWh of battery capacity. Our first step in this direction should bring India to a meaningful scale," he said.

"Though we have big plans for industry, these do not come at the expense of our aspirations for the Indian consumer," Chandrasekaran stated. He highlighted that Tata’s consumer businesses are growing rapidly: Trent has tripled its store count, Indian Hotels has added over 100 properties, and Tata Consumer has been India’s fastest-growing FMCG firm for five years. Tata Digital is scaling fast, with NeuPass reaching 140 million members, while Tata Capital is expanding with a new branch every day.

Tata Sons Moves to Avoid IPO Mandate

The annual report said Tata Sons has applied to the RBI to give up its registration as a Core Investment Company (CIC), in a move aimed at avoiding the mandatory stock market listing that would otherwise be required by September 2025. Under the RBI’s new rules, large financial holding companies like Tata Sons — classified as upper-layer NBFCs or CICs — must list if they meet certain thresholds.

To sidestep this, Tata Sons took several key steps. It reportedly repaid over ₹20,000 crore in debt to bring down its liabilities last year and stopped lending to group companies. It also gave up practices such as providing cross-default guarantees and letters of comfort, and reportedly assured the RBI that it would no longer engage in indirect financial support of its subsidiaries.

This strategy is expected to help Tata Sons avoid going public with an IPO potentially worth ₹7–8 lakh crore. Despite calls from minority shareholders like the Shapoorji Pallonji Group for a listing, the company is choosing to stay private and simplify its operations.

Instead, it is moving ahead with the IPO of its NBFC arm Tata Capital, another upper-layer NBFC under RBI’s Scale-Based Regulation. In February 2025, Tata Capital approved an IPO to issue new shares and allow existing shareholders to sell in order to meet the RBI’s listing mandate. The IPO is expected to raise around $2 billion, with Tata Sons planning to offload 23 crore shares and IFC another 3.6 crore shares, along with a fresh issue of around 21 crore shares.