In the first six months of 2025, India witnessed over 2,898 acres of land change hands through 76 deals involving real estate giants like Godrej Properties, Lam Research, Puravankara Limited, Signature Global, M3M Group, Brigade Group, Macrotech Developers (Lodha), Prestige Group, Kolte Patil Developers, Mahindra Lifespaces, and Adani Realty.

According to data from ANAROCK Property Consultants, the land transacted in H1 2025 is already 1.15 times the volume recorded in the entire year of 2024, which saw around 133 deals for 2,515 acres.

The total value of land transacted in the first half of 2025 stood at ₹30,885 crore. These transactions, ANAROCK says, have a revenue potential of ₹1.47 lakh crore and a total development potential of over 233 million sq. ft.

Mayank Saksena, MD & CEO – Land Services, ANAROCK Group noted that the post-pandemic years—from 2021 onward—have witnessed a steady rise in land transactions. Between 2021 and H1 2025, over 11,858 acres were transacted across 423 deals nationwide, with a combined development potential of 841 million sq. ft.

"The scale and sophistication of these deals underscore the real estate market’s maturation—and the strategic importance of land as a cornerstone resource,” he added.

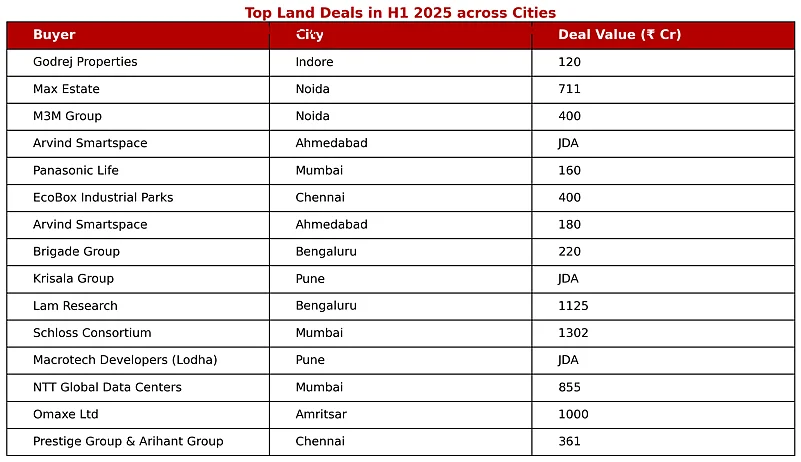

Top Deals of H1 2025

Among the major transactions, Godrej Properties acquired 24 acres in Indore for ₹120 crore for a plotted development. Max Healthcare Group’s real estate arm, Max Estates, picked up 10.33 acres in Noida for ₹711 crore for a mixed-use project, while M3M Group acquired 5.82 acres in the same city for ₹400 crore for commercial use. Brigade Group purchased 4.4 acres in Bengaluru for a ₹220 crore residential project, and Krisala Group signed a joint development agreement (JDA) for a 105-acre township in Pune.

A consortium of Schloss Bangalore Ltd, Arliga Ecospace Business Parks, and Schloss Chankya Pvt Ltd acquired an 8.31-acre commercial site in Mumbai for ₹1,302 crore. Macrotech Developers (Lodha) signed a JDA for 5 acres in Pune for residential development. Omaxe Ltd bought 260 acres in Amritsar for ₹1,000 crore for a township, while Prestige Group and Arihant Group jointly acquired 3.48 acres in Chennai for a ₹361 crore residential project.

It wasn't just residential projects—H1 also saw several major industrial and commercial land deals. American chipmaker Lam Research acquired 25 acres in Bengaluru for ₹1,125 crore to set up a semiconductor equipment manufacturing facility. NTT Global Data Centers picked up 2.39 acres in Mumbai for ₹855 crore for a data centre.

In Ahmedabad, Arvind Smartspace entered into JDAs for two major projects: 440 acres for an industrial and logistics park, and another 150 acres for a plotted development worth ₹180 crore. Panasonic Life invested ₹160 crore in a 1.63-acre commercial project in Mumbai, while EcoBox Industrial Parks acquired 50 acres in Chennai for ₹400 crore for an industrial and logistics park.

Tier 2–Tier 3 Cities See Major Action

The ANAROCK report highlighted that out of the total land deals closed in H1 2025, 67 deals covering approximately 991 acres took place in the top seven cities. The remaining nine deals, covering over 1,907 acres, were recorded in Tier 2 and 3 cities such as Ahmedabad, Amritsar, Coimbatore, Indore, Mysuru, and Panipat. Coimbatore topped this list with a single deal for 714 acres, followed by Amritsar (520 acres across 2 deals) and Ahmedabad (590 acres across 2 deals). Other active cities included Indore (24 acres), Panipat (43 acres), and Mysuru (16.42 acres over 2 deals).

“The emergence of Tier II/III cities as significant contributors to the national land transaction ecosystem is also noteworthy. These markets, once considered peripheral to mainstream real estate activity, now represent an inalienable component of the Indian real estate growth horizon—challenging the historical metro-centric model and inducing a healthier geographic distribution of economic opportunity,” said Saksena.

Among metro cities, Mumbai Metropolitan Region (MMR) led with 24 deals spanning 433 acres, followed by Pune with 13 deals across 214 acres. Bengaluru recorded 15 transactions for 182 acres, while the National Capital Region (NCR) saw 11 deals for nearly 99 acres. Chennai recorded four land deals amounting to 63 acres.

What It Means for Housing and Office Prices

Earlier reports by ANAROCK show that in H1 2025, net office leasing across the top seven Indian cities rose significantly to approximately 26.8 million sq. ft., up from 19.08 million sq. ft. in H1 2024. Bengaluru led this surge with around 6.55 million sq. ft. of leasing, marking a 64% year-on-year increase. These cities also recorded a 25% increase in new office completions—from 19.65 million sq. ft. in H1 2024 to 24.51 million sq. ft. in H1 2025. Average monthly office rentals rose 5%, from ₹84 per sq. ft. to ₹88, with Chennai seeing the highest annual rental growth of 6%.

In the residential market, Chennai was the only top city to record an annual rise in housing sales, up 11% year-on-year to approximately 5,660 units between April and June 2025. Rising property prices and geopolitical tensions, including Operation Sindoor and the Iran-Israel conflict, impacted housing sales in the top seven cities during Q2 2025, according to ANAROCK Research.

Housing sales dropped 20% year-on-year in Q2 2025, with approximately 96,285 units sold compared to 1,20,335 units in Q2 2024. Average property prices across top cities rose 11% year-on-year, with NCR seeing the sharpest increase at 27%, followed by Bengaluru at 12% and Hyderabad at 11%.

The report also noted that premium housing (priced above ₹1.5 crore) continued to dominate new supply with a 46% share, while both mid-segment (₹40 lakh – ₹80 lakh) and premium segment (₹80 lakh – ₹1.5 crore) accounted for 21% each. Affordable housing remained limited, contributing just 12% of the new supply. Unsold inventory in the top seven cities declined by 3% annually, with Pune posting the highest drop at 15%.