Wind back to childhood when the days were simpler. You and your pack wore uniforms for much of the day, you fought to watch extra 15 minutes of TV, and dad (and, for many, mum too) took off to this mystical place every morning, without fail. When somebody asked where your parents were, pat came the response “office”, but all you knew about the ‘office’ was what you saw on TV — white walls, cubicles and a drab-looking space where adults did ‘big people’ things.

These workspaces have undergone a sea of change and offices have only gotten swankier with each decade. Fingerprint scans at entry, smart-ID cards, automated multilevel car parking and buildings covered in tempered, tinted glass are all too common today. In many places, the ‘chai waale bhaiyya’ has been replaced with a Rs.200,000 machine for espresso on demand. How about a chilled beer instead? Or a 10-minute power nap in one of the dedicated pods for you to relax? These hip new offices are blurring the lines between work and play.

Fads come and go, but the pain of setting up a new office remains. For one, you have budgetary constraints while hunting for a new official address. The logistics are a pain, the interior needs work, there’s no parking, and of course, there’s the extortionate security deposit. If you are a businessman on an expansion spree, or an entrepreneur graduating from your ‘work-from-home’ stage, good luck. At least, that was the case until recently.

Fancy that

Call it a miracle of shared economy, but today, you can share your offices just as you share taxis, scooters or self-drive cars. And for any company, start-up or freelancer who doesn’t want to invest millions in just setting up an office, there’s good news. Finding coworking spaces in metros now is like finding potholes in Mumbai; throw a stone and you’re likely to hit one. The idea behind coworking spaces is simple. You pay per seat and forget electricity bills, furniture, pantry maintenance, security personnel or even internet connectivity. And guess what? No lengthy lock-in periods either.

You get to choose among the type of seats as well. For instance, WeWork, the most popular player in the coworking space, classifies its offerings into — hot desks, dedicated desks and private offices. With hot desks, you pick any vacant seat in the facility’s community area and get cracking; dedicated desks get you a fixed, furnished work-spot; and private offices are reserved spaces for companies with five to 100 members.

Since these spaces are flexible with 24x7 access, they have become a hit among start-ups and small ventures. According to Awfis, 40% of it seats are booked by enterprises, 40% by SMEs and 20% by freelancers and start-ups. Besides specifying the number of seats and paying the fee, customers only have to decide how swanky they want their office to be.

For bragging rights, you need space in New York-based WeWork, which has a rather pricey $47 billion valuation and has already filed for an IPO hoping to raise $3.5 billion. A seat here typically costs Rs.12,000-25,000 per month, and its facilities can very well put five-star hotels to shame. Some of its spaces in the commercial districts of Bengaluru, Mumbai and Gurugram offer gyms and the odd swimming pool.

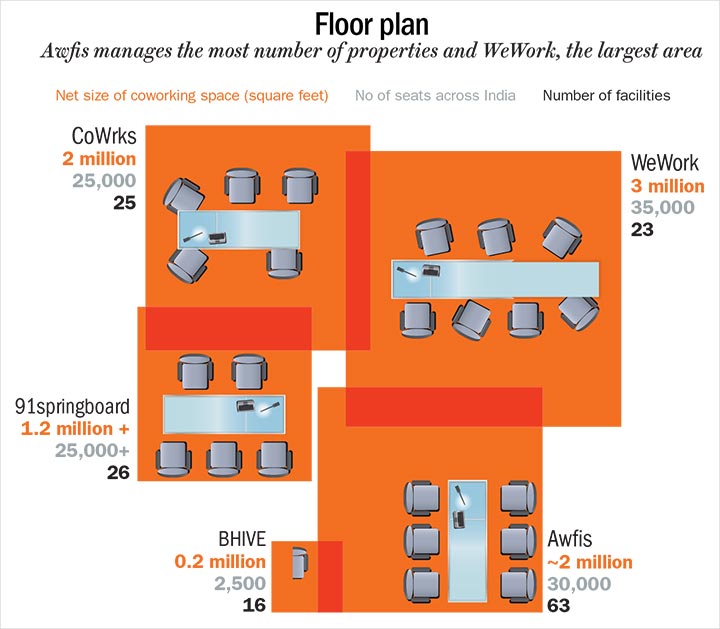

A little lower down the fancy train, there are Awfis and CoWrks whose seats cost around Rs.9,000-18,000, and have smaller properties than WeWork. Then there are names such as 91springboard and BHIVE, which fall in the Rs.7,000-12,000 bracket. The prices may vary according to the office’s location — from prime to suburban locales.

From a purely functional aspect, there’s not much that separates one space from the other if all one needs is a desk. In fact, the internal joke among coworking space users is that when the business does well, one shifts from a BHIVE or Awfis to WeWork. It goes the other way round during crunch time.

Exploding space

Some of the earliest coworking spaces in India have been around since 2012. For instance, New Delhi-based 91springboard, co-founded by Pranay Gupta in 2012, is among the most successful. It clocked revenue of Rs.405.5 million in FY18, though lagging behind Awfis and IndiQube (both founded in 2015) that made Rs.619 million and Rs.557.7 million, respectively. Bengaluru’s BHIVE has been around since 2014, and clocked FY18 revenue of Rs.56.5 million.

However, the coworking industry garnered attention in India only in 2017, the year when WeWork made its way into the market. Easily the biggest name in the domain, the company has expanded to over 35 countries within seven years of its inception and has nearly 800 properties across 124 cities. Its India venture has made investors and market experts sit up and take notice of the potential in this space. According to Anuj Puri, chairman, ANAROCK Group, “As of 2018-end, the total supply of flexible workspaces was anywhere between 7.1-7.5 million square feet area. It is expected to cross 10 million square feet by 2020.” (See: Floor plan)

The coworking sector has been growing strong at 30-40% over the past few years and Puri believes the trend will continue, albeit on a high base. “The sector may see growth between 15-20% over the next few years,” he says.

It’s no surprise that metros accounted for the lion’s share of growth. Puri adds, “In H12019, of the total 28 million square feet of office space absorption in top seven cities, almost five million square feet was for flexible workspaces and they were leased. Maximum activity was recorded in Bengaluru, followed by Hyderabad, Chennai, NCR and Mumbai.”

But, which segment is the demand coming from? Avishek Banerjee, advisory partner-real estate, EY India, says, “The rising number of start-ups and the move by traditional occupiers to flexible space options is sustaining growth.” He makes a pertinent point. India is positioned as the third largest start-up hub in the world today. By 2020, the country is expected to be home to over 10,000 tech start-ups employing nearly 200,000 people.

Smaller players are increasingly moving into such spaces for their higher flexibility, ease in setting up without administrative hindrances, and freedom from long-term commitment to real estate. Puri says that, on lease, coworking spaces are 15-20% cheaper than standalone offices.

Powered by technology, coworking spaces lend themselves to better use of real estate. Banerjee explains, “Technology helps track usage pattern, sweet-spots for sizing of workstations and meeting rooms, ensuring efficient use of the real-estate asset.” A company can even subscribe to an app to monitor preferences and usage patterns of its employees.

There is savings in human-resource engagement too for client companies, because the space providers organise community-building and networking events. For example, there are post-work hours workshops on anything from digital marketing to accounting — be it face-to-face interactions with investors or good old festival celebrations. Harvard Business Review speculates that coworking offices have a positive impact on employees by giving them a sense of meaning at work.

Companies such as WeWork and CoWrks even actively promote start-ups, almost in an incubator-like manner. WeWork Labs, the incubation wing for early-stage start-ups made news for helping 11 start-ups raise a cumulative $5.5 million. CoWrks is collaborating with Ivy League institutes such as Columbia (for urban-tech start-ups) and Yale University (start-ups targeting healthcare) to rope in mentors for entrepreneurs. “Our job is to help identify good ideas and potential entrepreneurs from the CoWrks Foundry programme, who can become part of the Yale family,” says Sten Vermund, dean, Yale School of Public Health. The institution is researching ways to improve the quality of life for people and has brought six companies into its incubator programme with CoWrks. He adds, “What we look for in ventures is whether they pass four criteria: feasibility, sustainability, market fit and impact on society.”

There is much that is being done in the coworking space and Banerjee predicts that it will see more players in time, and an eventual consolidation. In fact, this trend has already started kicking in. CoWrks very recently announced its acquisition of The UnCube, a company that provides on-demand workspace solutions. Under the new brand, CoWrks plans to offer flexible workspaces in restaurants and hotels. The combined entity will be renamed CoWrks Go. Meanwhile, OYO had acquired Delhi-based Innov8 for an estimated Rs.2.2 billion in March 2019.

Working it out

As OYO gears up to disrupt the coworking space like it did with the hotels space, let’s understand the business models at work. The fanciest of the lot, and also the first unicorn in this space, WeWork came to India with the help of a partner — Embassy Group, a Bengaluru-based luxury real estate company. Today, it has over three million square feet of leased coworking space under its fold in the country, across 23 properties and three cities with Bengaluru, Mumbai and Delhi being its top markets. Its other partners include DLF, Prestige Group, L&T and Vaswani Group. Besides boasting big partners, its clientele comprises names such as GoDaddy, Discovery India, Jaguar Land Rover, Knowlarity and Twitter, among others.

Karan Virwani, chief WeWork executive officer and the Embassy Group scion who approached the US-based company to foray into India, says, “More than 50% of our member base in India constitutes large enterprises.” This doesn’t come as a surprise, as you need to be big to be able to afford WeWork’s pricey workspaces.

But there are relatively cheaper, yet successful coworking enterprises as well such as BHIVE, which had been around for a few years before WeWork. Co-founded by Shesh and Avanthi Rao-Paplikar, and Ravindra MK, the company was started by converting villas in Koramangala (a suburb in Bengaluru). Where WeWork prides itself on opulence, BHIVE focuses on price; Paplikar calls his brand the IndiGo airlines of coworking spaces. The idea is to nail cost efficiency and get the basics — space, infrastructure, standardised customer experience and price — right. He is also of the view that expanding to other cities will be resource-intensive for the company at this stage. Hence, they are only present in Bengaluru for now.

BHIVE follows two models to expand the business. One is the traditional leasing model wherein BHIVE rents out a property for 15 years. The second is the franchise model wherein a landlord invests in the property for a guaranteed rent plus a cut in profit generated from the facility, which differs according to the location. In the latter, BHIVE saves on the initial deposit, which is often a major expense and the landlord wins too. Paplikar explains, “If the rent for a commercial property is Rs.1 million/month, it’s difficult to rent out a bare shell and the landlord has to do it up anyway, without certainty of finding a tenant. However, as a franchisor, we guarantee Rs.600,000 in rent. In the process, I save on the deposit and the landlord ends up earning almost Rs.1.5 million after profit-sharing.”

To maintain standardisation across its properties, BHIVE controls the operations right from the interior designing of all franchised facilities. This also allows Paplikar and team to keep their expenses low. Ravindra says, “High-end coworking facilities pay up to Rs.2,000-3,000 per square feet for their interior décor and design. We can attain similar quality at Rs.1,000, which means we can break even quicker.” BHIVE is next planning to tap into coworking spaces in malls. Finding parking is a pain across facilities and Paplikar is eyeing the vacant slots malls have during a typical 10-6 working day. This location would also give employees access to subsidised meals at the food courts.

With over 16 properties spread across Bengaluru, BHIVE has reached a stage where the business is generating stable revenue. It doubled its earnings in FY19 to Rs.120 million and is expected to grow 4x in the current fiscal. It has raised a total of $2.6 million from Blume Ventures, Raghunandan G (co-founder, TaxiForSure) and Arihant Patni (MD, The Hive India). However, Paplikar admits capital doesn’t come easy and almost sounds despondent when he says, “People from business families come in and get ahead because they have an upper hand in terms of capital.”

He quips how a new player cannot imagine beating Embassy or RMZ unless backed by Chinese or Japanese VCs. “Getting capital from banks takes time and one needs to show a balance sheet that has been profitable for years,” he adds.

As with BHIVE, Awfis follows the leasing-cum-franchise model, albeit with one advantage. Capital has never been an issue for founder Amit Ramani. With Masters in real estate and workplace strategy from Cornell University, the former Bank of America employee and former MD of Nelson India knows a thing or two about real estate and raising capital.

In fact, ChrysCapital led the latest round of funding, capped at $30 million, while Sequoia India and The Three Sisters Institutional Office also participated. As of today, Awfis has raised a total of $81 million. It can easily be called the Indian goliath of the coworking space with 63 centres across nine cities — 11 in Bengaluru, 13 in Mumbai, nine in Pune and six each in Delhi, Gurugram, Hyderabad and Kolkata and a few in other cities; for reference, the number of centres of its peers CoWorks, WeWork and BHIVE taken together is 64. The company plans to expand to 15 cities over the next three years. Ramani says, “We are the Toyota Corolla of the market,” hinting that Awfis’ offering is premium, yet not over the top. The brand has been profitable since FY18, when it clocked Rs.560 million in revenue,up from Rs.180 million in FY17. It’s revenue for FY19 was Rs.1.65 billion.

The good ol’ office

According to the Global Coworking Unconference Conference, the sector is projected to expand to nearly 31,000 locations across the globe by 2022. These facilities are expected to attract about five million workers. Given the size of the population, India and China are estimated to be the leaders in the space. In fact, ANAROCK estimates that by 2020, demand for coworking spaces will surpass that of traditional office spaces in India.

That said, everyone from coworking space operators to enterprises agrees that the traditional offices aren’t going anywhere anytime soon. Puri says, “Large companies continue to follow the traditional form of business by leasing office spaces in prime locations across the top cities in the country.”

The new shared offices, despite their promised fun and joy, can lower productivity. Remember that colleague who drapes himself over the cubicle wall and launches into a long conversation? Multiply that by any number. Paplikar says, “Western countries treat privacy very differently. When you are working, people mind their business. In India, you need to put a door. If you are sitting out in the open, it means that you are open to talking,” he jokes.

Puri highlights another demerit: “There is far less scope for branding and they cannot provide a highly-focused business environment for any firm since they house a lot of different businesses.” Analysts agree that these spaces work as a gateway for turning products to companies, where they try, test and tinker with ideas. But once they are big enough, they do need their own offices to create their identity and build their brand.

Yes, they are playing an important role in incubating and supporting start-ups, but Nisha Ramchandani, head-outreach of Axilor Ventures, is sceptical. “At the end of the day, their revenue stream is driven by the number of seats sold,” she says. Ramchandani believes this support system is just an advertising ploy to fill up more seats and that we should not throw a party too early in the day. According to her, we can only gauge the success of such initiatives when some of these incubated ventures turn big. She’s right; most of the space providers are burning through cash while waiting for the start-up markets in India and China to peak.

Coworking is a compelling proposition nevertheless, especially for companies stuck in a bad economy. And despite all the challenges — of the nosy neighbour or the amateurish character of a shared office — it is an exciting proposition for users, if only for all the hilarity from crosstalk or the adventure of attending a workshop on a subject that is alien to one’s field.