Code jock Jeetendra Arora, was working for a British client sometime in 2006. The UK client wanted an interface that would link hotels all across the island and thus simplify the booking process. It struck the Delhi-based Arora that the same could be replicated in India and asked his client to help. The client, unexcited, decided to give it a pass, but Arora just could not get the idea — serving as an intermediary between a hotel and its customer — out of his head.

He started browsing the internet for a prototype and stumbled upon Super8, a hotel-aggregation website in the US. India too had something similar with Makemytrip and Yatra, but their preoccupation with air ticketing meant their hotel booking business got short shrift. Arora wanted to make the most of the opportunity. His plan was straightforward: aggregate budget hotels (an upper limit tariff of Rs.4,500 per night), negotiate a discount per room, add a commission and sell it to end-users with quality assurance. With this anthem in mind, he met travel agents who would assist him in tapping into the budget hotel space.

During one of those meetings, Arora met Varun Chawla, whose family ran a travel agency. Chawla who then worked at an investment company, was toying with a similar idea. “The travel market in India is worth over $25 billion and has a lot of scope for intermediaries. When Arora approached me, I asked him, ‘Can we do this together?’ and the rest is history.” says Chawla.

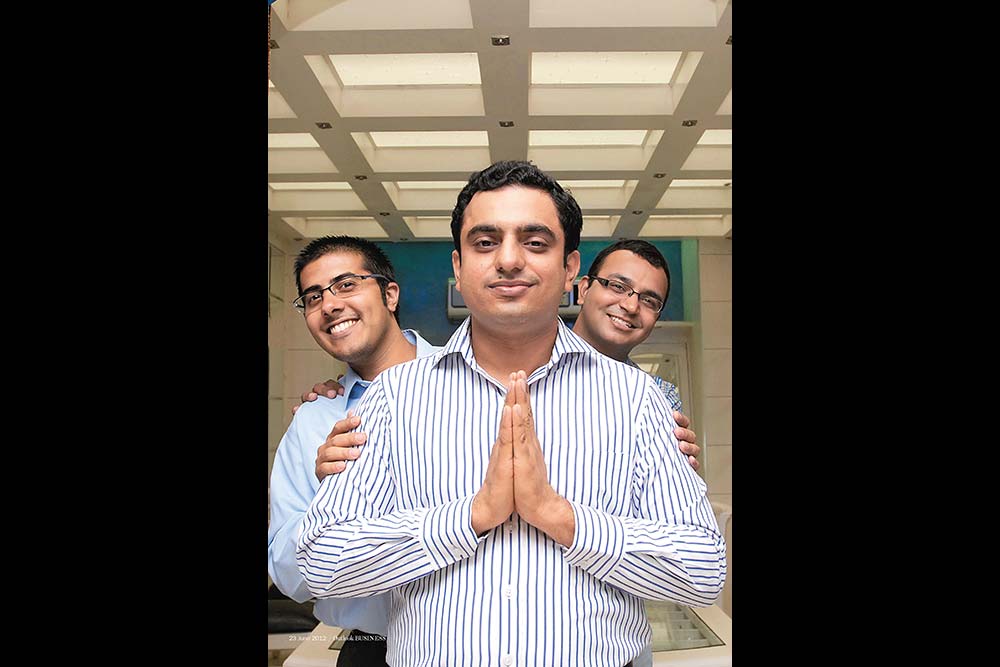

The duo set up MyGuestHouse (MGH) in January 2009 by pooling Rs.1.25 crore from their savings. Arora, who had by then designated himself as CEO, put together a sales team, headed by Prashant Chauhan fomerly from Airtel, to convince hoteliers to come on board and help them perform quality checks. These checks involved taking photographs of the room, the bathroom and view. Pretty soon, the cash-burn to develop the business started to hurt. That’s when Chawla’s rolodex came in handy.

Chawla, who doubles up as CFO is a Goldman Sachs alumnus. He tapped into a list of potential investors; an inheritance from his i-banking days. After weeks of cold calling, a Singapore-based angel investor invested $100,000. This was October 2009. After 15 months of pilots and trials during which they built and tested technology, talked to property owners to build inventories and created free sites for participating players with dedicated booking engines and payment gateways, MGH went live in April 2010.

Checking in

There were a few early birds, one was Hotel Silver Leaf in Noida. “There was no harm in listing,” says Saurabh Garg, proprietor. Garg registered in October 2010. He gets bookings for around 30 rooms via MGH every month. Despite feverishly trying to add hotels, MGH tries to maintain quality control. Every hotelier is assigned a log-in for the property management system (PMS) so he can update inventory and transaction-related information.

PMS is software that’s used to organise hotel bookings, transactions and operations. “It is easy to lose customers when the hotel’s service standards don’t match expectations,” says Chawla. So, “If a guest is turned away citing over-booking and complains to us, we give the hotel another chance to rectify their mistake, else they are barred from our website.”

The company has both B2B (dealing with other businesses) and B2C (when a customer visits their website, chooses a hotel and makes a booking directly) channels. However, B2C accounts for a negligible portion of the site’s business and revenues, most of which comes from the B2B mode. The company has tie-ups with 750 travel agents, online travel agents (OTA) and over 10 corporate clients. MGH’s reasoning for preferring B2B over B2C is simple.

In the B2C segment, it competes with powerfully established OTAs such as Yatra, Cleartrip, Expedia and until recently Makemytrip as well as other travel agents. Since competing with them would involve burning huge amounts of cash, MGH opted to partner with them. Margins per transaction are small and the only way to survive and grow is to scale up, get more hoteliers to list, and sell more. “There are roughly 80,000 budget properties in India,” says Arora. “Even if we bring a small chunk of them online, we will be extremely profitable.”

In a first for a travel portal, MGH plans on uploading video reviews of properties by FY14. Currently, 95% of budget properties in India are out of the PMS channel and MGH wants to bring them in. Star hotel chains have the money to buy sophisticated management systems; the smaller ones do not. To widen its reach, MGH provides budget hotels this technology free of cost.

To ensure ease of use, the PMS interface has been kept Microsoft Excel-like as small hoteliers find it comfortable. Arora adds that it’s a real challenge to convince small hoteliers to adopt technology, update inventory in real time and keep track of invoices and payment details. “We told them it’s in their own interest!” quips Arora. “They now update regularly.” As with all start-ups, finding and keeping good people is challenging and expensive for MGH. Typically, being a service business, staff constitutes the biggest head of expense.

No trip-ups

The company is slowly gathering traction and now has an inventory of 37,500 rooms. MGH estimates monthly visitors to be around 10,000 to 20,000 and a 10% conversion. “The average booking is around Rs.3,000,” Chawla says. Revenue was Rs.1.5 crore at the end of FY12 and although it expects to breakeven in two years, the losses are not keeping MGH from expanding. It has tripled its team size in the last four months from 25 to 75, and the company is in touch with “hundreds of new travel agents”.

MakeMyTrip (MMT) too, appears to believe it’s an idea that will work — in Novemeber 2011 the online travel leader pumped in $1 million for a 29% stake valuing MGH at around $3.5 million. The deal has given MGH an assured customer base, and MakeMyTrip now has a wide source for budget properties. Industry observers say that they could have fetched a better valuation if they had sold a little later but MGH sees it as a strategic decision. “MMT has not brought in its personnel; the partnership is about sharing best practices and technical know-how.” says Chawla. The affiliation with MMT brings in a brand endorsement of sorts; MGH also gets redirected traffic. MMT pulls in close to 3 million visitors a day and “usually, they need a place to stay in the city they are going to,” Chawla says.

But this isn’t all it wants to do. Arora and Chawla harbour ambitions of taking the portal overseas. The company will start with being technology partners and then partner local travel agents and begin all over again. Analysts however, disagree that this will be as easy as they make it out to be. The company, they recommend, should stick to India. But MGH has no plans to slow down.