At 14, Nandan Chakraborty had it all worked out. The hours spent poring over Isaac Asimov’s work in the school library had convinced him of a career as a nuclear scientist. After a peer-pressure fed detour to IIT Kharagpur and an “accidental MBA” from IIM Calcutta, four decades on, Chakraborty is completely at ease as the managing director of institutional equity research at Axis Capital. But what has remained unchanged is his unconditional love for music and a hard-to-get-rid-of reading habit.

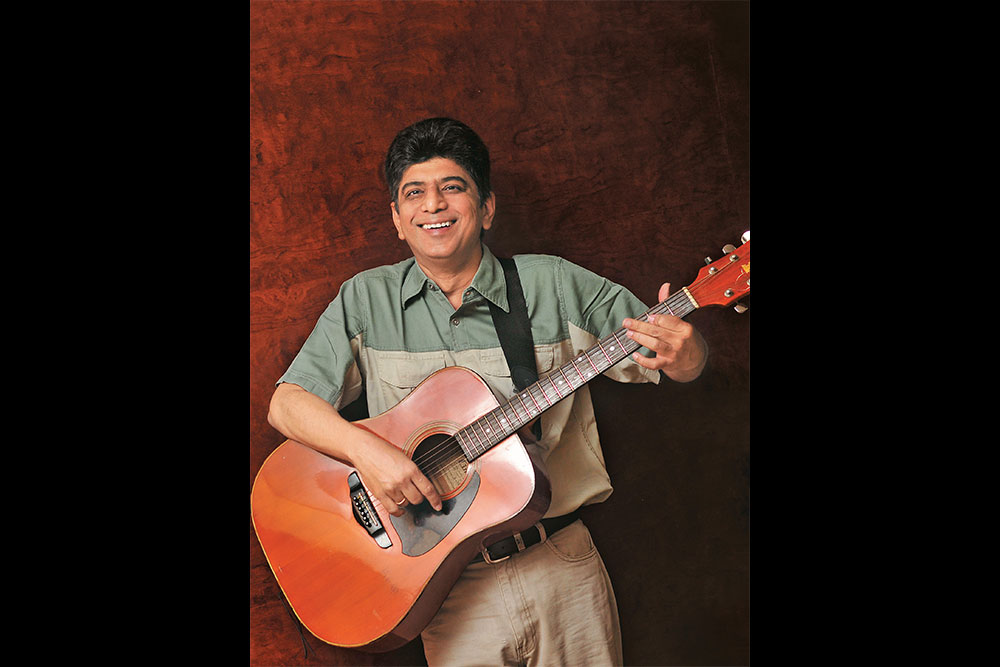

As the only son in a traditional Bengali family, Chakraborty picked up music quite early, honing his guitar skills during his stint at IIT. “We would often make our way to Calcutta from Kharagpur and watch local bands practise and play there,” he says. But the best of western classic rock was not the only thing to catch his attention at college — Chakraborty also developed a taste for philosophy, religion and psychology and breezed through college mainstays such as Camus, Sartre, Rand and Kafka. This was also when he learnt his earliest lessons on intersectionality between domains, plodding through tomes such as The Tao of Physics and Zen and the art of motorcycle maintenance.

After enriching stints at Eicher, Philips and HCL, Chakraborty eventually moved to Australia at the worst possible time — during the global economic trough around 1990. At a time when most others were struggling to get good jobs, Chakraborty managed to charm his way through interviews just a week after setting foot in the southern hemisphere. “I realised that I had nothing to lose and so was almost fearless. This no-risk philosophy worked and got me a job with Unisys Corporation.” A chance encounter with a stock exchange senior got him to sign up for a course in finance with the Securities Institute there, and there has been no looking back since.

Chakraborty says his voracious reading and interest in varied fields of thought have given him a well-rounded world-view, vital in research. “As the head of research at an equity firm, I need to have unbiased views. The analysts I work with are highly specialised in their fields and I can only help them by showing them their blind spots and making them look at things differently. This ensures that we never get blindsided.” And makes them prescient as well — an October 2008 Axis Capital report correctly predicted a 74% Sensex surge at a time when the global economy was down in the dumps.

“This ability to see how things can change comes from my exposure across fields and interactions with musicians, writers, all kinds of creative people,” he adds. And he intends to keep the process going. “I try to imbibe a bit of reading every day because you never know when it might come handy.”

Indeed, as he realised during a pep talk with one of his analysts. “I told him about how we have learnt through evolutionary biology that the failure of the first amphibians to tough it out in the ocean led to the eventual creation of man; how the failure of mammals to tower over other creatures ensured their survival in the calamity that wiped out the bigger dinosaurs; and how a single monkey being ostracised from the pack led to his survival in the grasslands and his transformation into man. So, as humans, we are successors of failure, and there is no reason to be disheartened by it; instead, it should fuel our appetite for risk.” Perhaps, the most fitting attitude in the stock-eat-stock world of personal finance.