CBDT chief expresses confidence in meeting FY26 direct tax collection target

New income tax forms and rules to be issued in February for stakeholder consultation

Majority of taxpayers have shifted to the new tax regime, Agarwal says

CBDT Chair Flags February Rollout of New Tax Forms, Confident on FY26 Collections

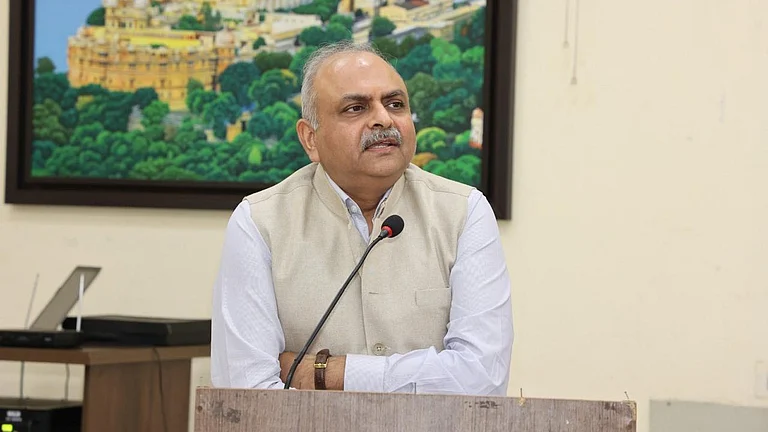

CBDT Chairman Ravi Agarwal said the Centre is on track to meet its FY26 direct tax collection target and will release new income tax forms and rules for public consultation in February

The Centre is scheduled to roll out new income tax forms, rules and detailed FAQs ahead of the implementation of the Income Tax Act, 2025, on April 1. Speaking at a post-Budget interaction session, Ravi Agarwal, Chairman of the Central Board of Direct Taxes (CBDT), said the department plans to issue the new forms and rules within this month and place them in the public domain for stakeholder consultation before the law is enforced.

“We will be issuing the new income tax forms and rules within February. They will be opened for stakeholder consultation before the new Income Tax Act, 2025, gets implemented from April 1, 2026,” Agarwal said. He added that the direct tax proposals announced in the Union Budget for FY27 by Union Finance Minister Nirmala Sitharaman should be viewed as part of a continuing effort to simplify India’s tax framework. The Union Budget 2026 was presented on Sunday, February 1.

“Last year, the focus was on simplifying the language and presenting the law in a manner comfortable for taxpayers. We deliberately avoided major process changes at that stage,” Agarwal said.

Major measures introduced in the Budget for the next financial year include structural reforms such as the decriminalisation of certain prosecution provisions, immunity from penalties in select cases, simplification of compliance procedures, and reduced litigation. Another key change is the modification of Minimum Alternate Tax (MAT) provisions for companies. The Budget proposed treating MAT as the final tax and reducing the rate to 14% from 15%.

Although taxpayers and analysts did not expect any major income tax announcements this year, the industry had urged greater clarity and simplification of laws, along with a revision of tax deducted at source (TDS) provisions.

Agarwal clarified that certain proceedings initiated under the Income Tax Act, 2025, may still relate to provisions of the Income Tax Act, 1961, ensuring continuity during the transition to the new regime. He also said that nearly 88% of individual taxpayers have moved to the new tax regime, and the Centre is not considering a sunset clause for filing income tax returns under the old regime.

According to a Business Standard report quoting Agarwal, around 97% of taxpayers under presumptive taxation schemes have also migrated to the new regime, while 60% of corporate earnings are reported under the revised tax structure. Agarwal also remained confident of meeting the revised direct tax collection target of ₹24.21 lakh crore for the financial year ending March 31, reflecting continued growth in taxpayer compliance and economic activity, the report said.