India’s GCC landscape is undergoing a structural shift, with Tier-2 cities like Coimbatore and Indore emerging as new hubs.

India hosts over 1,800 GCCs employing nearly 2 million professionals and 35% of Fortune Global 500 firms running centres handling core technology and innovation work.

Rising costs and saturation in Tier-1 cities are accelerating decentralisation, with 20–30% of new GCCs expected in Tier-2 and Tier-3 cities by 2030.

Year Ender 2025: States Scramble with Incentives as GCCs Redraw India's Technology Map

With nearly 2,500 GCCs expected by 2030, Indian states are locked in fierce competition to attract the next wave of global technology investments beyond traditional hubs

A decade ago, Coimbatore and Indore featured nowhere in the expansion plans of global technology giants. Today, they are emerging as serious contenders for advanced engineering, AI and R&D operations—functions that were once the exclusive preserve of Bengaluru and Hyderabad. The shift—a fundamental recalibration in how multinational corporations view India's GCC landscape—has also set off a fierce competition among the states to attract more and more of these ‘engines of job creation’.

India already enjoys several structural advantages, chief among them demographic, that already make it home to over half the world's Global Capability Centres. According to ANSR, there are roughly 1,800-1,900 centres employing close to 2 million professionals and generating about $64.6 billion in annual revenue in the country.

Once viewed largely as low-cost offshore support units, these centres today sit at the core of multinational enterprises, driving innovation, product development, AI, cloud engineering and advanced research. The growth of GCCs, as distinct from ‘outsourcing’, has been driven by the increasingly central role played by data and technology in determining success in today’s markets.

As technology has become inseparable from critical services such as product development and customer experience, companies have also become reluctant to hand over such strategic capabilities to external vendors, fueling the growth of GCCs in India. Today, around 33-35% of Fortune Global 500 companies are estimated to operate GCCs in India, with more than 170 such firms present in the country.

Global names such as Microsoft, Google, IBM, Apple, Amazon, JPMorgan Chase, Goldman Sachs, Citibank, Walmart and UnitedHealth Group run India-based centres handling AI, analytics, cybersecurity, product design and R&D, underscoring the shift away from traditional back-office functions.

“India is no longer just a destination for efficiency, but for capability depth and innovation leadership,” says Smitha Hemmigae, Managing Director, ANSR.

The Need for Diversification

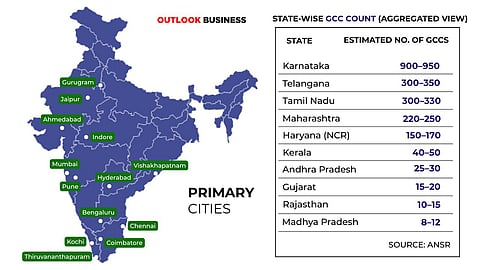

However, a closer look at the growth reveals another story. Today, most Indian GCCs are clustered around Tier-1 cities. Bengaluru is the largest hub with close to 950 GCCs, followed by Hyderabad (around 350), Chennai (280), Pune (200) and Gurugram (170), according to ANSR data. Bengaluru, Hyderabad and Pune collectively host over 50% of India’s GCCs.

Meanwhile, rising real estate costs, infrastructure congestion, higher attrition and talent saturation in these metros are forcing companies to reassess long-term sustainability, triggering a decisive shift towards Tier-2 and Tier-3 cities.

According to ANSR estimates, 20–30% of new GCCs—whose numbers are expected to rise to around 2,500 by 2030 from 1,800-1,900 at present—will be built in non-metro locations. Notably, nearly 28% of new GCCs set up in the financial year 2023–24 (FY24) were already located in Tier-2 cities, as per AMS data. The share of Tier-2 and Tier-3 cities, which currently stands at about 7%, is likely to rise to 15–20% in the near term, it projects.

The shift is already reflected in data from India’s commercial real estate markets, where Tier-2 cities already account for 14–16% of India’s new office supply, up from 5% five years ago, with GCCs acting as the primary catalyst. In Tier-2 locations such as Kochi Infopark and Indore’s Super Corridor, demand is already driving the development of Grade-A office spaces, IT parks and SEZs. While rentals have risen in select corridors, they remain 40–60% lower than Tier-1 cities.

So, what are the factors that are driving this expansion? The most obvious—cost—is definitely there. Tier-2 cities typically offer 40–60% lower rentals, 15–25% lower talent costs and 10–15% lower attrition compared to metros, according to AMS.

However, industry leaders stress that cost is not the only factor. Nearly 60% of India’s graduates come from non-metro regions, and enterprises have realised that tapping into this underutilised talent pool offers better long-term retention and improved quality of life.

Cities such as Vizag, Ahmedabad, Jaipur, Coimbatore, Indore, Kochi and Trivandrum are now seen as viable locations for complex, high-value GCC mandates, according to ANSR. “Over-concentration risk in metros is a growing concern,” notes Hemmigae. “Diversification is now an enterprise priority.”

On the operational side, the shift has been enabled by the hub-and-spoke operating model, where Tier-1 cities serve as leadership hubs while Tier-2 locations act as specialised capability centres. Bosch’s advanced engineering and IoT operations in Coimbatore and Schneider Electric’s industrial automation centre in Vadodara are cited by ANSR as early examples of this model.

State Competition

Meanwhile, with GCCs projected to contribute over $100 billion to India’s economy by 2030 (EY–NASSCOM), a race has broken out among state governments to attract as many of these engines for job creation, innovation and upskilling as they can.

The inter-state competition reflects across incentive frameworks, infrastructure investments, innovation cluster development, skilling partnerships and the establishment of targeted educational institutions such as AI academies.

“GCCs are being viewed as anchor institutions that are high-quality employment generators, export revenue drivers, and also serve as upskilling engines (AI, R&D and engineering),” says Peush Jain, Managing Director-Commercial Leasing & Advisory, ANAROCK Group, adding that a few states are also seeing the benefits of other states’ friendly GCC policies rolled out earlier and are looking to follow in their footsteps.

Competition levels heated up after the Union Budget 2025-26 introduced a national guidance framework to help states attract and promote GCCs, with several states coming up with tailor-made offerings. These include Karnataka, Uttar Pradesh, Gujarat, Madhya Pradesh, Maharashtra and Andhra Pradesh.

“Among the various incentive packages are fiscal and financial incentives including capital investment subsidies, low-cost land allotments, single-window clearances for ease of doing business, power tariff incentives, and branding cities as major GCC hubs (such as Ahmedabad and Vadodara in Gujarat). All these incentives and more aim to lower both set-up and recurring costs for GCCs,” said Anarock’s Jain.

For example, Karnataka has launched the ‘Beyond Bengaluru’ programme (2024–2029), which seeks to set up 500 new GCCs, generate around 3.5 lakh jobs and add $50 billion to the state’s economy. The focus is on Tier-2 cities such as Mysuru, Mangaluru and Hubballi-Dharwad. Incentives include rental support covering up to 50% (subject to an annual cap of ₹2 crore for one year from the commencement of operations), R&D infrastructure assistance of up to 40% or ₹50 crore for two GCCs per year, EPF reimbursements of ₹3,000 per employee per month for two years, and a 25% reimbursement of telecom costs for three years. In addition, there is an exemption from electricity duty (tax that state government imposes over the power bill) for five years.

Maharashtra’s GCC Policy 2025 targets the addition of 200–400 GCCs with a potential to create 3–4 lakh jobs by 2030, particularly in Tier-2 and Tier-3 locations such as Nashik, Nagpur and Chhatrapati Sambhajinagar. The policy adopts a zonal approach, offering differentiated incentives for metro regions (Mumbai–Pune) and the rest of the state. Benefits include capital subsidies of up to 20% (capped at ₹100 crore), rental assistance of 10–20% depending on the zone, payroll-linked incentives in non-metro areas, full stamp duty waivers, interest subsidies on term loans and power tariff concessions. The government has also signed a Memorandum of Understanding (MoU) with ANSR to develop a world-class GCC City in Navi Mumbai.

Uttar Pradesh has set one of the most ambitious goals under its GCC Policy 2024, aiming to attract more than 1,000 GCCs and create about five lakh jobs across cities such as Kanpur, Varanasi, Gorakhpur, Bareilly and the Noida-NCR region. The state is offering land cost support ranging from 30% to 50% based on regional development levels, complete stamp duty exemption, capital subsidies of up to 25%, annual operational support of ₹40–80 crore for five years, along with reimbursements for rent, power, internet services and wages for local employees.

Madhya Pradesh, with its GCC Policy 2025, has introduced India’s first framework specifically designed for Tier-2 cities. The state plans to attract over 50 GCCs and create more than 37,000 jobs in Indore and Bhopal, supported by capital subsidies of up to 40%, payroll assistance, skill development incentives and R&D support.

Odisha’s GCC Policy 2025 envisions the development of five advanced GCC hubs, drawing investments of over ₹1,000 crore and generating upwards of 50,000 jobs, backed by concessional land pricing, rental and power tariff support, SGST reimbursement and relocation assistance for firms.

Other states, including Tamil Nadu (Coimbatore, Madurai and Tiruchirappalli), Telangana (under its ‘Beyond Hyderabad’ push covering Warangal, Karimnagar and Nizamabad) and Andhra Pradesh (Visakhapatnam and Vijayawada), have also introduced focused GCC policies that prioritise infrastructure upgrades, talent availability and fiscal incentives to attract global firms beyond traditional urban centres.

Winners and Losers

Such fiscal incentives notwithstanding, the ultimate winners and losers will be determined by structural factors such as the availability of an educated workforce, according to experts. “Companies need to prioritise cities with demonstrated policy execution,” says Roop Kaistha, Regional Managing Director, APAC, AMS, pointing to infrastructure readiness, governance quality and university partnerships as key differentiators.

Factors that favor the growth of the industry include a strong university ecosystem that produces over 50,000 graduates annually—found in several Tier-2 cities—along with improving airport, fibre and transport infrastructure, lower attrition levels and better long-term retention, and rising local appetite for AI, engineering and digital roles.

The reconfiguration of India's GCC landscape is driven by more than cost arbitrage—it is driven by the search for capability depth, talent sustainability and policy support. For states, the prize is substantial—high-quality employment, export revenue and technology-led economic development.

The states that succeed will be those that move beyond fiscal incentives to deliver on infrastructure, governance and workforce readiness. The next five years will determine which of India's emerging GCC destinations can convert ambition into execution—and which will remain on the margins of the global capability map.