RBI is reportedly open to allowing family-owned investment companies to transfer holdings to private family trusts.

The move aligns RBI’s approach with market regulator Sebi.

On a case-by-case basis, RBI now permits such transfers if trustees are family members.

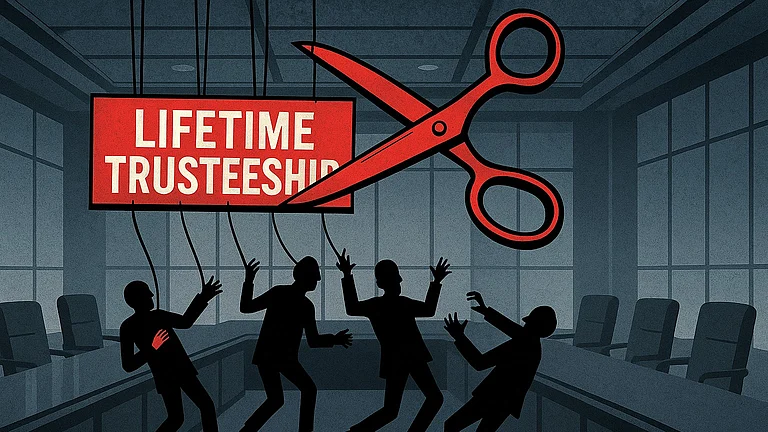

RBI May Open Door for Family Trusts to Own NBFCs, but with More Safeguards

As more business families reorganise their holdings through trusts for succession and governance purposes, the regulator is focusing on ensuring trustees and beneficiaries are aligned to prevent any hidden change in control

The Reserve Bank of India is reportedly open to allowing family-owned investment companies to transfer their holdings to private family trusts. The move is seen as a sign of the regulator easing its stance on NBFC ownership transfers and aligning it with that of market regulator Sebi.

According to the Economic Times, the RBI is now permitting, on a case-by-case basis, the transfer of ownership of investment companies holding family assets to private family trusts. This shifts control from senior family members to the trust, provided the trustees are also part of the family. At least three such applications have been approved in the past two months, the report said.

As more business families reorganise their holdings through trusts for succession and governance purposes, the regulator is focusing on ensuring trustees and beneficiaries are aligned to prevent any hidden change in control.

Entities holding listed and unlisted shares on behalf of families are typically NBFCs or core investment companies registered with the RBI. Any change in control of 26% or more in such entities requires regulatory approval. As per a September release, more than 9,000 NBFCs are registered with the regulator.

The RBI has recently adopted a more practical approach to NBFC approval requests and is now open to allowing ownership transfers to family trusts for succession planning. In such cases, the regulator may seek an undertaking that any change in trustees, especially the induction of outsiders, would require prior regulatory consent. Experts note that Sebi already has defined conditions for such transfers.

Where an NBFC holds significant stakes in listed companies, a family trust taking control can seek a Sebi exemption from making an open offer. Sebi restricts trustees to specified persons and bars third-party trustees from influencing regulated entities. The RBI, however, still lacks comparable rules defining who can serve as trustees for NBFCs and CICs.

Given the rising use of family trusts and the RBI’s increasing engagement on the topic, experts believe the regulator may eventually formalise norms, similar to Sebi’s, requiring trustees to be family members to ensure control of NBFCs and CICs remains within the promoter family.