TCS reported $7.5 billion in revenue for Q2 FY26, up 0.8% sequentially, beating consensus estimates of 0.4% QoQ growth.

But, the IT giant has faced growth stagnation for five consecutive quarters.

After a 3.3% drop in Q1 FY26, TCS managed a marginal rebound of 0.8% this quarter, signalling only a slight recovery in momentum.

TCS Q2 Remains Flat: Will Data Centres and Layoffs Bring Back Growth for IT Giant?

In Q2 FY26, TCS reported total contract value (TCV) of $10 billion, up 16% YoY, driven by balanced deal wins across sectors, including a major deal with insurance firm Tryg. BFSI contributed $3.2 billion and consumer business $1.8 billion, fuelled by AI-driven modernisation, vendor consolidation, and cost-efficiency efforts

Tata Consultancy Services (TCS), the crown jewel of Tata Group, on Thursday reported $7.5 billion in revenue for the quarter ending September 30. In constant currency terms, the IT giant's topline is down 3.3% year on year and just 0.8% higher sequentially. This performance beat consensus estimates of 0.4% quarter on quarter growth.

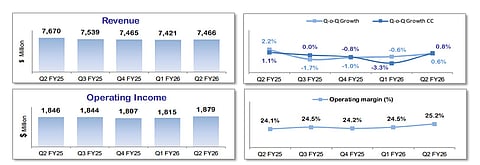

The Mumbai-based firm has been facing growth stagnation for at least 5 quarters. The company's revenue in constant currency has been in negative after reporting 1.1% growth in Q2 FY25. It declined by 1.7% in Q3 FY25, 1% in Q4 FY25 and 3.3% in Q1 FY26. This quarter it was finally able to grow slightly by just 0.8%.

But all this time, the firm's revenue in US dollar terms has oscillated between $7.4–7.7 billion. During this period, the IT giant's Earnings Before Interest and Tax (EBIT) margin has also remained flat around 25%, ending Q2 FY26 at 25.2%.

JM Financial Services has now raised its EBIT margin assumptions by 43–74 basis points for FY26–28E, primarily due to reduction in employee benefit expenses. Meanwhile, Motilal expects "no material improvement" in the firm's earnings in FY26, compared to FY25.

"While management expects FY26 growth to be better than FY25, we believe this guidance is somewhat fuzzy," said the brokerage, explaining that TCS’ international business fell around 1% in constant currency terms in the first half of FY26. Even with a 1% quarterly growth in the second half, full-year international growth is expected to be only about 0.5–0.8%.

For EBIT margins, Motilal expects a range-bound performance in the next couple of quarters, "as the BSNL ramp-up, wage hikes, and furloughs are likely to offset efficiency gains."

TCS CEO K Krithivasan told analysts in the post-earnings conference call that "macros have not changed much," but the number of projects getting deferred or paused has reduced compared to the preceding quarter.

"We have had better growth compared to Q1. Macros have not changed much, but our deep engagement with clients, AI solutions, all of this gives confidence that we will improve the growth momentum compared to the first half," he said.

According to JM Financial, commentary indicated that clients continued to keep tight control over discretionary budgets, focusing on vendor consolidation to achieve transformation objectives. They added that while smaller deals did not see any significant improvement, they witnessed an increase in the number of rapid build and modernisation projects.

In Q2 FY26, TCS reported total contract value (TCV) of $10 billion, up 16% YoY, driven by balanced deal wins across sectors, including a major deal with insurance firm Tryg. BFSI contributed $3.2 billion and consumer business $1.8 billion, fuelled by AI-driven modernisation, vendor consolidation, and cost-efficiency efforts.

Geographically, they mentioned that India and emerging markets reported strong growth, while the UK remained soft.

A day after the results was announced, Tata Consultancy Services shares were trading at ₹3,033.20, down 0.93% at 1.16 PM.

Data Centre Plans

But amid these headwinds, the company has announced its foray into the data centre business to capitalise on the demand created by artificial intelligence. The company plans to create a new subsidiary to develop a localised data centre business in India.

Together with its partners, the company plans to invest between $5–7 billion over the next five to seven years to build up to 1GW of capacity. The project will follow a colocation model, allowing clients such as hyperscalers, AI-focused firms, Indian enterprises, and government bodies to bring their own compute and storage infrastructure, while TCS will provide only the passive infrastructure. The capital expenditure will be phased, with about $1 billion allocated for every 150MW of capacity, funded through a mix of equity, debt, and external financing. The company expects to begin generating revenue within the next 18 to 24 months.

While most brokerages are not including this new venture into their growth forecasts, they expect this co-location foray to be "value accretive."

" TCS’ willingness to put its balance sheet to use, a significant deviation from its earlier conservative approach, is a welcome change in the current dynamic environment," said JM Financials.

Motilal Oswal views TCS’s new data centre venture as a low-technology, passive model focused on providing sovereign colocation space rather than cloud or managed services. The venture is expected to generate stable, annuity-like revenue and strengthen TCS’s ties with hyperscalers and AI firms.

Returns will likely be lower than TCS’s group ROE due to high capital intensity, but it shouldn’t dilute overall margins since external partners will share funding. Analysts see this primarily as a strategic cash deployment to expand into the AI infrastructure space, with further clarity awaited on financing structure, capex schedule, and potential client agreements.

TCS management, on the other hand, noted the gap between India's current installed data centre capacity and demand. TCS said that India’s current installed data centre capacity stands at about 1.2 GW. They highlighted that while demand could expand nearly 10 times in the next five to six years, the committed capacity is only just 5–6 GW, creating a significant revenue opportunity.

AI Service Delivery Still in Focus

As part of its AI strategy, TCS outlined five key pillars: becoming an AI-first organisation, redesigning all service lines under a “human + AI” model, developing future-ready talent, delivering practical AI solutions for clients, and strengthening partnerships through M&A and infrastructure investments.

Supporting this, TCS acquired US-based ListEngage, a Salesforce partner, for about $73 million to boost marketing transformation capabilities. ListEngage helps in marketing transformation and is a Salesforce Summit Partner.

The company yesterday outlined its aspiration to become the world’s largest AI tech services company. The AI DC WOS will scale capacity in a uniform manner over 5–7 years and financial partners will co-invest. This entity will not be margin dilutive and return ratios will sustain.

TCS reiterated its margin target of 26–28% driven by productivity, efficiency and outcome-based models offset by AI investments. Q3 will see the full impact of wage hikes and restructuring costs are expected throughout the year.

Restructuring Layoffs to Continue

Data showed TCS' headcount for the first time came down below 6 lakh in the past eight quarters. The Tata Group company’s closing headcount for Q2 stood at 593,314 employees, compared with 613,069 in Q1 FY26, a decline of 3.2%. 19,755 employees left the company in just the past three months. This came after the company had announced a restructuring plan which included laying off 2% of its workforce. Now its new Chief Human Resources Officer, Udeep Kunnumal, says they are not “chasing any number” on job cuts, rejecting reports of 50,000–80,000 layoffs as “highly exaggerated and inaccurate.”

Voluntary attrition in the IT services segment stood at 13.3% over the past 12 months, down 50 basis points.

The IT workers’ union Nascent Information Technology Employees Senate (NITES) alleges that this decline suggests the exits were not voluntary but “management-driven.”

“This is not a minor difference. Nearly 8,000 more employees than what TCS admitted have disappeared from the rolls. For a company of TCS’s scale, such underreporting cannot be dismissed as an error. It points to a deliberate attempt to downplay the scale of retrenchments and mislead regulators, policymakers, and the public,” said Harpreet Singh Saluja, President of NITES, calling the situation “deeply alarming.”

TCS’s new Chief Human Resources Officer, Udeep Kunnumal, in his comments to PTI dismissed the “extremely exaggerated numbers” of layoffs circulating online and urged that such figures be disregarded.

He said that around 1% of the workforce, about 6,000 employees, were let go as part of a restructuring exercise initiated by the company.

During the quarter, TCS recorded a one-time restructuring expense of ₹1,135 crore, providing termination benefits in line with company policy. Employee costs stood at ₹38,606 crore, forming 58.7% of total revenue of ₹65,799 crore, compared with 59.5% in the June quarter and 57% a year earlier.

TCS management indicated that the H-1B visa proclamation had minimal impact, as only around 500 US workers are on those visas.