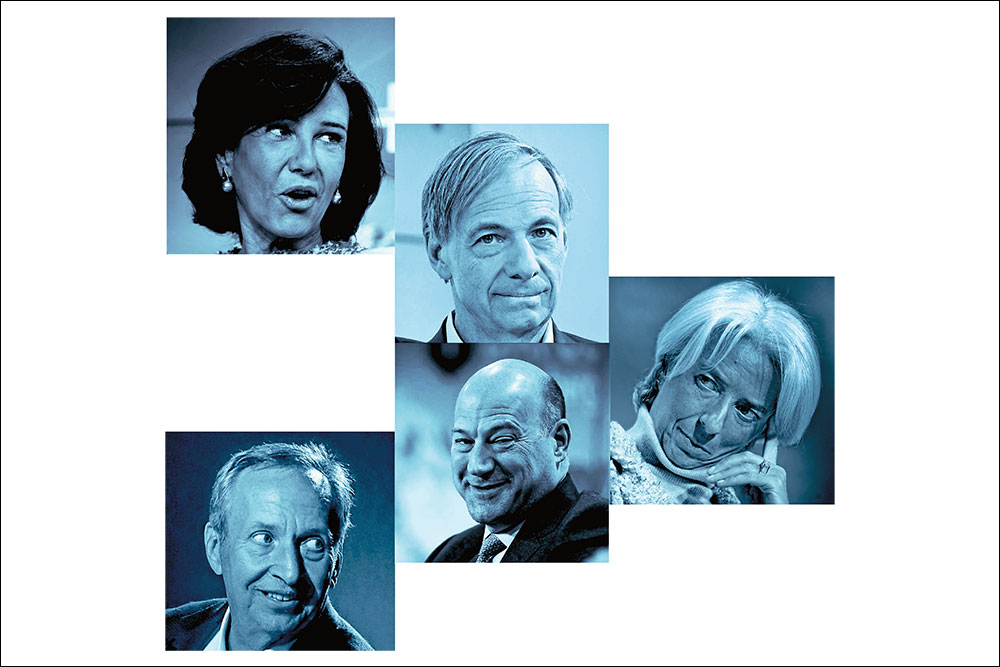

Panelists: Christine Lagarde, managing director, IMF; Ana Botín, chairman, Banco Santander; Gary Cohn, president and COO, Goldman Sachs; Larry Summers, former US treasury secretary; Ray Dalio, founder, Bridgewater Associates

Moderator: Christine Lagarde, let me start off with you. Because the world needs more easing, how difficult is it going to be for the Fed to raise rates?

Christine Lagarde: The Fed is probably going to raise rates this year. Our expectation at the IMF is that it is more likely to happen in the middle of this year. That is good news in itself because it shows that things are moving in the right direction. Employment is up. Inflation is hopefully giving some signs of moving up. Now, the consequence [of tightening] is going to be a different story because clearly there will be side effects but, in itself, it is a good sign.

Moderator: Gary, you think the Fed won’t raise interest rates this year. Does that mean we should be worried?

Gary Cohn: I don’t think we should be worried. I think that the US is growing — that’s a non-debatable fact. But when you look at Europe, Japan and other parts of the world, there exists an enormous spread between positive US rates and the negative rate environment elsewhere. The dollar will only get stronger if we raise rates in the US today. That will have a chilling effect on the US economy. The good news is that we are getting back some of that headwind in lower oil prices.

Madame Lagarde talked about the unemployment picture. We have good news in the headline unemployment rate in the US but if you start peeling back the unemployment rate, we have less good news. Last month’s report had negative wages. If you look at the participation rate, we are not pulling people into the US job market. No one is looking for jobs because they think the jobs out there are very low-paying. Then, inflation is nowhere close to the Fed’s 2% target.

Moderator: Larry, what do you think the Federal Reserve should be looking at when setting interest rates this year — activity or inflation?

Larry Summers: Inflation. The risks are enormously asymmetrical of setting off a spiral towards deflation. The Fed should not be fighting against inflation until it sees the whites of its eyes. That is a long way off. There has not been a moment in my memory when the gap between market expectations of monetary policy as measured in the market place and the Fed’s statement about future monetary policy as reflected in the dots has been greater.

Moderator: Ray, what is your take? You think there are more downward risks?

Ray Dalio: I think we are in a new era, where central banks have largely lost their prerogative to ease. They still have their prerogative to tighten. But if

you get a downturn in the economy, the effectiveness of monetary policy will be less. Originally, monetary policy worked by lowering interest rates, which would lower debt service payments, cause the present value of assets to go up and produce a wealth effect and stimulation.

When interest rates reached zero and there were large credit spreads in the market, the purchases of those financial assets narrowed those spreads. The spreads are a transmission mechanism for monetary policy. So, if you put liquidity in and there are spreads, people wanting high returns will go in and buy those assets. The buying of those assets cause those future returns to go down. The yields of bonds, the yields of expected future return of equities, too, go down, producing asset price appreciation, which causes the wealth effect that we have. We now have a situation in which we have largely no spreads and, as a result, the transmission mechanism of monetary policy will be less effective. This is a big thing. Through all my life and through all history, monetary policy was the main tool.

So, I do believe that we are entering an era — it’s the end of the super cycle. It’s the end of the great debt cycle, in which the process of lowering interest rates, causing higher levels of debt and debt servicing and spending is coming to an end. Since 1980, every cyclical peak and every cyclical trough in interest rates was lower than the one before.

So, we have a deflationary set of circumstances. We have zero to negative interest rates. How far will negative interest rates carry us? With negative interest rates, money under the mattress looks good. So, I worry about the downside because the downside will come.

Moderator: Larry, given the QE experiment in the US, is QE in Europe going to work?

Larry Summers: I am all for European QE. The risks of doing too little far exceed the risks of doing too much. Deflation and secular stagnation are the macroeconomic threats of our time. That said, I think it is a mistake to suppose that QE is a panacea in Europe or that it will be sufficient. There are several differences that are worth noting with the US experience. The US QE was most effective at the very beginning, when the markets were functioning less well than they are functioning in Europe today. QE functioned well in the US, starting with long-term interest rates in the 3% range, not with long-term interest rates starting in the 40 bps range. QE worked best in the US when it was unexpected, rather than when it had been widely predicted. QE worked best in the US because it worked through the capital markets channel and a large part of lending in Europe takes place through a banking channel that is clogged by regulatory processes. So, there is every reason to expect that QE in Europe will be less impactful in the present context than it was in the context of the US.

I would just like to remind everybody that no institution, neither the IMF nor the US government, has predicted any of the recessions a year in advance. Yet, recession does sometimes come, that is fact one. Fact two: when it happens on average once every seven years, the Fed has to cut interest rates by 3-4% to combat that recession. Are we anywhere near getting ourselves to a place where there is going to be a 3-4% running room to cut the next time the problem happens? I don’t think so. If you look at the forward curve, the market doesn’t think so either. So, we have to recognise that central banking improvisation as the world’s growth strategy is coming to an end and we have to move to a broader range of strategies. Some of it goes to banking policy. Some of it goes to structural reform, although a lot of structural reform is on the supply side and much of the problem is on the demand side. So, we have to be strategic about structural reform and there is also a crucial role for direct support for investment in both the public and private sectors.

Moderator: Ana, emerging markets did not like Fed QE. Will they like ECB QE?

Ana Botín: I think ECB QE is a good thing. We need it and it will partly compensate what the Fed is not doing. Obviously, it is another size. The balance sheet of the ECB is two trillion and I don’t know what the size is going to be. In Latin America, which is the region I know better, I think certain countries were in a very different situation as compared with the 1990s. In previous crises, countries such as Chile, Colombia, Peru, Mexico and even Brazil, I think, would be less affected because they had better policies and very high level of reserves. So, I think this time it will be different for certain countries.

Moderator: Gary, are we looking at currency wars or have they never actually left?

Gary Cohn: I think we are in currency wars, have always been in it. Recently, when Abe got involved in Japan and did a conscious devaluation of the Yen, it clearly put the Europeans in a position where you had the Europeans looking at their exportability versus Japanese exportability. I think if you look at that pair, the Euro had to devalue at some point. Now, you are seeing Euro devaluing and Yen holding. It is interesting how the Japanese are going to follow at this point. And lo and behold, we have got the US just watching and being the one currency that is rallying because everyone else is trying to devalue. Thank you for the Swiss — they have decided to join the currencies that would rally. We are happy to have them on that side of the ledger. It does feel like we are in a global economy and I don’t disagree with this. The prevailing view is that one of the easier ways to stimulate growth is to have a low currency to export against and hopefully create tourism in imports. Makes sense.

Moderator: I want a quick response from each of you on who needs to pull their weight more: central banks, politicians, regulators or businessmen? Gary, I will start with you.

Gary Cohn: It is hard to separate it. At the end of the day, I think business needs to pull their weight. If Europe has to grow, business has to grow. I will make a very quick point. If you look back at the US, what got it going was that we had cheap energy, low interest rates and a very competitive currency. We used that to create jobs. The question is, can Europe create jobs? So, I will go to business — it has to create jobs. But you need structural reforms to be able to create jobs. Look what we did in Silicon Valley in the technology world — how many jobs we created in the US in the past five-10 years.

Moderator: Christine?

Christine Lagarde: All. Because I think that they all need to pull their weight. 2015 is a critical year for all the reasons we have discussed but also because there are big trade deals at the table that need to be wrapped. There is a big climate deal that is coming up that would certainly fuel anxiety but also a lot of opportunities. There are development objectives but those are three key items. Central bankers, policy makers, businessmen and politicians, all of them have to rally around those jobs and growth objectives in the context of those big deals. So, all of them, and hopefully cooperatively. I think it is absolutely necessary. We have not talked about geopolitical issues. They all need collective support to be eradicated.

Moderator: Larry, is it politicians?

Larry Summers: All of the above. The central bank is doing its part and is doing as much as the politics will allow. Business leaders like Ana are primed and ready to go. The question is whether there is going to be the political leadership needed to put a dynamic framework that has got both demand and supply elements in place for adequate growth.

Moderator: If you only had to choose one, Ray?

Ray Dalio: I agree with whatever was said.

Moderator: Which one?

Ray Dalio: All of them.

Moderator: But you have to choose one because that makes it that much more exciting?

Ray Dalio: I won’t.

Moderator: Ana, what is your choice?

Ana Botín: I am going to say that banks are prepared and ready to lend. We are a central part of the equation. We are the transmitters of monetary policy to the real economy, to businesses and people who are going to buy a home and get a mortgage. I think we need a balanced approach to regulation that takes into account the broader public policy issues that we discussed here.

Moderator: Thank you so much. It was a great pleasure.

This WEF session was developed in partnership with Bloomberg TV