1942 was a tumultuous year. World War II was underway and Gandhiji launched the Quit India movement. In those days, paints industry in India comprised few foreign companies and Indian players like Shalimar Paints. A temporary ban on paint imports then resulted in an opportunity for domestic production. Spotting this opportunity, Champaklal H. Choksey and three of his friends — Chimanlal N. Choksi, Suryakant C. Dani, and Arvind R. Vakil, set up Asian Paints in Mumbai.

1942 was a tumultuous year. World War II was underway and Gandhiji launched the Quit India movement. In those days, paints industry in India comprised few foreign companies and Indian players like Shalimar Paints. A temporary ban on paint imports then resulted in an opportunity for domestic production. Spotting this opportunity, Champaklal H. Choksey and three of his friends — Chimanlal N. Choksi, Suryakant C. Dani, and Arvind R. Vakil, set up Asian Paints in Mumbai.

By 1967, Asian Paints had become the largest paint company in India — a position it holds until this day. Champakbhai, as he was fondly known, passed away on 31st July 1997, also the last day of his family holding a stake in Asian Paints. The families of the other three founders continue to own 52.8% of the firm’s shares outstanding.

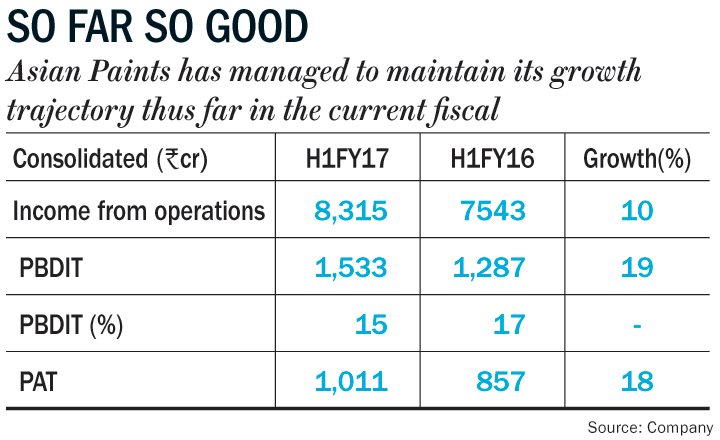

As the firm nears its 75th anniversary (in 2017), it is an exemplary case study of a homegrown brand taking on competition (domestic and foreign) and winning in India. It is a rare example of a large Indian company, held by multiple promoters, and yet run by a high-calibre, management team. The remarkable consistency in revenue growth, and disciplined capital deployment stands testimony to their calibre. However, CY17 will also mark a chapter in the history of the company as to how it battled an unforeseen event that shook the economy.

Cash pang

The demonetisation of 86% of India’s currency in circulation will disrupt the economy, especially those segments where cash-based transactions are the norm like real estate, unsecured lending, and building materials. Asian Paints will be impacted by two aspects of demand destruction in the aftermath of demonetisation: one, 20% of its revenues are associated with new home building, a segment which could see reduction in the number of transactions; and second, the remaining 80% of revenues are associated with repainting of homes, which could be deferred by households for a couple of years. However, the company will benefit from a combination of other factors.

Distribution gains

Unlike most other B2C categories, there are no distributors or wholesalers in the distribution channel of decorative paints in India. Manufacturers sell their products directly to dealers who further sell it to the end consumers or painters. As a result, decorative paint companies will be the least affected by liquidity constraints in the distribution channel. Moreover, Asian Paints has historically used such ‘crisis situations’ to strengthen its relationship with dealers through non-transactional initiatives which go beyond its stellar IT systems that make dealers’ lives easier. “50% of dealers of don’t check their accounts, despite having access to a web portal which gives them real time updates on their accounts. They say they have faith in the firm’s fairness in dealing with them. But they check their accounts with other paint companies thoroughly and regularly,” says KBS Anand, CEO of Asian Paints.

Several dealers have told us that historically Asian Paints has gone beyond its call of duty to help its channel partners, should they face any unexpected problem. “Dealers are part of our family. If we find that they are affected due to unforeseen events such as riots, floods, earthquakes etc, we ensure that best support is provided to them, including extending the credit period so as to help them get back on their feet,” says Jalaj Dani, member from the promoter family, Asian Paints.

Given the strength of its balance sheet and the culture of building relationships with dealers, it is likely to use the current circumstances to offer innovative solutions to dealers, painters and contractors.

Betting on IT

With structural resets such as the GST and demonetisation likely to call for more digitised and tax-compliant ways of conducting business in India, firms which use IT-based systems and processes as their competitive advantages are likely to outperform against others in the same industry.

Asian Paints invests capital to buy and use best-in-class technology to improve its supply chain efficiencies and working capital management — which are the two biggest drivers of competitive advantage in the paints industry. For instance, mainframes were used for demand forecasting as early as in 1970s. Many of Asian Paints’ new plants across the country are controlled through IT servers placed in Mumbai. They are totally controlled over interfaces where operators sit and operate across all segments of manufacturing. IT encompasses other functions such as human resources. Key result areas (popularly known as KRAs in office parlance) are given to the middle management who are encouraged to increase the productivity of operations through their respective roles.

The benefits of using IT are also visible at dealer levels. As one of the largest dealers of Asian Paints in Mumbai told us, “I order products five to ten times a day and receive supplies. Initially we used to call the depot to place our orders. Then they started their call centres in 2002-2003. Now they incentivise us to order online rather than the call-centres, by giving us between Rs.500 and Rs.10,000 extra per month, depending on the size of our orders. Even if others copy this in a few years, they will have frequent stock-outs, and hence won’t meet our requirements.” The management told us that from 2000-2015, IT became a ‘go-to’ resource for everyone in the company, rather than being just a low-priority support function.

Nurturing talent

Besides IT, Asian Paints nurtures professional talent in a unique work culture where empowerment allows creativity. This strength is likely to help the firm launch innovative business initiatives amid disruption, which can further strengthen its competitive advantages. Once an employee gains independent responsibility to manage a depot or a manufacturing plant, there is a high degree of accountability. The firm has one of the best processes of internal reporting and budgeting and therefore, performance of each individual or branch is clearly measurable.

Long lasting shade

Asian Paints will face near-term demand headwinds from a potential slowdown in real estate caused by the clampdown on black money. However, in the medium-long term, it will emerge stronger and gain market share, given its three main reasons: one, lower disruption in supply chain as it is least driven by cash among peers; two, lower impact of a real estate slowdown as repainting by existing flat owners is its key demand driver; and three, shrinking of the unorganised segment.

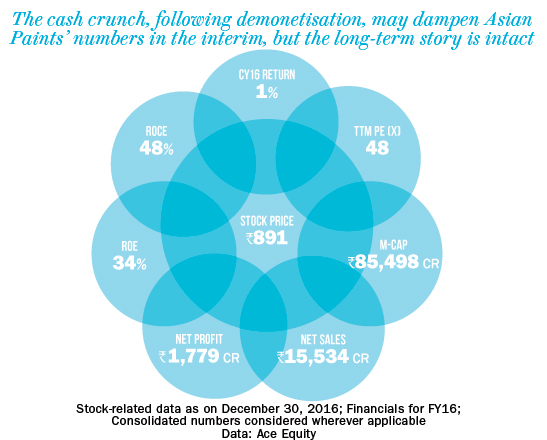

The stock currently trades at 30 times with its estimated FY18 earnings. While Ambit’s FY17-18 estimates (sales growth of 20%, operating profit growth of 26% and EPS growth of 28%) could be at risk due to demonetisation, growth should accelerate in the long term for this champion franchise.

The writer has no position in the stock