In the past decade or so the Indian consumer has become more brand conscious. Once a privilege only the rich could afford, brands are everywhere and accessible to the majority of the consuming class.

Any company that has managed to take an early lead by carving a niche for their brands across diverse categories such as foods and beverages, footwear, garments, kitchen appliances, sanitary-ware have reaped the benefits of increased brand awareness among consumers. The brand consciousness and brand awareness have also been driven by a demographic shift to a young and consuming class in India who have rising aspirations and higher income levels. Companies have also managed to create higher brand visibility by spending more on advertising. There has been significant shift in the way brands are leaving an impression in the minds of buyers.

Changing times

Page Industries with its leading inner wear brand Jockey is one such company that has seen unprecedented rise in brand value, market share, sales and market capitalisation. The company’s market cap increased from Rs.468 crore in 2008 to Rs.15593.28 crore, as on December 19, 2016. Its revenues soared from Rs.192 crore to Rs.1,749 crore during the same period. But not all companies have been able to leverage the rising Indian brand wagon and, in fact, have lost some of their mojo as times changed.

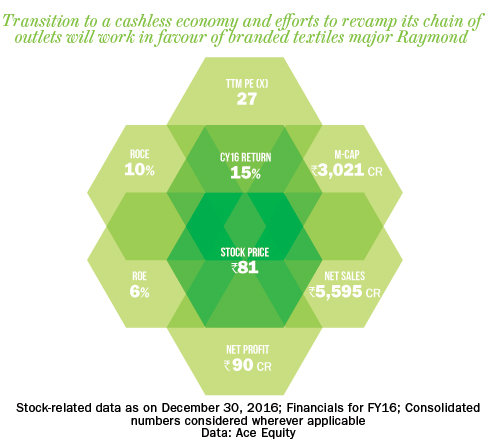

Take the case of Raymond, for instance. A leading name in men’s premium wear and suitings, the company’s market cap has only increased from Rs.1,860 crore on March 2008 to Rs.2,913 crore as on December 19, 2016. Standalone revenues consisting primarily of textiles, increased from Rs.1,322 crore in FY08 to Rs.2,793 crore in FY16. While it may not be an apple to apple comparison,

as one company is focused on innerwear and casual wear and the other is present across almost all major textile segments, the divergence in performance is too stark. It gives a sense on how Raymond has failed to leverage its brand while others have capitalised on their brand advantage through different strategies.

Nevertheless, while some of the older brands in textiles have faded away, Raymond has managed to maintain its identity.

Rewriting legacy

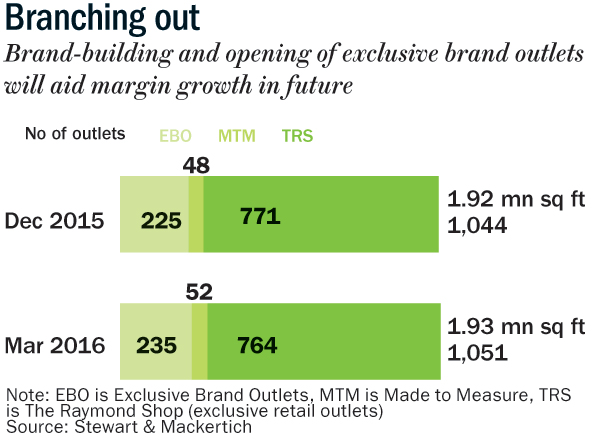

Raymond comes with a rich history of around 91 years and is one of the largest vertically and horizontally integrated manufacturer of worsted suiting fabric. It is a one-stop shop providing various solutions to customers across various product categories. After the advent of ready-mades in early 2000, most companies in the suiting and shirting gradually lost market as ready-mades were preferred over tailored garments. Recognising the shift in the market, the company quickly brought in professionals from FMCG and garment companies to give shape to the company and bring the partly lost mojo back to the company. Its branded apparel segment, which has labels such as Park Avenue, Color Plus, Raymond Premium Apparel, Parx and Made to Measure, has shown commendable growth in recent quarters spearheaded by Sanjay Behl, CEO, Lifestyle Business, who joined the group in 2013. Raymond is also revamping its outlets to upgrade in-store shopping experience for consumer, improve their brand image and making them tech savvy. Now at a Raymond’s store, a consumer has the option to book his trial room and have all the items selected waiting for him in the changing room.

Mixed numbers but right direction

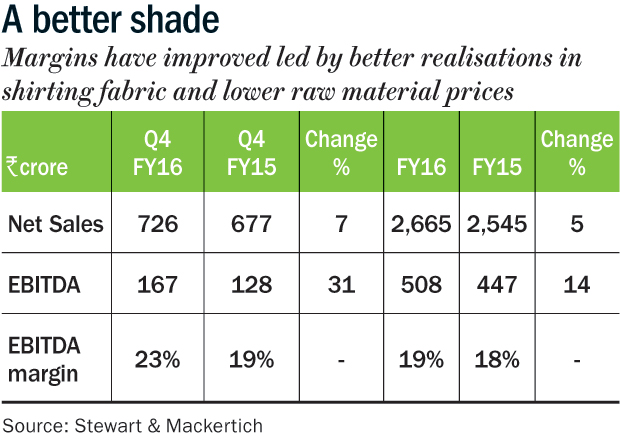

The performance of the company has been mixed in its latest quarter, although strategies are in place to see them grow in subsequent quarters. Consolidated revenues grew by 12% to Rs.1,553 crore. The branded textile business grew by 12% during the quarter, suiting by 10% with 7% volume growth and B2C shirting by 23% with 32% volume growth. In the suiting fabric the average realisation was higher in the quarter by 2%. According to the company, the key drivers of the growth were the newly launched fabric Technosmart, the trouser exchange scheme, which saw nearly 60% new customers, and the store renovations, resulting in a 20% plus sales growth.

Domestic sales grew by 15% to Rs.1,314 crore and export sales by 3% y-o-y to Rs.270 crore. The advertisement and promotional expense stood at 5.6% of revenue. Importantly, net profit more than tripled to Rs.25 crore y-o-y, aided by higher share of branded textile sales. Net debt to equity stood at 1.06 times versus 1.11 times y-o-y, as a result the average interest cost reduced by 80 bps in the quarter.

Though the company’s textile division may see a decline in sales on a y-o-y basis in the third quarter owing to demonetisation, the concern is adequately reflected in the decline of the stock price by around 28% from its recent peak. Post demonetisation, we expect more sales through the digital route at the company’s traditional outlets. While the return ratios currently appear dismal, we expect RoE and RoCE to pick up from FY18 onwards. We expect the stock to touch Rs.814 in CY17.

The brokerage has a buy call on the stock, but the writer, in his personal capacity, does not own the stock