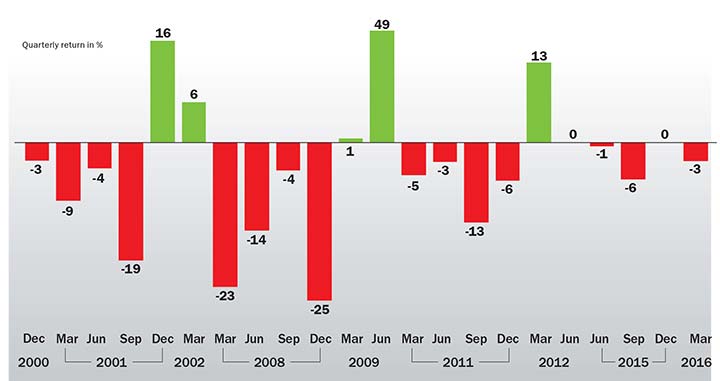

Disheartened by the market’s lacklustre performance in FY16, when the markets ended in the red for all quarters? Don’t despair, as things should start looking up soon. According to data compiled by Outlook Business, over the past 16 years, only on three occasions has the Sensex given negative returns for four consecutive quarters. And on all those occasions, the following two quarters saw the Sensex rebound, with average gains of 14%.

During the spell beginning December 2000, the markets ended up with 22% gain in the following two quarters. Similarly, the March and June 2009 quarters saw the market bouncing back 50%, with the maximum rebound happening during the June quarter, when the market gave 49% return. The March and June quarters in 2012 saw the Sensex giving 13% return, with the entire return coming in March.

Will history repeat itself in FY17? Although one cannot be sure as past performance is not an indicator of future return, given the signs of a recovery in some sectors of the economy, there is a high probability that the next two quarters could be good for investors.

FY16 was marred by slow economic and industrial growth. Besides, severe correction in global commodity prices, poor monsoon and stress in the banking space led to a decline in earnings. For the first time since FY09, the Sensex reported a 3% decline in FY16 earnings at Rs.1,320 a share; earnings have been flat for the past three years. However, today the base is lower and if we go by consensus estimates, FY17 earnings could grow by 15-18% to Rs.1,550 a share.

On-the-ground data supports hopes of a revival. The eight core industries have reported an impressive 6.4% growth in March. Bank credit growth has recovered to 11% in the past three months. Electricity, consumption of diesel, steel and cement have all shown a good recovery during the first three months of the current year. RBI has also cut interest rates by 150 basis points and provided higher liquidity to banks, thus helping stressed sectors and spurring consumer demand, which is going up in both rural and urban areas.

Now, if this year’s monsoon turns out to be as good as hoped, it will only help in raising demand and sustaining a recovery. Apart from domestic factors, the stability in China, recovery in crude oil and commodity prices should play their part. While all the positives are in place, investors will have to wait another month to figure out which way the Street is headed.